Film Industry

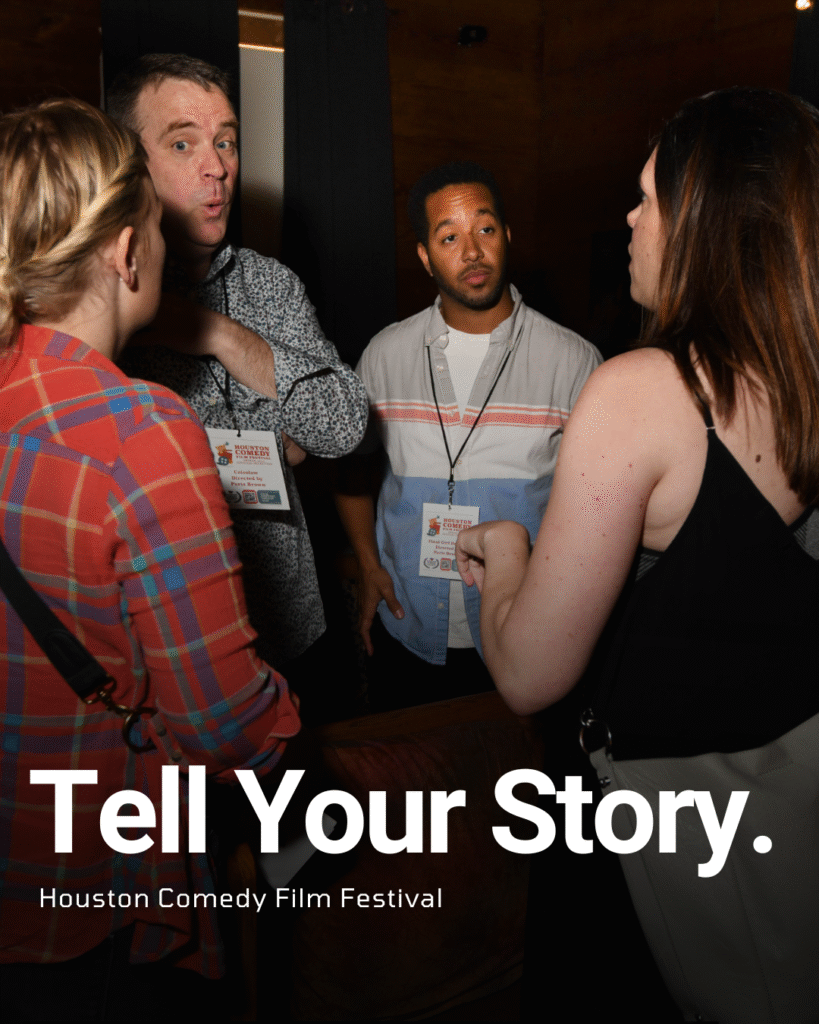

Newbie Film Academy Summer Camp: Inspiring Young Filmmakers

This summer, the Newbie Film Academy Summer Camp is opening its doors to children eager to immerse themselves in the magic of movie-making. The camp provides a vibrant, hands-on environment where kids not only discover the basics of filmmaking but are given practical opportunities to develop and showcase their new talents under the guidance of experienced industry professionals.

