Best Holiday Deals

Top-rated gifts that will arrive on time

Moderate Democrats are fuming over the Biden administration’s decision to propose significant climate change-related stipulations on the use of a lucrative tax credit for hydrogen energy producers.

Sen. Joe Manchin (D-W.Va.), a frequent critic of the administration’s climate policies, said the proposal “makes absolutely no sense.”

And moderates who have been more supportive of the administration, like Sen. Tom Carper (D-Del.), are also pushing back on Biden’s rules.

Best Holiday Deals

Top-rated gifts that will arrive on time

The hydrogen energy issue divides Democrats, with more conservative Democrats pressing for the flexibility they say will help a nascent industry that could be important in the climate fight. Liberals argue loose rules could make hydrogen energy a climate change problem rather than a solution.

Hydrogen energy can be made by either using electricity to separate the hydrogen out of water molecules in an electrolyzer or through a reaction between steam and methane, a key component of natural gas.

The fuel could be a key tool for cutting emissions from industries whose climate pollution is difficult to mitigate, including aviation and making chemicals, cement and steel.

The Inflation Reduction Act signed by President Biden last year provided a tax credit for hydrogen that is intended to jumpstart production of hydrogen made using low- and no-emitting power sources.

But the question of who can qualify is a contentious one, and moderate Democrats argue the administration is going too far with its new rules.

“This Administration cannot keep itself from violating the Inflation Reduction Act in their relentless pursuit of their radical climate agenda,” Manchin said in a written statement.

He said that the move would “kneecap the hydrogen market before it can even begin.”

Manchin vowed to fight the proposal, saying: “Today’s proposed rule doesn’t just violate the law — it makes absolutely no sense, and I will continue to fight this Administration’s manipulation of the IRA.”

Manchin, who is not running for reelection but has flirted with a third-party presidential bid, has criticized a number of Biden administration climate policies, including its handling of a tax credit for people who purchase electric vehicles, saying it was applied to vehicles too broadly and that a new guidance is too loose on Chinese battery components.

Such criticisms sometimes leave Manchin on an island in the Democratic party, but that wasn’t the case Friday.

Carper, a frequent Biden ally who chairs the Senate’s Environment and Public Works Committee, also criticized the guidance.

“When developing the Inflation Reduction Act, we intended for the clean hydrogen incentives to be flexible and technology-neutral,” Carper said in a written statement.

“Treasury’s draft guidance does not fully reflect this intent, potentially jeopardizing the clean hydrogen industry’s ability to get off the ground successfully,” he added.

Sen. Sherrod Brown (D-Ohio), who faces a tough reelection battle next year in an increasingly red state, also said that the proposed guidance would “undermine” the law’s goals of lower energy costs and innovation.

“These new proposed rules will slow down and ultimately undermine our country’s ability to produce the clean hydrogen needed to build the energy economy of the future,” Brown said in a statement. “The proposed rules’ lack of flexibility will cut out Ohio workers and Ohio businesses from creating the energy of the 21st century.”

This pushback is not a surprise. Last month, 11 Democrats signed a letter pushing for flexible rules for the hydrogen industry. Carper was not on that letter but also sent a missive calling for flexibility.

At issue is whether to require hydrogen producers to build new clean power sources to fuel hydrogen production, or whether electrolyzers should be allowed to pull existing power off the grid.

Climate hawks warn the latter could result in more fossil fuel use because it could drive up power demand in general and push planet-warming gas plants online.

They have also called for this new power to be in the same geographic region and produced within the same hour that it is used to try to limit hydrogen’s impacts on power demand overall.

“I applaud the Biden administration for taking this important step to ensure that we develop a truly clean hydrogen industry,” Sen. Jeff Merkley (D-Ore.) said in a statement. “Hydrogen has the potential to be a key part of the climate solution, but only if we get it right.”

“Creating hydrogen energy can be very greenhouse gas-intensive. I and others have pushed hard for high standards because if hydrogen is not clean, then it cannot be a solution for hard-to-decarbonize sectors like heavy industry, and could even take us in the wrong direction,” he added.

Merkley led a letter in October pushing for stringent standards and was joined by seven of his colleagues.

