News

Gavin Michael Booth and Roselyn Omaka | Houston Comedy Film Festival 2024

News

Forget the Box Office: The New Blockbuster Lives in the “Swipe Up”

The silver screen is no longer the gold standard. For decades, the industry defined a “blockbuster” by the number of people sitting in a dark room for two hours. But in 2026, the real action has moved to the device in your palm. The “swipe up” has replaced the ticket stub as the ultimate indicator of success, turning vertical filmmaking from a social media niche into a multi-billion-dollar economic engine.

The Mobile Hostage: Why Vertical Wins

Traditional cinema asks for your time; vertical cinema demands your focus. Because vertical video fills 100% of a mobile screen—eliminating the “dead space” of black bars—it creates an immersive environment that is hard to escape.

- Completion Rates: Vertical videos see a 90% higher completion rate compared to horizontal formats on mobile.

- Viewer Preference: 71% of users now prefer vertical video for general consumption, and 90% of smartphone users report a better experience with 9:16 content.

- The Gen Z Shift: Approximately 78% of Gen Z’s video consumption is now in vertical orientation, with 43% of this demographic preferring TikTok and YouTube over traditional TV or paid streaming services.

The Investor’s Dream: Retention and Revenue

Investors are pivoting to vertical not just because of the “cool factor,” but because the math is undeniable. Vertical dramas achieve 40% higher completion rates than traditional formats, and the industry is finding ways to monetize every second of that attention.

The Vertical vs. Horizontal Economy (2025-2026)

| Metric | Vertical (Mobile-First) | Horizontal (Legacy) |

|---|---|---|

| Completion Rate | 90% | ~24% (avg) |

| Market Valuation | $4.16B (Micro-dramas) | Maturing/Slowing |

| Purchase Intent | 2x Higher | Baseline |

| Content Strategy | 1-3 min high-hook | 90+ min slow-burn |

The “Micro-Drama” Explosion

The rise of apps like ReelShort and DramaBox has proven that audiences are willing to pay for premium vertical stories. In 2025 alone, global video streaming app downloads increased by nearly 39%, fueled largely by the boom in micro-dramas. These platforms leverage viral hooks and in-app purchases, with some generating over $700 million in annual revenue by focusing on “snackable” vertical episodes.

A New Visual Language

Filmmaking in 9:16 is not just “cropping the sides.” It is a new art form that prioritizes the close-up and the vertical stack. For creators, this means lower production overhead—AI tools can now reduce adaptation costs by 60%—and the ability to test concepts with a global audience instantly. In 2026, the smartest filmmakers aren’t waiting for a distribution deal; they are building their own box office, one swipe at a time.

Business

New DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

In early 2026, the global conversation surrounding the “Epstein files” has reached a fever pitch as the Department of Justice continues to un-redact millions of pages of internal records. Among the most explosive revelations are detailed email exchanges between Ghislaine Maxwell and Jeffrey Epstein that directly name supermodel Naomi Campbell. While Campbell has long maintained she was a peripheral figure in Epstein’s world, the latest documents—including an explicit message where Maxwell allegedly offered “two playmates” for the model—have forced a national re-evaluation of her proximity to the criminal enterprise.

