Business & Money

Unlocking Financial Stability: Investing in Gold with an Eye on the Future

In the world of investments, where trends come and go, one timeless option stands out: gold. Imagine an investment that isn’t tied to economic ups and downs, doesn’t rely on market sentiment, and carries a legacy of trust. That’s gold. In this article, we’ll explore the glittering potential of Gold investment and analyze how it’s uniquely poised to shine even brighter with the ambitious goals of BRICS (Brazil, Russia, India, China, South Africa) to reshape the global currency landscape. Here we say that Dive into gold investment opportunities amidst the BRICS currency evolution. Explore the synergy of precious metal and global dynamics in this era.

The Golden Advantage

Gold isn’t just a metal; it’s a financial sanctuary. Unlike stocks that swing like a rollercoaster or currencies that rise and fall with politics, gold has held its value through the ages. It’s a tangible asset, a real thing you can hold. And that’s a big deal in a world full of digital uncertainties.

Why Should You Consider Gold?

Steady Amidst Storms: When economic storms rage, Gold Investment and BRICS Currency remains a steadfast ship. It’s a shield against inflation and economic uncertainty. When the financial world wobbles, gold stands strong.

Diversity’s Best Friend: Your investment portfolio is like a recipe. And just like any good recipe, diversity is key. Gold adds that much-needed spice. It often moves in a different direction from stocks, balancing out your financial feast.

Always in Vogue: You don’t have to worry about gold going out of style. Throughout history, it’s been a symbol of wealth, status, and value. Its timeless appeal is here to stay.

BRICS: The Goldez Partnership

Now, let’s talk about BRICS. These five powerhouse nations are on a mission to reshape how the world handles currency through Gold Investment and BRICS Currency Evolution. As they challenge the status quo and work towards alternatives to traditional currencies, gold nods its head in approval.

Why Gold Investment and BRICS Currency Make Sense Together

Imagine gold as a silent ally in the midst of global currency change. As BRICS nations strive to decrease dependence on certain currencies (yes, we’re looking at you, U.S. dollar), gold steps in as the universal constant. It doesn’t play favorites with countries. It’s not influenced by political speeches or economic reports. It’s a reliable rock.

Investing in gold isn’t just about seeking a shiny asset; it’s about embracing a symbol of stability. As the financial world keeps evolving, gold stands tall. And with BRICS working to reshape the global currency stage, holding onto gold gains an added advantage. So, whether you’re a financial aficionado or just dipping your toes into the investment sea, consider adding gold to your portfolio. It’s like having a piece of the past, a stake in the present, and a promise for a secure financial future all rolled into one.

Contact STATT Financial: info@stattfs.com

Business & Money

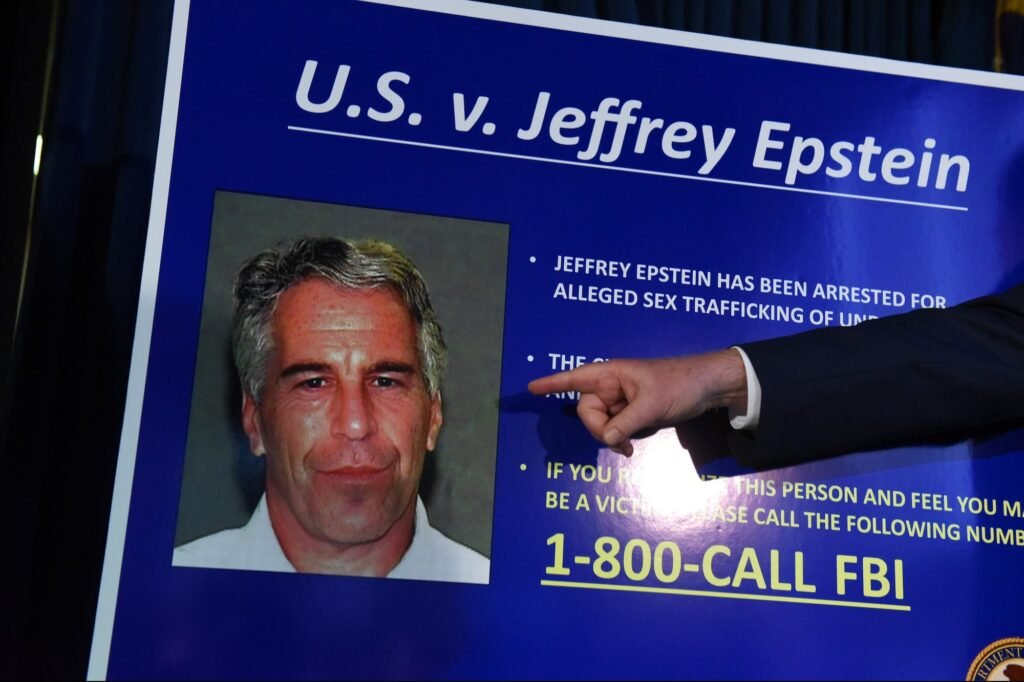

Ghislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her

February 9, 2026 — Ghislaine Maxwell tried to bargain with Congress from a prison video call.