Sen. Martin Heinrich (D-N.M.) who signed the letter, also praised the rule in a post on X, formerly known as Twitter.

“.@USTreasury’s hydrogen tax credit guidance includes the climate safeguards that will ensure the hydrogen economy of the future is clean,” he wrote.

“The alternative would have made the problem worse, not better. I applaud the Biden Administration’s leadership here,” he added.

Energy & Environment, Business, News, Policy, Senate Moderate Democrats are fuming over the Biden administration’s decision to propose significant climate change-related stipulations on the use of a lucrative tax credit for hydrogen energy producers. Sen. Joe Manchin (D-W.Va.), a frequent critic of the administration’s climate policies, said the proposal “makes absolutely no sense.” And moderates who have been more supportive of the administration, like…

Jeffrey Epstein’s money did more than buy private jets and legal leverage. It flowed into the same ecosystem that decides which artists get pushed to the front, which research gets labeled “cutting edge,” and which stories about race and power are treated as respectable debate instead of hate speech. That doesn’t mean he sat in a control room programming playlists. It means his worldview seeped into institutions that already shape what we hear, see, and believe.

The fallout around Casey Wasserman is a vivid example of how this works. Wasserman built a powerhouse talent and marketing agency that controls a major slice of sports, entertainment, and the global touring business. When the Epstein files revealed friendly, flirtatious exchanges between Wasserman and Ghislaine Maxwell, and documented his ties to Epstein’s circle, artists and staff began to question whose money and relationships were quietly underwriting their careers.

That doesn’t prove Epstein “created” any particular star. But it shows that a man deeply entangled with Epstein was sitting at a choke point: deciding which artists get representation, which tours get resources, which festivals and campaigns happen. In an industry built on access and favor, proximity to someone like Epstein is not just gossip; it signals which values are tolerated at the top.

When a gatekeeper with that history sits between artists and the public, “the industry” stops being an abstract machine and starts looking like a web of human choices — choices that, for years, were made in rooms where Epstein’s name wasn’t considered a disqualifier.

Epstein’s interest in culture didn’t end with celebrity selfies. He was obsessed with the science of brains, intelligence, and behavior — and that’s where his money begins to overlap with how audiences are modeled and, eventually, how algorithms are trained.

He cultivated relationships with scientists at elite universities and funded research into genomics, cognition, and brain development. In one high‑profile case, a UCLA professor specializing in music and the brain corresponded with Epstein for years and accepted funding for an institute focused on how music affects neural circuits. On its face, that looks like straightforward philanthropy. Put it next to his email trail and a different pattern appears.

Epstein’s correspondence shows him pushing eugenics and “race science” again and again — arguing that genetic differences explain test score gaps between Black and white people, promoting the idea of editing human beings under the euphemism of “genetic altruism,” and surrounding himself with thinkers who entertained those frames. One researcher in his orbit described Black children as biologically better suited to running and hunting than to abstract thinking.

So you have a financier who is:

None of that proves a specific piece of music research turned into a specific Spotify recommendation. But it does show how his ideology was given time, money, and legitimacy in the very spaces that define what counts as serious knowledge about human minds.

There is another layer that is easier to see: what enters the knowledge base that machines learn from.

Fringe researchers recently misused a large U.S. study of children’s genetics and brain development to publish papers claiming racial hierarchies in IQ and tying Black people’s economic outcomes to supposed genetic deficits. Those papers then showed up as sources in answers from large AI systems when users asked about race and intelligence. Even after mainstream scientists criticized the work, it had already entered both the academic record and the training data of systems that help generate and rank content.

Epstein did not write those specific papers, but he funded the kind of people and projects that keep race‑IQ discourse alive inside elite spaces. Once that thinking is in the mix, recommendation engines and search systems don’t have to be explicitly racist to reproduce it. They simply mirror what’s in their training data and what has been treated as “serious” research.

Zoomed out, the pipeline looks less like a neat conspiracy and more like an ecosystem:

The algorithm deciding what you see next is standing downstream from all of this.

