Business & Money

Unlocking Financial Stability: Investing in Gold with an Eye on the Future

In the world of investments, where trends come and go, one timeless option stands out: gold. Imagine an investment that isn’t tied to economic ups and downs, doesn’t rely on market sentiment, and carries a legacy of trust. That’s gold. In this article, we’ll explore the glittering potential of Gold investment and analyze how it’s uniquely poised to shine even brighter with the ambitious goals of BRICS (Brazil, Russia, India, China, South Africa) to reshape the global currency landscape. Here we say that Dive into gold investment opportunities amidst the BRICS currency evolution. Explore the synergy of precious metal and global dynamics in this era.

The Golden Advantage

Gold isn’t just a metal; it’s a financial sanctuary. Unlike stocks that swing like a rollercoaster or currencies that rise and fall with politics, gold has held its value through the ages. It’s a tangible asset, a real thing you can hold. And that’s a big deal in a world full of digital uncertainties.

Why Should You Consider Gold?

Steady Amidst Storms: When economic storms rage, Gold Investment and BRICS Currency remains a steadfast ship. It’s a shield against inflation and economic uncertainty. When the financial world wobbles, gold stands strong.

Diversity’s Best Friend: Your investment portfolio is like a recipe. And just like any good recipe, diversity is key. Gold adds that much-needed spice. It often moves in a different direction from stocks, balancing out your financial feast.

Always in Vogue: You don’t have to worry about gold going out of style. Throughout history, it’s been a symbol of wealth, status, and value. Its timeless appeal is here to stay.

BRICS: The Goldez Partnership

Now, let’s talk about BRICS. These five powerhouse nations are on a mission to reshape how the world handles currency through Gold Investment and BRICS Currency Evolution. As they challenge the status quo and work towards alternatives to traditional currencies, gold nods its head in approval.

Why Gold Investment and BRICS Currency Make Sense Together

Imagine gold as a silent ally in the midst of global currency change. As BRICS nations strive to decrease dependence on certain currencies (yes, we’re looking at you, U.S. dollar), gold steps in as the universal constant. It doesn’t play favorites with countries. It’s not influenced by political speeches or economic reports. It’s a reliable rock.

Investing in gold isn’t just about seeking a shiny asset; it’s about embracing a symbol of stability. As the financial world keeps evolving, gold stands tall. And with BRICS working to reshape the global currency stage, holding onto gold gains an added advantage. So, whether you’re a financial aficionado or just dipping your toes into the investment sea, consider adding gold to your portfolio. It’s like having a piece of the past, a stake in the present, and a promise for a secure financial future all rolled into one.

Contact STATT Financial: info@stattfs.com

Business

How Trump’s Tariffs Could Hit American Wallets

As the debate over tariffs heats up ahead of the 2024 election, new analysis reveals that American consumers could face significant financial consequences if former President Donald Trump’s proposed tariffs are enacted and maintained. According to a recent report highlighted by Forbes, the impact could be felt across households, businesses, and the broader U.S. economy.

The Household Cost: Up to $2,400 More Per Year

Research from Yale University’s Budget Lab, cited by Forbes, estimates that the average U.S. household could pay an additional $2,400 in 2025 if the new tariffs take effect and persist. This projection reflects the cumulative impact of all tariffs announced in Trump’s plan.

Price Hikes Across Everyday Goods

The tariffs are expected to drive up consumer prices by 1.8% in the near term. Some of the hardest-hit categories include:

- Apparel: Prices could jump 37% in the short term (and 18% long-term).

- Footwear: Up 39% short-term (18% long-term).

- Metals: Up 43%.

- Leather products: Up 39%.

- Electrical equipment: Up 26%.

- Motor vehicles, electronics, rubber, and plastic products: Up 11–18%.

- Groceries: Items like vegetables, fruits, and nuts could rise up to 6%, with additional increases for coffee and orange juice due to specific tariffs on Brazilian imports.

A Historic Tariff Rate and Economic Impact

If fully implemented, the effective tariff rate on U.S. consumers could reach 18%, the highest level since 1934. The broader economic consequences are also notable:

- GDP Reduction: The tariffs could reduce U.S. GDP by 0.4% annually, equating to about $110 billion per year.

