News

Who Owns Your AI Afterlife?

As artificial intelligence increasingly resurrects the voices and faces of the dead, the question of ownership over a person’s “digital afterlife” has never been more urgent. Generative AI can now create digital avatars, voice clones, and chatbots echoing the memories and personalities of those long gone, propelling a rapidly expanding global industry projected to reach up to $80 billion by 2035. Yet behind the novelty and comfort offered by these virtual presences lies a complex web of legal, ethical, and emotional challenges about who truly controls a person’s legacy after death.

The Rise of Digital Resurrection

AI-driven “deadbots” now allow families to interact with highly realistic digital versions of departed loved ones, sometimes for as little as $30 per video. In China, more than 1,000 people have reportedly been digitally “revived” for families using AI, while platforms in Russia, the U.S., and beyond have seen a wave of demand following tragic losses. Globally, tech firms like Microsoft, Meta, and various startups are investing heavily in tools that can preserve memories and even simulate ongoing conversations after death.

Market and Adoption Statistics

Industry analysis shows that the digital afterlife market, encompassing AI-powered grief technology, memorial services, and “legacy chatbots,” was worth over $22 billion in 2024 and is on track for a compound annual growth rate of 13-15% into the next decade. As more than 50% of people now store digital assets and personal data online, demand for posthumous control over these “digital selves” is surging. By 2100, there could be as many as 1.4 billion deceased Facebook users, further complicating the landscape of digital rights and memorialization.

Who Controls the Data: The Legal Uncertainty

Ownership of a digital afterlife is a legal gray zone worldwide. Laws about digital assets after death differ by country and platform, with many social media and AI firms resisting calls to grant families or estates clear ownership or deletion rights. There is limited global consensus, and few legal mechanisms for relatives to prevent (or approve) AI recreations or to control how the data and digital likenesses are used after death.

A 2024 study found that 58% of people believe digital resurrection should require explicit “opt-in” consent from the deceased, while only 3% supported allowing digital clones without any advance approval. Still, AI companies often hold ultimate authority over the deceased’s data and images, operating on terms of service that many users never read or fully understand.

Ethical and Emotional Questions

The debate goes far beyond just ownership. While some psychologists argue that digital afterlife tech can provide comfort or therapeutic closure, others warn it may trap grieving individuals in endless “loops” of loss, unable to truly let go. Public figures like Zelda Williams have publicly condemned unauthorized AI recreations, calling them “horrendous Frankensteinian monsters” that disrespect the dead. As these recreations expand—sometimes for memorial purposes, sometimes for profit or political gain—the risk of reputational harm, deepfakes, or even fraud increases.

The Future: Demand for Control, Not Just Comfort

As the landscape evolves, demand is rising for “digital legacy” services that allow people to set rules for their AI afterlife, designate heirs to data, or permanently erase online profiles. Some startups are building secure digital “wills” and vaults to give users control even from beyond the grave.

Yet until legal systems catch up, the answer to “who owns your AI afterlife?” remains unsettled—caught between the comfort of those left behind, the commercial interests of tech firms, and the fundamental rights of the deceased to control their own legacy in the digital age.

News

THE MACHINE VS. THE ARTIST

What SAG-AFTRA’s AI Rules Mean For Actors & Filmmakers in 2026

AI isn’t coming for the film industry—it’s already inside your contracts. SAG-AFTRA has been building an AI rulebook across multiple agreements, from TV/streaming to video games and commercials, and those choices will shape how your face, body, and voice can be used.

1. SAG-AFTRA’s AI “guardrails” in one page

SAG-AFTRA says its AI framework is built on three core promises: clear consent, fair compensation, and control over performances.

In practice, that means:

- Your name, image, and voice are treated as rights that must be licensed, not free raw material.

- Any AI recreation of you is supposed to require informed consent, not buried boilerplate.

- Unions are pushing to make it cheaper to hire a human than to rely on synthetic replicas.

Across contracts, SAG-AFTRA has been adding AI protections in the TV/Theatrical deal that ended the 2023 strike, in animation and commercials agreements, and in the newer Interactive Media (video game) agreement ratified in 2025.

2. What “digital replicas” actually are

Newer agreements break AI uses into categories so producers can’t hide everything under vague language.

Key terms:

- Vocal digital replica: An AI-generated version of your voice, trained from your recorded work and used to create new lines you didn’t physically say.

- Visual digital replica: A digital version of your likeness used to generate new shots or performances.

- Independently created digital replica (ICDR): A replica made from non‑union material or by prompting a generative model with your name (for example, a game company asking a tool to “make a voice like X”).

Under the 2025 Interactive Media Agreement, for example:

- These different replica types all require consent and disclosure.

