Business & Money

Mastering the Art of Salary Negotiation: Insights from Financial Experts

Mastering the Art of Salary Negotiation

Navigating the complex realm of salary negotiation strategies can be both daunting and rewarding. It’s a critical skill that can significantly impact your financial future. This article, guided by insights from financial experts, delves into the strategies, mindset, and tactics that can empower you to negotiate your salary effectively.

Research and Preparation about Salary Negotiation Strategies

Before entering a negotiation, arm yourself with information. Begin by researching industry standards and market trends for your role and location. Websites like Glassdoor, Payscale, and LinkedIn can provide valuable data on average salaries. This research provides you with a solid foundation for your negotiation, allowing you to set realistic expectations.

Understand Your Worth

Your worth encompasses not only your skills and experience but also your unique contributions to the organization. Clearly define your value proposition by highlighting your accomplishments, relevant certifications, and any specialized training you’ve undertaken. Demonstrating your impact can give you leverage during salary discussions.

Timing is Key

Timing plays a pivotal role in salary negotiations Strategies. Initiate the conversation after you’ve successfully completed a project, received a commendation, or achieved a milestone. This positions you as an asset to the company, making your request more compelling.

Adopt a Win-Win Mindset

Effective negotiation is about finding common ground that benefits both parties. Approach the negotiation with a positive attitude, emphasizing your commitment to the company’s growth and success. When your employer sees you as invested in the organization’s prosperity, they’re more likely to consider your request.

Practice Effective Communication

Clear and concise communication is vital during negotiations. Craft a persuasive pitch that outlines your achievements and the reasons you deserve a higher salary. Emphasize your dedication to continuous improvement and your enthusiasm for taking on additional responsibilities.

Be Flexible

While you should have a target salary in mind, be open to negotiation. Consider non-monetary benefits like additional vacation days, remote work options, professional development opportunities, or performance bonuses. Flexibility demonstrates your willingness to collaborate and can lead to a more favorable outcome.

Practice Active Listening

Listening is just as essential as speaking during negotiations. Pay close attention to your employer’s responses and concerns. Address any objections calmly and provide relevant examples to demonstrate your readiness to overcome challenges.

Leverage Competing Offers

If you have multiple job offers or a robust potential offer from another company, use this as leverage. Express your desire to stay with your current employer but emphasize that you need a competitive offer to make an informed decision. This approach can prompt your current employer to match or exceed the competing offer.

Seek Long-Term Growth

Focus on your career trajectory rather than just your immediate salary. Inquire about opportunities for advancement, performance reviews, and salary growth over time. This approach underscores your commitment to your professional development and shows that you’re thinking about the company’s long-term success.

Follow Up Professionally

After the negotiation, regardless of the outcome, maintain professionalism. If you’re successful, express gratitude for your consideration. If the negotiation didn’t result in the desired increase, express appreciation for the opportunity to discuss the matter and ask about future possibilities.

Mastering the art of salary negotiation requires a combination of research, self-confidence, effective communication, and a win-win mindset. Financial experts stress that this skill can have a lasting impact on your earning potential and overall economic well-being. By employing these strategies, you can approach salary negotiations with confidence and secure a compensation package that reflects your true worth.

Contact STATT Financial: info@stattfs.com

Business

How Trump’s Tariffs Could Hit American Wallets

As the debate over tariffs heats up ahead of the 2024 election, new analysis reveals that American consumers could face significant financial consequences if former President Donald Trump’s proposed tariffs are enacted and maintained. According to a recent report highlighted by Forbes, the impact could be felt across households, businesses, and the broader U.S. economy.

The Household Cost: Up to $2,400 More Per Year

Research from Yale University’s Budget Lab, cited by Forbes, estimates that the average U.S. household could pay an additional $2,400 in 2025 if the new tariffs take effect and persist. This projection reflects the cumulative impact of all tariffs announced in Trump’s plan.

Price Hikes Across Everyday Goods

The tariffs are expected to drive up consumer prices by 1.8% in the near term. Some of the hardest-hit categories include:

- Apparel: Prices could jump 37% in the short term (and 18% long-term).

- Footwear: Up 39% short-term (18% long-term).

- Metals: Up 43%.

- Leather products: Up 39%.

- Electrical equipment: Up 26%.

- Motor vehicles, electronics, rubber, and plastic products: Up 11–18%.

- Groceries: Items like vegetables, fruits, and nuts could rise up to 6%, with additional increases for coffee and orange juice due to specific tariffs on Brazilian imports.

A Historic Tariff Rate and Economic Impact

If fully implemented, the effective tariff rate on U.S. consumers could reach 18%, the highest level since 1934. The broader economic consequences are also notable:

- GDP Reduction: The tariffs could reduce U.S. GDP by 0.4% annually, equating to about $110 billion per year.

- Revenue vs. Losses: While tariffs are projected to generate $2.2 trillion in revenue over the next decade, this would be offset by $418 billion in negative economic impacts.

