Business

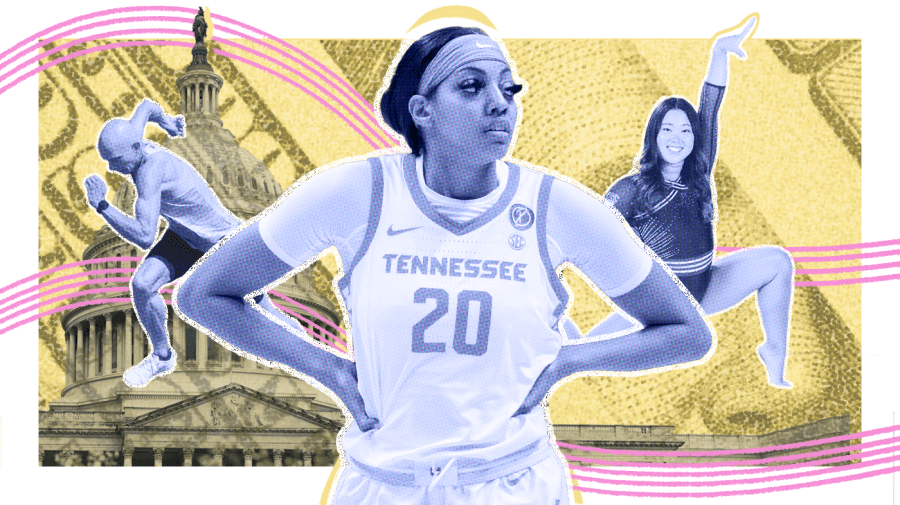

Congress eyes college sports fixes. Are student-athletes on board? on August 26, 2023 at 10:00 am Business News | The Hill

If lawmakers have their way, change is afoot in college sports.

After the Supreme Court in 2021 opened the floodgates for money into college sports, Congress appears ready to impose guardrails on universities and force transparency around deals that are making some student-athletes rich.

But it’s unclear how much these changes will benefit the more than half-a-million student athletes competing in NCAA championship sports.

“There’s so much money in collegiate sports, but the voice and the well being of the athlete has historically not been taken into account,” Nicole Goot, a synchronized swimmer for Stanford, told The Hill.

The Supreme Court decision for the first time allowed college athletes to profit from their name, image and likeness, opening the way for multi-million “NIL deals” for some of the star players at major schools. But the benefits aren’t being felt by the vast majority of NCAA athletes.

“Under the mask of NIL, the idea that athletes are being better supported is beginning to exist, but the realities of that support aren’t being actualized,” Goot said.

Goot was among seven current and former Division 1 student-athletes who spoke to The Hill in recent weeks about their own experiences with NIL and what they would like to see from federal legislation.

They agreed with the thrust of much of the legislation aiming to prevent recruiting from becoming a bidding war among a few powerhouse universities.

“If the school is offering a million to get me there and I need that money, I’m going to go there over a school that might be a better degree because I’m setting myself up for success,” Goot said.

“I’m worried that that’s going to completely reshape collegiate athletics, because it becomes less about talent, team, culture, community and becomes more about who has the most money and most connections.”

But the student-athletes disagreed with other proposals, such as one from Sens. Joe Manchin (D-W.Va.) and Tommy Tuberville (R-Ala.), a former Auburn football coach, to restrict transfers before three years of eligibility.

And they want to see Congress put the onus on universities to provide their student-athletes with the education, resources, health care, and financial aid guarantees to succeed during and after college — regardless of whether they are benefiting directly from NIL deals.

Reining in recruiting

Recruiting inducements such as direct payments or promises of profit are technically prohibited by the NCAA’s interim NIL policy — imposed after the Supreme Court decision — and would be explicitly outlawed in each bill.

But there are widespread questions about enforcement.

“They can say don’t do it. But already there’s a rule that says, ‘Don’t do it,’ and it’s being violated. What does adding this law do that really help the situation get better?” said Boston College law professor Alfred Yen. “The answer to that depends entirely on its enforcement.”