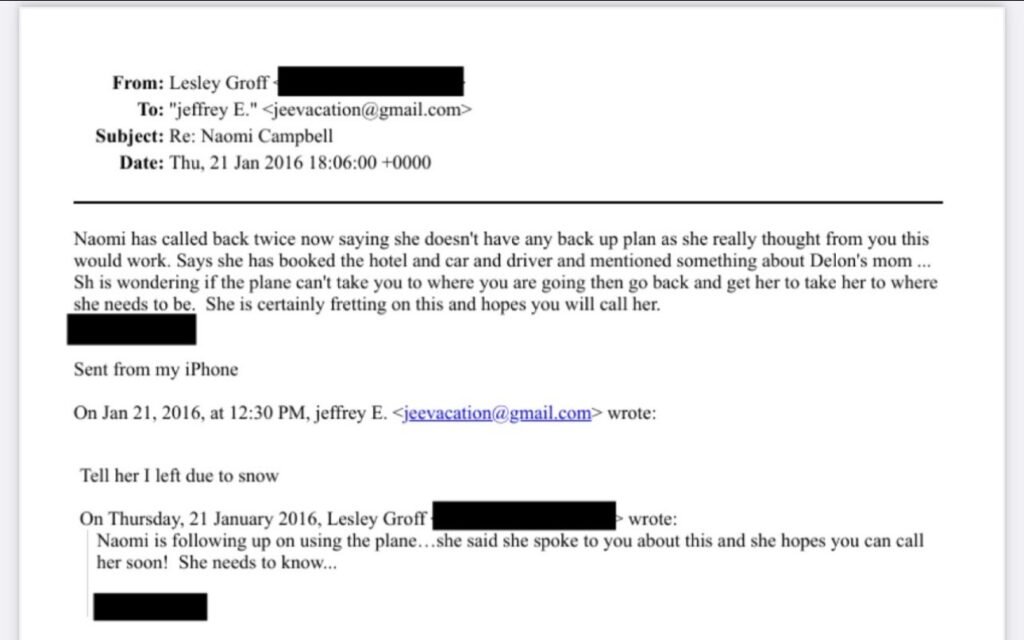

The Logistics of a High-Fashion Connection

The declassified files provide a rare look into the operational relationship between the supermodel and the financier. Flight logs and internal staff emails from as late as 2016 show that Campbell’s travel was frequently subsidized by Epstein’s private fleet. In one exchange, Epstein’s assistants discussed the urgency of her travel requests, noting she had “no backup plan” and was reliant on his jet to reach international events.

This level of logistical coordination suggests a relationship built on significant mutual favors, contrasting with Campbell’s previous descriptions of him as just another face in the crowd.

In Her Own Words: The “Sickened” Response

Campbell has not remained silent as these files have surfaced, though her defense has been consistent for years. In a widely cited 2019 video response that has been recirculated amid the 2026 leaks, she stated, “What he’s done is indefensible. I’m as sickened as everyone else is by it.” When confronted with photos of herself at parties alongside Epstein and Maxwell, she has argued against the concept of “guilt by association,” telling the press:

She has further emphasized her stance by aligning herself with those Epstein harmed, stating,

“I stand with the victims. I’m not a person who wants to see anyone abused, and I never have been.””

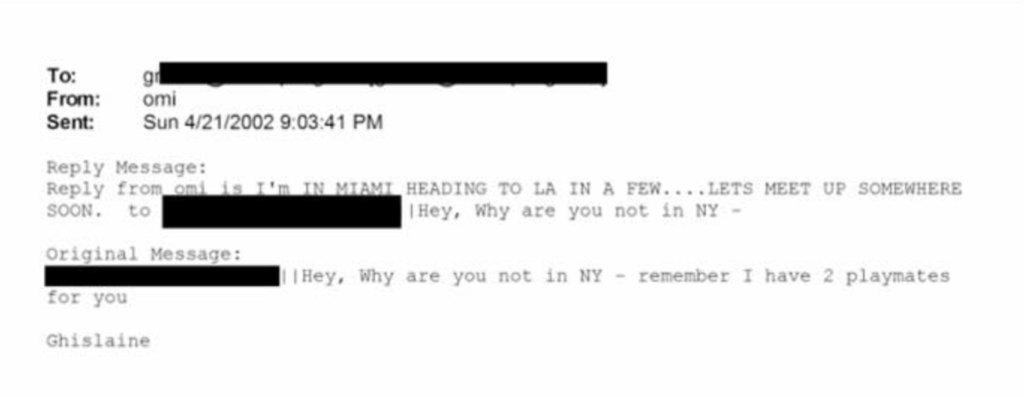

The Mystery of the “Two Playmates”

The most damaging piece of evidence in the recent 2026 release is an email where Maxwell reportedly tells Epstein she has “two playmates” ready for Campbell.

