Politics

Bill Aims to Strip Convicted Felons of Secret Service Protection

Washington, D.C. – In a significant legislative move, Rep. Bennie G. Thompson (D-MS), Ranking Member of the Committee on Homeland Security, has introduced the *Denying Infinite Security and Government Resources Allocated toward Convicted and Extremely Dishonorable Former Protectees Act* (DISGRACED Former Protectees Act). This bill aims to address a critical gap in current U.S. law regarding Secret Service protection for convicted felons who are sentenced to prison.

Under existing law, the Secret Service is mandated to protect former presidents and other high-level officials, even if they are convicted of a felony. The DISGRACED Former Protectees Act seeks to terminate such protection if the individual is convicted of a felony and sentenced to prison.

Key Provisions of the DISGRACED Former Protectees Act

1. Automatic Termination of Protection: The Act would automatically end Secret Service protection for any former protectee, including former presidents, who are sentenced to prison following a felony conviction. This provision ensures that convicted individuals do not receive special treatment due to their previous status.

2. Responsibility Shift: Once Secret Service protection is terminated, the responsibility for the protection of the convicted individual would shift to prison authorities. This change ensures that the individual is treated like any other inmate, maintaining the integrity of the prison system and the justice process.

3. Legislative Intent: The legislation is designed to ensure that protective status does not result in special treatment for convicted felons. By updating the law, the bill aims to maintain the integrity of the justice system and ensure that all individuals serve their sentences as required, without the complications of Secret Service protection.

Context and Implications

This legislative move comes in the context of former President Donald J. Trump’s recent conviction on 34 felony counts of falsifying business records. The historic conviction has raised questions about the implications of Secret Service protection if he were to be sentenced to prison. Under current law, the Secret Service would be responsible for protecting him within prison premises, a scenario that presents significant logistical and legal challenges.

Rep. Thompson emphasized the necessity of the legislation, stating, “Unfortunately, current law doesn’t anticipate how Secret Service protection would impact the felony prison sentence of a protectee—even a former President. It is regrettable that it has come to this, but this previously unthought-of scenario could become our reality. Therefore, it is necessary for us to be prepared and update the law so the American people can be assured that protective status does not translate into special treatment—and that those who are sentenced to prison will indeed serve the time required of them”.

Political Reactions

The introduction of the DISGRACED Former Protectees Act has sparked a range of political reactions. Governor Tate Reeves (R-MS) criticized the legislation, calling it “truly shameful, outrageous, and a new low for the leftwing in America.” He argued that the bill could leave former President Trump vulnerable to assassination attempts, a claim that has been met with both support and opposition from various political figures.

Despite the controversy, the bill has garnered support from several Democratic co-sponsors, including Reps. Troy A. Carter Sr., Barbara Lee, Frederica Wilson, Yvette D. Clarke, Bonnie Watson Coleman, Jasmine Crockett, Joyce Beatty, and Steve Cohen. They argue that the legislation is necessary to ensure the fair administration of justice and to prevent any individual from receiving preferential treatment due to their former status.

Conclusion

The DISGRACED Former Protectees Act represents a significant step in addressing the complexities of providing Secret Service protection to convicted felons. By terminating such protection upon sentencing, the legislation aims to uphold the principles of justice and equality, ensuring that all individuals, regardless of their past positions, are subject to the same legal standards and treatment.

As the bill moves through the legislative process, it will undoubtedly continue to generate debate and discussion about the balance between security, justice, and the rule of law in the United States.

Stay Connected

News

US May Completely Cut Income Tax Due to Tariff Revenue

President Donald Trump says the United States might one day get rid of federal income tax because of money the government collects from tariffs on imported goods. Tariffs are extra taxes the U.S. puts on products that come from other countries.

What Trump Is Saying

Trump has said that tariff money could become so large that it might allow the government to cut income taxes “almost completely.” He has also talked about possibly phasing out income tax over the next few years if tariff money keeps going up.

How Taxes Work Now

Right now, the federal government gets much more money from income taxes than from tariffs. Income taxes bring in trillions of dollars each year, while tariffs bring in only a small part of that total. Because of this gap, experts say tariffs would need to grow by many times to replace income tax money.

Questions From Experts

Many economists and tax experts doubt that tariffs alone could pay for the whole federal budget. They warn that very high tariffs could make many imported goods more expensive for shoppers in the United States. This could hit lower- and middle‑income families hardest, because they spend a big share of their money on everyday items.

What Congress Must Do

The president can change some tariffs, but only Congress can change or end the federal income tax. That means any real plan to remove income tax would need new laws passed by both the House of Representatives and the Senate. So far, there is no detailed law or full budget plan on this idea.

