Politics

What are the most criticized projects funded by USAID

Based on recent criticisms and controversies, here are some of the most criticized USAID-funded projects that are less well-known:

- $50 million for condoms to the Hamas through USAID. This project has raised eyebrows due to its controversial recipient.

- $446,700 to promote the expansion of atheism in Nepal through the State Department This project has been criticized for potentially interfering with religious beliefs in a foreign country.

- $3,315,446 for “being LGBTQ in the Caribbean” through USAID. Critics argue this is an inappropriate use of foreign aid funds.

- $2.5 million to build electric vehicle charging stations in Vietnam’s largest cities. This project has been questioned for its relevance to USAID’s core mission.

- $425,622 to help Indonesian coffee companies become more climate and gender-friendly. Critics argue this is not a priority for foreign aid.

- $1.5 million to promote job opportunities for LGBTQ individuals in Serbia. This project has been criticized for focusing on specific groups rather than broader economic development.

- $70,884 to create a U.S.-Irish musical to promote DEI in Ireland. This project has been questioned for its cultural relevance and impact.

- $7,071.58 for a BIPOC speaker series in Canada. Critics argue this is an unnecessary expenditure in a developed country.

It’s important to note that these projects represent a small fraction of USAID’s $40 billion budget. While some view these as wasteful, others argue they align with broader U.S. foreign policy goals. The controversy surrounding these projects has led to increased scrutiny of USAID’s spending and priorities.commented on the situation, sharing a post mocking Swift on Truth Social and claiming that his “Make America Great Again” (MAGA) movement was responsible for the boos. He contrasted the crowd’s reaction to Swift with the cheers he received when shown on the jumbotron.

Bolanle Media covers a wide range of topics, including film, technology, and culture. Our team creates easy-to-understand articles and news pieces that keep readers informed about the latest trends and events. If you’re looking for press coverage or want to share your story with a wider audience, we’d love to hear from you! Contact us today to discuss how we can help bring your news to life

Entertainment

These Movies Aren’t “True Crime for Fun”

When scandals and cover‑ups dominate the timeline, it’s tempting to process them the same way we process everything else online: as content.

A headline becomes a meme, a victim becomes a character, and a years‑long story of abuse or corruption gets flattened into a 30‑second clip. In that kind of environment, it matters what we choose to watch—and how we watch it.

Some films lean into shock and spectacle. Others slow us down, asking us to sit with the systems that make these stories possible in the first place.

This article is about that second group.

Below are three films that are difficult, necessary, and deeply relevant when we’re surrounded by conversations about power, silence, and who actually gets held accountable. They’re not “true crime for fun.” They are stories about people who push back: journalists digging through archives, lawyers refusing to look away, and insiders who decide that telling the truth matters more than staying comfortable.

Why movies about accountability matter right now

There’s a difference between consuming tragedy and engaging with it.

Scroll culture trains us to treat everything as a quick hit: outrage, reaction, move on. But systemic abuse and corruption don’t work on a 24‑hour cycle. They live in sealed files, non‑disclosure agreements, money, and relationships that make it easier to protect those in power than the people they harm. Films that focus on accountability rather than spectacle can do three important things:

- Slow our attention down long enough to see how cover‑ups are built—through policies, reputations, and quiet decisions, not just villains and heroes.

- Give us a closer look at the people trying to break those systems open: reporters, lawyers, whistleblowers, survivors, and community members.

- Help us recognize the patterns so that when a new scandal breaks, we have more than vibes and rumors to work with—we see mechanisms, not just headlines.

With that frame in mind, here are three films that are worth revisiting or discovering for the first time.

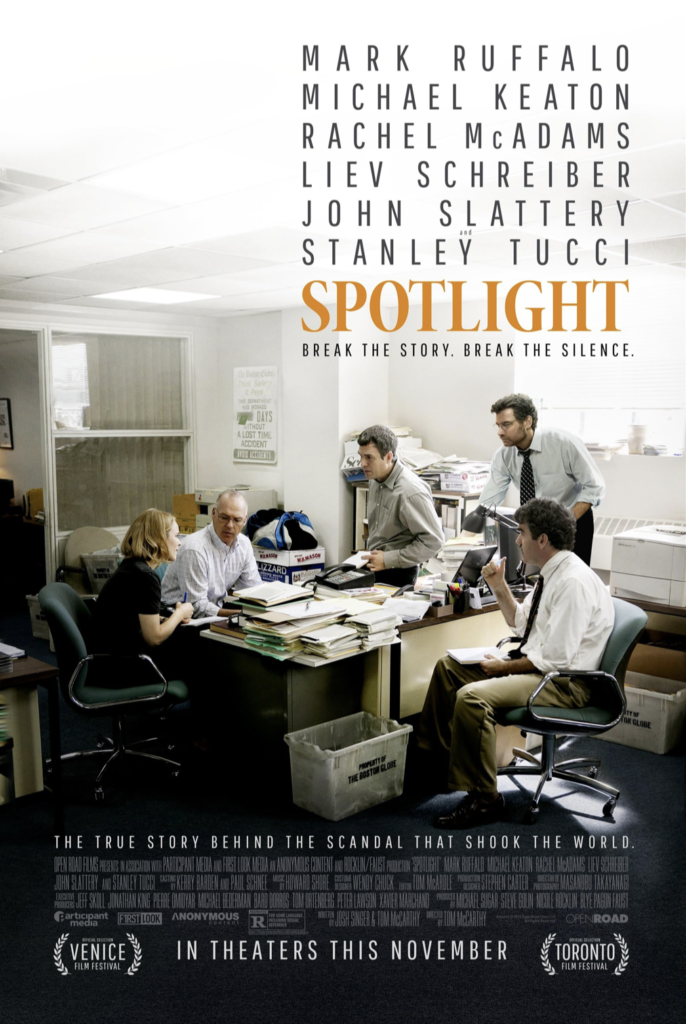

Spotlight: following the paper trail

Spotlight follows a small investigative team at a Boston newspaper as they uncover decades of child abuse inside the Catholic Church and the institutional effort to conceal it. It’s not flashy. There are no chase scenes, no “big twist.” The tension comes from phone calls that aren’t returned, doors that stay closed, and documents that may or may not exist. That’s the point.

The power of Spotlight is in its realism. The journalists don’t “win” through a single heroic act; they win through months of stubborn, often boring work—checking names, cross‑referencing records, going back to survivors who have every reason not to trust them. The film shows how systems protect themselves: not only through powerful leaders, but through a culture of looking away, minimizing harm, or deciding that “now isn’t the right time” to publish the truth.

Watching it in the context of any modern scandal is a reminder that revelations don’t come out of nowhere. Someone has to decide that the story is worth their career, their sleep, their peace. Someone has to keep calling.

Dark Waters: the cost of not looking away

In Dark Waters, a corporate defense lawyer discovers that a chemical company has been poisoning a community for years. The more he learns, the less plausible it becomes to stay on the side he’s paid to protect. What starts as a single client and a stack of records becomes a decades‑long fight against a corporation with far more money, influence, and time than he has.

The film is heavy—not because of graphic imagery, but because of the slow realization that this could happen anywhere. It shows how corporate harm doesn’t usually look like one dramatic event; it looks like small decisions, tolerated over time, because changing course would be expensive or embarrassing. Internal memos, risk calculations, and legal strategies become characters in their own right.

What makes Dark Waters important in this moment is the way it illustrates complicity. Very few people in the film set out to be “villains.” Many are simply doing their jobs, protecting their company, or choosing the convenient version of the truth. The story forces us to ask uncomfortable questions about where we draw our own lines—and what it costs to cross them.

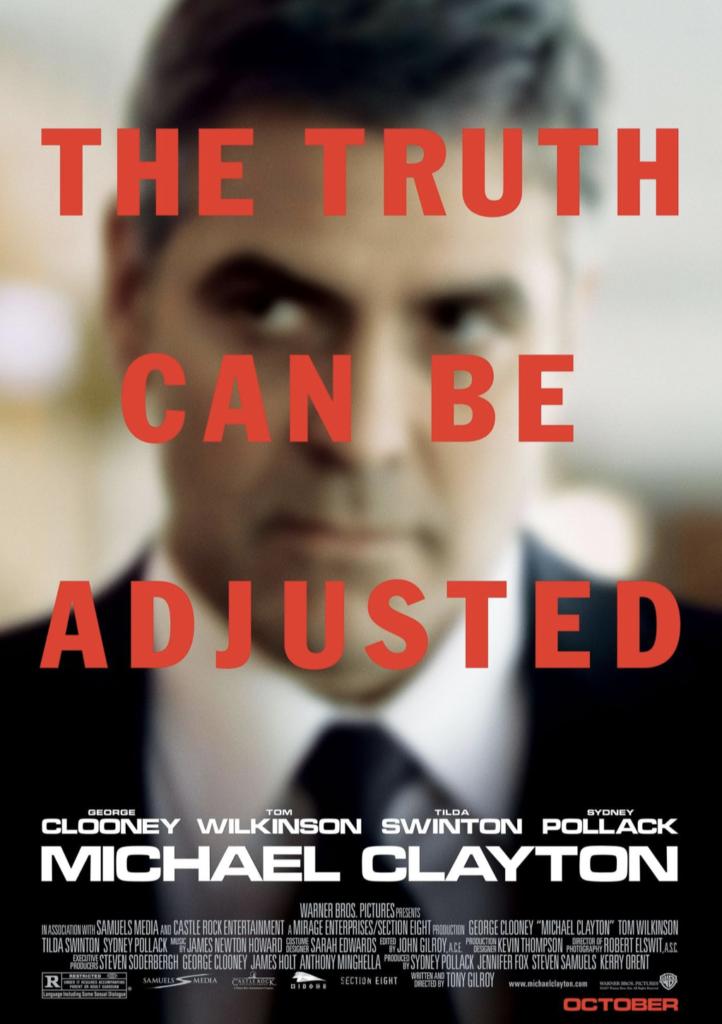

Michael Clayton: inside the clean‑up machine

If Spotlight looks at journalism and Dark Waters at corporate litigation, Michael Clayton focuses on the people whose job is to make problems disappear. The title character is a “fixer” at a prestigious law firm: he isn’t in court, and his name isn’t on the building, but he is the person they call when a client’s mess threatens to become public.

The film peels back the layers of how reputations are maintained. We see how language is used to soften reality—harm becomes “exposure,” victims become “plaintiffs,” and the goal is not necessarily to find the truth but to manage it. When Clayton begins to understand the scale of what his client has done, he faces a question at the core of a lot of modern scandals: what happens when someone inside the machine decides not to play their part anymore?

Michael Clayton is especially resonant when conversations online focus on “who knew” and “who helped.” It reminds us that entire careers and infrastructures exist to protect power and to make sure certain stories never catch fire in the first place.

How to watch these films with care

Because these movies deal with abuse, corruption, and betrayal, they can be emotionally heavy—especially for people who have personal experience with similar harms. A few ways to approach them thoughtfully:

- Check in with yourself before you press play. It’s okay to wait until you’re in a better headspace.

- Watch with someone you trust, or plan a debrief after. These aren’t background‑noise films; they merit conversation.

- Remember that survivors’ experiences are not plot devices. If a conversation about the movie starts turning into speculation or jokes about real people, you have permission to pull it back or step away.

The goal isn’t to turn real‑world pain into “content you can feel good about watching.” It’s to understand the systems around that pain more clearly and to keep our empathy intact.

Why sharing this kind of list matters

Sharing watchlists online can feel trivial, but small choices add up. When we recommend movies that take harm seriously, we’re nudging the culture in a different direction than the endless churn of sensational docuseries and clips built around shock value.

A thoughtful share says:

- I’m paying attention to the structures behind the headlines, not just the gossip.

- I’m interested in stories that center accountability, not just spectacle.

- I want our conversations to honor victims and the people fighting for the truth.

If you decide to post about these films, you don’t have to mention any specific scandal or case at all. You can simply say: “If you’re thinking a lot about power, silence, and cover‑ups right now, these are worth your time.” That alone can open up more grounded, respectful conversations than another round of speculation and rumor.

In a feed full of noise, choosing to highlight stories of persistence, investigation, and courage is its own quiet statement.

Business

How Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Jeffrey Epstein’s money did more than buy private jets and legal leverage. It flowed into the same ecosystem that decides which artists get pushed to the front, which research gets labeled “cutting edge,” and which stories about race and power are treated as respectable debate instead of hate speech. That doesn’t mean he sat in a control room programming playlists. It means his worldview seeped into institutions that already shape what we hear, see, and believe.