How Businesses Are Responding

A KPMG survey cited in the report found that 83% of business leaders expect to raise prices within six months of tariff implementation. More than half say their profit margins are already under pressure, suggesting that consumers will likely bear the brunt of these increased costs.

What This Means for Americans

The findings underscore the potential for substantial financial strain on American families and businesses if Trump’s proposed tariffs are enacted. With consumer prices set to rise and economic growth projected to slow, the debate over tariffs is likely to remain front and center in the months ahead.

For more in-depth economic analysis and updates, stay tuned to Bolanlemedia.com.

Business & Money

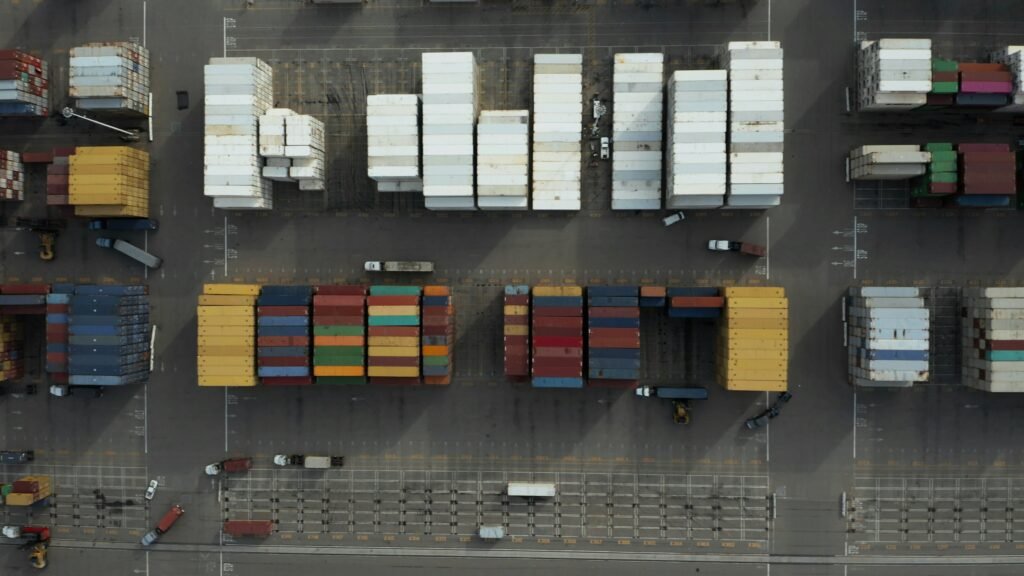

Trump Announces 35% Tariff on Canadian Imports Starting August 1, 2025

U.S. President Donald Trump has announced a sweeping 35% tariff on all Canadian imports, effective August 1, 2025. This move marks a significant escalation in trade tensions between the United States and Canada, two of the world’s closest economic partners. The measure is part of Trump’s broader strategy to address what he calls “unsustainable Trade Deficits” and protect American industries.

Details of the Tariff

- Scope: The 35% tariff applies to virtually all Canadian exports to the United States, with no exemptions for goods that comply with the USMCA (United States-Mexico-Canada Agreement), which had previously provided certain protections.

- Enforcement: Goods transshipped through third countries to avoid the tariff will still be subject to the 35% rate.

- Timeline: The tariff takes effect on August 1, 2025.

- Potential Adjustments: Trump has indicated that the rate could be increased if Canada retaliates with its own tariffs, or lowered if Canada addresses U.S. concerns, such as stopping fentanyl trafficking.

Justifications Cited by the Trump Administration

President Trump’s announcement cited several reasons for the new tariff:

- Retaliatory Measures: Canada’s previous retaliatory tariffs against U.S. goods.

- Trade Deficits: Concerns over the U.S. trade deficit with Canada, which Trump claims threatens national security.

- Dairy Industry: Complaints about Canada’s high tariffs on U.S. dairy products, reportedly up to 400%.

- Fentanyl Trafficking: Allegations that Canada has not done enough to prevent the flow of fentanyl into the U.S..

Economic and Political Impact

Economic Concerns

- Business Reaction: A recent poll found that 84% of American business leaders are worried about the negative impact of tariffs on the U.S. economy’s global standing.

- Supply Chains: The integrated North American supply chain, especially in the automotive sector, is expected to be severely affected. Major automakers have warned of significant disruptions and cost increases.

- Tariff Trends: U.S. applied tariff rates have surged under Trump’s administration, reaching historic highs in early 2025. The new Canadian tariff could push average rates even higher after a brief reduction earlier in the year.

Diplomatic Repercussions

- Canadian Response: Prime Minister Mark Carney, recently elected on an anti-Trump platform, is preparing retaliatory tariffs on U.S. goods. Canada has previously imposed tariffs on $20 billion (CA$30 billion) worth of American products, with plans to expand further.

- Breakdown in Negotiations: Diplomatic relations have deteriorated, especially after the U.S. ended trade talks following Canada’s implementation of a digital services tax in June 2025. Despite previous commitments at the G7 summit to seek compromise, the relationship remains tense.