What It Means Right Now

For now, Trump’s comments are a proposal, not a change in the law. People and businesses still have to pay federal income tax under the current rules. The debate over using tariffs instead of income taxes is likely to continue among lawmakers, experts, and voters.

News

Candace Owens Says Macrons Funded Plot to Kill Her

Conservative commentator Candace Owens has made explosive allegations that French President Emmanuel Macron and First Lady Brigitte Macron orchestrated and financed a plot to assassinate her. Owens alleges that she was alerted by a high-ranking source within the French government who revealed that the assassination was to be carried out by an elite French police unit, the National Gendarmerie Intervention Group (GIGN), along with the involvement of at least one Israeli operative. According to Owens, this “joint state operation” was motivated by her outspoken coverage and conspiratorial claims about Brigitte Macron, including controversial statements questioning the First Lady’s gender identity.

Owens further claims the payments for the assassination were funneled through a secret French elite club called Club des Cent, suggesting a sophisticated and well-financed scheme. She also links this alleged plot to the assassination of her late friend Charlie Kirk in 2025, suggesting that his killer received training from France’s 13th Foreign Legion Brigade and that these events are part of a larger multi-state conspiracy.

Despite these serious accusations, Owens has not publicly shared concrete evidence, and French, Israeli, and American authorities have not confirmed any part of the story. The Macron family has previously filed defamation lawsuits against Owens over her unfounded assertions about them, highlighting a tense and ongoing feud.

Owens has vowed to provide further details, including identities and financial proof, if given the opportunity, and has called on the public and patriotic investigators to examine the matter closely. While her claims have stirred widespread attention and heated debate across social media and conservative circles, they currently remain unsubstantiated allegations amid a highly charged political and media environment.

This controversy adds a new and dramatic layer to Owens’ volatile relationship with the Macrons, marking perhaps the most sensational claim so far in her ongoing public disputes with the French presidential couple.

