Business

Fight for economic equity under ‘assault’ 60 years after March on Washington, advocates warn on August 24, 2023 at 10:00 am Business News | The Hill

Sixty years after civil rights leaders demanded equal access to employment and fair wages for Black Americans at the historic March on Washington for Jobs and Freedom, economic equity is still far from a reality in the U.S.

While advocates acknowledge that some strides have been made in the decades since the march, notable gaps persist between Black and white Americans in areas such as wealth and income, joblessness and homeownership.

And concern is mounting that further progress could be threatened amid rising racial tensions.

“We are strongly not on the path of bridging inequality,” said Dedrick Asante-Muhammad, chief of Race, Wealth and Community for the National Community Reinvestment Coalition (NCRC).

“I think oftentimes, people approach it like, ‘Oh, we’re almost there. There’s a few things we got to do,’” he said. But, he argued, “We are on a very clear path of ongoing Black-white economic apartheid for centuries — unless we do radical policy change.”

Glaring disparities persist decades later

Roughly 250,000 people gathered for the march on Aug. 28, 1963, with a list of demands from Washington for effective policy combatting discrimination in federal programs and in labor, including calls for a “decent” minimum wage, housing and education for all Americans.

Decades later, experts and advocates point to significant remaining disparities between races.

The racial wealth gap has narrowed only slightly since the march. The ratio between white and Black wealth per capita saw a notable decline in the years following emancipation, according to a June 2022 paper published by the National Bureau of Economic Research. In 1860, that ratio stood at roughly 60-to-1. By the 1920s, it was down to 10-to-1.

But it decreased much more slowly in the years that followed, reaching 7-to-1 in the 1950s before inching to “a similar magnitude of 6-to-1” roughly seven decades later.

Among the factors that likely slowed progress in closing the gap, the report cites the revival of the Ku Klux Klan in the 1920s and the nation’s lengthy history of racist laws and practices, ranging from political disenfranchisement of Black Americans to Jim Crow-era policies.

“You have to be honest about these policies and their impacts,” said Algernon Austin, the Director for Race and Economic Justice at the Center for Economic and Policy Research. “And then when you fail to do that, then people who have political agendas to maintain, frankly, to maintain white supremacy, then can attack all these attempts at remediation.”

Other economic disparities have also persisted into the present day. Among Americans who are employed, research from the Economic Policy Institute (EPI) showed the typical Black worker made more than 24 percent less than their white counterparts per hour in 2019 — a figure the group noted was about 8 percentage points higher than it was four decades earlier.

There is much more work to be done to address the Black-white homeownership gap, advocates add. A 2022 report from the National Association of Real Estate Brokers found the Black homeownership rate had “only modestly” increased since the 1968 passage of the Fair Housing Act, while the racial homeownership gap has widened over the years.

The report found the homeownership disparity between Black and white Americans, which sat at 23.8 percent in 1970, reached more than 31 percent five decades later. It said the gap hit 30 percent in 2022, continuing what the group called “a two-decades long trend of an expanding homeownership gap between Blacks and whites.”

“We have housing disparities that are wider than they were during Jim Crow,” said Samantha Tweedy, chief executive officer for the Black Economic Alliance, in an interview, calling housing “one of the foremost drivers of wealth in this country.”

Earlier this year, the White House cheered data showing the Black unemployment rate fell to a historic low in March, with Bharat Ramamurti, deputy director of the White House National Economic Council, calling the news an “incredible milestone” in remarks to TheGrio at the time.

“President [Biden] and Vice President [Harris], from the moment that they came into office, identified that they not only wanted to have a strong economic recovery, they wanted to have an equitable recovery,” Ramamurti said then.

The rate hit 5 percent in March, compared to a 3.2 percent unemployment rate for white Americans, and fell again in April, reaching 4.7 percent, before seeing upticks in the following months. But advocates are pushing for more sustained improvements.

“You can’t draw any conclusions from one month of numbers,” National Urban League President Marc Morial said. “The issue is, is the gap now over a one-, two-, three-year period?”

“While I like to see the gap narrow, I’m not popping a cork on one or two months of a narrower gap,” he added, adding: “We have to measure these things in sustainability.”

At the same time, experts have pointed to some progress the nation has made toward racial economic equality over a longer time, including headway in educational attainment and an overall drop in the poverty rate for Black Americans — which data from EPI shows declined more than 12 percent between 1968, when it sat at 34.7 percent, and 2016.

“In 1962, whites had about 2.4 times the four-year college attainment level of Blacks,” Asante-Muhammad said, while discussing the racial gap in higher education. “In 2022, it’s 1.7. So still, serious disparities, but there has been some bridging over those years.”

However, he also notes African Americans with college degrees don’t have equal levels of employment to their white counterparts, nor “have equal income levels and really don’t have equal wealth levels.”

“Even with kind of solid educational attainment, even with less segregation, more civil rights laws, we still see this massive income inequality that, if it continued to improve, as it has been since 1963, it would take us over 500 years for Blacks just to get income equality with whites,” he argued.

Research shows views of capitalism have shifted among Black Americans over the years, with a 2022 survey from the Pew Research Center finding 54 percent of Black adults said “they had a very or somewhat negative impression of capitalism.” The number is a 14-percentage-point jump from 2019.

“The question is, is it working for me?” Morial said of the findings. “That’s the issue.”

“People are saying, well, if I don’t think I’ve got a fair wage, well, they’re gonna tell you they don’t think the economic system’s working for them,” he said. “It’s less of a philosophical question and more of a practical question.”

‘A threat to progress’

There is concern among advocates and experts that an increased focus by conservatives on affirmative action and diversity initiatives could add greater hurdles to the battle for economic equality in the years ahead.

“The biggest threat is the right-wing assault on the policies which have made a difference,” National Urban League president Marc Morial said. “They’ve not made enough of a difference, but they’ve made a difference. It’s an assault by right-wing interests.”

From GOP-led efforts restricting how race is taught in schools across the country to those targeting affirmative action, advocates have been sounding alarms over what they see as a backlash to initiatives aimed at improving racial diversity and inclusion that gained momentum during the months of global protests against police brutality following the murder of George Floyd in 2020.

Bills have also gained traction in the Republican House majority that seek to take aim at diversity training and efforts to increase representation as part of a larger so-called “anti-woke” push proponents say is needed to tackle unfair and unnecessary race initiatives.

“When you’re trying to reduce some of this burden that’s been placed on these victims of racial subjugation, and you’re calling that racist, it’s racist to call that racist,” Austin said.

“That’s the problem in this society, which is in fact why we need to talk about race more, and more honestly, because we live in a society where being white has been a positive, has given you preferences in varieties of ways,” he said, citing the impact of redlining, segregation, criminal justice policies and underfunding schools in the Black community.

The road ahead

Experts say a combination of race-conscious policies and broader measures like wage and labor reform is necessary to narrow racial economic gaps. But some have doubts about how far national leaders are willing to go to address those disparities, given history.

A recent report from the NCRC estimated it would take more than 500 years for Black Americans to reach the white median household income at the pace set in past decades.

“I think the biggest threat is the unwillingness to seriously commit to redistribution of resources, which is what is required to bridge racial inequality,” Asante-Muhammad of the NCRC said — a problem he charged both sides of the aisle with failing to adequately address.

“It’s one thing to take down the segregation sign, it’s another thing to invest in building affordable housing and doing lending in a way that would strongly increase Black homeownership,” he said. “Those are different.”

As the nation marks the 60th anniversary of the March on Washington, advocates say the demands made by the hundreds of thousands of protesters who gathered in the nation’s capital for the event still hold today — including those for better wages and jobs.

“Raising the minimum wage is crucial,” Morial also said. “Increase in job training and education is crucial. Enforcing anti-discrimination laws is crucial.”

“Creating more tools and more of a commitment to homeownership for low and moderate income Americans is crucial,” he said. “Raising and improving access to capital for small businesses and Black small businesses is crucial.”

Asante-Muhammad points to measures congressional lawmakers have introduced that focus on Black homeownership, reparations and asset policies, like the baby bonds proposal championed by Rep. Ayanna Pressley (D-Mass.) and Sen. Cory Booker (D-N.J.), as steps in the right direction in countering economic inequality.

But many experts aren’t holding their breath for significant change anytime soon.

“There used to be a time when there was more agreement on what the basic facts were, that we’re dealing with, and then we could argue about, ‘OK, what’s the appropriate solution?’” said Austin.

“But now, when people are wanting to make up facts, then it’s really hard to have a productive debate over what is the appropriate solution,” he said.

Business Sixty years after civil rights leaders demanded equal access to employment and fair wages for Black Americans at the historic March on Washington for Jobs and Freedom, economic equity is still far from a reality in the U.S. While advocates acknowledge that some strides have been made in the decades since the march, notable gaps…

Business

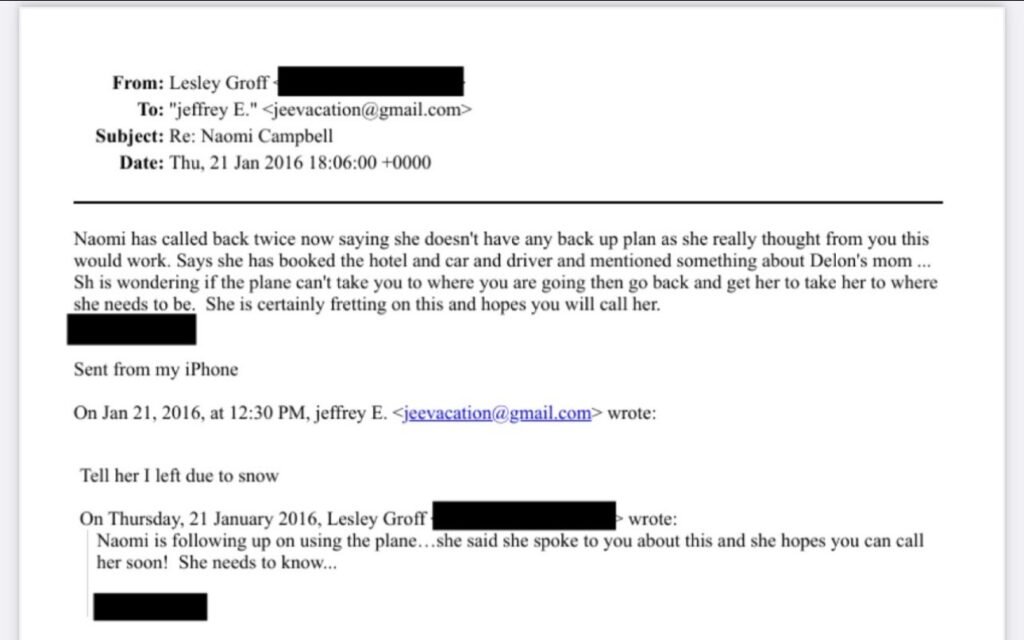

New DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

In early 2026, the global conversation surrounding the “Epstein files” has reached a fever pitch as the Department of Justice continues to un-redact millions of pages of internal records. Among the most explosive revelations are detailed email exchanges between Ghislaine Maxwell and Jeffrey Epstein that directly name supermodel Naomi Campbell. While Campbell has long maintained she was a peripheral figure in Epstein’s world, the latest documents—including an explicit message where Maxwell allegedly offered “two playmates” for the model—have forced a national re-evaluation of her proximity to the criminal enterprise.

The Logistics of a High-Fashion Connection

The declassified files provide a rare look into the operational relationship between the supermodel and the financier. Flight logs and internal staff emails from as late as 2016 show that Campbell’s travel was frequently subsidized by Epstein’s private fleet. In one exchange, Epstein’s assistants discussed the urgency of her travel requests, noting she had “no backup plan” and was reliant on his jet to reach international events.

This level of logistical coordination suggests a relationship built on significant mutual favors, contrasting with Campbell’s previous descriptions of him as just another face in the crowd.

In Her Own Words: The “Sickened” Response

Campbell has not remained silent as these files have surfaced, though her defense has been consistent for years. In a widely cited 2019 video response that has been recirculated amid the 2026 leaks, she stated, “What he’s done is indefensible. I’m as sickened as everyone else is by it.” When confronted with photos of herself at parties alongside Epstein and Maxwell, she has argued against the concept of “guilt by association,” telling the press:

She has further emphasized her stance by aligning herself with those Epstein harmed, stating,

“I stand with the victims. I’m not a person who wants to see anyone abused, and I never have been.””

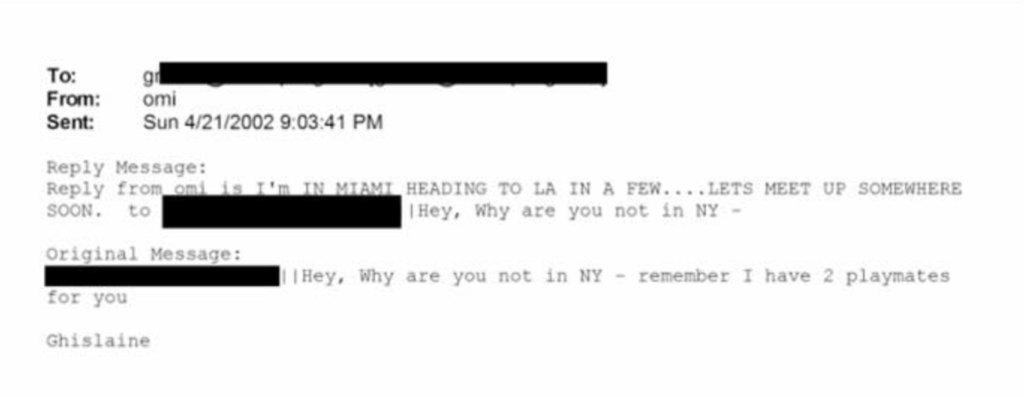

The Mystery of the “Two Playmates”

The most damaging piece of evidence in the recent 2026 release is an email where Maxwell reportedly tells Epstein she has “two playmates” ready for Campbell.

While the context of this “offer” remains a subject of intense debate—with some investigators suggesting it refers to the procurement of young women for social or sexual purposes—Campbell’s legal team has historically dismissed such claims as speculative. However, for a public already wary of elite power brokers, the specific wording used in these private DOJ records has created a “stop-the-scroll” moment that is proving difficult for the fashion icon to move past.

A Reputation at a Crossroads

As a trailblazer in the fashion industry, Campbell is now navigating a period where her professional achievements are being weighed against her presence in some of history’s most notorious social circles. The 2026 files don’t just name her; they place her within a broader system where modeling agents and scouts allegedly groomed young women under the guise of high-fashion opportunities. Whether these records prove a deeper complicity or simply illustrate the unavoidable overlap of the 1% remains the central question of the ongoing DOJ investigation.

Business

Google Accused Of Favoring White, Asian Staff As It Reaches $28 Million Deal That Excludes Black Workers

Google has tentatively agreed to a $28 million settlement in a California class‑action lawsuit alleging that white and Asian employees were routinely paid more and placed on faster career tracks than colleagues from other racial and ethnic backgrounds.

- A Santa Clara County Superior Court judge has granted preliminary approval, calling the deal “fair” and noting that it could cover more than 6,600 current and former Google workers employed in the state between 2018 and 2024.

How The Discrimination Claims Emerged

The lawsuit was brought by former Google employee Ana Cantu, who identifies as Mexican and racially Indigenous and worked in people operations and cloud departments for about seven years. Cantu alleges that despite strong performance, she remained stuck at the same level while white and Asian colleagues doing similar work received higher pay, higher “levels,” and more frequent promotions.

Cantu’s complaint claims that Latino, Indigenous, Native American, Native Hawaiian, Pacific Islander, and Alaska Native employees were systematically underpaid compared with white and Asian coworkers performing substantially similar roles. The suit also says employees who raised concerns about pay and leveling saw raises and promotions withheld, reinforcing what plaintiffs describe as a two‑tiered system inside the company.

Why Black Employees Were Left Out

Cantu’s legal team ultimately agreed to narrow the class to employees whose race and ethnicity were “most closely aligned” with hers, a condition that cleared the path to the current settlement.

The judge noted that Black employees were explicitly excluded from the settlement class after negotiations, meaning they will not share in the $28 million payout even though they were named in earlier versions of the case. Separate litigation on behalf of Black Google employees alleging racial bias in pay and promotions remains pending, leaving their claims to be resolved in a different forum.

What The Settlement Provides

Of the $28 million total, about $20.4 million is expected to be distributed to eligible class members after legal fees and penalties are deducted. Eligible workers include those in California who self‑identified as Hispanic, Latinx, Indigenous, Native American, American Indian, Native Hawaiian, Pacific Islander, and/or Alaska Native during the covered period.

Beyond cash payments, Google has also agreed to take steps aimed at addressing the alleged disparities, including reviewing pay and leveling practices for racial and ethnic gaps. The settlement still needs final court approval at a hearing scheduled for later this year, and affected employees will have a chance to opt out or object before any money is distributed.

H2: Google’s Response And The Broader Stakes

A Google spokesperson has said the company disputes the allegations but chose to settle in order to move forward, while reiterating its public commitment to fair pay, hiring, and advancement for all employees. The company has emphasized ongoing internal audits and equity initiatives, though plaintiffs argue those efforts did not prevent or correct the disparities outlined in the lawsuit.

For many observers, the exclusion of Black workers from the settlement highlights the legal and strategic complexities of class‑action discrimination cases, especially in large, diverse workplaces. The outcome of the remaining lawsuit brought on behalf of Black employees, alongside this $28 million deal, will help define how one of the world’s most powerful tech companies is held accountable for alleged racial inequities in pay and promotion.

Business

Luana Lopes Lara: How a 29‑Year‑Old Became the Youngest Self‑Made Woman Billionaire

At just 29, Luana Lopes Lara has taken a title that usually belongs to pop stars and consumer‑app founders.

Multiple business outlets now recognize her as the world’s youngest self‑made woman billionaire, after her company Kalshi hit an 11 billion dollar valuation in a new funding round.

That round, a 1 billion dollar Series E led by Paradigm with Sequoia Capital, Andreessen Horowitz, CapitalG and others participating, instantly pushed both co‑founders into the three‑comma club. Estimates place Luana’s personal stake at roughly 12 percent of Kalshi, valuing her net worth at about 1.3 billion dollars—wealth tied directly to equity she helped create rather than inheritance.

Kalshi itself is a big part of why her ascent matters.

Founded in 2019, the New York–based company runs a federally regulated prediction‑market exchange where users trade yes‑or‑no contracts on real‑world events, from inflation reports to elections and sports outcomes.

As of late 2025, the platform has reached around 50 billion dollars in annualized trading volume, a thousand‑fold jump from roughly 300 million the year before, according to figures cited in TechCrunch and other financial press. That hyper‑growth convinced investors that event contracts are more than a niche curiosity, and it is this conviction—expressed in billions of dollars of new capital—that turned Luana’s share of Kalshi into a billion‑dollar fortune almost overnight.

Her path to that point is unusually demanding even by founder standards. Luana grew up in Brazil and trained at the Bolshoi Theater School’s Brazilian campus, where reports say she spent up to 13 hours a day in class and rehearsal, competing for places in a program that accepts fewer than 3 percent of applicants. After a stint dancing professionally in Austria, she pivoted into academics, enrolling at the Massachusetts Institute of Technology to study computer science and mathematics and later completing a master’s in engineering.

During summers she interned at major firms including Bridgewater Associates and Citadel, gaining a front‑row view of how global macro traders constantly bet on future events—but without a simple, regulated way for ordinary people to do the same.

That realization shaped Kalshi’s founding thesis and ultimately her billionaire status. Together with co‑founder Tarek Mansour, whom she met at MIT, Luana spent years persuading lawyers and U.S. regulators that a fully legal event‑trading exchange could exist under commodities law. Reports say more than 60 law firms turned them down before one agreed to help, and the company then spent roughly three years in licensing discussions with the Commodity Futures Trading Commission before gaining approval. The payoff is visible in 2025’s numbers: an 11‑billion‑dollar valuation, a 1‑billion‑dollar fresh capital injection, and a founder’s stake that makes Luana Lopes Lara not just a compelling story but a data point in how fast wealth can now be created at the intersection of finance, regulation, and software.

Entertainment2 weeks ago

Entertainment2 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry3 weeks ago

Film Industry3 weeks agoTurning One Short Film into 12 Months of Content

Film Industry4 weeks ago

Film Industry4 weeks ago10 Ways Filmmakers Are Building Careers Without Waiting for Distributors

Film Industry2 weeks ago

Film Industry2 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Film Industry3 weeks ago

Film Industry3 weeks agoHow to Write a Logline That Makes Programmers Hit Play

News2 weeks ago

News2 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Entertainment1 week ago

Entertainment1 week agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Entertainment2 weeks ago

Entertainment2 weeks agoYou wanted to make movies, not decode Epstein. Too late.