Conclusion

The imposition of a 35% tariff on Canadian imports by the United States represents a major shift in North American trade relations. The move is expected to have wide-ranging economic and diplomatic consequences, with both countries bracing for further escalation and uncertainty in cross-border commerce.

Business

Pros and Cons of the Big Beautiful Bill

The “Big Beautiful Bill” (officially the One Big Beautiful Bill Act) is a sweeping tax and spending package passed in July 2025. It makes permanent many Trump-era tax cuts, introduces new tax breaks for working Americans, and enacts deep cuts to federal safety-net programs. The bill also increases spending on border security and defense, while rolling back clean energy incentives and tightening requirements for social programs.

Pros

1. Tax Relief for Middle and Working-Class Families

- Makes the 2017 Trump tax cuts permanent, preventing a scheduled tax hike for many Americans.

- Introduces new tax breaks: no federal income tax on tips and overtime pay (for incomes under $150,000, with limits).

- Doubles the Child Tax Credit to $2,500 per child through 2028.

- Temporarily raises the SALT (state and local tax) deduction cap to $40,000.

- Creates “Trump Accounts”: tax-exempt savings accounts for newborns.

2. Support for Small Businesses and Economic Growth

- Makes the small business deduction permanent, supporting Main Street businesses.

- Expands expensing for investment in short-lived assets and domestic R&D, which is considered pro-growth.

3. Increased Spending on Security and Infrastructure

- Allocates $175 billion for border security and $160 billion for defense, the highest peacetime military budget in U.S. history.

- Provides $12.5 billion for air traffic control modernization.

4. Simplification and Fairness in the Tax Code

- Expands the Earned Income Tax Credit (EITC) and raises marginal rates on individuals earning over $400,000.

- Closes various deductions and loopholes, especially those benefiting private equity and multinational corporations.

Cons

1. Deep Cuts to Social Safety Net Programs

- Cuts Medicaid by approximately $930 billion and imposes new work requirements, which could leave millions without health insurance.

- Tightens eligibility and work requirements for SNAP (food assistance), potentially removing benefits from many low-income families.

- Rolls back student loan forgiveness and repeals Biden-era subsidies.

2. Increases the Federal Deficit

- The bill is projected to add $3.3–4 trillion to the federal deficit over 10 years.

- Critics argue that the combination of tax cuts and increased spending is fiscally irresponsible.

3. Benefits Skewed Toward the Wealthy

- The largest income gains go to affluent Americans, with top earners seeing significant after-tax increases.

- Critics describe the bill as the largest upward transfer of wealth in recent U.S. history.

4. Rollback of Clean Energy and Climate Incentives

- Eliminates tax credits for electric vehicles and solar energy by the end of 2025.

- Imposes stricter requirements for renewable energy developers, which could lead to job losses and higher electricity costs.

5. Potential Harm to Healthcare and Rural Hospitals

- Reduces funding for hospitals serving Medicaid recipients, increasing uncompensated care costs and threatening rural healthcare access.

- Tightens verification for federal premium subsidies under the Affordable Care Act, risking coverage for some middle-income Americans.

6. Public and Political Backlash

- The bill is unpopular in public polls and is seen as a political risk for its supporters.

- Critics warn it will widen the gap between rich and poor and reverse progress on alternative energy and healthcare.

Summary Table

| Pros | Cons |

|---|---|

| Permanent middle-class tax cuts | Deep Medicaid and SNAP cuts |

| No tax on tips/overtime for most workers | Millions may lose health insurance |

| Doubled Child Tax Credit | Adds $3.3–4T to deficit |

| Small business support | Benefits skewed to wealthy |

| Increased border/defense spending | Clean energy incentives eliminated |

| Simplifies some tax provisions | Threatens rural hospitals |

| Public backlash, political risk |

In summary:

The Big Beautiful Bill delivers significant tax relief and new benefits for many working and middle-class Americans, but it does so at the cost of deep cuts to social programs, a higher federal deficit, and reduced support for clean energy and healthcare. The bill is highly polarizing, with supporters touting its pro-growth and pro-family provisions, while critics warn of increased inequality and harm to vulnerable populations.

Business2 weeks ago

Business2 weeks agoPros and Cons of the Big Beautiful Bill

Advice3 weeks ago

Advice3 weeks agoWhat SXSW 2025 Filmmakers Want Every New Director to Know

Film Industry4 weeks ago

Film Industry4 weeks agoFilming Yourself and Look Cinematic

News2 weeks ago

News2 weeks agoFather Leaps Overboard to Save Daughter on Disney Dream Cruise

Health2 weeks ago

Health2 weeks agoMcCullough Alleges Government Hid COVID Vaccine Side Effects

Advice3 weeks ago

Advice3 weeks agoWhy 20% of Us Are Always Late

Advice3 weeks ago

Advice3 weeks agoHow to Find Your Voice as a Filmmaker

Entertainment2 weeks ago

Entertainment2 weeks agoJuror 25’s Behavior Sparks Debate Over Fairness in High-Profile Diddy Trial