- Producers must track when they use replicas and pay based on output (like per line of AI dialogue).

- Consent has to be “clear and conspicuous,” often in a separate rider that describes what the replica will do and whether it will handle sensitive material.

3. Seedance 2.0: why everyone’s talking about it

In February 2026, SAG-AFTRA publicly condemned Seedance 2.0, a new AI video model, saying it enables blatant infringement of performers’ voices and likenesses and undermines their ability to earn a living.

The union’s position:

- Seedance 2.0 disregards law, ethics, industry norms and consent by allowing unauthorized cloning and mash‑ups.

- It’s being criticized at the exact same time SAG-AFTRA is back at the table negotiating a new TV/Theatrical/Streaming contract, where AI protections are a top priority.

For you, Seedance 2.0 is a case study in what not to do: using AI tools that ingest copyrighted work or people’s likenesses without explicit, documented permission.

4. If you’re an actor: your AI checklist

Before you sign any contract, look for language about “digital replicas,” “AI,” “synthetic performance,” or “simulation.” Then ask three questions:

- Can they create a digital replica of me?

Is the contract asking for the right to use your voice or image to generate new material that looks/sounds like you? - What do I get paid if they use it?

Is there separate compensation for AI-generated lines, scenes, or future uses, or is the contract trying to roll everything into a one‑time fee? - Can I say no later?

Does the agreement give you any ability to suspend or revoke consent, especially if the content changes (becomes more sensitive, political, or explicit) or if there’s a labor dispute?

Practical moves:

- Keep a copy of every AI rider you sign and what you were told the replica would be used for.

- If something feels too broad (“any use, in any medium, forever”), ask for narrower language or talk to your rep/union before signing.

- Use SAG-AFTRA’s AI resource pages and explainers to understand your rights and current policy fights.

5. If you’re a filmmaker or producer: how not to get burned

Using AI on your project doesn’t have to mean fighting your cast later—but only if you handle it correctly.

Non‑negotiables if you’re working with union talent:

- Get explicit, written consent before creating any replica, with a rider that describes the use in plain language.

- Budget for AI‑related pay. Many agreements treat AI output as additional work, not a free bonus.

- Avoid gray‑area tools. If a model has been publicly condemned by the performers’ union for unauthorized cloning, using it with performers’ likenesses is both an ethical and legal risk.

- Align your paperwork with union rules. Update your deal memos so AI sections don’t quietly overreach beyond what the union agreements allow.

If you’re non‑union, following these standards still protects you:

- You reduce your exposure to future lawsuits or takedowns.

- You build trust with actors who may join your projects precisely because you’re not cutting corners on AI.

6. Where to learn more

If you want to go deeper than this article, start with:

- Union AI hubs and FAQs explaining their core principles.

- AI bargaining timelines that show what’s already been won and what’s still being fought over.

- Interactive media and digital replica explainers that spell out definitions, consent rules, and pay structures.

- Public statements about tools like Seedance 2.0, which show where the red lines are.

7. The bottom line

AI is not a side issue anymore—it is part of how performance is captured, stored, and reused. The only real question is whether that happens with you or to you.

If you’re an actor, your power starts with reading every AI line in your contracts and refusing to trade your likeness for a one‑time fee. If you’re a filmmaker, your reputation will be built on whether people trust you with their face, their voice, and their future earning potential.

The machine is here. The artists who last will be the ones who learn the rules, push for better ones, and refuse to treat human performance as disposable training data.

Save this, share this with your cast and crew, and make sure the story you’re telling about AI is one you’d be proud to see on screen.

News

Harlem’s Hottest Ticket: Ladawn Mechelle Taylor Live

Harlem doesn’t always announce its biggest nights in advance—but when it does, you feel it in the air. From Feb 22 through Mar 22, Room 623 in New York, NY becomes the home of an intimate, soulful run you’ll want to say you caught in real time: “Billie Fitzgerald: Love Notes to Harlem.” This isn’t a background-music type of evening—it’s a sit-forward, lock-in, feel-every-note experience starring the main event herself: Ladawn Taylor.

Ladawn takes the stage as headliner, producer, and vocalist, leading the night with presence, storytelling, and a voice that pulls the room into one shared heartbeat. The show invites you into “love notes” inspired by Harlem’s soulful vibes—heartfelt stories paired with live tunes that bring the spirit of Harlem to life, not as nostalgia, but as something living and happening right now. If you’ve been craving culture that feels close, real, and electric, this is exactly what it looks like.

And while Ladawn is the star, she’s surrounded by talent that strengthens the whole experience: Stephen White (vocalist) and Safin Karim (accompanist) join her to build a live sound that’s rich, emotional, and unforgettable. This is the kind of lineup that doesn’t just “support” a headliner—it amplifies her, giving Ladawn space to soar, improvise, and turn the room into a moment people can’t stop talking about.