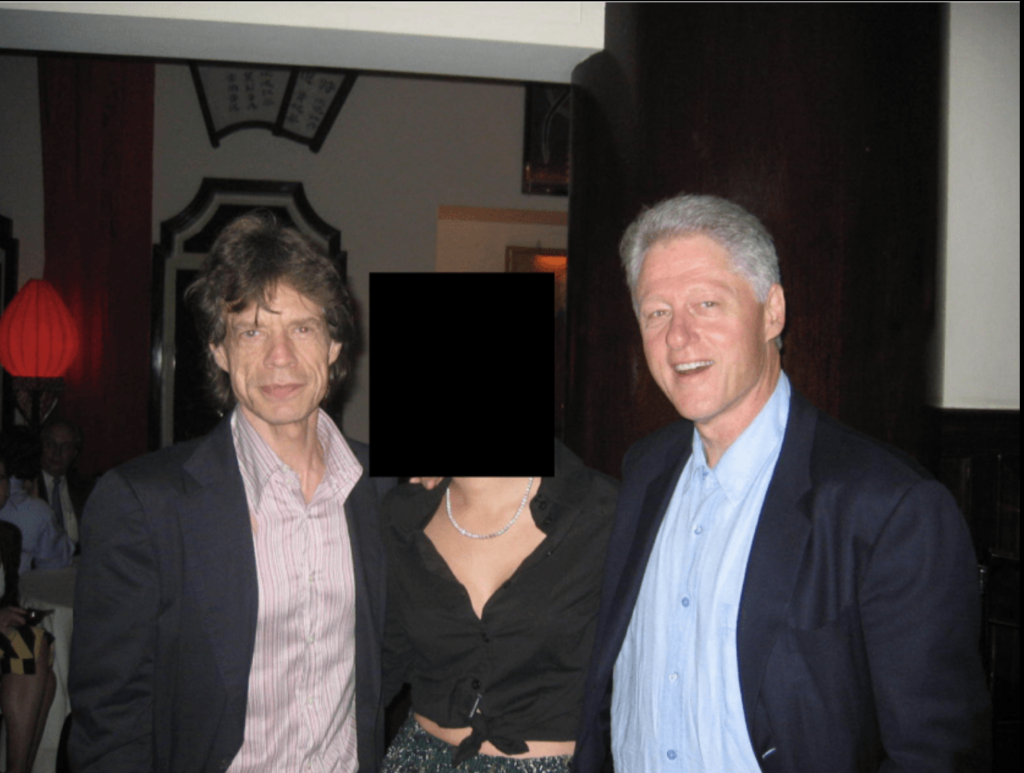

Epstein’s contact lists are full of directors, actors, musicians, authors, and public intellectuals. Many now insist they had no idea what he was doing. Some probably didn’t; others clearly chose not to ask. From Epstein’s perspective, the value of those relationships is obvious.

Being seen in orbit around beloved artists and cultural figures created a reputational firewall. If the public repeatedly saw him photographed with geniuses, Oscar winners, and hit‑makers, their brains filed him under “eccentric patron” rather than “dangerous predator.”

That softens the landing for his ideas, too. Race science sounds less toxic when it’s discussed over dinner at a university‑backed salon or exchanged in emails with a famous thinker.

The more oxygen is spent on the celebrity angle — who flew on which plane, who sat at which dinner — the less attention is left for what may matter more in the long run: the way his money and ideology were welcomed by institutions that shape culture and knowledge.

The point is not to claim that Jeffrey Epstein was secretly programming your TikTok feed or hand‑picking your favorite rapper. The deeper question is what happens when a man with his worldview is allowed to invest in the people and institutions that decide:

If your media diet feels saturated with certain kinds of Black representation — hyper‑visible in music and sports, under‑represented in positions of uncontested authority — while “objective” science quietly debates Black intelligence, that’s not random drift. It’s the outcome of centuries of narrative work that men like Epstein bought into and helped sustain.

No one can draw a straight, provable line from his bank account to a specific song or recommendation. But the lines he did draw — to elite agencies, to brain and music research, to race‑obsessed science networks — are enough to show this: his money was not only paying for crimes in private. It was also buying him a seat at the tables where culture and knowledge are made, where the stories about who to love and who to fear get quietly agreed upon.

For anyone making culture inside this system, that’s the uncomfortable part: this isn’t just a story about “them.” It’s also a story about you.