Maxwell, the woman convicted of helping Jeffrey Epstein traffic underage girls, appeared virtually before the House Oversight Committee today and refused to answer a single question. She invoked her Fifth Amendment right against self‑incrimination on every substantive topic, including Epstein’s network, his associates, and any powerful figures who moved through his orbit.

Maxwell is serving a 20‑year federal sentence at a prison camp in Texas after being found guilty in 2021 of sex‑trafficking, conspiracy, and related charges. Her trial exposed a pattern of recruiting and grooming minors for Epstein’s abuse, and her conviction has been upheld on appeal. Despite that legal reality, her appearance today was less about accountability and more about negotiation.

Her lawyer, David Markus, told lawmakers that Maxwell would be willing to “speak fully and honestly” about Epstein and his world — but only if President Donald Trump grants her clemency or a pardon. Markus also claimed she could clear both Trump and Bill Clinton of wrongdoing related to Epstein, a statement critics immediately dismissed as a political play rather than a genuine bid for truth.

Republican Chair James Comer has already said he does not support clemency for Maxwell, and several Democrats accused her of trying to leverage her potential knowledge of powerful people as a way to escape prison. To many survivors’ advocates, the spectacle reinforced the sense that the system is more sympathetic to the powerful than to the victims.

At the same time, Congress is now reviewing roughly 3.5 million pages of Epstein‑related documents that the Justice Department has made available under tight restrictions. Lawmakers must view them on secure computers at the DOJ, with no phones allowed and no copies permitted. Early reports suggest that at least six male individuals, including one high‑ranking foreign official, had their names and images redacted without clear legal justification.

Those unredacted files are supposed to answer questions about who knew what, and when. The problem is that Maxwell is signaling she may never answer any of them — unless she is set free. As of February 9, 2026, the story is still this: a convicted trafficker is using her silence as leverage, Congress is sifting through a wall of redacted files, and the public is still waiting to see who really stood behind Epstein’s power.

Business

Overqualified? Great, Now Prove You’ll Work for Free and Love It!

The phrase “Overqualified? Great, Now Prove You’ll Work for Free and Love It!” sums up the snake-eating-its-tail absurdity of the modern job search. In 2025, the most experienced, credentialed candidates are told they’re not quite the right fit—because they’re too capable, too seasoned, and might actually threaten the status quo by knowing what they’re worth.

The Experience Dilemma

Picture this: half the workforce has too much education or experience for the entry-level roles on offer, and yet, employers still claim they can’t find “qualified” people. The result? An absurd interview dance where applicants with years of achievement must convince employers they’re perfectly fine being underpaid and unappreciated. Many are even asked to perform hours of free “sample work”—projects that benefit the company but are never compensated.

Nearly half of job seekers have applied for jobs for which they were overqualified this year, and about a quarter feel “overqualification” is a major obstacle to actually getting hired. Employers call it “hiring for culture fit” or “salary alignment.” Candidates call it gaslighting: “We love your credentials, but wouldn’t someone like you get bored… or want a living wage?”.

Free Labor: The New Normal

The job hunt is now a marathon of unpaid labor. Applicants often rewrite resumes dozens of times (to game robotic filters), complete personality tests, and spend weeks in multi-stage interviews, only to be ghosted. In a perverse twist, talented workers jump through hoops for jobs explicitly beneath their skill level, all because employers believe an overqualified hire will “leave at the first better opportunity.” In reality, people just want to pay the bills—and would gladly contribute their value if someone gave them a chance.

Even as companies bemoan a “labor shortage,” they turn away the best and brightest, fearing they’ll disrupt the hierarchy, demand raises, or burn out from boredom. What’s left? The less skilled get trained on the job, and even they are told not to expect too much—after all, wouldn’t you do it for the “experience” alone?.

The Absurdity of the Market

Workers at every level—laid off, mid-career, executives—are hunting desperately for positions once reserved for recent graduates. Administrative jobs that previously required a high school diploma now routinely demand a college degree and relevant work history. Degree inflation means the bar keeps rising, but the pay and job security aren’t budging; 2025’s job search feels more like a dystopian obstacle course than a professional meritocracy.

Employers wield the “overqualified” label to maintain the illusion that they could hire anyone, while making sure they never have to pay what a role is really worth. Ironically, most companies spend more time filtering out talent than developing it—and everyone loses in the end.

What’s the Solution?

Job seekers are increasingly advised to do the following:

- Tailor resumes and cover letters to each application, emphasizing culture fit and signaling “no threat to the boss”.