Building Essential Skills

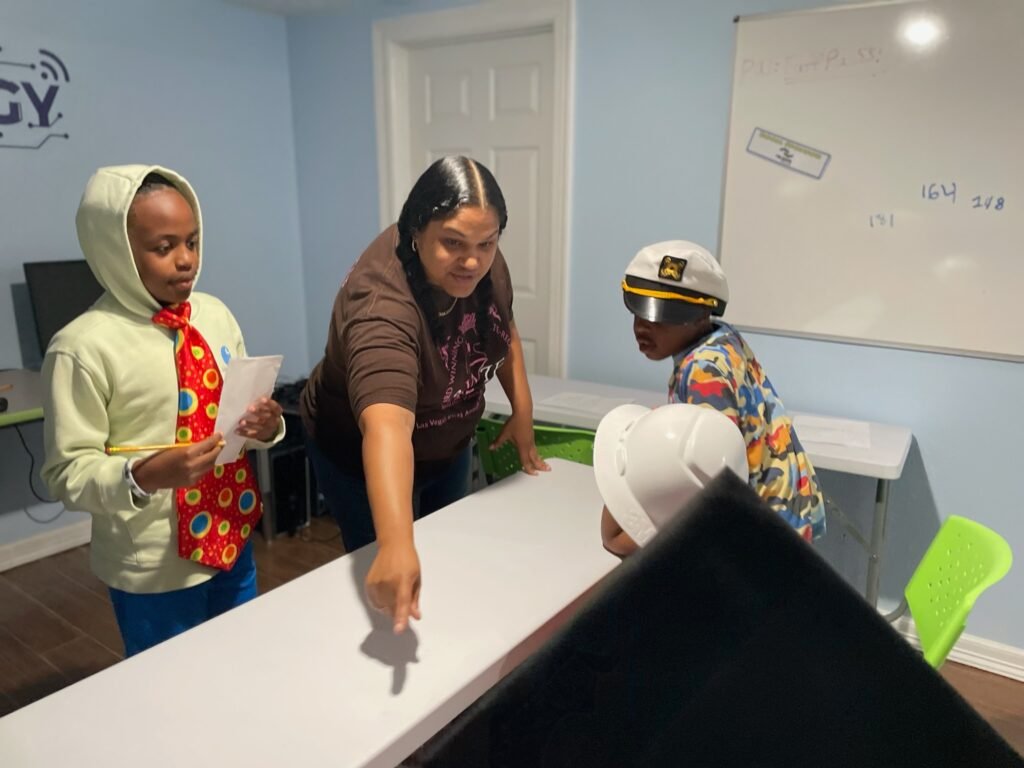

Campers dive straight into the filmmaking process, participating in workshops that span the entire spectrum of film production. The curriculum covers core skills such as:

- Screenwriting: Crafting stories, developing characters, and understanding structure.

- Directing and Acting: Exploring creative vision, leadership, and performance—both behind and in front of the camera.

- Cinematography: Learning to operate cameras, compose shots, and understand lighting.

- Editing and Sound Design: Using professional software to cut footage, add effects, and create polished, finished projects.

- Collaboration: Film is a team effort, so campers work in groups to bring projects to life, learning communication and teamwork along the way.

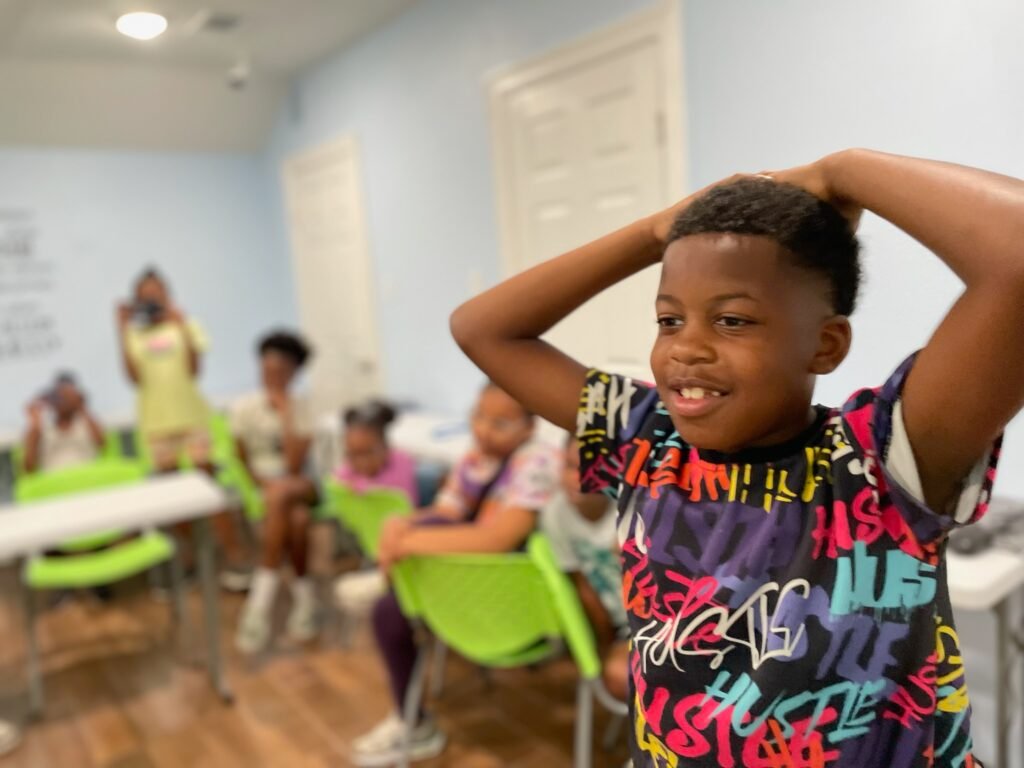

Learning by Doing

At Newbie Film Academy, learning is an active process. Kids and teens script, direct, shoot, and edit their very own short films, using real industry tools and receiving mentorship from instructors who are working filmmakers. They engage in fun challenges such as storyboarding workshops, production sprints, and even film critique sessions, where they present and discuss their work for constructive feedback. By the end of their time at camp, each participant walks away with a completed film and newfound confidence in their storytelling abilities.

Practicing for the Industry

In addition to technical skills, campers also develop crucial soft skills for the film industry—like creative problem-solving, managing production deadlines, expressing ideas effectively, and building self-confidence through public speaking and presentations. The camp experience fosters an inclusive, supportive space where every child’s perspective matters and every story deserves to be told.

A Showcase for Young Talent

The summer camp culminates in a showcase event, where families and friends are invited to screen the completed films, celebrating the creativity and hard work of all participants. This public display not only honors campers’ achievements but encourages them to continue their journey in filmmaking, inspired and prepared to take on greater creative projects in the future.

At Newbie Film Academy Summer Camp, every child gets to be a storyteller, a creator, and a member of the next generation of filmmakers—learning skills that last a lifetime and building memories along the way.

Film Industry

Disney Brings Beloved Characters to ChatGPT After $1 Billion OpenAI Deal

Disney is deepening its push into artificial intelligence with a $1 billion investment in OpenAI, the company behind ChatGPT, in a far-reaching deal that will also license Disney’s iconic characters for use within OpenAI’s new conversational AI platform, Sora.

The agreement positions Disney at the forefront of the entertainment industry’s growing intersection with generative AI, blending the company’s extensive character library with OpenAI’s advanced technology. Under the terms of the partnership, OpenAI will deploy select Disney intellectual property — spanning its animation classics, Pixar, Marvel, and Lucasfilm — across AI-driven storytelling and interactive experiences within ChatGPT Sora.

Sources familiar with the rollout say users will be able to engage directly with Disney characters through immersive dialogues powered by Sora, with potential extensions into digital parks, virtual assistants, and cross-platform storytelling initiatives.

A limited launch is expected to debut in 2026 as Disney explores new ways to integrate AI into consumer experiences.

“This collaboration continues Disney’s legacy of innovation, combining our storytelling heritage with cutting-edge technology to reach audiences in remarkable new ways,” said Disney CEO Bob Iger in a statement.

For OpenAI, Disney’s backing represents both a financial boost and a creative endorsement from one of the world’s most influential content companies. The partnership could accelerate mainstream adoption of AI entertainment tools while positioning ChatGPT Sora as a leader in branded and interactive media spaces.

The investment also signals an industry-wide shift as studios seek to capture value in AI-driven content creation, distribution, and personalization. With Disney’s move, legacy media joins a growing list of entertainment heavyweights aligning with AI firms to future-proof storytelling — marking what could be a pivotal step in Hollywood’s technological reinvention.

Film Industry

Netflix Got Outbid: Paramount Drops a $108 Billion Cash Bomb on Warner Bros.

Paramount has stunned Hollywood with a hostile, all‑cash offer to buy Warner Bros. Discovery outright for about 108.4 billion dollars, topping Netflix’s already splashy takeover agreement. The proposal, disclosed in SEC filings and a tender‑offer announcement, would pay 30 dollars per share in cash, roughly a 139% premium to where Warner Bros. Discovery traded before sale talks heated up and several dollars per share higher than Netflix’s mixed cash‑and‑stock offer.

