Business & Money

Surprisingly strong economy shifts political calculations on July 28, 2023 at 9:00 am Business News | The Hill

The U.S. economy is hitting a stride, growing at a 2.4-percent rate in the second quarter in a Strong Economy Alters Politics, a surprisingly strong showing that adds confidence to the idea that the nation may avoid a long-threatened recession.

The growing economy comes coupled with other good economic news: Inflation is slowing, and unemployment sits at just 3.6 percent.

Markets have noticed. The Dow Jones Industrial Average is up more than 4 percent over the last month and more than six percent this year, despite dropping on Thursday.

It’s all good news for the White House and President Biden, who have used the recent string of positive economic announcements to tout their stewardship over the economy as they head into an election next year.

But it doesn’t mean the administration can breathe easy — over the economy or Biden’s political future.

Some economists think a recession is still possible, and Republicans, while more focused in recent weeks on probes into Hunter Biden’s legal difficulties, have not dropped their economic criticisms of the White House.

“It’s entertaining to watch the administration sit here and say, ‘oh everything’s great now,” Rep. Mike Lawler (R-N.Y.) said Thursday.

“Yes, inflation has come down but the economy in no way is growing at the levels that it needs to be and we need to enact reasonable and responsible budget cuts going forward to right size our economy and get the country moving in the right direction,” added Lawler, who represents a swing district and is one of the more vulnerable House Republicans in next year’s election.

The White House rebuked GOP lawmakers, pointing remarks from to Fox Business Channel’s Cheryl Casone, who said on Thursday: “There goes that recession talk, right?”

“Even Fox Business is welcoming today’s blockbuster economic growth numbers, the latest in a long line of proof points that Bidenomics is delivering for middle class families,” spokesperson Andrew Bates said in a memo. “That’s because this strong growth report is objectively good news for the American people, which elected officials should support regardless of their political party.”

The resilience of the economy has been a surprise for a number of reasons.

Market commentators for most of Biden’s term have been worried about a recession, and as the Federal Reserve launched a series of interest rate hikes in response to rising inflation, the fear was that a downturn would be hard to avoid.

The Federal Reserve itself in March predicted a “mild recession,” before reversing its position on Wednesday after raising interest rates another quarter-percent.

“The staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession,” Federal Reserve chairman Jerome Powell said Wednesday.

That resilience has taken several different forms but has been nowhere more noticeable than in the labor market. Unemployment has remained near historic lows even as the Fed has undertaken one of the fastest interest rate tightening cycles on record in response to prices that climbed as high as 9.1 percent annually last June.

Lower employment is usually associated with lower prices due to how much businesses have to pay workers and still turn a profit. But that relationship has been called into question during the recent inflation, as prices have been steadily falling since last June while unemployment has remained near record lows.

The unusual nature of the post-pandemic inflation, driven in part by massive consumer savings during the lockdown era and supply chain shutdowns, was likely the primary reason. Price fluctuations occurred in different sectors of the economy at different times, and companies raked in record profits, choosing to keep prices high.

In making the case for its handling of the economy, the Biden administration on Thursday pointed to investments it made when Democrats held majorities in Congress in 2021 and 2022. Those investments were mostly in the Inflation Reduction Act, a bipartisan transportation and infrastructure bill and a major semiconductor bill.

This has led to investments north of $190 billion as of May, much of it in green tech and industry, that is expected to lead to a factory construction boom.

The White House Council of Economic Advisers touted the investment in plants and equipment in a blog post on Thursday, noting its contribution to the beefy GDP number.

“Nonresidential private fixed investment accelerated, contributing 1 percentage point to [second quarter] growth. Private construction of manufacturing facilities alone, such as factories, contributed about 0.4 percentage point, this category’s largest growth contribution since 1981,” economists with the CEA wrote.

Some key factors do leave a number of economists wary of another ding on the economy later this year. Millions will see an end to the three-year pause in student loan payments later this year, which could put a crunch on consumer spending.

Interest rate hikes have also weighed heavily on the housing market for more than a year, driving high mortgage rates and dampening demand.

Demand is beginning to rise again, but so are prices with would-be sellers reluctant to give up their low mortgage rates and put their homes on the market.

Powell said on Wednesday that the housing market has “a ways to go” before it reaches a balance and prices cool.