- Revenue vs. Losses: While tariffs are projected to generate $2.2 trillion in revenue over the next decade, this would be offset by $418 billion in negative economic impacts.

How Businesses Are Responding

A KPMG survey cited in the report found that 83% of business leaders expect to raise prices within six months of tariff implementation. More than half say their profit margins are already under pressure, suggesting that consumers will likely bear the brunt of these increased costs.

What This Means for Americans

The findings underscore the potential for substantial financial strain on American families and businesses if Trump’s proposed tariffs are enacted. With consumer prices set to rise and economic growth projected to slow, the debate over tariffs is likely to remain front and center in the months ahead.

For more in-depth economic analysis and updates, stay tuned to Bolanlemedia.com.

Business & Money

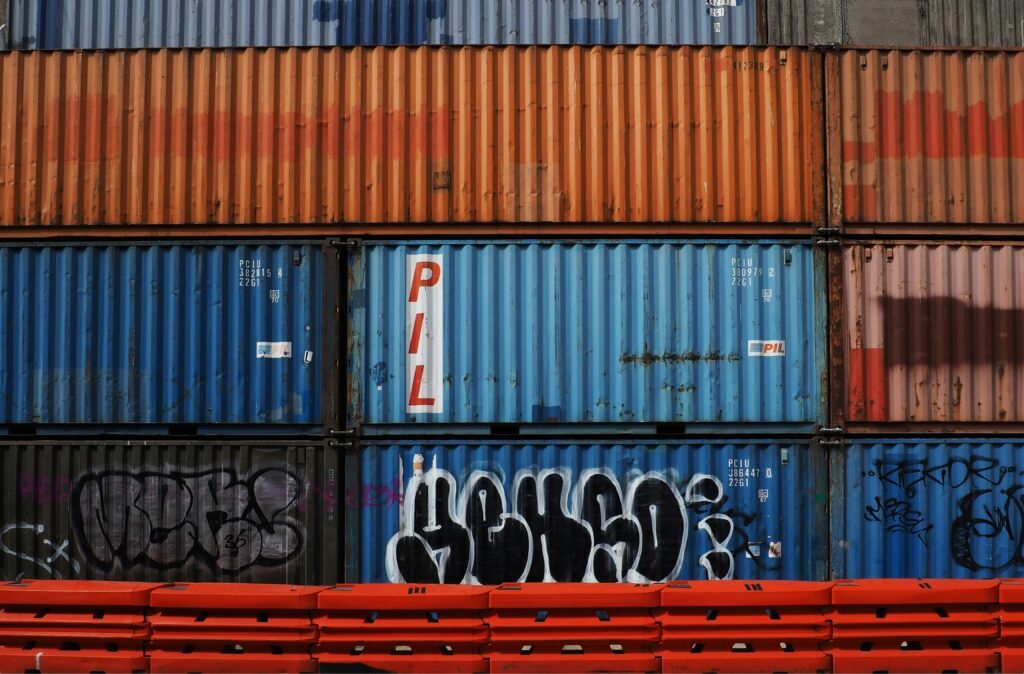

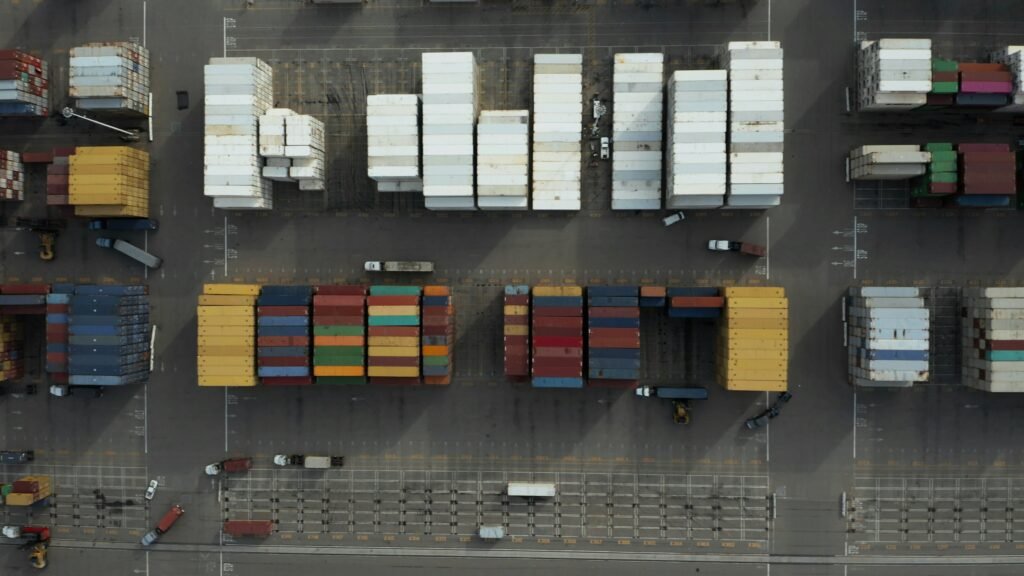

Trump Announces 35% Tariff on Canadian Imports Starting August 1, 2025

U.S. President Donald Trump has announced a sweeping 35% tariff on all Canadian imports, effective August 1, 2025. This move marks a significant escalation in trade tensions between the United States and Canada, two of the world’s closest economic partners. The measure is part of Trump’s broader strategy to address what he calls “unsustainable Trade Deficits” and protect American industries.

Details of the Tariff

- Scope: The 35% tariff applies to virtually all Canadian exports to the United States, with no exemptions for goods that comply with the USMCA (United States-Mexico-Canada Agreement), which had previously provided certain protections.

- Enforcement: Goods transshipped through third countries to avoid the tariff will still be subject to the 35% rate.

- Timeline: The tariff takes effect on August 1, 2025.

- Potential Adjustments: Trump has indicated that the rate could be increased if Canada retaliates with its own tariffs, or lowered if Canada addresses U.S. concerns, such as stopping fentanyl trafficking.

Justifications Cited by the Trump Administration

President Trump’s announcement cited several reasons for the new tariff:

- Retaliatory Measures: Canada’s previous retaliatory tariffs against U.S. goods.

- Trade Deficits: Concerns over the U.S. trade deficit with Canada, which Trump claims threatens national security.

- Dairy Industry: Complaints about Canada’s high tariffs on U.S. dairy products, reportedly up to 400%.

- Fentanyl Trafficking: Allegations that Canada has not done enough to prevent the flow of fentanyl into the U.S..

Economic and Political Impact

Economic Concerns

- Business Reaction: A recent poll found that 84% of American business leaders are worried about the negative impact of tariffs on the U.S. economy’s global standing.

- Supply Chains: The integrated North American supply chain, especially in the automotive sector, is expected to be severely affected. Major automakers have warned of significant disruptions and cost increases.

- Tariff Trends: U.S. applied tariff rates have surged under Trump’s administration, reaching historic highs in early 2025. The new Canadian tariff could push average rates even higher after a brief reduction earlier in the year.

Diplomatic Repercussions

- Canadian Response: Prime Minister Mark Carney, recently elected on an anti-Trump platform, is preparing retaliatory tariffs on U.S. goods. Canada has previously imposed tariffs on $20 billion (CA$30 billion) worth of American products, with plans to expand further.

- Breakdown in Negotiations: Diplomatic relations have deteriorated, especially after the U.S. ended trade talks following Canada’s implementation of a digital services tax in June 2025. Despite previous commitments at the G7 summit to seek compromise, the relationship remains tense.

Conclusion

The imposition of a 35% tariff on Canadian imports by the United States represents a major shift in North American trade relations. The move is expected to have wide-ranging economic and diplomatic consequences, with both countries bracing for further escalation and uncertainty in cross-border commerce.

Business

Pros and Cons of the Big Beautiful Bill

The “Big Beautiful Bill” (officially the One Big Beautiful Bill Act) is a sweeping tax and spending package passed in July 2025. It makes permanent many Trump-era tax cuts, introduces new tax breaks for working Americans, and enacts deep cuts to federal safety-net programs. The bill also increases spending on border security and defense, while rolling back clean energy incentives and tightening requirements for social programs.

Pros

1. Tax Relief for Middle and Working-Class Families

- Makes the 2017 Trump tax cuts permanent, preventing a scheduled tax hike for many Americans.

