Business

Worst corporate polluters hide in regulatory ‘darkness,’ study finds on August 25, 2023 at 10:00 am Business News | The Hill

Many of the world’s corporations may be responsible for climate damages far greater than their annual profits, a new study has found.

For the biggest polluters worldwide — the fossil fuel-dependent power industry — that means potential legal liabilities around seven times their annual profits, four economists from leading universities wrote on Thursday in Science.

“The average corporate carbon damages [are] economically large,” the economists wrote.

Those climate damages result from a “choice” on the part of regulators, coauthor Michael Greenstone of the University of Chicago told The HIll.

That’s because the key to bringing those emissions down is forcing firms to disclose them — and creating penalties for failing to do so, Greenstone said.

While agencies like the Securities and Exchange Commission have proposed making such disclosures mandatory, “to date, that has not been a requirement,” he added.

It has also been politically controversial: The GOP has made a campaign against mandatory climate disclosure a key plank of its platform, as The Hill has reported.

In the absence of rigorous information, the researchers made use of publicly available data based on 15,000 companies’ voluntary disclosures. Then they multiplied those numbers by an estimated “social cost of carbon” — a metric of the damage done by every ton of greenhouse gas released into the atmosphere.

While most firms were responsible for a lot of damage, they write, culpability was not equal.

The team found a wide range of climate costs “across firms, industries, firms within industries, and countries.”

Among “companies who are basically doing the same thing, some emitted more than others producing the same product,” a sign that it’s possible “to produce the product without such heavy emissions,” Greenstone said.

In those instances, government regulators could require particularly high-emitting businesses within a given sector to shift their emissions down; investors could choose not to invest in them; or plaintiffs could sue them.

“You can reduce emissions through many different channels,” Greenstone said. But mandatory disclosure is “the foundation of many forms of carbon policy.

Based on the limited data available, researchers concluded that the average firm worldwide could be liable for damages equal to 44 percent of their annual profits.

That number was a bit lower for U.S. companies — an average of 18.5 percent of profits.

But in this case, averages aren’t very helpful because even in the most polluting sectors — energy, power utilities, transportation and agriculture — have stark variations in their potential carbon damage.

Worldwide, energy companies in the bottom 10 percent of emitters could have caused carbon damages equivalent to 4.5 percent of their annual profits.

But global energy companies in the top 90 percent and above could be responsible for carbon damages of nearly four times their annual profits — or comparatively 100 times as much as those bottom-ranked energy companies.

In the U.S., the 90th percentile polluters in the most carbon-intensive sectors were also responsible for damages in excess of their annual profits.

That meant 234 percent for energy; 178 percent for food, beverages and tobacco; 201 percent for materials, including concrete to petrochemicals; and 342 percent for utilities.

But there’s one big caveat, the authors note: These numbers are likely significant underestimates because they come almost entirely from disclosures that those companies have made voluntarily — companies that face “no penalties for misreporting.”

“This … underscores the need for mandatory and verified emissions reporting,” they write.

They note that financial markets can’t “discipline” high polluters through lower stock prices if they don’t know how many tons of greenhouse gasses those companies release — a core demand of the environmental, social and governance (ESG) movement.

Finally, the need to share their emissions — a source of potential embarrassment and even legal liability — creates a good incentive for companies for bring them down, they wrote.

While many companies worldwide have net-zero policies, those claims are difficult to evaluate against the company’s actual actions.

The economists argue that climate legislation without legal teeth to punish companies that don’t comply, or that mislead investors will struggle to be anything more than “ad hoc.”

Greenstone cautioned it was “inappropriate and incorrect” to lay all this blame at the feet of the companies themselves. When it comes to parsing out the relative responsibility between companies and consumers, he said, “we don’t have the data for it.”

More to the point, he argued, such blame isn’t necessary: regulatory change is. “Companies respond to the regulatory and policy playing field,” he said.

“If there was a carbon price of $200 a ton, the companies would figure out how to deal with it, they might be painful for them, but they would figure out how to do it.”

But right now, he noted, “our national carbon price is effectively zero.”