News

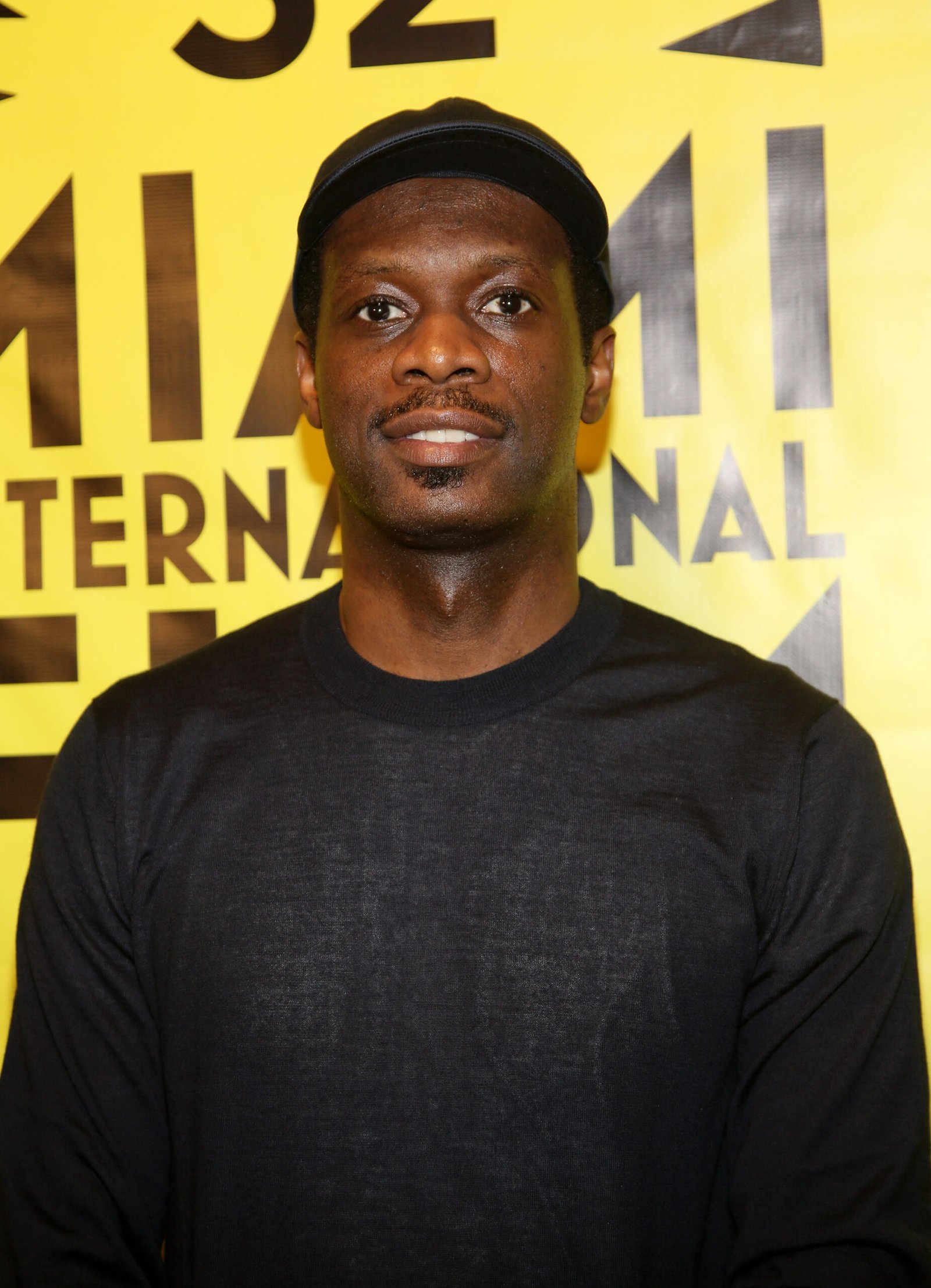

Fugees Rapper Pras Michel Sentenced to 14 Years in Campaign Scandal

Pras Michel, Grammy-winning rapper and founding member of the iconic group the Fugees, has been sentenced to 14 years in federal prison for his role in a sprawling illegal campaign finance and foreign influence scheme. The sentencing was handed down on November 20, 2025, by U.S. District Judge Colleen Kollar-Kotelly in Washington, D.C., following Michel’s conviction in April 2023 on charges including conspiracy, money laundering, acting as an unregistered foreign agent, and witness tampering.

At the heart of the scandal was Michel’s involvement in funneling over $120 million from fugitive Malaysian financier Low Taek Jho—known as Jho Low—into the 2012 reelection campaign of former President Barack Obama. Prosecutors detailed how Michel helped hide the origin of foreign donations through shell companies and straw donors, violating U.S. campaign finance laws that prohibit foreign contributions. Beyond the Obama campaign, Michel also engaged in illegal lobbying efforts during the Trump administration to obstruct investigations into Low’s role in the notorious 1MDB scandal, a massive Malaysian sovereign wealth fund corruption case.

Prosecutors described Michel as having “betrayed his country for financial gain,” persistently lying and manipulating government entities over nearly a decade. They advocated for a life sentence, emphasizing the severity of his offenses and the threat posed to U.S. national security. Testimonies during the high-profile trial included notable figures such as Hollywood actor Leonardo DiCaprio and former U.S. Attorney General Jeff Sessions.

Michel’s defense team condemned the harsh sentence as “entirely disproportionate,” arguing that similar cases resulted in lighter penalties, and pointed out that Michel received no espionage charges—a key consideration in foreign agent prosecutions. They announced plans to appeal the verdict and sentence. Following the prison term, Michel faces three years of supervised release and forfeiture of more than $64 million tied to the illegal campaign finance activity.

Michel, who shot to fame in the 1990s as part of the Fugees alongside Lauryn Hill and Wyclef Jean, now confronts a dramatic fall from grace that underscores the extensive consequences of illicit foreign influence in American politics. Despite this setback, his representatives remain grateful for the support received, stating that this chapter does not mark the end of his journey.

This landmark case serves as a stark reminder of the importance of safeguarding U.S. elections from covert foreign interference and the serious repercussions for those who betray democratic principles for financial gain.bbc+4

- https://www.bbc.com/news/articles/cg7n7l70vzgo

- https://www.aljazeera.com/news/2025/11/21/fugees-rapper-sentenced-to-14-years-in-prison-over-illegal-obama-donations

- https://www.wsj.com/us-news/fugees-member-sentenced-to-14-years-for-campaign-donation-scheme-7bbb7850

- https://www.youtube.com/watch?v=ow4bcn8mkIM

- https://www.lemonde.fr/en/international/article/2025/11/21/fugees-rapper-pras-michel-sentenced-to-14-years-in-prison-in-us-campaign-financing-scandal_6747698_4.html

- https://www.politico.com/newsletters/politico-influence/2025/11/20/fugees-star-sentenced-to-14-years-in-fara-case-00664124

- https://www.justice.gov/archives/opa/pr/us-entertainer-convicted-engaging-foreign-influence-campaign

- https://apnews.com/article/852e3aa86a604597b99c5e81179a7b6b

- https://www.reddit.com/r/hiphopheads/comments/11g6you/the_fugee_the_fugitive_and_the_fbi_how_rapper/