While the context of this “offer” remains a subject of intense debate—with some investigators suggesting it refers to the procurement of young women for social or sexual purposes—Campbell’s legal team has historically dismissed such claims as speculative. However, for a public already wary of elite power brokers, the specific wording used in these private DOJ records has created a “stop-the-scroll” moment that is proving difficult for the fashion icon to move past.

A Reputation at a Crossroads

As a trailblazer in the fashion industry, Campbell is now navigating a period where her professional achievements are being weighed against her presence in some of history’s most notorious social circles. The 2026 files don’t just name her; they place her within a broader system where modeling agents and scouts allegedly groomed young women under the guise of high-fashion opportunities. Whether these records prove a deeper complicity or simply illustrate the unavoidable overlap of the 1% remains the central question of the ongoing DOJ investigation.

Entertainment

What Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Jeffrey Epstein was a convicted sex offender, but for years after his 2008 conviction, he still moved comfortably through elite social circles that touched media, politics, finance, and film culture. His calendars, contact books, and guest lists show a pattern: powerful people kept accepting his invitations, attending his dinners, and standing beside him, even when they knew exactly who he was.

If you make films, run festivals, or work in development and distribution, this isn’t just a political scandal on the news. It’s a mirror. It forces one uncomfortable question: do you truly know what – and who – you stand for when you say yes to certain rooms, collaborators, and funders?

The guest list is a moral document

Epstein didn’t just collect money; he collected people.

His power came from convening others: intimate dinners, salon‑style gatherings, screenings, and trips where being invited signaled that you were “important enough” to be in the room. Prestige guests made him look respectable; he made them feel chosen.

Awards‑season publicists and event planners played a crucial role in that ecosystem. For years, some of the same people who curated high‑status screenings and industry dinners also opened the door for Epstein, placing him in rooms with producers, critics, cultural figures, and politicians. They controlled the lists that determined who got close to money, influence, and decision‑makers.

When those ties became public, companies that had long benefitted from those curated lists cut certain publicists off almost overnight. One day they were trusted architects of taste and access; the next day they were toxic. That whiplash exposes the truth: guest lists were never neutral logistics. They were moral documents disguised as marketing strategy.

If you’re a filmmaker or festival director, the same is true for you. Every invite list, every VIP pass, every “intimate industry mixer” quietly answers a question:

- Who are you willing to legitimize?

- Who gets to bask in the glow of your platform, laurels, and audience?

- Whose history are you willing to overlook because they’re “good for the project”?

You may tell yourself you’re “just trying to get the film seen.” Epstein’s orbit shows that this is exactly how people talk themselves into standing next to predators.

“I barely knew him”: the lie everyone rehearses

After Epstein’s 2019 arrest and death, a familiar chorus started: “I barely knew him.” “We only met once.” “It was purely professional.” In case after case, logs, calendars, and emails told a different story: repeated meetings, trips, dinners, and years of social overlap.

This isn’t unique to Epstein. Our industry does the same thing whenever a powerful director, producer, or executive is finally exposed. Suddenly:

- The person was “always difficult,” but nobody quite remembers when they first heard the stories.

- Collaborators swear they had no idea, despite years of rumors in green rooms, writers’ rooms, and hotel bars.

- Everyone rushes to minimize proximity: one film, one deal, one panel, one party.

Sometimes that’s true. Often it’s a script people have been rehearsing in their heads for years, just in case the day came when they’d need it.

So ask yourself now, before any future scandal:

- If every calendar entry and email around a controversial figure in your orbit were revealed tomorrow, would your values be obvious?

- Would your words and actions show someone wrestling with the ethics and drawing lines, or someone who stood for nothing but opportunity and a good step‑and‑repeat photo?

Your future statement is being written today, in the rooms you choose and the excuses you make.

Power, access, and the cost of staying in the room

People kept going to Epstein’s dinners and accepting his calls after his conviction because he was useful. He made introductions between billionaires and politicians, intellectuals and media figures, donors and institutions. Being in his network could mean access to funding, deals, prestige, and proximity to other powerful guests.