The setting is part of the magic. The series is in-person and 18+, designed for grown, ready-to-vibe energy—an up-close Harlem night where the music hits different because you’re right there for it. And the address puts you exactly where you need to be: Room 623, 271 West 119th Street, New York, NY 10026.

Call it a date night, a friend night, a solo “I’m outside” night—just don’t call it optional. This is Harlem’s hottest ticket for a reason: Ladawn Taylor Live is the kind of experience you share because it’s not just an event—it’s proof you were in the room when something special happened.

News

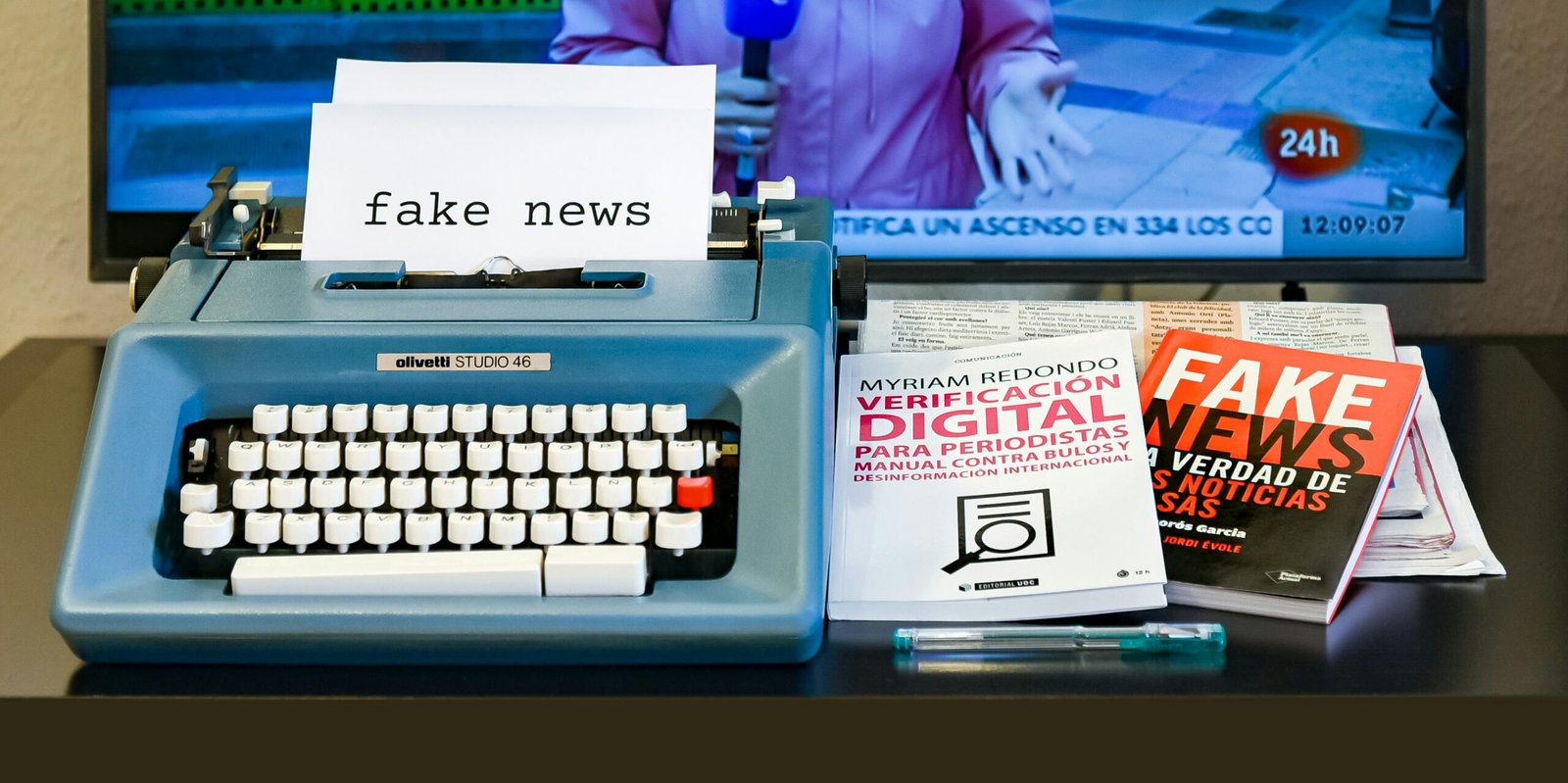

How Misinformation Overload Breaks Creative Focus

Misinformation overload doesn’t just confuse you—it fractures your attention, hijacks your nervous system, and makes it nearly impossible to create with clarity. When your brain is stuck sorting “what’s real” from “what’s rumored,” your creative work doesn’t just slow down; it starts to feel unsafe to even begin.