The findings in Science do not specifically focus on the idea of litigation to make companies pay those damages. But their publication comes amid a new wave of litigation against fossil fuel companies and the legislatures that have reflexively encouraged and subsidized their use

Equilibrium & Sustainability, Business, Energy & Environment, News, Climate change, climate disclosure rules, pollution Many of the world’s corporations may be responsible for climate damages far greater than their annual profits, a new study has found. For the biggest polluters worldwide — the fossil fuel-dependent power industry — that means potential legal liabilities around seven times their annual profits, four economists from leading universities wrote on Thursday in Science. “The average corporate carbon…

Business

New DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

In early 2026, the global conversation surrounding the “Epstein files” has reached a fever pitch as the Department of Justice continues to un-redact millions of pages of internal records. Among the most explosive revelations are detailed email exchanges between Ghislaine Maxwell and Jeffrey Epstein that directly name supermodel Naomi Campbell. While Campbell has long maintained she was a peripheral figure in Epstein’s world, the latest documents—including an explicit message where Maxwell allegedly offered “two playmates” for the model—have forced a national re-evaluation of her proximity to the criminal enterprise.

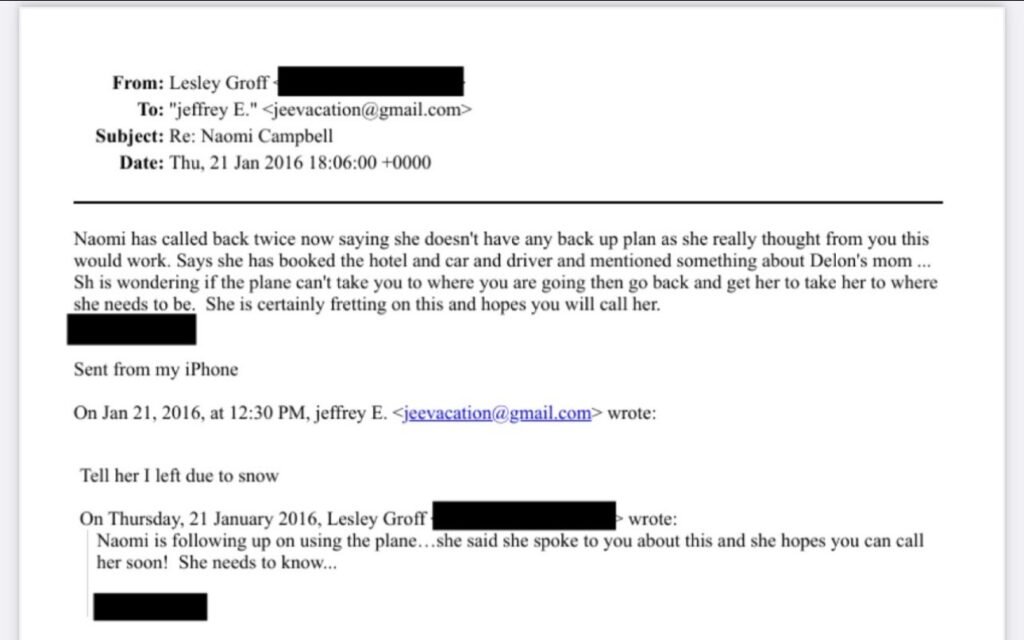

The Logistics of a High-Fashion Connection

The declassified files provide a rare look into the operational relationship between the supermodel and the financier. Flight logs and internal staff emails from as late as 2016 show that Campbell’s travel was frequently subsidized by Epstein’s private fleet. In one exchange, Epstein’s assistants discussed the urgency of her travel requests, noting she had “no backup plan” and was reliant on his jet to reach international events.

This level of logistical coordination suggests a relationship built on significant mutual favors, contrasting with Campbell’s previous descriptions of him as just another face in the crowd.

In Her Own Words: The “Sickened” Response

Campbell has not remained silent as these files have surfaced, though her defense has been consistent for years. In a widely cited 2019 video response that has been recirculated amid the 2026 leaks, she stated, “What he’s done is indefensible. I’m as sickened as everyone else is by it.” When confronted with photos of herself at parties alongside Epstein and Maxwell, she has argued against the concept of “guilt by association,” telling the press:

She has further emphasized her stance by aligning herself with those Epstein harmed, stating,

“I stand with the victims. I’m not a person who wants to see anyone abused, and I never have been.””