One recent case of punishment for inducement involved Florida International University’s women’s soccer and softball programs, which included a $5,000 fine and suspensions for those involved.

Perhaps the highest-profile punishment of late was doled out to the University of Tennessee’s football program in July following more than 200 violations of recruiting rules and direct payments to prospects.

The program was fined $8 million, put on five years of probation, and will be subject to an annual compliance review by an external group, among other punishments.

However, experts and athletes say the problem is still widespread. Yet no one had an answer to what would deter agents, boosters, or third parties from inducing recruitment.

Though each bill explicitly prohibits such inducements and some create a new entity outside of the NCAA to investigate and enforce the prohibition, both the punishments and methods of enforcement remain unclear.

However, simply having the prohibition as a federal law could act as a deterrent, said Bryce Choate, one of three student-athlete representatives on the NCAA Board of Governors.

UC Berkeley gymnast Elise Byun, who represents the Pac-12 Conference on the Division I NCAA Student Athlete Advisory Committee (SAAC), said SAAC has proposed that Congress require every student-athlete to disclose the contracts they enter into, creating transparency around the NIL marketplace. Each bill includes this requirement but under different time restrictions, and no punishment is outlined for missing the deadline.

Though not directly related to inducements, Elise said the SAAC also discussed whether narrowing the transfer portal – which allows students to transfer from school to school during a specified period of time postseason — will deter last-minute transfer deals related to NIL money.

Tweaking the transfer portal

Manchin and Tuberville propose forcing players to sit out a season if they transfer before three seasons with their initial team.

Choate called the proposal “ridiculous.”

“I would be surprised if that goes through,” Choate said. “If it does, we have a legislature that doesn’t care.”

University of Pennsylvania (UPenn) volleyball player Tatum DeMann’s initial reaction to the potential change was similar, noting how transferring can sometimes be crucial for a students’ mental and physical health.

“If you’re just not right for a program, then you’re not right for a program,” DeMann said.

Erin Morley, an incoming freshman who will row for the University of North Carolina at Chapel Hill (UNC), saw a benefit to limiting transfers motivated by money.

“When NIL deals come into the equation, sports kind of take a backseat and the money and the fame kind of take the driver’s side,” Morley said.

Search for equity

According to University of Iowa track and field runner Armando Bryson, the Division I Student-Athlete Advisory Committee (SAAC) has been focusing its discussions on transparency and equity.

That includes a streamlined process to vet and register agents, boosters, collectives, and third parties that will be entering into NIL deals with students.

Bryson said student-athletes should have to disclose the types of deals signed, the annual activities performed, and other components it entails — something that each bill requires, to a certain extent.

On the equity front, Bryson noted that not all sports have the same opportunity to enter into NIL deals. And even in sports that are huge money-makers, not all positions are lucrative.

Washington Commanders offensive lineman Chris Paul recalled that it was hard for him to access NIL deals at University of Tulsa because of his relatively low visibility. And that hasn’t changed at the professional level.

“(My position) is just not a position that most people pay attention to unless something goes wrong,” Paul said. “I have played the same position my whole life so I’ve never been in a position where brand deals are just being thrown to me.”

While these inequities are unlikely to change, legislators are looking to level the playing field in other ways.

Covering health care and injuries

For example, two of the bills would require institutions making more than $20 million annually from athletics to contribute to a fund or pay for student-athletes’ injury-related out-of-pocket medical expenses.

This would be “a wonderful plus” according to Morley, the incoming UNC rower.

“They [athletes] are putting a lot of time and effort, and honestly risk, into the sport that they’re competing in for the school,” Morley told The Hill.

When University of Tennessee basketball player Tamari Key was diagnosed with a pulmonary embolism—blood clots in the arteries that send blood to the lungs—her university-provided insurance took care of her medical expenses.

“I know not a lot of athletes feel as though they’re taking care of health-wise when they’re not eligible or available to play,” Key told The Hill. “But I had all my doctor’s appointments, I had physical therapy, everyone was really hands-on, even from the mental health side of things as well.”

According to Choate, the NCAA adopted new rules for D1 schools in March that will require schools to cover out-of-pocket costs for sports-related injuries, among other provisions, beginning in August 2024.

Last Wednesday, the NCAA also announced it will provide member schools with injury insurance coverage for student-athletes for two years after they are no longer eligible to play.

Safeguarding scholarships

One of the bills also proposes guaranteed tuition aid for athletes. The act stipulates that financial aid for a student’s education cannot be terminated under circumstances, like if a player sustains a career ending injury or is cut from the team.

DeMann, the UPenn volleyball player, was in full support of this measure despite not being able to benefit from it as UPenn is part of the Ivy League conference, which prohibits athletic scholarships on account of their “commitment to academic excellence.”

“I think under the condition that a student isn’t feeling like their sports are serving them anymore, like for their mental health, they shouldn’t be scared of losing their ability to attend a school financially because of that,” DeMann told The Hill.

Choate echoed DeMann’s sentiments, underscoring the importance of mental health.

“I can say from my time, if I was able to take a month off or a week off or a few practices off to focus on my mental athlete and I knew my scholarship wasn’t going to be threatened, I might have taken it,” Choate said. “But right now, that’s not a guarantee so our student athletes aren’t taking care of their mental health like they could be because if they take time off… some coaches would probably punish them.”

However, law professor Yen said schools may not be as receptive to the idea.

“I don’t think that NCAA institutions are in Congress saying, ‘Please force us to extend medical benefits to our athletes,’” Yen told The Hill. “I actually rather suspect that there would be objection to those provisions should any of these bills seriously come up for consideration.”

Financial literacy

Some of the bills also grapple with helping students understand how NIL deals work and what to do with the money they receive. One would require students to take classes on financial literacy and life skills, which was met with mixed reactions from different athletes.

Byun, the Berkely gymnast, said some student-athletes aren’t aware they have to pay taxes on the money they receive from NIL deals. However, she said that mandating more classes would add unnecessary work into the already packed schedules of student-athletes.

“Grouping all athletes into a category of needing classes and needing education on this and that when the general public isn’t required is slightly unfair, considering we already have a very beefy and built up schedule,” Morley said.

According to Key, her team has found other ways to increase their financial literacy. First Horizon Bank, one of the team’s corporate sponsors, comes to campus every year to teach the team about taxes, saving money and opens free accounts specifically for NIL revenue.

Goot said programs could also help the situation by embracing NIL deals, so that players don’t feel judges when they sign on.

“(Success in NIL) depends a lot on the culture of your school: Is it going to be something that’s going to be celebrated like you going out and making money… or is it something that you’re going to be judged for?” Goot posited.

“The fear of judgment holds a lot of people back and the lack of clarity makes overcoming that fear of judgment even harder,” Goot added. “There needs to be a community of athletes that are trying to support each other, have these conversations, and make sure that people of all backgrounds have access.”

Education, Business, News, college athletes, college sports, NIL deals, scholarships, transfer portal If lawmakers have their way, change is afoot in college sports. After the Supreme Court in 2021 opened the floodgates for money into college sports, Congress appears ready to impose guardrails on universities and force transparency around deals that are making some student-athletes rich. But it’s unclear how much these changes will benefit the more…

Business

New DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

In early 2026, the global conversation surrounding the “Epstein files” has reached a fever pitch as the Department of Justice continues to un-redact millions of pages of internal records. Among the most explosive revelations are detailed email exchanges between Ghislaine Maxwell and Jeffrey Epstein that directly name supermodel Naomi Campbell. While Campbell has long maintained she was a peripheral figure in Epstein’s world, the latest documents—including an explicit message where Maxwell allegedly offered “two playmates” for the model—have forced a national re-evaluation of her proximity to the criminal enterprise.

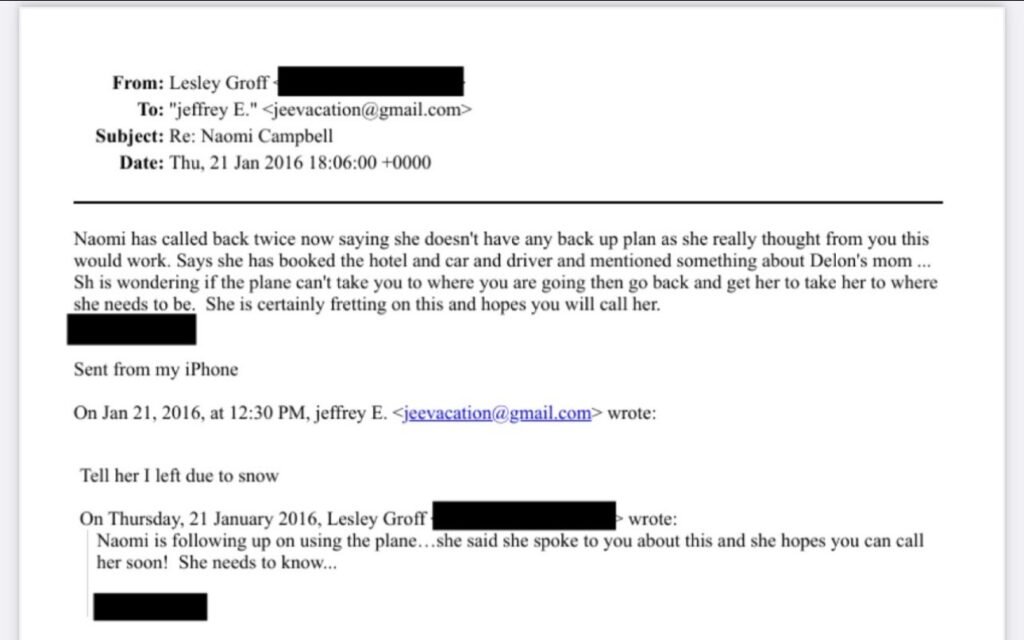

The Logistics of a High-Fashion Connection

The declassified files provide a rare look into the operational relationship between the supermodel and the financier. Flight logs and internal staff emails from as late as 2016 show that Campbell’s travel was frequently subsidized by Epstein’s private fleet. In one exchange, Epstein’s assistants discussed the urgency of her travel requests, noting she had “no backup plan” and was reliant on his jet to reach international events.

This level of logistical coordination suggests a relationship built on significant mutual favors, contrasting with Campbell’s previous descriptions of him as just another face in the crowd.

In Her Own Words: The “Sickened” Response

Campbell has not remained silent as these files have surfaced, though her defense has been consistent for years. In a widely cited 2019 video response that has been recirculated amid the 2026 leaks, she stated, “What he’s done is indefensible. I’m as sickened as everyone else is by it.” When confronted with photos of herself at parties alongside Epstein and Maxwell, she has argued against the concept of “guilt by association,” telling the press:

She has further emphasized her stance by aligning herself with those Epstein harmed, stating,

“I stand with the victims. I’m not a person who wants to see anyone abused, and I never have been.””

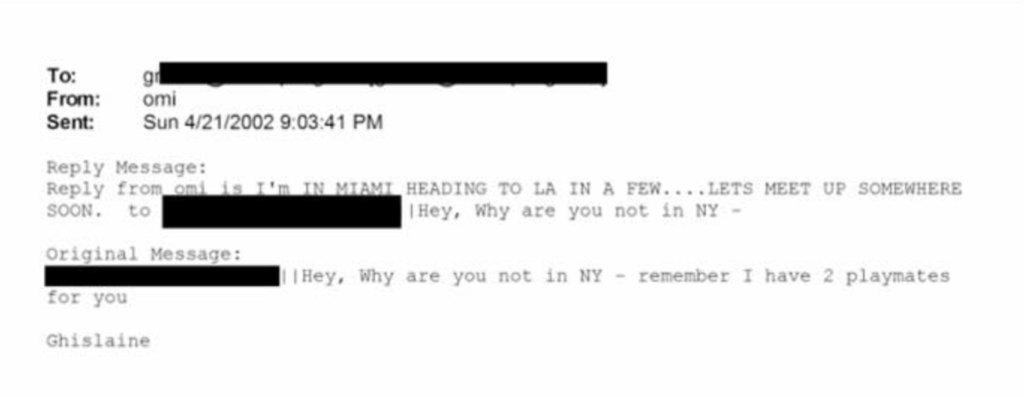

The Mystery of the “Two Playmates”

The most damaging piece of evidence in the recent 2026 release is an email where Maxwell reportedly tells Epstein she has “two playmates” ready for Campbell.

While the context of this “offer” remains a subject of intense debate—with some investigators suggesting it refers to the procurement of young women for social or sexual purposes—Campbell’s legal team has historically dismissed such claims as speculative. However, for a public already wary of elite power brokers, the specific wording used in these private DOJ records has created a “stop-the-scroll” moment that is proving difficult for the fashion icon to move past.

A Reputation at a Crossroads

As a trailblazer in the fashion industry, Campbell is now navigating a period where her professional achievements are being weighed against her presence in some of history’s most notorious social circles. The 2026 files don’t just name her; they place her within a broader system where modeling agents and scouts allegedly groomed young women under the guise of high-fashion opportunities. Whether these records prove a deeper complicity or simply illustrate the unavoidable overlap of the 1% remains the central question of the ongoing DOJ investigation.

Business

Google Accused Of Favoring White, Asian Staff As It Reaches $28 Million Deal That Excludes Black Workers

Google has tentatively agreed to a $28 million settlement in a California class‑action lawsuit alleging that white and Asian employees were routinely paid more and placed on faster career tracks than colleagues from other racial and ethnic backgrounds.

- A Santa Clara County Superior Court judge has granted preliminary approval, calling the deal “fair” and noting that it could cover more than 6,600 current and former Google workers employed in the state between 2018 and 2024.

How The Discrimination Claims Emerged

The lawsuit was brought by former Google employee Ana Cantu, who identifies as Mexican and racially Indigenous and worked in people operations and cloud departments for about seven years. Cantu alleges that despite strong performance, she remained stuck at the same level while white and Asian colleagues doing similar work received higher pay, higher “levels,” and more frequent promotions.

Cantu’s complaint claims that Latino, Indigenous, Native American, Native Hawaiian, Pacific Islander, and Alaska Native employees were systematically underpaid compared with white and Asian coworkers performing substantially similar roles. The suit also says employees who raised concerns about pay and leveling saw raises and promotions withheld, reinforcing what plaintiffs describe as a two‑tiered system inside the company.

Why Black Employees Were Left Out

Cantu’s legal team ultimately agreed to narrow the class to employees whose race and ethnicity were “most closely aligned” with hers, a condition that cleared the path to the current settlement.

The judge noted that Black employees were explicitly excluded from the settlement class after negotiations, meaning they will not share in the $28 million payout even though they were named in earlier versions of the case. Separate litigation on behalf of Black Google employees alleging racial bias in pay and promotions remains pending, leaving their claims to be resolved in a different forum.

What The Settlement Provides

Of the $28 million total, about $20.4 million is expected to be distributed to eligible class members after legal fees and penalties are deducted. Eligible workers include those in California who self‑identified as Hispanic, Latinx, Indigenous, Native American, American Indian, Native Hawaiian, Pacific Islander, and/or Alaska Native during the covered period.

Beyond cash payments, Google has also agreed to take steps aimed at addressing the alleged disparities, including reviewing pay and leveling practices for racial and ethnic gaps. The settlement still needs final court approval at a hearing scheduled for later this year, and affected employees will have a chance to opt out or object before any money is distributed.

H2: Google’s Response And The Broader Stakes

A Google spokesperson has said the company disputes the allegations but chose to settle in order to move forward, while reiterating its public commitment to fair pay, hiring, and advancement for all employees. The company has emphasized ongoing internal audits and equity initiatives, though plaintiffs argue those efforts did not prevent or correct the disparities outlined in the lawsuit.

For many observers, the exclusion of Black workers from the settlement highlights the legal and strategic complexities of class‑action discrimination cases, especially in large, diverse workplaces. The outcome of the remaining lawsuit brought on behalf of Black employees, alongside this $28 million deal, will help define how one of the world’s most powerful tech companies is held accountable for alleged racial inequities in pay and promotion.

Business

Luana Lopes Lara: How a 29‑Year‑Old Became the Youngest Self‑Made Woman Billionaire

At just 29, Luana Lopes Lara has taken a title that usually belongs to pop stars and consumer‑app founders.

Multiple business outlets now recognize her as the world’s youngest self‑made woman billionaire, after her company Kalshi hit an 11 billion dollar valuation in a new funding round.

That round, a 1 billion dollar Series E led by Paradigm with Sequoia Capital, Andreessen Horowitz, CapitalG and others participating, instantly pushed both co‑founders into the three‑comma club. Estimates place Luana’s personal stake at roughly 12 percent of Kalshi, valuing her net worth at about 1.3 billion dollars—wealth tied directly to equity she helped create rather than inheritance.

Kalshi itself is a big part of why her ascent matters.

Founded in 2019, the New York–based company runs a federally regulated prediction‑market exchange where users trade yes‑or‑no contracts on real‑world events, from inflation reports to elections and sports outcomes.

As of late 2025, the platform has reached around 50 billion dollars in annualized trading volume, a thousand‑fold jump from roughly 300 million the year before, according to figures cited in TechCrunch and other financial press. That hyper‑growth convinced investors that event contracts are more than a niche curiosity, and it is this conviction—expressed in billions of dollars of new capital—that turned Luana’s share of Kalshi into a billion‑dollar fortune almost overnight.

Her path to that point is unusually demanding even by founder standards. Luana grew up in Brazil and trained at the Bolshoi Theater School’s Brazilian campus, where reports say she spent up to 13 hours a day in class and rehearsal, competing for places in a program that accepts fewer than 3 percent of applicants. After a stint dancing professionally in Austria, she pivoted into academics, enrolling at the Massachusetts Institute of Technology to study computer science and mathematics and later completing a master’s in engineering.

During summers she interned at major firms including Bridgewater Associates and Citadel, gaining a front‑row view of how global macro traders constantly bet on future events—but without a simple, regulated way for ordinary people to do the same.

That realization shaped Kalshi’s founding thesis and ultimately her billionaire status. Together with co‑founder Tarek Mansour, whom she met at MIT, Luana spent years persuading lawyers and U.S. regulators that a fully legal event‑trading exchange could exist under commodities law. Reports say more than 60 law firms turned them down before one agreed to help, and the company then spent roughly three years in licensing discussions with the Commodity Futures Trading Commission before gaining approval. The payoff is visible in 2025’s numbers: an 11‑billion‑dollar valuation, a 1‑billion‑dollar fresh capital injection, and a founder’s stake that makes Luana Lopes Lara not just a compelling story but a data point in how fast wealth can now be created at the intersection of finance, regulation, and software.

Entertainment2 weeks ago

Entertainment2 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry3 weeks ago

Film Industry3 weeks agoTurning One Short Film into 12 Months of Content

Film Industry4 weeks ago

Film Industry4 weeks ago10 Ways Filmmakers Are Building Careers Without Waiting for Distributors

Film Industry2 weeks ago

Film Industry2 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Film Industry3 weeks ago

Film Industry3 weeks agoHow to Write a Logline That Makes Programmers Hit Play

News2 weeks ago

News2 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Entertainment1 week ago

Entertainment1 week agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Entertainment2 weeks ago

Entertainment2 weeks agoYou wanted to make movies, not decode Epstein. Too late.