- Network with insiders for referrals, since faceless applications are now nearly pointless.

- Accept that unpaid proof-of-skills work is now part of the game.

- Keep learning, but remember: adding skills may just make you even more overqualified for the next round.

The paradox of 2025? “Show us your value—just don’t expect to be treated like you have any.” The only thing more overqualified than today’s job seeker is the job market itself: packed with hurdles, full of empty promises, and rigged to keep the most talented quietly waiting for a call that may never come.

Business & Money

How the GENIUS Act Will Transform Your Money and Payments

The passage of the GENIUS Act in 2025 marks a revolutionary step in how money and payments will work in the United States. It is the first comprehensive federal law specifically regulating stablecoins—digital currencies pegged to traditional money like the U.S. dollar. This new legislation is poised to reshape your experience with money, making payments faster, more transparent, and potentially cheaper, while introducing clear consumer protections and regulatory standards for digital currencies.

What is the GENIUS Act?

The GENIUS Act stands for Guiding and Establishing National Innovation for U.S. Stablecoins. It establishes a clear legal framework for stablecoins, which are designed to hold a steady value (usually $1) unlike the more volatile cryptocurrencies such as Bitcoin. Stablecoins are increasingly used for routine transactions such as paying bills, sending remittances, or transferring money across borders.

Under the new law:

- Only authorized issuers like banks, credit unions, and federally approved non-bank financial institutions can issue stablecoins.

- Issuers must maintain 100% reserves—meaning for every digital coin issued, there must be a corresponding $1 held in cash, U.S. Treasury securities, or other approved liquid assets.

- Issuers are required to undergo regular audits and publish disclosures about their reserves.

- If an issuer fails or goes bankrupt, holders of stablecoins get priority in getting their money back ahead of other creditors.

This stringent reserve and audit requirement provides much-needed transparency and trust for consumers.

Key Consumer Benefits and Protections

- Faster, Cheaper Payments

Integrating stablecoins into mainstream banking systems can speed up transactions dramatically. You could receive paychecks instantly, send money overseas with minimal fees, and settle payments without the delays typical of current banking transfers. - Clear Regulation and Oversight

Before the GENIUS Act, the regulatory environment was fragmented and uncertain. Now, stablecoins have a federal framework that coordinates oversight between federal and state regulators to prevent fraud, money laundering, and abuses. - Privacy and Government Limits

The law bans the Federal Reserve from creating retail Central Bank Digital Currencies (CBDCs)—digital dollars controlled directly by the government—addressing privacy concerns about surveillance of everyday spending. - Financial Stability and Consumer Priority

The Act gives stablecoin holders priority status in bankruptcy cases, meaning your digital dollars are protected better than traditional bank deposits or bondholder claims in insolvencies.

What This Means for You

The GENIUS Act could significantly change your daily financial life:

- You may start to see stablecoins integrated within banking apps, payroll systems, and payment services.

- Money transfers could become almost instantaneous and cost less, especially across borders.

- More businesses and financial institutions might accept digital dollars pegged to the U.S. dollar.

- Consumer protections could increase, with more audit oversight and clarity about your rights as a stablecoin holder.

However, challenges remain. Regulators have up to 18 months to finalize detailed rules on audits, reserve management, fraud prevention, and compliance. The evolving regulations will determine how safe and seamless digital currency payments become.

A Global Race to Modernize Money

While the U.S. passed the GENIUS Act to catch up, other countries like China and members of the European Union are already piloting their own digital currencies. The legislation positions the U.S. to retain the dollar’s dominant role globally by tying digital currencies directly to U.S. dollars and Treasury securities, potentially boosting demand for American debt and keeping borrowing costs stable.

The Future of Money and Payments

The GENIUS Act opens the door to a more modern, efficient financial system where digital dollars coexist with traditional money, offering consumers faster options and better protections. While adoption will take time, this law lays the groundwork for a future where your payments, savings, and everyday money management are fundamentally transformed by technology—making financial services more accessible, transparent, and resilient.

Whether you choose to use stablecoins actively or not, the changes unfolding will reach into many aspects of how money moves in our economy. Staying informed about this evolving landscape will help you navigate the future of payments confidently.

Advice2 weeks ago

Advice2 weeks agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Business3 weeks ago

Business3 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Entertainment4 weeks ago

Entertainment4 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Film Industry2 weeks ago

Film Industry2 weeks agoWhy Burnt-Out Filmmakers Need to Unplug Right Now

Business3 weeks ago

Business3 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Entertainment3 weeks ago

Entertainment3 weeks agoYou wanted to make movies, not decode Epstein. Too late.

News2 weeks ago

News2 weeks agoHarlem’s Hottest Ticket: Ladawn Mechelle Taylor Live

Business & Money3 weeks ago

Business & Money3 weeks agoGhislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her