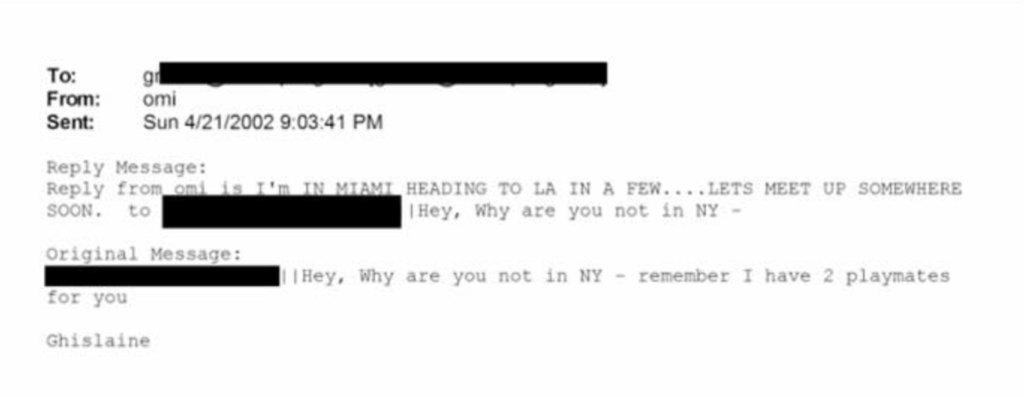

The Mystery of the “Two Playmates”

The most damaging piece of evidence in the recent 2026 release is an email where Maxwell reportedly tells Epstein she has “two playmates” ready for Campbell.

While the context of this “offer” remains a subject of intense debate—with some investigators suggesting it refers to the procurement of young women for social or sexual purposes—Campbell’s legal team has historically dismissed such claims as speculative. However, for a public already wary of elite power brokers, the specific wording used in these private DOJ records has created a “stop-the-scroll” moment that is proving difficult for the fashion icon to move past.

A Reputation at a Crossroads

As a trailblazer in the fashion industry, Campbell is now navigating a period where her professional achievements are being weighed against her presence in some of history’s most notorious social circles. The 2026 files don’t just name her; they place her within a broader system where modeling agents and scouts allegedly groomed young women under the guise of high-fashion opportunities. Whether these records prove a deeper complicity or simply illustrate the unavoidable overlap of the 1% remains the central question of the ongoing DOJ investigation.

Business

Google Accused Of Favoring White, Asian Staff As It Reaches $28 Million Deal That Excludes Black Workers

Google has tentatively agreed to a $28 million settlement in a California class‑action lawsuit alleging that white and Asian employees were routinely paid more and placed on faster career tracks than colleagues from other racial and ethnic backgrounds.

- A Santa Clara County Superior Court judge has granted preliminary approval, calling the deal “fair” and noting that it could cover more than 6,600 current and former Google workers employed in the state between 2018 and 2024.

How The Discrimination Claims Emerged

The lawsuit was brought by former Google employee Ana Cantu, who identifies as Mexican and racially Indigenous and worked in people operations and cloud departments for about seven years. Cantu alleges that despite strong performance, she remained stuck at the same level while white and Asian colleagues doing similar work received higher pay, higher “levels,” and more frequent promotions.

Cantu’s complaint claims that Latino, Indigenous, Native American, Native Hawaiian, Pacific Islander, and Alaska Native employees were systematically underpaid compared with white and Asian coworkers performing substantially similar roles. The suit also says employees who raised concerns about pay and leveling saw raises and promotions withheld, reinforcing what plaintiffs describe as a two‑tiered system inside the company.

Why Black Employees Were Left Out

Cantu’s legal team ultimately agreed to narrow the class to employees whose race and ethnicity were “most closely aligned” with hers, a condition that cleared the path to the current settlement.

The judge noted that Black employees were explicitly excluded from the settlement class after negotiations, meaning they will not share in the $28 million payout even though they were named in earlier versions of the case. Separate litigation on behalf of Black Google employees alleging racial bias in pay and promotions remains pending, leaving their claims to be resolved in a different forum.

What The Settlement Provides

Of the $28 million total, about $20.4 million is expected to be distributed to eligible class members after legal fees and penalties are deducted. Eligible workers include those in California who self‑identified as Hispanic, Latinx, Indigenous, Native American, American Indian, Native Hawaiian, Pacific Islander, and/or Alaska Native during the covered period.