The news of economic growth comes just weeks after the White House launched its “Bideonomics” messaging, which was met with speculation at the time about whether they were taking a victory lap too soon.

Throughout Biden’s presidency, Republicans have hammered him for high inflation, and they sought to use it against Democrats in the 2022 midterms. They are expected to focus on the economy, along with their investigations into the Biden family, again in 2024.

President Biden celebrated that the GDP number on Thursday, arguing that the economic progress “wasn’t inevitable or accidental,” but it was due to Bidenomics — a message voters can expect to keep hearing as Biden and officials traverse the country to tout their work on the economy.

“[H]ard-working Americans are seeing the results: Our unemployment rate remains near record lows, inflation has fallen by two thirds, real wages are higher than they were before the pandemic, and we’ve seen more than half a trillion dollars in private sector investment commitments in clean energy and manufacturing,” he said.

Administration, Business, News, Bidenomics, GDP, inflation, Joe Biden, Mike Lawler, unemployment The U.S. economy is hitting a stride, growing at a 2.4-percent rate in the second quarter in a surprisingly strong showing that adds confidence to the idea that the nation may avoid a long-threatened recession. The growing economy comes coupled with other good economic news: Inflation is slowing, and unemployment sits at just 3.6 percent.

To stay informed with the latest information, reach out to Bolanle.

Business & Money

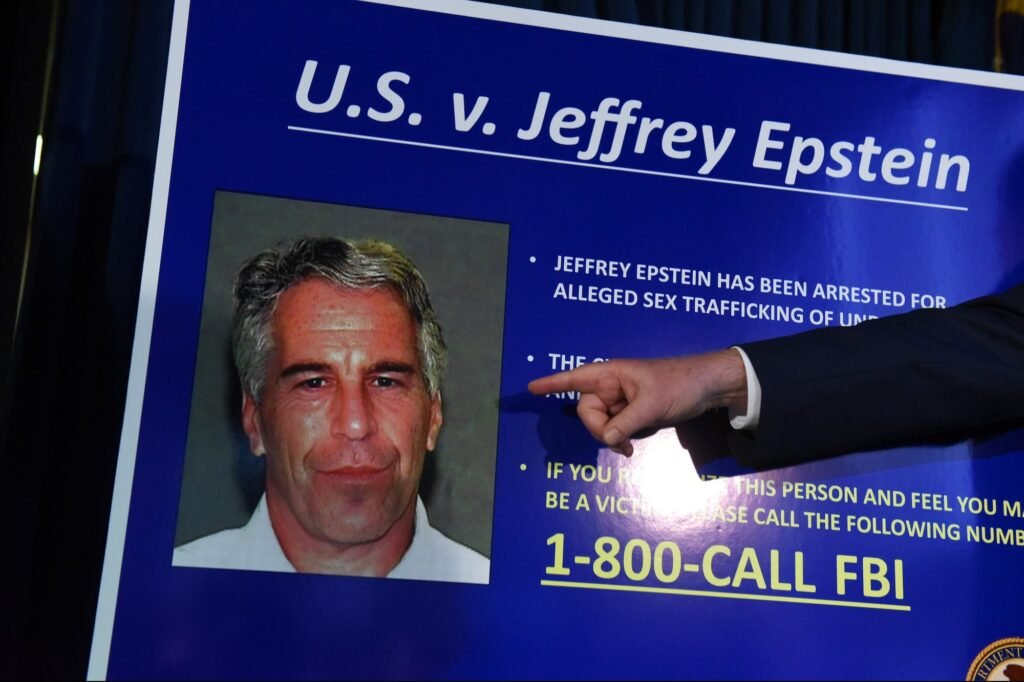

Ghislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her

February 9, 2026 — Ghislaine Maxwell tried to bargain with Congress from a prison video call.

Maxwell, the woman convicted of helping Jeffrey Epstein traffic underage girls, appeared virtually before the House Oversight Committee today and refused to answer a single question. She invoked her Fifth Amendment right against self‑incrimination on every substantive topic, including Epstein’s network, his associates, and any powerful figures who moved through his orbit.

Maxwell is serving a 20‑year federal sentence at a prison camp in Texas after being found guilty in 2021 of sex‑trafficking, conspiracy, and related charges. Her trial exposed a pattern of recruiting and grooming minors for Epstein’s abuse, and her conviction has been upheld on appeal. Despite that legal reality, her appearance today was less about accountability and more about negotiation.