If that dynamic feels uncomfortably familiar, it should. In film and TV, you know this pattern:

- A producer with a reputation for abusive behavior who still gets projects greenlit.

- A financier whose source of money is murky but opens doors.

- A festival VIP everyone whispers about but no one publicly confronts because they bring stars, sponsors, or press.

The unwritten deal is the same: look away, laugh it off, or stay quiet, and in return you get access. What Epstein’s guest lists reveal is how many people accepted that deal until the public cost became unbearable.

The question for you is simple and brutal: how much harm are you willing to tolerate in exchange for access to power? If the answer is “more than I’d admit out loud,” you’re already in the danger zone.

Building your own red lines as a filmmaker

You cannot control every person who ends up in your orbit. But you can refuse to drift. You can decide in advance what you will and will not normalize. That means building your own red lines before there’s a headline.

Some practical commitments:

- Write down your “no‑platform” criteria

Don’t wait until a scandal explodes to decide what’s unacceptable. Define the patterns you will not align with:- Repeat, credible allegations of abuse or harassment.

- Past convictions for sexual exploitation or violence.

- Documented histories of exploiting young or vulnerable people in professional settings.

This doesn’t mean trial‑by‑rumor. It means acknowledging there are lines you simply will not cross, no matter how good the deal looks.

- Interrogate the rooms you’re invited into

Before you say yes to that exclusive dinner, private screening, or “small circle of VIPs,” ask:- Who is hosting, and what are they known for?

- Who else will be there, and what’s their pattern of behavior?

- Is this room built on genuine artistic community, or on quiet complicity around someone with power and a bad history?

When you feel that knot in your stomach, treat it as information, not an inconvenience.

- Bake ethics into your company or festival policy

If you run a production company, collective, or festival, put your values in writing:- How do you respond to credible allegations against a guest, juror, funder, or staff member?

- What is your process for reviewing partnerships and sponsorships?

- Under what conditions will you withdraw an invitation or return money?

This won’t make you perfect, but it forces you to act from a standard rather than improvising around whoever seems too powerful to offend.

- Use the “headline test”

Before you agree to a collaboration or keep showing up for someone whose reputation is rotting, imagine a future article that simply lays out the facts:

“Filmmaker X repeatedly attended private events hosted by Y after Y’s conviction and multiple public allegations.”

If seeing your name in that sentence makes you flinch, believe that feeling. That’s your conscience trying to speak louder than your ambition.

The question you leave your audience with

Epstein’s guest lists are historical artifacts, but they are also warnings. They show what an ecosystem looks like when hundreds of people make the same small compromise: “I’ll just go to this one dinner. I’ll just take this one meeting. I’ll just look the other way one more time.”

One man became a hub, but it took a whole web of people choosing access over integrity to keep him powerful. His documents don’t only reveal who he was; they reveal who others decided to be around him.

You may never face a choice as stark as “Do I have dinner with Jeffrey Epstein?” But you are already facing smaller versions of that question:

- Do I keep working with the person everyone quietly warns newcomers about?

- Do I take money from the funder whose business model depends on exploitation?

- Do I invite, platform, and celebrate people whose presence makes survivors in the room feel less safe?

You will not be able to claim you “didn’t know” about every name in your orbit. But you can decide that when you learn, you act. You can decide that your guest lists, your partnerships, and your presence in the room will mean something.

Because in the end, your career is not only made of films and laurels. It is made of the rooms you chose and the people you stood next to when it mattered.

Film Industry3 weeks ago

Film Industry3 weeks agoTurning One Short Film into 12 Months of Content

Entertainment2 weeks ago

Entertainment2 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry3 weeks ago

Film Industry3 weeks ago10 Ways Filmmakers Are Building Careers Without Waiting for Distributors

Film Industry2 weeks ago

Film Industry2 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Film Industry3 weeks ago

Film Industry3 weeks agoHow to Write a Logline That Makes Programmers Hit Play

News2 weeks ago

News2 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Entertainment1 week ago

Entertainment1 week agoYou wanted to make movies, not decode Epstein. Too late.

Entertainment6 days ago

Entertainment6 days agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?