- Introduces new tax breaks: no federal income tax on tips and overtime pay (for incomes under $150,000, with limits).

- Doubles the Child Tax Credit to $2,500 per child through 2028.

- Temporarily raises the SALT (state and local tax) deduction cap to $40,000.

- Creates “Trump Accounts”: tax-exempt savings accounts for newborns.

2. Support for Small Businesses and Economic Growth

- Makes the small business deduction permanent, supporting Main Street businesses.

- Expands expensing for investment in short-lived assets and domestic R&D, which is considered pro-growth.

3. Increased Spending on Security and Infrastructure

- Allocates $175 billion for border security and $160 billion for defense, the highest peacetime military budget in U.S. history.

- Provides $12.5 billion for air traffic control modernization.

4. Simplification and Fairness in the Tax Code

- Expands the Earned Income Tax Credit (EITC) and raises marginal rates on individuals earning over $400,000.

- Closes various deductions and loopholes, especially those benefiting private equity and multinational corporations.

Cons

1. Deep Cuts to Social Safety Net Programs

- Cuts Medicaid by approximately $930 billion and imposes new work requirements, which could leave millions without health insurance.

- Tightens eligibility and work requirements for SNAP (food assistance), potentially removing benefits from many low-income families.

- Rolls back student loan forgiveness and repeals Biden-era subsidies.

2. Increases the Federal Deficit

- The bill is projected to add $3.3–4 trillion to the federal deficit over 10 years.

- Critics argue that the combination of tax cuts and increased spending is fiscally irresponsible.

3. Benefits Skewed Toward the Wealthy

- The largest income gains go to affluent Americans, with top earners seeing significant after-tax increases.

- Critics describe the bill as the largest upward transfer of wealth in recent U.S. history.

4. Rollback of Clean Energy and Climate Incentives

- Eliminates tax credits for electric vehicles and solar energy by the end of 2025.

- Imposes stricter requirements for renewable energy developers, which could lead to job losses and higher electricity costs.

5. Potential Harm to Healthcare and Rural Hospitals

- Reduces funding for hospitals serving Medicaid recipients, increasing uncompensated care costs and threatening rural healthcare access.

- Tightens verification for federal premium subsidies under the Affordable Care Act, risking coverage for some middle-income Americans.

6. Public and Political Backlash

- The bill is unpopular in public polls and is seen as a political risk for its supporters.

- Critics warn it will widen the gap between rich and poor and reverse progress on alternative energy and healthcare.

Summary Table

| Pros | Cons |

|---|---|

| Permanent middle-class tax cuts | Deep Medicaid and SNAP cuts |

| No tax on tips/overtime for most workers | Millions may lose health insurance |

| Doubled Child Tax Credit | Adds $3.3–4T to deficit |

| Small business support | Benefits skewed to wealthy |

| Increased border/defense spending | Clean energy incentives eliminated |

| Simplifies some tax provisions | Threatens rural hospitals |

| Public backlash, political risk |

In summary:

The Big Beautiful Bill delivers significant tax relief and new benefits for many working and middle-class Americans, but it does so at the cost of deep cuts to social programs, a higher federal deficit, and reduced support for clean energy and healthcare. The bill is highly polarizing, with supporters touting its pro-growth and pro-family provisions, while critics warn of increased inequality and harm to vulnerable populations.

Business1 week ago

Business1 week agoPros and Cons of the Big Beautiful Bill

Advice3 weeks ago

Advice3 weeks agoWhat SXSW 2025 Filmmakers Want Every New Director to Know

Film Industry3 weeks ago

Film Industry3 weeks agoFilming Yourself and Look Cinematic

News2 weeks ago

News2 weeks agoFather Leaps Overboard to Save Daughter on Disney Dream Cruise

Politics4 weeks ago

Politics4 weeks agoBolanle Newsroom Brief: Israel Strikes Iran’s Nuclear Sites — What It Means for the World

Health2 weeks ago

Health2 weeks agoMcCullough Alleges Government Hid COVID Vaccine Side Effects

Advice2 weeks ago

Advice2 weeks agoWhy 20% of Us Are Always Late

Advice2 weeks ago

Advice2 weeks agoHow to Find Your Voice as a Filmmaker