Filmmakers, showrunners, musicians, actors, and writers all sit at points where money, narrative, and visibility intersect. You rarely control where the capital ultimately comes from, but you do control what you validate, what you reproduce, and what you challenge.

Questions worth carrying into every room:

If wealth like Epstein’s can quietly seep into agencies, labs, and institutions that decide what gets made and amplified, then the stories you choose to tell — and refuse to tell — become one of the few levers of resistance inside that machine. You may not control every funding source, but you can decide whether your work reinforces a world where Black people are data points and aesthetics, or one where they are subjects, authors, and owners.

The industry will always have its “gatekeepers.” The open question is whether creatives accept that role as fixed, or start behaving like counter‑programmers: naming the patterns, refusing easy archetypes, and building alternative pathways, platforms, and partnerships wherever possible. In a landscape where money has long been used to decide what to love and who to fear, your choices about whose stories get light are not just artistic decisions. They are acts of power.

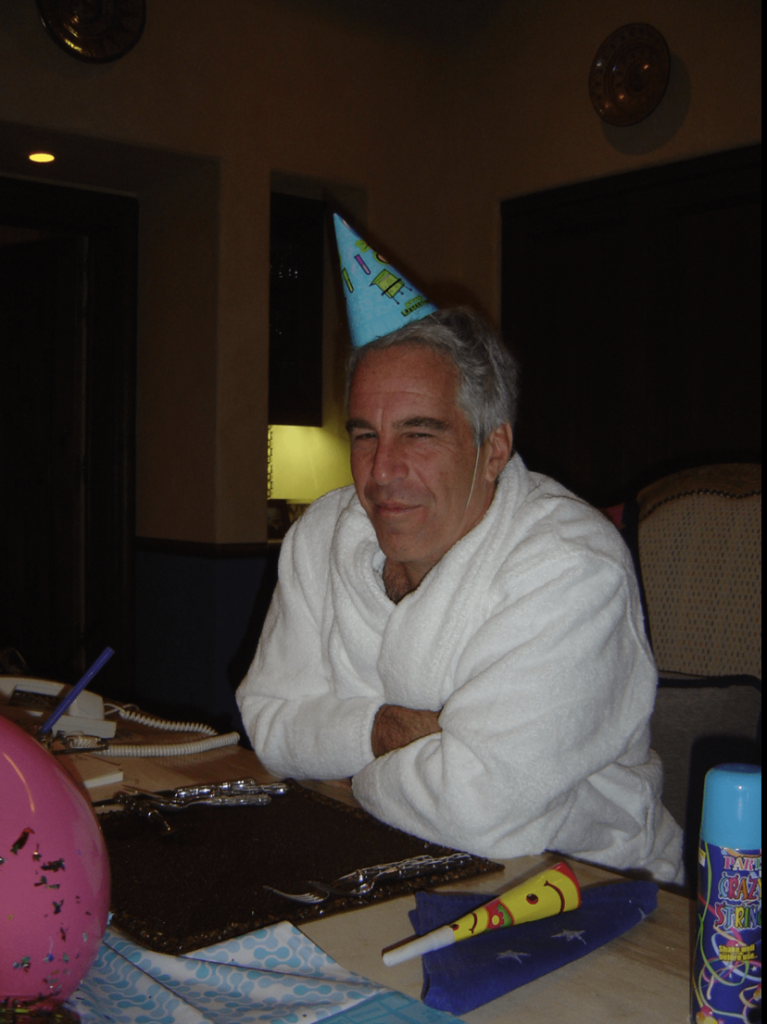

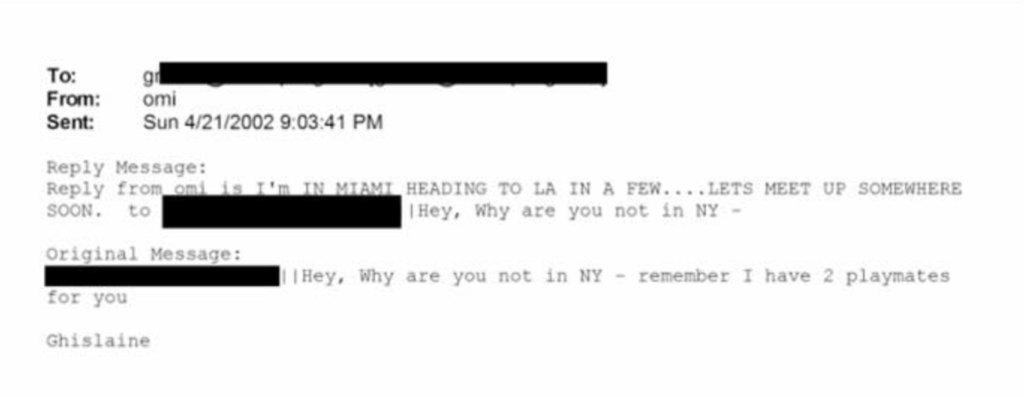