How Paramount’s Bid Beats Netflix’s

Netflix’s deal focuses on acquiring the core Warner assets—Warner Bros. studio, HBO and the Max streaming service—for a valuation in the low‑80‑billion‑dollar range, compensated partly in Netflix stock. Paramount Skydance, by contrast, is offering all cash for the entire company, valuing Warner Bros. Discovery—including its cable brands like CNN and Discovery—at about 108–109 billion dollars. CEO David Ellison is pitching the bid as “superior” because it gives shareholders a higher headline price, avoids stock‑price risk and comes with committed financing lines from banks and investment partners.

The Regulatory Chess Match

Both deals would face intense antitrust scrutiny, but the risk profiles differ. A Netflix–Warner tie‑up would marry the world’s largest subscription streamer with one of its biggest rivals, a combination analysts say could draw especially tough questions from U.S. and EU regulators about market dominance in streaming. Paramount is arguing that merging two diversified legacy media groups—Paramount Global and Warner Bros. Discovery—creates a stronger competitor to Netflix, Disney and Amazon rather than a streaming near‑monopoly, and therefore should be easier to clear.

What a Paramount–Warner Giant Would Look Like

If Paramount wins, it would control a vast portfolio: Warner Bros. and Paramount Pictures, HBO and Max alongside Paramount+, DC and Harry Potter next to Mission: Impossible and Top Gun, plus global news and lifestyle networks from CNN to Discovery. In pitch materials, Paramount has pledged to keep a robust theatrical pipeline of 30+ films per year from the combined studios while using the enlarged library and sports rights to turbo‑charge streaming growth.

What Happens Next

Warner Bros. Discovery’s board, which has already endorsed Netflix’s agreement, must now evaluate whether Paramount’s richer all‑cash offer is worth triggering a sizeable breakup fee and resetting the regulatory process. Shareholders will ultimately decide between a higher but potentially more complex studio‑merger path and a slightly lower, tech‑powered streaming combo with Netflix. Whatever the outcome, Paramount’s 108‑billion‑dollar cash swing has turned an already historic sale into one of the most dramatic bidding wars Hollywood has ever seen.

Entertainment

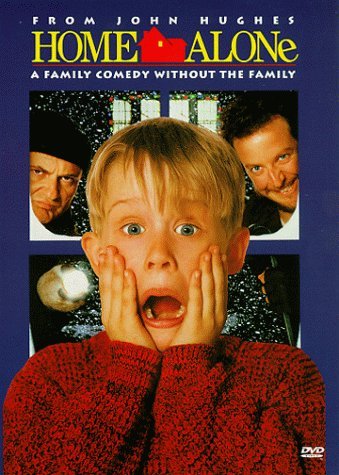

This ‘Too Small’ Christmas Movie Turned an $18M Gamble Into a Half‑Billion Classic

Studios almost left this Christmas staple on the cutting‑room floor. Executives initially saw it as a “small” seasonal comedy with limited box‑office upside, and internal budget fights kept the project hovering in limbo around an $18 million price tag.

The fear was simple: why spend real money on a kid‑driven holiday film that would vanish from theaters by January?

That cautious logic aged terribly. Once released, the movie exploded past expectations, pulling in roughly $475–$500 million worldwide and camping at the top of the box office for weeks.

That’s a return of more than 25 times its production budget, putting it among the most profitable holiday releases in modern studio history.

What some decision‑makers viewed as disposable seasonal content quietly became a financial engine that still prints money through re‑runs, streaming, and merchandising every December.

The story behind the numbers is part of why fans feel so attached to it. This was not a four‑quadrant superhero bet with guaranteed franchise upside; it was a character‑driven family comedy built on specific jokes, one child star, and a very particular vision of Christmas chaos. The fact that it nearly got shelved—and then turned into a half‑billion global phenomenon—makes every rewatch feel like a win against studio risk‑aversion.

When you press play each year, you are not just revisiting nostalgia; you are revisiting the rare moment when a “small” movie out‑performed the system that almost killed it.