Beyond cash payments, Google has also agreed to take steps aimed at addressing the alleged disparities, including reviewing pay and leveling practices for racial and ethnic gaps. The settlement still needs final court approval at a hearing scheduled for later this year, and affected employees will have a chance to opt out or object before any money is distributed.

H2: Google’s Response And The Broader Stakes

A Google spokesperson has said the company disputes the allegations but chose to settle in order to move forward, while reiterating its public commitment to fair pay, hiring, and advancement for all employees. The company has emphasized ongoing internal audits and equity initiatives, though plaintiffs argue those efforts did not prevent or correct the disparities outlined in the lawsuit.

For many observers, the exclusion of Black workers from the settlement highlights the legal and strategic complexities of class‑action discrimination cases, especially in large, diverse workplaces. The outcome of the remaining lawsuit brought on behalf of Black employees, alongside this $28 million deal, will help define how one of the world’s most powerful tech companies is held accountable for alleged racial inequities in pay and promotion.

Business

Luana Lopes Lara: How a 29‑Year‑Old Became the Youngest Self‑Made Woman Billionaire

At just 29, Luana Lopes Lara has taken a title that usually belongs to pop stars and consumer‑app founders.

Multiple business outlets now recognize her as the world’s youngest self‑made woman billionaire, after her company Kalshi hit an 11 billion dollar valuation in a new funding round.

That round, a 1 billion dollar Series E led by Paradigm with Sequoia Capital, Andreessen Horowitz, CapitalG and others participating, instantly pushed both co‑founders into the three‑comma club. Estimates place Luana’s personal stake at roughly 12 percent of Kalshi, valuing her net worth at about 1.3 billion dollars—wealth tied directly to equity she helped create rather than inheritance.

Kalshi itself is a big part of why her ascent matters.

Founded in 2019, the New York–based company runs a federally regulated prediction‑market exchange where users trade yes‑or‑no contracts on real‑world events, from inflation reports to elections and sports outcomes.

As of late 2025, the platform has reached around 50 billion dollars in annualized trading volume, a thousand‑fold jump from roughly 300 million the year before, according to figures cited in TechCrunch and other financial press. That hyper‑growth convinced investors that event contracts are more than a niche curiosity, and it is this conviction—expressed in billions of dollars of new capital—that turned Luana’s share of Kalshi into a billion‑dollar fortune almost overnight.

Her path to that point is unusually demanding even by founder standards. Luana grew up in Brazil and trained at the Bolshoi Theater School’s Brazilian campus, where reports say she spent up to 13 hours a day in class and rehearsal, competing for places in a program that accepts fewer than 3 percent of applicants. After a stint dancing professionally in Austria, she pivoted into academics, enrolling at the Massachusetts Institute of Technology to study computer science and mathematics and later completing a master’s in engineering.

During summers she interned at major firms including Bridgewater Associates and Citadel, gaining a front‑row view of how global macro traders constantly bet on future events—but without a simple, regulated way for ordinary people to do the same.

That realization shaped Kalshi’s founding thesis and ultimately her billionaire status. Together with co‑founder Tarek Mansour, whom she met at MIT, Luana spent years persuading lawyers and U.S. regulators that a fully legal event‑trading exchange could exist under commodities law. Reports say more than 60 law firms turned them down before one agreed to help, and the company then spent roughly three years in licensing discussions with the Commodity Futures Trading Commission before gaining approval. The payoff is visible in 2025’s numbers: an 11‑billion‑dollar valuation, a 1‑billion‑dollar fresh capital injection, and a founder’s stake that makes Luana Lopes Lara not just a compelling story but a data point in how fast wealth can now be created at the intersection of finance, regulation, and software.

Entertainment2 weeks ago

Entertainment2 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry3 weeks ago

Film Industry3 weeks agoTurning One Short Film into 12 Months of Content

Film Industry4 weeks ago

Film Industry4 weeks ago10 Ways Filmmakers Are Building Careers Without Waiting for Distributors

Film Industry2 weeks ago

Film Industry2 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Film Industry3 weeks ago

Film Industry3 weeks agoHow to Write a Logline That Makes Programmers Hit Play

News2 weeks ago

News2 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Entertainment1 week ago

Entertainment1 week agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Entertainment2 weeks ago

Entertainment2 weeks agoYou wanted to make movies, not decode Epstein. Too late.