In early 2026, the global conversation surrounding the “Epstein files” has reached a fever pitch as the Department of Justice continues to un-redact millions of pages of internal records. Among the most explosive revelations are detailed email exchanges between Ghislaine Maxwell and Jeffrey Epstein that directly name supermodel Naomi Campbell. While Campbell has long maintained she was a peripheral figure in Epstein’s world, the latest documents—including an explicit message where Maxwell allegedly offered “two playmates” for the model—have forced a national re-evaluation of her proximity to the criminal enterprise.

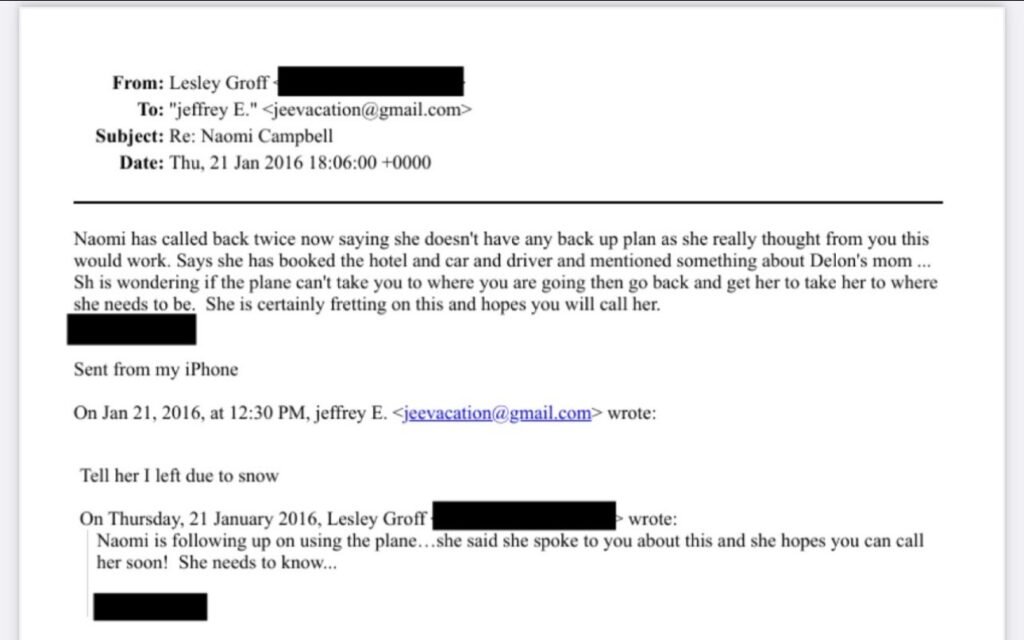

The declassified files provide a rare look into the operational relationship between the supermodel and the financier. Flight logs and internal staff emails from as late as 2016 show that Campbell’s travel was frequently subsidized by Epstein’s private fleet. In one exchange, Epstein’s assistants discussed the urgency of her travel requests, noting she had “no backup plan” and was reliant on his jet to reach international events.

This level of logistical coordination suggests a relationship built on significant mutual favors, contrasting with Campbell’s previous descriptions of him as just another face in the crowd.

Campbell has not remained silent as these files have surfaced, though her defense has been consistent for years. In a widely cited 2019 video response that has been recirculated amid the 2026 leaks, she stated, “What he’s done is indefensible. I’m as sickened as everyone else is by it.” When confronted with photos of herself at parties alongside Epstein and Maxwell, she has argued against the concept of “guilt by association,” telling the press:

She has further emphasized her stance by aligning herself with those Epstein harmed, stating,

“I stand with the victims. I’m not a person who wants to see anyone abused, and I never have been.””

The most damaging piece of evidence in the recent 2026 release is an email where Maxwell reportedly tells Epstein she has “two playmates” ready for Campbell.

While the context of this “offer” remains a subject of intense debate—with some investigators suggesting it refers to the procurement of young women for social or sexual purposes—Campbell’s legal team has historically dismissed such claims as speculative. However, for a public already wary of elite power brokers, the specific wording used in these private DOJ records has created a “stop-the-scroll” moment that is proving difficult for the fashion icon to move past.

As a trailblazer in the fashion industry, Campbell is now navigating a period where her professional achievements are being weighed against her presence in some of history’s most notorious social circles. The 2026 files don’t just name her; they place her within a broader system where modeling agents and scouts allegedly groomed young women under the guise of high-fashion opportunities. Whether these records prove a deeper complicity or simply illustrate the unavoidable overlap of the 1% remains the central question of the ongoing DOJ investigation.

Google has tentatively agreed to a $28 million settlement in a California class‑action lawsuit alleging that white and Asian employees were routinely paid more and placed on faster career tracks than colleagues from other racial and ethnic backgrounds.

- A Santa Clara County Superior Court judge has granted preliminary approval, calling the deal “fair” and noting that it could cover more than 6,600 current and former Google workers employed in the state between 2018 and 2024.

The lawsuit was brought by former Google employee Ana Cantu, who identifies as Mexican and racially Indigenous and worked in people operations and cloud departments for about seven years. Cantu alleges that despite strong performance, she remained stuck at the same level while white and Asian colleagues doing similar work received higher pay, higher “levels,” and more frequent promotions.

Cantu’s complaint claims that Latino, Indigenous, Native American, Native Hawaiian, Pacific Islander, and Alaska Native employees were systematically underpaid compared with white and Asian coworkers performing substantially similar roles. The suit also says employees who raised concerns about pay and leveling saw raises and promotions withheld, reinforcing what plaintiffs describe as a two‑tiered system inside the company.

Cantu’s legal team ultimately agreed to narrow the class to employees whose race and ethnicity were “most closely aligned” with hers, a condition that cleared the path to the current settlement.

The judge noted that Black employees were explicitly excluded from the settlement class after negotiations, meaning they will not share in the $28 million payout even though they were named in earlier versions of the case. Separate litigation on behalf of Black Google employees alleging racial bias in pay and promotions remains pending, leaving their claims to be resolved in a different forum.

Of the $28 million total, about $20.4 million is expected to be distributed to eligible class members after legal fees and penalties are deducted. Eligible workers include those in California who self‑identified as Hispanic, Latinx, Indigenous, Native American, American Indian, Native Hawaiian, Pacific Islander, and/or Alaska Native during the covered period.

Beyond cash payments, Google has also agreed to take steps aimed at addressing the alleged disparities, including reviewing pay and leveling practices for racial and ethnic gaps. The settlement still needs final court approval at a hearing scheduled for later this year, and affected employees will have a chance to opt out or object before any money is distributed.

A Google spokesperson has said the company disputes the allegations but chose to settle in order to move forward, while reiterating its public commitment to fair pay, hiring, and advancement for all employees. The company has emphasized ongoing internal audits and equity initiatives, though plaintiffs argue those efforts did not prevent or correct the disparities outlined in the lawsuit.

For many observers, the exclusion of Black workers from the settlement highlights the legal and strategic complexities of class‑action discrimination cases, especially in large, diverse workplaces. The outcome of the remaining lawsuit brought on behalf of Black employees, alongside this $28 million deal, will help define how one of the world’s most powerful tech companies is held accountable for alleged racial inequities in pay and promotion.

How to Make Your Indie Film Pay Off Without Losing Half to Distributors

What the Epstein Files Actually Say About Jay-Z

AI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

What Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

How Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Catherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Why Burnt-Out Filmmakers Need to Unplug Right Now

New DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein