Film Industry

The Harsh Truth About Filmmaking That Nobody Tells You

We’re often sold a romantic image of filmmaking: the visionary director on set, pointing dramatically through a viewfinder, surrounded by crew and magic, making art that transcends reality. The dream job. The red carpets. The Oscars. The “glamour” of Hollywood.

But the truth? Filmmaking is not a dream. It’s a war.

Once you step behind the glossy curtain, you realize how much politics, chaos, business strategy, and sheer endurance it takes to get a film made, let alone distributed. Here’s the reality check on the biggest myths about filmmaking and the system that keeps those illusions alive.

Film Festivals Aren’t a Level Playing Field

When you’re just starting out, film festivals like Sundance or SXSW look like a fair platform. Anyone can submit through FilmFreeway, pay the entry fee, and hope for the best. Right?

Not exactly.

- Festivals are businesses first. They need films with buzz, recognizable names, or agency connections to draw attention.

- Major talent agencies like WME or CAA have direct lines to programmers. If they call, their films move to the top of the stack.

- Emerging filmmakers without connections are grouped into the “cold submissions” pool. Those entries are still watched, but they face harder odds.

- Labs and programs like the Sundance Labs give certain filmmakers direct pipelines into prestigious slots—think Ryan Coogler with Fruitvale Station.

The takeaway: while raw talent can break through, access and relationships heavily influence who gets accepted.

Studios Don’t Always “Make” Movies

A24. Lionsgate. Universal. When you see their logos, you probably assume they produced the film.

But in reality:

- Many smaller studios act as distributors, not producers. They buy finished independent films after they’ve already generated buzz at festivals.

- Example: Operation Avalanche (2016). Filmmakers risked a million-dollar loan to shoot the movie themselves. Only after Sundance did Lionsgate swoop in—reimbursing the costs and adding their logo.

- This creates the illusion that the studio was behind the whole process when the heavy lifting—financing, risk-taking, and creativity—was already done.

Independent filmmakers often carry all the risk. Studios frequently come in only when those risks prove successful.

Development Deals Aren’t Guarantees

One of the cruelest myths young filmmakers believe is that selling a script means their movie will be made.

Here’s the reality:

- Studios sometimes buy scripts simply to shelve them, preventing competition with similar projects.

- Projects enter development hell, where endless rewrites, executive notes, and creative disagreements stall them indefinitely.

- Some shorts go viral, get bought, and then vanish because the studio loses interest or a bigger project doesn’t align.

As the saying goes: don’t trust a greenlight until you’re a week into shooting.

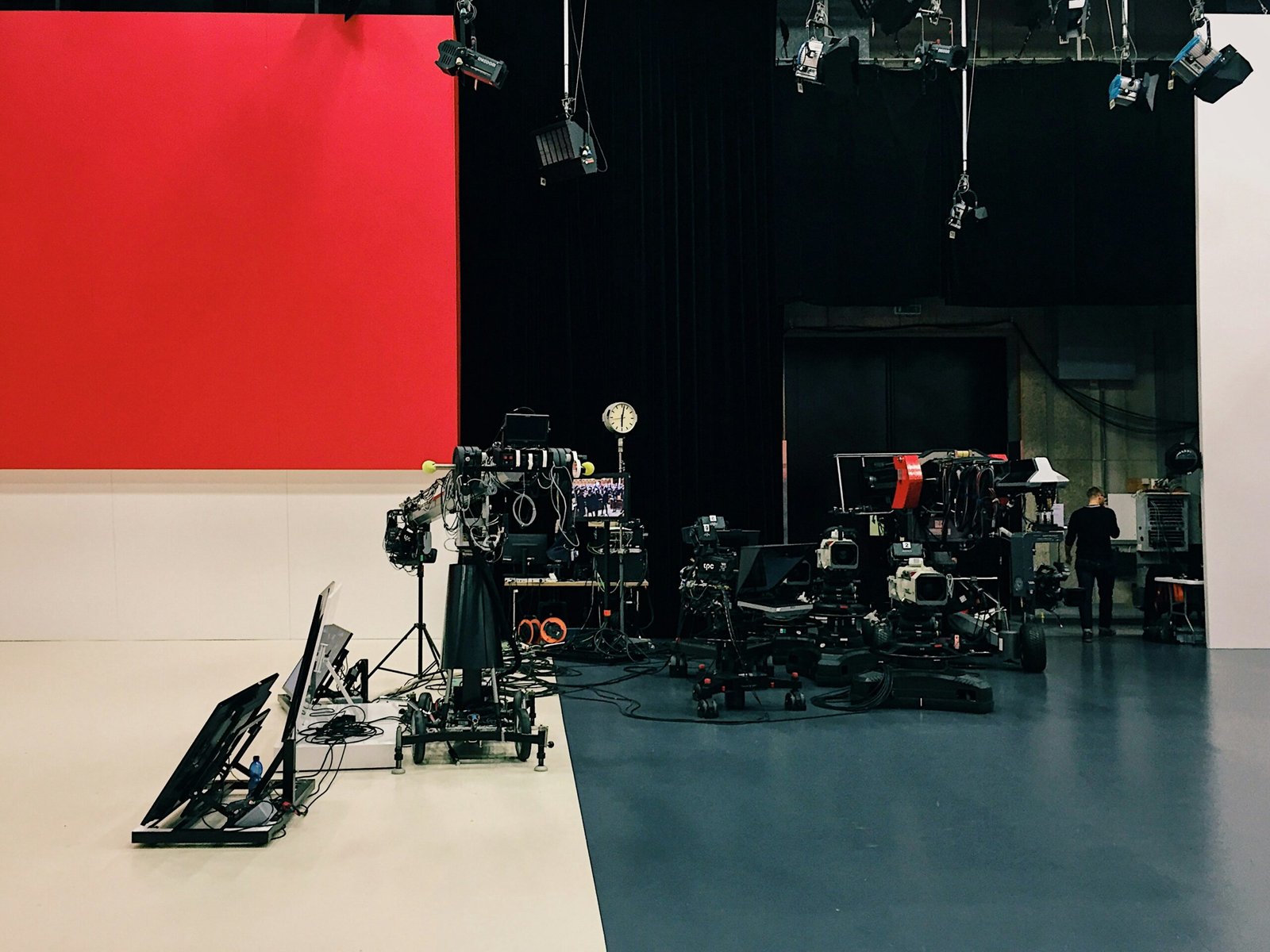

Filmmaking Is Not Glamorous—it’s Survival

Behind-the-scenes reels show actors laughing between takes, directors nodding confidently, and glamorous studio lots.

The day-to-day reality:

- Endless fights about budgets, schedules, and rewrites.

- Producers and executives pushing competing agendas on the same project.

- Department tensions, last-minute pivots, and the daily threat of collapse.

- Stanley Kubrick once called set life “the worst milieu for creative work ever devised by man.”

Francis Ford Coppola put it more bluntly while reflecting on Apocalypse Now:

“We had access to too much money, too much equipment, and little by little, we went insane.”

The Oscars Are Political Campaigns

The Academy Awards are framed as merit-based: the “best” films rising to the top. In truth, Oscars function like a political race.

- Studios and producers must fund campaigns—billboards, ads, screenings, and elegant “For Your Consideration” efforts aimed directly at academy voters.

- Some studios spend more on Oscar campaigning than the actual production budget. For instance, the indie film Anora reportedly cost $6 million to make while its Oscar campaign ran around $18 million.

- Without campaigning, many deserving films never get attention, regardless of quality.

At the Oscars, the best film isn’t always the winner—it’s often the best-funded campaign.

Even Famous Directors Fight Battles

Think success secures freedom? Not always.

- Steven Spielberg struggled for a decade to get Lincoln made; studios wanted to relegate it to HBO instead of theaters.

- Francis Ford Coppola self-financed Megalopolis because no studio would back him.

- Guillermo del Toro had to scale back The Shape of Water to a $20 million budget, despite being an Oscar-winning director.

- Martin Scorsese had to turn to Netflix to make The Irishman.

Even the most powerful names constantly negotiate between personal vision and what the system will allow.

The Real Takeaway

Filmmaking is a battlefield of passion, politics, business, and compromise. For every dazzling story of discovery, there are dozens of hidden tales of projects that were shelved, rewritten, underfunded, or lost in the system.

The illusion of glamour is part of the sales pitch to audiences. The reality behind the curtain is messy, exhausting, and often heartbreaking—but for those who love it, there’s nothing more meaningful.

Film Industry

Disney Brings Beloved Characters to ChatGPT After $1 Billion OpenAI Deal

Disney is deepening its push into artificial intelligence with a $1 billion investment in OpenAI, the company behind ChatGPT, in a far-reaching deal that will also license Disney’s iconic characters for use within OpenAI’s new conversational AI platform, Sora.

The agreement positions Disney at the forefront of the entertainment industry’s growing intersection with generative AI, blending the company’s extensive character library with OpenAI’s advanced technology. Under the terms of the partnership, OpenAI will deploy select Disney intellectual property — spanning its animation classics, Pixar, Marvel, and Lucasfilm — across AI-driven storytelling and interactive experiences within ChatGPT Sora.

Sources familiar with the rollout say users will be able to engage directly with Disney characters through immersive dialogues powered by Sora, with potential extensions into digital parks, virtual assistants, and cross-platform storytelling initiatives.

A limited launch is expected to debut in 2026 as Disney explores new ways to integrate AI into consumer experiences.

“This collaboration continues Disney’s legacy of innovation, combining our storytelling heritage with cutting-edge technology to reach audiences in remarkable new ways,” said Disney CEO Bob Iger in a statement.

For OpenAI, Disney’s backing represents both a financial boost and a creative endorsement from one of the world’s most influential content companies. The partnership could accelerate mainstream adoption of AI entertainment tools while positioning ChatGPT Sora as a leader in branded and interactive media spaces.

The investment also signals an industry-wide shift as studios seek to capture value in AI-driven content creation, distribution, and personalization. With Disney’s move, legacy media joins a growing list of entertainment heavyweights aligning with AI firms to future-proof storytelling — marking what could be a pivotal step in Hollywood’s technological reinvention.

Film Industry

Netflix Got Outbid: Paramount Drops a $108 Billion Cash Bomb on Warner Bros.

Paramount has stunned Hollywood with a hostile, all‑cash offer to buy Warner Bros. Discovery outright for about 108.4 billion dollars, topping Netflix’s already splashy takeover agreement. The proposal, disclosed in SEC filings and a tender‑offer announcement, would pay 30 dollars per share in cash, roughly a 139% premium to where Warner Bros. Discovery traded before sale talks heated up and several dollars per share higher than Netflix’s mixed cash‑and‑stock offer.

How Paramount’s Bid Beats Netflix’s

Netflix’s deal focuses on acquiring the core Warner assets—Warner Bros. studio, HBO and the Max streaming service—for a valuation in the low‑80‑billion‑dollar range, compensated partly in Netflix stock. Paramount Skydance, by contrast, is offering all cash for the entire company, valuing Warner Bros. Discovery—including its cable brands like CNN and Discovery—at about 108–109 billion dollars. CEO David Ellison is pitching the bid as “superior” because it gives shareholders a higher headline price, avoids stock‑price risk and comes with committed financing lines from banks and investment partners.

The Regulatory Chess Match

Both deals would face intense antitrust scrutiny, but the risk profiles differ. A Netflix–Warner tie‑up would marry the world’s largest subscription streamer with one of its biggest rivals, a combination analysts say could draw especially tough questions from U.S. and EU regulators about market dominance in streaming. Paramount is arguing that merging two diversified legacy media groups—Paramount Global and Warner Bros. Discovery—creates a stronger competitor to Netflix, Disney and Amazon rather than a streaming near‑monopoly, and therefore should be easier to clear.

What a Paramount–Warner Giant Would Look Like

If Paramount wins, it would control a vast portfolio: Warner Bros. and Paramount Pictures, HBO and Max alongside Paramount+, DC and Harry Potter next to Mission: Impossible and Top Gun, plus global news and lifestyle networks from CNN to Discovery. In pitch materials, Paramount has pledged to keep a robust theatrical pipeline of 30+ films per year from the combined studios while using the enlarged library and sports rights to turbo‑charge streaming growth.

What Happens Next

Warner Bros. Discovery’s board, which has already endorsed Netflix’s agreement, must now evaluate whether Paramount’s richer all‑cash offer is worth triggering a sizeable breakup fee and resetting the regulatory process. Shareholders will ultimately decide between a higher but potentially more complex studio‑merger path and a slightly lower, tech‑powered streaming combo with Netflix. Whatever the outcome, Paramount’s 108‑billion‑dollar cash swing has turned an already historic sale into one of the most dramatic bidding wars Hollywood has ever seen.

Entertainment

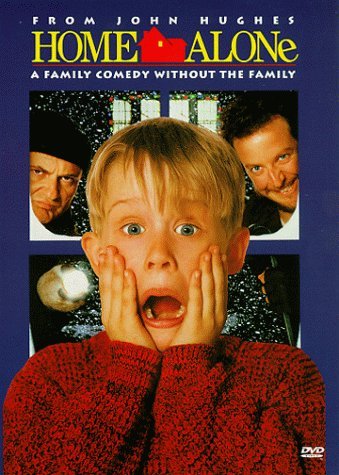

This ‘Too Small’ Christmas Movie Turned an $18M Gamble Into a Half‑Billion Classic

Studios almost left this Christmas staple on the cutting‑room floor. Executives initially saw it as a “small” seasonal comedy with limited box‑office upside, and internal budget fights kept the project hovering in limbo around an $18 million price tag.

The fear was simple: why spend real money on a kid‑driven holiday film that would vanish from theaters by January?

That cautious logic aged terribly. Once released, the movie exploded past expectations, pulling in roughly $475–$500 million worldwide and camping at the top of the box office for weeks.

That’s a return of more than 25 times its production budget, putting it among the most profitable holiday releases in modern studio history.

What some decision‑makers viewed as disposable seasonal content quietly became a financial engine that still prints money through re‑runs, streaming, and merchandising every December.

The story behind the numbers is part of why fans feel so attached to it. This was not a four‑quadrant superhero bet with guaranteed franchise upside; it was a character‑driven family comedy built on specific jokes, one child star, and a very particular vision of Christmas chaos. The fact that it nearly got shelved—and then turned into a half‑billion global phenomenon—makes every rewatch feel like a win against studio risk‑aversion.

When you press play each year, you are not just revisiting nostalgia; you are revisiting the rare moment when a “small” movie out‑performed the system that almost killed it.