In the newsroom, we see this pattern constantly: when a story becomes a nonstop stream of claims, counterclaims, screenshots, “leaks,” and reaction content, the audience doesn’t end up informed—they end up flooded. And for filmmakers, writers, editors, and entrepreneurs, that flood hits the part of you that’s responsible for focus, judgment, and decisive action.

The modern trap: infinite updates, zero certainty

There’s a particular kind of exhaustion that comes from trying to track a high-temperature story online. You’re not simply consuming information—you’re doing mental triage every minute:

- Is this confirmed or speculation?

- Is this a primary source or someone’s interpretation?

- Is the clip edited?

- Is the account credible?

- Why are ten people saying ten different things?

This is what breaks people. Not one article. Not one update. It’s the endless requirement to verify reality while the feed keeps moving.

Why creators are extra vulnerable

Creators are pattern-seekers by design. You’re trained to read subtext, connect dots, and search for meaning—skills that make great storytelling possible. But in a misinformation-heavy environment, those strengths can be exploited.

Instead of using your brain to build a story, you’re using it to defend yourself against confusion. Your mind becomes a courtroom, a detective board, and a crisis team all at once. That’s not “research.” That’s cognitive overload.

What misinformation overload does to your creative brain

When your system is overloaded, you’ll notice changes like:

- You can’t start, even though you care.

- You jump between tasks and finish none.

- You feel compelled to “check updates” mid-work session.

- You lose confidence in your instincts.

- Your creativity becomes reactive (responding to the feed) instead of generative (creating from vision).

This is the quiet damage: your attention span shortens, your risk tolerance drops, and your work becomes harder to trust—because you don’t feel internally steady.

The “who can I trust?” spiral

One of the most corrosive effects of misinformation overload is relational paranoia. When the feed is full of allegations, lists, rumors, and “everyone is compromised” language, your mind starts scanning your own life the same way.

You begin asking:

- Who should I work with?

- Who should I avoid?

- If I collaborate with the wrong person, will it hurt my career?

- If I say the wrong thing, will I get dragged?

Some caution is wise. But when your career is being steered by fear and uncertainty, you stop moving. And a creative career that stops moving starts shrinking.

A newsroom perspective: being informed vs being consumed

Here’s the line we want you to remember:

Being informed is intentional.

Being consumed is automatic.

Being informed means you check a limited number of reliable sources, you notice what’s verified vs unverified, and you step away. Being consumed means you keep refreshing, keep scrolling, keep absorbing emotional pressure—until you feel like you can’t breathe without an “update.”

If you’re consumed, your next best move is not another deep dive. It’s distance.

The 72-hour clarity reset (built for creators)

If your focus is broken, don’t try to “power through.” Do this instead:

- Create a 72-hour boundary: No threads, no reaction videos, no screenshot “proof” without sourcing, no doomscrolling.

- Choose two check-in windows: For example, 12:00pm and 6:00pm only.

- Cut the loop at the source: Remove the apps that trigger spirals from your home screen (or delete them temporarily).

- Protect one daily creation block: 60–90 minutes, phone in another room, one deliverable (one page, one scene pass, one rough cut, one outline).

- Do one grounding activity per day: Walk, stretch, cook, clean, journal—low-stimulation inputs that calm your body so your mind can work again.

What to do when you come back online

After your reset, return with rules—not vibes:

- Don’t confuse volume with truth.

- Don’t confuse confidence with credibility.

- Don’t outsource your nervous system to strangers.

- If you can’t verify it, don’t build your day around it.

And most importantly: don’t let the feed decide what you create next.

Your next move needs you clear

If you’re trying to figure out your next step—your next film, your next pitch, your next collaborator, your next chapter—you need clarity more than you need more content.

Disconnect long enough to hear your own signal again. That’s where the work lives.

If you tell me your ideal word count (600, 900, 1200, or 1400) and whether you want this framed strictly for filmmakers or for “creatives + entrepreneurs,” I’ll tighten the structure and tailor the examples to match your audience on Bolanle Media.

Advice7 days ago

Advice7 days agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Entertainment4 weeks ago

Entertainment4 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry4 weeks ago

Film Industry4 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Entertainment3 weeks ago

Entertainment3 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Business2 weeks ago

Business2 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

News4 weeks ago

News4 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Film Industry7 days ago

Film Industry7 days agoWhy Burnt-Out Filmmakers Need to Unplug Right Now

Business2 weeks ago

Business2 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein