Business

Chinese Business Owners Face Uncertainty as Trade War Escalates and Growth Slows

The deepening U.S.-China trade war has plunged Chinese entrepreneurs into a crisis of confidence, with retaliatory tariffs exceeding 145% on key exports and domestic economic pressures compounding fears of prolonged stagnation. While China reported stronger-than-expected GDP growth of 5.4% in Q1 2025, analysts warn this pre-dates the full impact of America’s sweeping tariffs enacted in April—a move that threatens to derail export-driven sectors and exacerbate existing vulnerabilities.

Trade War Fallout

The U.S. has imposed a 145% tariff on Chinese goods, prompting Beijing to retaliate with 125% duties on American imports, including agricultural products. This escalation has disrupted supply chains globally, with Chinese manufacturers reporting canceled orders from U.S. buyers and halted shipments across industries like furniture, toys, and apparel. Hong Kong-based exporters, such as Gaoxd, have seen sales drop by 20% this year, with owners citing a “wait-and-see” paralysis among clients.

Domestic Challenges

Despite the Q1 growth surge, China faces a fragile recovery:

- Real estate crisis: Property market indicators remain weak despite minor price rebounds.

- Consumer hesitancy: Domestic demand lacks momentum, with households reluctant to spend amid deflationary pressures.

- Manufacturing strains: Factories report minimal room to further cut costs, with relocation to Southeast Asia hindered by underdeveloped supply chains.

Strategic Shifts

Beijing is aggressively diversifying trade partnerships, reducing U.S. export reliance from historic highs to 14.7% in 2024. President Xi Jinping’s recent Southeast Asia tour emphasized China’s pitch as a “reliable” alternative to U.S.-led trade frameworks. Meanwhile, state media insists China has “valuable experience” from eight years of trade tensions, framing the conflict as an existential struggle against Western decline.

Outlook

While China’s $586 billion fiscal stimulus and focus on high-end manufacturing aim to offset trade losses, analysts caution that the tariffs’ delayed effects could erase Q1 gains. With U.S. imports of Chinese goods effectively halted by prohibitive tariffs, businesses face a bifurcated future: adapt to decoupled markets or risk collapse in a prolonged standoff between the world’s largest economies.

As economist Vina Nadjibulla notes, the critical question is which economy can endure more pain—a calculus now keeping Chinese business owners awake at night.

Bolanle Media covers a wide range of topics, including film, technology, and culture. Our team creates easy-to-understand articles and news pieces that keep readers informed about the latest trends and events. If you’re looking for press coverage or want to share your story with a wider audience, we’d love to hear from you! Contact us today to discuss how we can help bring your news to life

Business

How Trump’s Tariffs Could Hit American Wallets

As the debate over tariffs heats up ahead of the 2024 election, new analysis reveals that American consumers could face significant financial consequences if former President Donald Trump’s proposed tariffs are enacted and maintained. According to a recent report highlighted by Forbes, the impact could be felt across households, businesses, and the broader U.S. economy.

The Household Cost: Up to $2,400 More Per Year

Research from Yale University’s Budget Lab, cited by Forbes, estimates that the average U.S. household could pay an additional $2,400 in 2025 if the new tariffs take effect and persist. This projection reflects the cumulative impact of all tariffs announced in Trump’s plan.

Price Hikes Across Everyday Goods

The tariffs are expected to drive up consumer prices by 1.8% in the near term. Some of the hardest-hit categories include:

- Apparel: Prices could jump 37% in the short term (and 18% long-term).

- Footwear: Up 39% short-term (18% long-term).

- Metals: Up 43%.

- Leather products: Up 39%.

- Electrical equipment: Up 26%.

- Motor vehicles, electronics, rubber, and plastic products: Up 11–18%.

- Groceries: Items like vegetables, fruits, and nuts could rise up to 6%, with additional increases for coffee and orange juice due to specific tariffs on Brazilian imports.

A Historic Tariff Rate and Economic Impact

If fully implemented, the effective tariff rate on U.S. consumers could reach 18%, the highest level since 1934. The broader economic consequences are also notable:

- GDP Reduction: The tariffs could reduce U.S. GDP by 0.4% annually, equating to about $110 billion per year.

- Revenue vs. Losses: While tariffs are projected to generate $2.2 trillion in revenue over the next decade, this would be offset by $418 billion in negative economic impacts.

How Businesses Are Responding

A KPMG survey cited in the report found that 83% of business leaders expect to raise prices within six months of tariff implementation. More than half say their profit margins are already under pressure, suggesting that consumers will likely bear the brunt of these increased costs.

What This Means for Americans

The findings underscore the potential for substantial financial strain on American families and businesses if Trump’s proposed tariffs are enacted. With consumer prices set to rise and economic growth projected to slow, the debate over tariffs is likely to remain front and center in the months ahead.

For more in-depth economic analysis and updates, stay tuned to Bolanlemedia.com.

Business

U.S. Limits Nigerian Non-Immigrant Visas to Three-Month Validity

In July 2025, the United States implemented significant changes to its visa policy for Nigerian citizens, restricting most non-immigrant and non-diplomatic visas to a single entry and a maximum validity of three months. This marks a departure from previous policies that allowed for multiple entries and longer stays, and has important implications for travel, business, and diplomatic relations between the two countries.

Key Changes in U.S. Visa Policy for Nigerians

- Single-Entry, Three-Month Limit: As of July 8, 2025, most non-immigrant visas issued to Nigerians are now valid for only one entry and up to three months.

- No Retroactive Impact: Visas issued prior to this date remain valid under their original terms.

- Reciprocity Principle: The U.S. cited alignment with Nigeria’s own visa policies for U.S. citizens as the basis for these changes.

- Enhanced Security Screening: Applicants are required to make their social media accounts public for vetting, and are subject to increased scrutiny for any signs of hostility toward U.S. institutions.

Rationale Behind the Policy Shift

- Security and Immigration Integrity: The U.S. government stated the changes are intended to safeguard the immigration system and meet global security standards.

- Diplomatic Reciprocity: These restrictions mirror the limitations Nigeria imposes on U.S. travelers, emphasizing the principle of fairness in international visa agreements.

- Potential for Further Action: The U.S. has indicated that additional travel restrictions could be introduced if Nigeria does not address certain diplomatic and security concerns.

Nigeria’s Updated Visa Policy

- Nigeria Visa Policy 2025 (NVP 2025): Introduced in May 2025, this policy features a new e-Visa system for short visits and reorganizes visa categories:

- Short Visit Visas (e-Visa): For business or tourism, valid up to three months, non-renewable, processed digitally within 48 hours.

- Temporary Residence Visas: For employment or study, valid up to two years.

- Permanent Residence Visas: For investors, retirees, and highly skilled individuals.

- Visa Exemptions: ECOWAS citizens and certain diplomatic passport holders remain exempt.

- Reciprocal Restrictions: Most short-stay and business visas for U.S. citizens are single-entry and short-term, reflecting reciprocal treatment.

Impact on Travelers and Bilateral Relations

- Nigerian Travelers: Face increased administrative requirements, higher costs, and reduced travel flexibility to the U.S.

- U.S. Travelers to Nigeria: Encounter similar restrictions, with most visas limited to single entry and short duration.

- Diplomatic Tensions: Nigerian officials have called for reconsideration of the U.S. policy, warning of negative effects on bilateral ties and people-to-people exchanges.

Conclusion

The U.S. decision to limit Nigerian non-immigrant visas to three months highlights the growing complexity and reciprocity in global visa regimes. Both countries are tightening their policies, citing security and fairness, which underscores the need for travelers and businesses to stay informed and adapt to evolving requirements.

