Business & Money

US economy unexpectedly accelerated to a 2.4% growth rate in April-June quarter despite Fed hikes Business News | The Hill

The U.S. economy surprisingly accelerated to a 2.4% annual growth rate from April through June, showing continued resilience in the face of steadily higher interest rates resulting from the Federal Reserve’s 16-month-long fight to bring down inflation. “US Economy Accelerates” despite challenges, demonstrating robust performance.

Thursday’s estimate from the Commerce Department indicated that the gross domestic product — the economy’s total output of goods and services — picked up from the 2% growth rate in the January-March quarter. Last quarter’s expansion was well above the 1.5% annual rate that economists had forecast.

Driving last quarter’s growth was a burst of business investment. Excluding housing, business spending surged at a 7.7% annual rate, the fastest such pace since early 2022. Companies plowed more money into factories and equipment. Increased spending by state and local governments also helped fuel the economy’s expansion in the April-June quarter.

Consumer spending, the heart of the nation’s economy, was also solid last quarter, though it slowed to a 1.6% annual rate from a robust 4.2% pace in the first quarter of the year.

Investment in housing, though, fell, weakened by the weight of higher mortgage rates.

“This is a strong report, confirming that this economy continues to largely shrug off the Fed’s aggressive rate increases and tightening credit conditions,’’ said Olu Sonola, head of U.S. economics at Fitch Ratings. “The bottom line is that the U.S. economy is still growing above trend, and the Fed will be wondering if they need to do more to slow this economy.”

In fighting inflation, which last year hit a four-decade high, the Fed has raised its benchmark rate 11 times since March 2022, most recently on Wednesday. The resulting higher costs for a broad range of loans — from mortgages and credit cards to auto loans and business borrowing — have taken a toll on growth.

Still, they have yet to tip the United States into a widely forecast recession. Optimism has been growing that a recession isn’t coming after all, that the Fed can engineer a so-called “soft-landing” — slowing the economy enough to bring inflation down to its 2% annual target without wrecking an expansion of surprising durability.

This week, the International Monetary Fund upgraded its forecast for U.S. economic growth for all of 2023 to 1.8%. Though that would be down from 2.1% growth for 2022, it marked an increase from the 1.6% growth that the IMF had predicted for 2023 back in April.

At a news conference Wednesday after the Fed announced its latest quarter-point rate hike, Chair Jerome Powell revealed that the central bank’s staff economists no longer foresee a recession in the United States. In April, the minutes of the central bank’s March meeting had revealed that the Fed’s staff economists envisioned a “mild” recession later this year.

In his remarks, Powell noted that the economy has proved resilient despite the Fed’s rapid rate hikes. And he said he still thinks a soft landing remains possible.

By any measure, the American job market has shown itself to be remarkably strong. At 3.6% in June, the unemployment rate hovers just above a five-decade low. A surge in retirements after COVID-19 hit in early 2020 has contributed to a shortage of workers across the country, forcing many companies to raise wages to attract or keep staffers.

Higher pay and job security are giving Americans the confidence and financial wherewithal to keep shopping. Indeed, consumer spending, which drives about 70% of economic activity, rose at a 4.2% annual rate from January through March, the fastest quarterly pace in nearly two years. Americans have kept spending — crowding airplanes, traveling overseas and flocking to concerts and movie theaters.

And the Conference Board, a business research group, reported Tuesday that Americans this month are in their sunniest mood in two years, based on the board’s reading of consumer confidence.

Indeed, many consumers are finally enjoying some relief from spiking prices: Year-over-year inflation, which peaked at 9.1% in June 2022, has eased consistently ever since. Inflation-adjusted hourly pay rose 1.4% in June from a year earlier, the sharpest such gain since early 2021.

“Inflation is easing, moving in the right direction,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. ”In other words, the Fed is achieving what it wants without causing damage to the economy, so they don’t need to push too hard from this point on.”

Still, Farooqi suggested, the surprisingly healthy GDP report makes it somewhat more likely that the Fed will raise rates again because the economy appears to be “much stronger” than what the central bank would like to see. With stronger growth comes a greater likelihood of high inflation.

But Thursday’s GDP report contained some encouraging news for the Fed’s inflation fighters: One measure of prices — the personal consumption expenditures index — rose at a 2.6% annual rate last quarter, down from a 4.1% pace in the January-March quarter, to the lowest level since the end of 2020.

Though that is still above the Fed’s 2% inflation target, it amounts to “another welcome sign of disinflation,” said Mike Fratantoni, chief economist at the Mortgage Bankers Association.

The Biden White House’s Council of Economic Advisers estimated Thursday that investment in factories and other manufacturing facilities added 0.4 percentage point of growth last quarter, the largest such proportion since 1981. President Joe Biden pushed the Inflation Reduction Act and the CHIPS Act last year to encourage domestic manufacturing. Michael Feroli, chief U.S. economist at JP Morgan Chase, agreed that much of last quarter’s uptick in business investment was “likely in response to recent federal incentives.’’

“This progress wasn’t inevitable or accidental,’’ the president said in a statement. “It is Bidenomics in action.’’

The risk remains that the weight of ever-higher interest rates will eventually slow borrowing so much — for homes, cars, renovations, business expansions and other costly expenses — as to pull the economy into recession.

Among the economy’s weakest links has been the housing market. In June, sales of previously occupied homes sank to their slowest pace since January. The problem is that a near-historic low number of homes for sale and higher mortgage rates kept many would-be homebuyers on the sidelines. Sales fell 19% compared with June 2022 and were down 23% through the first half of the year.

___

AP Writer Josh Boak contributed to this report.

Business, AP Business WASHINGTON (AP) — The U.S. economy surprisingly accelerated to a 2.4% annual growth rate from April through June, showing continued resilience in the face of steadily higher interest rates resulting from the Federal Reserve’s 16-month-long fight to bring down inflation. Thursday’s estimate from the Commerce Department indicated that the gross domestic product — the economy’s…

Business & Money

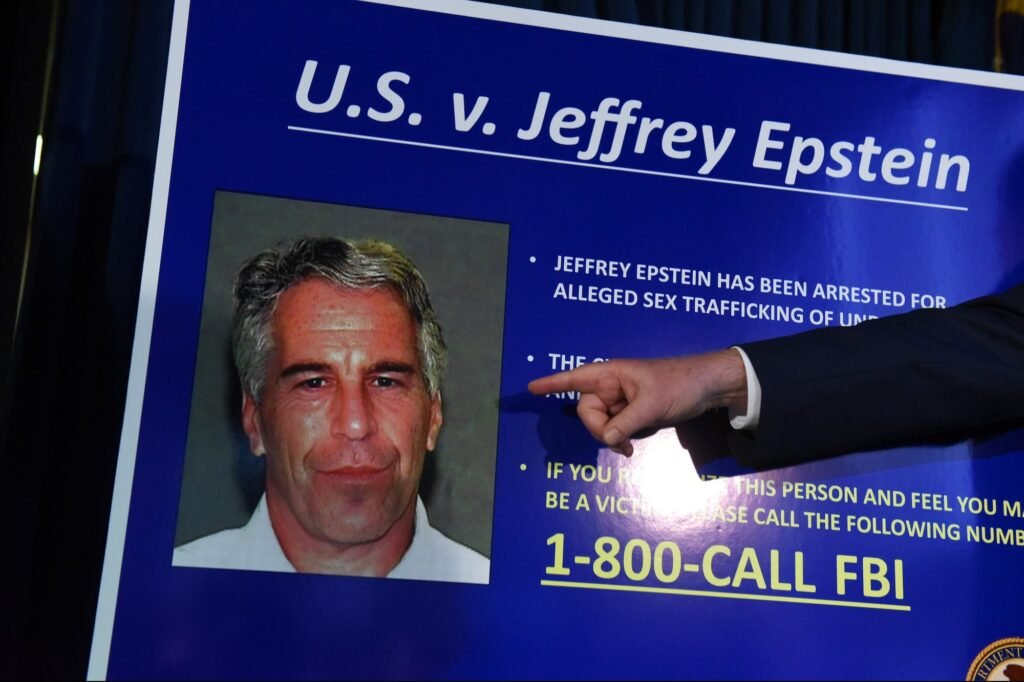

Ghislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her

February 9, 2026 — Ghislaine Maxwell tried to bargain with Congress from a prison video call.

Maxwell, the woman convicted of helping Jeffrey Epstein traffic underage girls, appeared virtually before the House Oversight Committee today and refused to answer a single question. She invoked her Fifth Amendment right against self‑incrimination on every substantive topic, including Epstein’s network, his associates, and any powerful figures who moved through his orbit.

Maxwell is serving a 20‑year federal sentence at a prison camp in Texas after being found guilty in 2021 of sex‑trafficking, conspiracy, and related charges. Her trial exposed a pattern of recruiting and grooming minors for Epstein’s abuse, and her conviction has been upheld on appeal. Despite that legal reality, her appearance today was less about accountability and more about negotiation.

Her lawyer, David Markus, told lawmakers that Maxwell would be willing to “speak fully and honestly” about Epstein and his world — but only if President Donald Trump grants her clemency or a pardon. Markus also claimed she could clear both Trump and Bill Clinton of wrongdoing related to Epstein, a statement critics immediately dismissed as a political play rather than a genuine bid for truth.

Republican Chair James Comer has already said he does not support clemency for Maxwell, and several Democrats accused her of trying to leverage her potential knowledge of powerful people as a way to escape prison. To many survivors’ advocates, the spectacle reinforced the sense that the system is more sympathetic to the powerful than to the victims.

At the same time, Congress is now reviewing roughly 3.5 million pages of Epstein‑related documents that the Justice Department has made available under tight restrictions. Lawmakers must view them on secure computers at the DOJ, with no phones allowed and no copies permitted. Early reports suggest that at least six male individuals, including one high‑ranking foreign official, had their names and images redacted without clear legal justification.

Those unredacted files are supposed to answer questions about who knew what, and when. The problem is that Maxwell is signaling she may never answer any of them — unless she is set free. As of February 9, 2026, the story is still this: a convicted trafficker is using her silence as leverage, Congress is sifting through a wall of redacted files, and the public is still waiting to see who really stood behind Epstein’s power.

Business

Overqualified? Great, Now Prove You’ll Work for Free and Love It!

The phrase “Overqualified? Great, Now Prove You’ll Work for Free and Love It!” sums up the snake-eating-its-tail absurdity of the modern job search. In 2025, the most experienced, credentialed candidates are told they’re not quite the right fit—because they’re too capable, too seasoned, and might actually threaten the status quo by knowing what they’re worth.

The Experience Dilemma

Picture this: half the workforce has too much education or experience for the entry-level roles on offer, and yet, employers still claim they can’t find “qualified” people. The result? An absurd interview dance where applicants with years of achievement must convince employers they’re perfectly fine being underpaid and unappreciated. Many are even asked to perform hours of free “sample work”—projects that benefit the company but are never compensated.

Nearly half of job seekers have applied for jobs for which they were overqualified this year, and about a quarter feel “overqualification” is a major obstacle to actually getting hired. Employers call it “hiring for culture fit” or “salary alignment.” Candidates call it gaslighting: “We love your credentials, but wouldn’t someone like you get bored… or want a living wage?”.

Free Labor: The New Normal

The job hunt is now a marathon of unpaid labor. Applicants often rewrite resumes dozens of times (to game robotic filters), complete personality tests, and spend weeks in multi-stage interviews, only to be ghosted. In a perverse twist, talented workers jump through hoops for jobs explicitly beneath their skill level, all because employers believe an overqualified hire will “leave at the first better opportunity.” In reality, people just want to pay the bills—and would gladly contribute their value if someone gave them a chance.

Even as companies bemoan a “labor shortage,” they turn away the best and brightest, fearing they’ll disrupt the hierarchy, demand raises, or burn out from boredom. What’s left? The less skilled get trained on the job, and even they are told not to expect too much—after all, wouldn’t you do it for the “experience” alone?.

The Absurdity of the Market

Workers at every level—laid off, mid-career, executives—are hunting desperately for positions once reserved for recent graduates. Administrative jobs that previously required a high school diploma now routinely demand a college degree and relevant work history. Degree inflation means the bar keeps rising, but the pay and job security aren’t budging; 2025’s job search feels more like a dystopian obstacle course than a professional meritocracy.

Employers wield the “overqualified” label to maintain the illusion that they could hire anyone, while making sure they never have to pay what a role is really worth. Ironically, most companies spend more time filtering out talent than developing it—and everyone loses in the end.

What’s the Solution?

Job seekers are increasingly advised to do the following:

- Tailor resumes and cover letters to each application, emphasizing culture fit and signaling “no threat to the boss”.

- Network with insiders for referrals, since faceless applications are now nearly pointless.

- Accept that unpaid proof-of-skills work is now part of the game.

- Keep learning, but remember: adding skills may just make you even more overqualified for the next round.

The paradox of 2025? “Show us your value—just don’t expect to be treated like you have any.” The only thing more overqualified than today’s job seeker is the job market itself: packed with hurdles, full of empty promises, and rigged to keep the most talented quietly waiting for a call that may never come.