Her lawyer, David Markus, told lawmakers that Maxwell would be willing to “speak fully and honestly” about Epstein and his world — but only if President Donald Trump grants her clemency or a pardon. Markus also claimed she could clear both Trump and Bill Clinton of wrongdoing related to Epstein, a statement critics immediately dismissed as a political play rather than a genuine bid for truth.

Republican Chair James Comer has already said he does not support clemency for Maxwell, and several Democrats accused her of trying to leverage her potential knowledge of powerful people as a way to escape prison. To many survivors’ advocates, the spectacle reinforced the sense that the system is more sympathetic to the powerful than to the victims.

At the same time, Congress is now reviewing roughly 3.5 million pages of Epstein‑related documents that the Justice Department has made available under tight restrictions. Lawmakers must view them on secure computers at the DOJ, with no phones allowed and no copies permitted. Early reports suggest that at least six male individuals, including one high‑ranking foreign official, had their names and images redacted without clear legal justification.

Those unredacted files are supposed to answer questions about who knew what, and when. The problem is that Maxwell is signaling she may never answer any of them — unless she is set free. As of February 9, 2026, the story is still this: a convicted trafficker is using her silence as leverage, Congress is sifting through a wall of redacted files, and the public is still waiting to see who really stood behind Epstein’s power.

Business

Overqualified? Great, Now Prove You’ll Work for Free and Love It!

The phrase “Overqualified? Great, Now Prove You’ll Work for Free and Love It!” sums up the snake-eating-its-tail absurdity of the modern job search. In 2025, the most experienced, credentialed candidates are told they’re not quite the right fit—because they’re too capable, too seasoned, and might actually threaten the status quo by knowing what they’re worth.

The Experience Dilemma

Picture this: half the workforce has too much education or experience for the entry-level roles on offer, and yet, employers still claim they can’t find “qualified” people. The result? An absurd interview dance where applicants with years of achievement must convince employers they’re perfectly fine being underpaid and unappreciated. Many are even asked to perform hours of free “sample work”—projects that benefit the company but are never compensated.

Nearly half of job seekers have applied for jobs for which they were overqualified this year, and about a quarter feel “overqualification” is a major obstacle to actually getting hired. Employers call it “hiring for culture fit” or “salary alignment.” Candidates call it gaslighting: “We love your credentials, but wouldn’t someone like you get bored… or want a living wage?”.

Free Labor: The New Normal

The job hunt is now a marathon of unpaid labor. Applicants often rewrite resumes dozens of times (to game robotic filters), complete personality tests, and spend weeks in multi-stage interviews, only to be ghosted. In a perverse twist, talented workers jump through hoops for jobs explicitly beneath their skill level, all because employers believe an overqualified hire will “leave at the first better opportunity.” In reality, people just want to pay the bills—and would gladly contribute their value if someone gave them a chance.

Even as companies bemoan a “labor shortage,” they turn away the best and brightest, fearing they’ll disrupt the hierarchy, demand raises, or burn out from boredom. What’s left? The less skilled get trained on the job, and even they are told not to expect too much—after all, wouldn’t you do it for the “experience” alone?.

The Absurdity of the Market

Workers at every level—laid off, mid-career, executives—are hunting desperately for positions once reserved for recent graduates. Administrative jobs that previously required a high school diploma now routinely demand a college degree and relevant work history. Degree inflation means the bar keeps rising, but the pay and job security aren’t budging; 2025’s job search feels more like a dystopian obstacle course than a professional meritocracy.

Employers wield the “overqualified” label to maintain the illusion that they could hire anyone, while making sure they never have to pay what a role is really worth. Ironically, most companies spend more time filtering out talent than developing it—and everyone loses in the end.

What’s the Solution?

Job seekers are increasingly advised to do the following:

- Tailor resumes and cover letters to each application, emphasizing culture fit and signaling “no threat to the boss”.

- Network with insiders for referrals, since faceless applications are now nearly pointless.

- Accept that unpaid proof-of-skills work is now part of the game.

- Keep learning, but remember: adding skills may just make you even more overqualified for the next round.