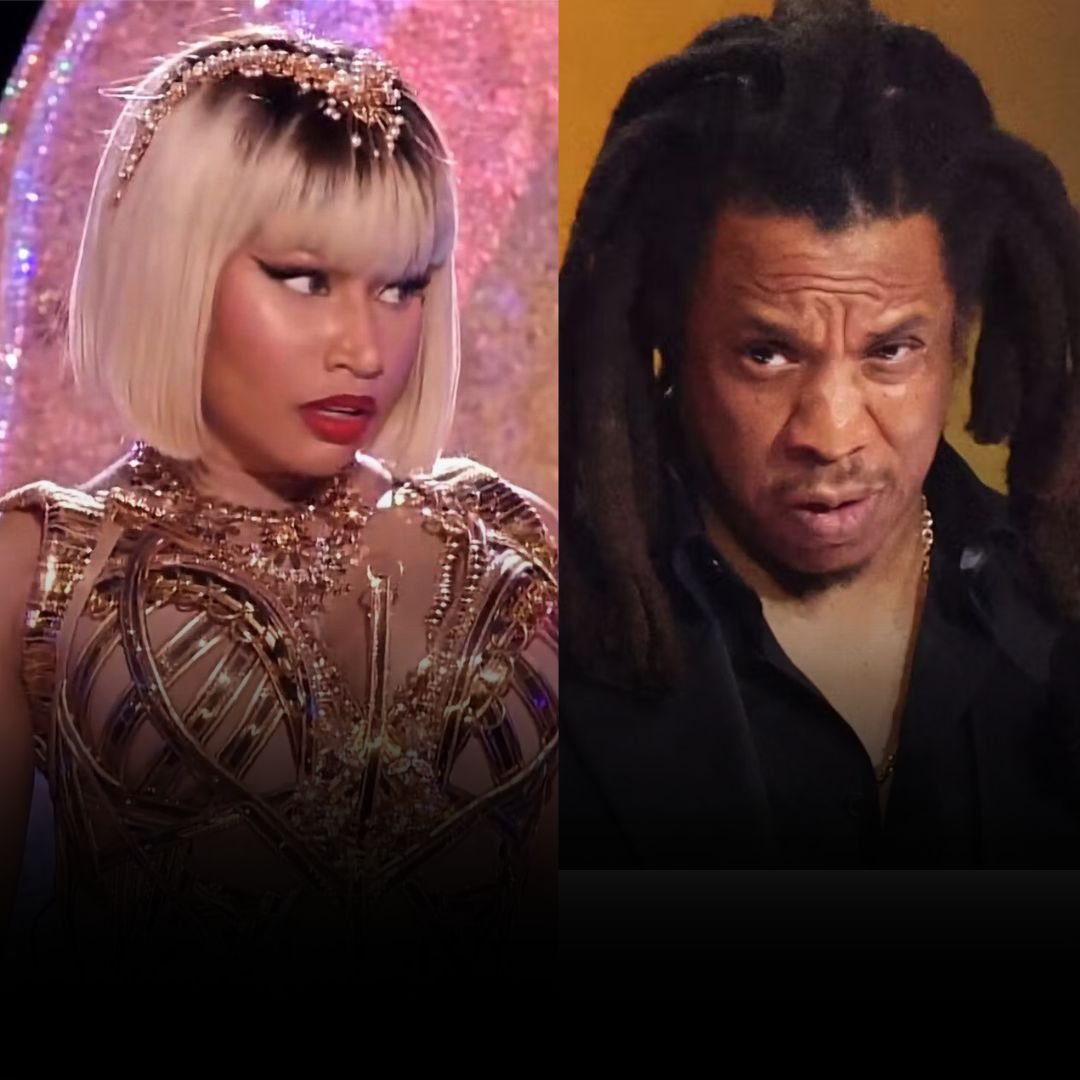

Business

Nicki Minaj Demands $200 Million from Jay-Z in Explosive Twitter Rant

Nicki Minaj has once again set social media ablaze, this time targeting Jay-Z with a series of pointed tweets that allege he owes her an eye-popping $200 million. The outburst has reignited debates about artist compensation, industry transparency, and the ongoing power struggles within hip-hop’s elite circles.

The $200 Million Claim

In a string of tweets, Minaj directly addressed Jay-Z, writing, “Jay-Z, call me to settle the karmic debt. It’s only collecting more interest. You still in my top five though. Let’s get it.” She went further, warning, “Anyone still calling him Hov will answer to God for the blasphemy.” According to Minaj, the alleged debt stems from Jay-Z’s sale of Tidal, the music streaming platform he launched in 2015 with a group of high-profile artists—including Minaj herself, J. Cole, and Rihanna.

When Jay-Z sold Tidal in 2021, Minaj claims she was only offered $1 million, a figure she says falls dramatically short of what she believes she is owed based on her ownership stake and contributions. She has long voiced dissatisfaction with the payout, but this is the most public—and dramatic—demand to date.

Beyond the Money: Broader Grievances

Minaj’s Twitter storm wasn’t limited to financial complaints. She also:

- Promised to start a college fund for her fans if she receives the money she claims is owed.

- Accused blogs and online creators of ignoring her side of the story, especially when it involves Jay-Z.

- Warned content creators about posting “hate or lies,” saying, “They won’t cover your legal fees… I hope it’s worth losing everything including your account.”

She expressed frustration that mainstream blogs and platforms don’t fully cover her statements, especially when they involve Jay-Z, and suggested that much of the coverage she receives is from less reputable sources.

Satirical Accusations and Industry Critique

Minaj’s tweets took a satirical turn as she jokingly blamed Jay-Z for a laundry list of cultural grievances, including:

- The state of hip-hop, football, basketball, and touring

- The decline of Instagram and Twitter

- Even processed foods and artificial dyes in candy

She repeatedly declared, “The jig is up,” but clarified that her statements were “alleged and for entertainment purposes only.”

Political and Cultural Criticism

Minaj also criticized Jay-Z’s political involvement, questioning why he didn’t campaign more actively for Kamala Harris or respond to President Obama’s comments about Black men. While Jay-Z has a history of supporting Democratic campaigns, Minaj’s critique centered on more recent events and what she perceives as a lack of advocacy for the Black community.

The Super Bowl and Lil Wayne

Adding another layer to her grievances, Minaj voiced disappointment that Lil Wayne was not chosen to perform at the Super Bowl in New Orleans, a decision she attributes to Jay-Z’s influence in the entertainment industry.

Public and Industry Reaction

Despite the seriousness of her financial claim, many observers note that if Minaj truly believed Jay-Z owed her $200 million, legal action—not social media—would likely follow. As of now, there is no public record of a lawsuit or formal complaint.

Some fans and commentators see Minaj’s outburst as part of a larger pattern of airing industry grievances online, while others interpret it as a mix of personal frustration and performance art. Minaj herself emphasized that her tweets were “for entertainment purposes only.”

Conclusion

Nicki Minaj’s explosive Twitter rant against Jay-Z has once again placed the spotlight on issues of artist compensation and industry dynamics. Whether her claims will lead to further action or remain another dramatic chapter in hip-hop’s ongoing soap opera remains to be seen, but for now, the world is watching—and tweeting.

Business1 week ago

Business1 week agoPros and Cons of the Big Beautiful Bill

Advice2 weeks ago

Advice2 weeks agoWhat SXSW 2025 Filmmakers Want Every New Director to Know

Film Industry3 weeks ago

Film Industry3 weeks agoFilming Yourself and Look Cinematic

News2 weeks ago

News2 weeks agoFather Leaps Overboard to Save Daughter on Disney Dream Cruise

Politics4 weeks ago

Politics4 weeks agoBolanle Newsroom Brief: Israel Strikes Iran’s Nuclear Sites — What It Means for the World

Health1 week ago

Health1 week agoMcCullough Alleges Government Hid COVID Vaccine Side Effects

Advice2 weeks ago

Advice2 weeks agoWhy 20% of Us Are Always Late

Entertainment4 weeks ago

Entertainment4 weeks agoThe Hidden Reality Behind Victoria’s Secret