Business & Money

How the GENIUS Act Will Transform Your Money and Payments

The passage of the GENIUS Act in 2025 marks a revolutionary step in how money and payments will work in the United States. It is the first comprehensive federal law specifically regulating stablecoins—digital currencies pegged to traditional money like the U.S. dollar. This new legislation is poised to reshape your experience with money, making payments faster, more transparent, and potentially cheaper, while introducing clear consumer protections and regulatory standards for digital currencies.

What is the GENIUS Act?

The GENIUS Act stands for Guiding and Establishing National Innovation for U.S. Stablecoins. It establishes a clear legal framework for stablecoins, which are designed to hold a steady value (usually $1) unlike the more volatile cryptocurrencies such as Bitcoin. Stablecoins are increasingly used for routine transactions such as paying bills, sending remittances, or transferring money across borders.

Under the new law:

- Only authorized issuers like banks, credit unions, and federally approved non-bank financial institutions can issue stablecoins.

- Issuers must maintain 100% reserves—meaning for every digital coin issued, there must be a corresponding $1 held in cash, U.S. Treasury securities, or other approved liquid assets.

- Issuers are required to undergo regular audits and publish disclosures about their reserves.

- If an issuer fails or goes bankrupt, holders of stablecoins get priority in getting their money back ahead of other creditors.

This stringent reserve and audit requirement provides much-needed transparency and trust for consumers.

Key Consumer Benefits and Protections

- Faster, Cheaper Payments

Integrating stablecoins into mainstream banking systems can speed up transactions dramatically. You could receive paychecks instantly, send money overseas with minimal fees, and settle payments without the delays typical of current banking transfers. - Clear Regulation and Oversight

Before the GENIUS Act, the regulatory environment was fragmented and uncertain. Now, stablecoins have a federal framework that coordinates oversight between federal and state regulators to prevent fraud, money laundering, and abuses. - Privacy and Government Limits

The law bans the Federal Reserve from creating retail Central Bank Digital Currencies (CBDCs)—digital dollars controlled directly by the government—addressing privacy concerns about surveillance of everyday spending. - Financial Stability and Consumer Priority

The Act gives stablecoin holders priority status in bankruptcy cases, meaning your digital dollars are protected better than traditional bank deposits or bondholder claims in insolvencies.

What This Means for You

The GENIUS Act could significantly change your daily financial life:

- You may start to see stablecoins integrated within banking apps, payroll systems, and payment services.

- Money transfers could become almost instantaneous and cost less, especially across borders.

- More businesses and financial institutions might accept digital dollars pegged to the U.S. dollar.

- Consumer protections could increase, with more audit oversight and clarity about your rights as a stablecoin holder.

However, challenges remain. Regulators have up to 18 months to finalize detailed rules on audits, reserve management, fraud prevention, and compliance. The evolving regulations will determine how safe and seamless digital currency payments become.

A Global Race to Modernize Money

While the U.S. passed the GENIUS Act to catch up, other countries like China and members of the European Union are already piloting their own digital currencies. The legislation positions the U.S. to retain the dollar’s dominant role globally by tying digital currencies directly to U.S. dollars and Treasury securities, potentially boosting demand for American debt and keeping borrowing costs stable.

The Future of Money and Payments

The GENIUS Act opens the door to a more modern, efficient financial system where digital dollars coexist with traditional money, offering consumers faster options and better protections. While adoption will take time, this law lays the groundwork for a future where your payments, savings, and everyday money management are fundamentally transformed by technology—making financial services more accessible, transparent, and resilient.

Whether you choose to use stablecoins actively or not, the changes unfolding will reach into many aspects of how money moves in our economy. Staying informed about this evolving landscape will help you navigate the future of payments confidently.

Advice2 weeks ago

Advice2 weeks agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Business3 weeks ago

Business3 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Entertainment4 weeks ago

Entertainment4 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Film Industry2 weeks ago

Film Industry2 weeks agoWhy Burnt-Out Filmmakers Need to Unplug Right Now

Business3 weeks ago

Business3 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Entertainment3 weeks ago

Entertainment3 weeks agoYou wanted to make movies, not decode Epstein. Too late.

News2 weeks ago

News2 weeks agoHarlem’s Hottest Ticket: Ladawn Mechelle Taylor Live

Business & Money4 weeks ago

Business & Money4 weeks agoGhislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her