The paradox of 2025? “Show us your value—just don’t expect to be treated like you have any.” The only thing more overqualified than today’s job seeker is the job market itself: packed with hurdles, full of empty promises, and rigged to keep the most talented quietly waiting for a call that may never come.

Business & Money

How the GENIUS Act Will Transform Your Money and Payments

The passage of the GENIUS Act in 2025 marks a revolutionary step in how money and payments will work in the United States. It is the first comprehensive federal law specifically regulating stablecoins—digital currencies pegged to traditional money like the U.S. dollar. This new legislation is poised to reshape your experience with money, making payments faster, more transparent, and potentially cheaper, while introducing clear consumer protections and regulatory standards for digital currencies.

What is the GENIUS Act?

The GENIUS Act stands for Guiding and Establishing National Innovation for U.S. Stablecoins. It establishes a clear legal framework for stablecoins, which are designed to hold a steady value (usually $1) unlike the more volatile cryptocurrencies such as Bitcoin. Stablecoins are increasingly used for routine transactions such as paying bills, sending remittances, or transferring money across borders.

Under the new law:

- Only authorized issuers like banks, credit unions, and federally approved non-bank financial institutions can issue stablecoins.

- Issuers must maintain 100% reserves—meaning for every digital coin issued, there must be a corresponding $1 held in cash, U.S. Treasury securities, or other approved liquid assets.

- Issuers are required to undergo regular audits and publish disclosures about their reserves.

- If an issuer fails or goes bankrupt, holders of stablecoins get priority in getting their money back ahead of other creditors.

This stringent reserve and audit requirement provides much-needed transparency and trust for consumers.

Key Consumer Benefits and Protections

- Faster, Cheaper Payments

Integrating stablecoins into mainstream banking systems can speed up transactions dramatically. You could receive paychecks instantly, send money overseas with minimal fees, and settle payments without the delays typical of current banking transfers. - Clear Regulation and Oversight

Before the GENIUS Act, the regulatory environment was fragmented and uncertain. Now, stablecoins have a federal framework that coordinates oversight between federal and state regulators to prevent fraud, money laundering, and abuses. - Privacy and Government Limits

The law bans the Federal Reserve from creating retail Central Bank Digital Currencies (CBDCs)—digital dollars controlled directly by the government—addressing privacy concerns about surveillance of everyday spending. - Financial Stability and Consumer Priority

The Act gives stablecoin holders priority status in bankruptcy cases, meaning your digital dollars are protected better than traditional bank deposits or bondholder claims in insolvencies.

What This Means for You

The GENIUS Act could significantly change your daily financial life:

- You may start to see stablecoins integrated within banking apps, payroll systems, and payment services.

- Money transfers could become almost instantaneous and cost less, especially across borders.

- More businesses and financial institutions might accept digital dollars pegged to the U.S. dollar.

- Consumer protections could increase, with more audit oversight and clarity about your rights as a stablecoin holder.

However, challenges remain. Regulators have up to 18 months to finalize detailed rules on audits, reserve management, fraud prevention, and compliance. The evolving regulations will determine how safe and seamless digital currency payments become.

A Global Race to Modernize Money

While the U.S. passed the GENIUS Act to catch up, other countries like China and members of the European Union are already piloting their own digital currencies. The legislation positions the U.S. to retain the dollar’s dominant role globally by tying digital currencies directly to U.S. dollars and Treasury securities, potentially boosting demand for American debt and keeping borrowing costs stable.

The Future of Money and Payments

The GENIUS Act opens the door to a more modern, efficient financial system where digital dollars coexist with traditional money, offering consumers faster options and better protections. While adoption will take time, this law lays the groundwork for a future where your payments, savings, and everyday money management are fundamentally transformed by technology—making financial services more accessible, transparent, and resilient.

Whether you choose to use stablecoins actively or not, the changes unfolding will reach into many aspects of how money moves in our economy. Staying informed about this evolving landscape will help you navigate the future of payments confidently.

Advice7 days ago

Advice7 days agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Entertainment4 weeks ago

Entertainment4 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry4 weeks ago

Film Industry4 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Entertainment3 weeks ago

Entertainment3 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Business2 weeks ago

Business2 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

News4 weeks ago

News4 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Business2 weeks ago

Business2 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Film Industry7 days ago

Film Industry7 days agoWhy Burnt-Out Filmmakers Need to Unplug Right Now