The Gatekeepers and Their Stains

The fallout around Casey Wasserman is a vivid example of how this works. Wasserman built a powerhouse talent and marketing agency that controls a major slice of sports, entertainment, and the global touring business. When the Epstein files revealed friendly, flirtatious exchanges between Wasserman and Ghislaine Maxwell, and documented his ties to Epstein’s circle, artists and staff began to question whose money and relationships were quietly underwriting their careers.

That doesn’t prove Epstein “created” any particular star. But it shows that a man deeply entangled with Epstein was sitting at a choke point: deciding which artists get representation, which tours get resources, which festivals and campaigns happen. In an industry built on access and favor, proximity to someone like Epstein is not just gossip; it signals which values are tolerated at the top.

When a gatekeeper with that history sits between artists and the public, “the industry” stops being an abstract machine and starts looking like a web of human choices — choices that, for years, were made in rooms where Epstein’s name wasn’t considered a disqualifier.

Funding Brains, Not Just Brands

Epstein’s interest in culture didn’t end with celebrity selfies. He was obsessed with the science of brains, intelligence, and behavior — and that’s where his money begins to overlap with how audiences are modeled and, eventually, how algorithms are trained.

He cultivated relationships with scientists at elite universities and funded research into genomics, cognition, and brain development. In one high‑profile case, a UCLA professor specializing in music and the brain corresponded with Epstein for years and accepted funding for an institute focused on how music affects neural circuits. On its face, that looks like straightforward philanthropy. Put it next to his email trail and a different pattern appears.

Epstein’s correspondence shows him pushing eugenics and “race science” again and again — arguing that genetic differences explain test score gaps between Black and white people, promoting the idea of editing human beings under the euphemism of “genetic altruism,” and surrounding himself with thinkers who entertained those frames. One researcher in his orbit described Black children as biologically better suited to running and hunting than to abstract thinking.

So you have a financier who is:

- Funding brain and behavior research.

- Deeply invested in ranking human groups by intelligence.

- Embedded in networks that shape both scientific agendas and cultural production.

None of that proves a specific piece of music research turned into a specific Spotify recommendation. But it does show how his ideology was given time, money, and legitimacy in the very spaces that define what counts as serious knowledge about human minds.

How Ideas Leak Into Algorithms

There is another layer that is easier to see: what enters the knowledge base that machines learn from.

Fringe researchers recently misused a large U.S. study of children’s genetics and brain development to publish papers claiming racial hierarchies in IQ and tying Black people’s economic outcomes to supposed genetic deficits. Those papers then showed up as sources in answers from large AI systems when users asked about race and intelligence. Even after mainstream scientists criticized the work, it had already entered both the academic record and the training data of systems that help generate and rank content.

Epstein did not write those specific papers, but he funded the kind of people and projects that keep race‑IQ discourse alive inside elite spaces. Once that thinking is in the mix, recommendation engines and search systems don’t have to be explicitly racist to reproduce it. They simply mirror what’s in their training data and what has been treated as “serious” research.

Zoomed out, the pipeline looks less like a neat conspiracy and more like an ecosystem:

- Wealthy men fund “edgy” work on genes, brains, and behavior.

- Some of that work revives old racist ideas with new data and jargon.

- Those studies get scraped, indexed, and sometimes amplified by AI systems.

- The same platforms host and boost music, video, and news — making decisions shaped by engagement patterns built on biased narratives.

The algorithm deciding what you see next is standing downstream from all of this.

The Celebrity as Smoke Screen

Epstein’s contact lists are full of directors, actors, musicians, authors, and public intellectuals. Many now insist they had no idea what he was doing. Some probably didn’t; others clearly chose not to ask. From Epstein’s perspective, the value of those relationships is obvious.

Being seen in orbit around beloved artists and cultural figures created a reputational firewall. If the public repeatedly saw him photographed with geniuses, Oscar winners, and hit‑makers, their brains filed him under “eccentric patron” rather than “dangerous predator.”

That softens the landing for his ideas, too. Race science sounds less toxic when it’s discussed over dinner at a university‑backed salon or exchanged in emails with a famous thinker.

The more oxygen is spent on the celebrity angle — who flew on which plane, who sat at which dinner — the less attention is left for what may matter more in the long run: the way his money and ideology were welcomed by institutions that shape culture and knowledge.

What to Love, Who to Fear

The point is not to claim that Jeffrey Epstein was secretly programming your TikTok feed or hand‑picking your favorite rapper. The deeper question is what happens when a man with his worldview is allowed to invest in the people and institutions that decide:

- Which artists are “marketable.”

- Which scientific questions are “important.”

- Which studies are “serious” enough to train our machines on.

- Which faces and stories are framed as aspirational — and which as dangerous.

If your media diet feels saturated with certain kinds of Black representation — hyper‑visible in music and sports, under‑represented in positions of uncontested authority — while “objective” science quietly debates Black intelligence, that’s not random drift. It’s the outcome of centuries of narrative work that men like Epstein bought into and helped sustain.

No one can draw a straight, provable line from his bank account to a specific song or recommendation. But the lines he did draw — to elite agencies, to brain and music research, to race‑obsessed science networks — are enough to show this: his money was not only paying for crimes in private. It was also buying him a seat at the tables where culture and knowledge are made, where the stories about who to love and who to fear get quietly agreed upon.

A Challenge to Filmmakers and Creatives

For anyone making culture inside this system, that’s the uncomfortable part: this isn’t just a story about “them.” It’s also a story about you.

Filmmakers, showrunners, musicians, actors, and writers all sit at points where money, narrative, and visibility intersect. You rarely control where the capital ultimately comes from, but you do control what you validate, what you reproduce, and what you challenge.

Questions worth carrying into every room:

- Whose gaze are you serving when you pitch, cast, and cut?

- Which Black characters are being centered — and are they full humans or familiar stereotypes made safe for gatekeepers?

- When someone says a project is “too political,” “too niche,” or “bad for the algorithm,” whose comfort is really being protected?

- Are you treating “the industry” as a neutral force, or as a set of human choices you can push against?

If wealth like Epstein’s can quietly seep into agencies, labs, and institutions that decide what gets made and amplified, then the stories you choose to tell — and refuse to tell — become one of the few levers of resistance inside that machine. You may not control every funding source, but you can decide whether your work reinforces a world where Black people are data points and aesthetics, or one where they are subjects, authors, and owners.

The industry will always have its “gatekeepers.” The open question is whether creatives accept that role as fixed, or start behaving like counter‑programmers: naming the patterns, refusing easy archetypes, and building alternative pathways, platforms, and partnerships wherever possible. In a landscape where money has long been used to decide what to love and who to fear, your choices about whose stories get light are not just artistic decisions. They are acts of power.

Entertainment

You wanted to make movies, not decode Epstein. Too late.

That’s the realization hanging over anyone picking up a camera right now. You didn’t sign up to be a forensic analyst of flight logs, sealed documents, or “unverified tips.” You wanted to tell stories. But your audience lives in a world where every new leak, every exposed celebrity, every dead‑end investigation feeds into one blunt conclusion:

Nobody at the top is clean. And nobody in charge is really coming to save us.

If you’re still making films in this moment, the question isn’t whether you’ll respond to that. You already are, whether you intend to or not. The real question is: will your work help people move, or help them go numb?

Your Audience Doesn’t Believe in Grown‑Ups Anymore

Look at the timeline your viewers live in:

- Names tied to Epstein.

- Names tied to trafficking.

- Names tied to abuse, exploitation, coverups.

- Carefully worded statements, high‑priced lawyers, and “no admission of wrongdoing.”

And in between all of that: playlists, memes, awards shows, campaign ads, and glossy biopics about “legends” we now know were monsters to someone.

If you’re under 35, this is your normal. You grew up:

- Watching childhood heroes get exposed one after another.

- Hearing “open secrets” whispered for years before anyone with power pretended to care.

- Seeing survivors discredited, then quietly vindicated when it was too late to matter.

So when the next leak drops and another “icon” is implicated, the shock isn’t that it happened. The shock is how little changes.

This is the psychic landscape your work drops into. People aren’t just asking, “Is this movie good?” They’re asking, often subconsciously: “Does this filmmaker understand the world I’m actually living in, or are they still selling me the old fantasy?”

You’re Not Just Telling Stories. You’re Translating a Crisis of Trust.

You may not want the job, but you have it: you’re a translator in a time when language itself feels rigged.

Politicians put out statements. Corporations put out statements. Studios put out statements. The public has learned to hear those as legal strategies, not moral positions.

You, on the other hand, still have this small window of trust. Not blind trust—your audience is too skeptical for that—but curious trust. They’ll give you 90 minutes, maybe a season, to see if you can make sense of what they’re feeling:

- The rage at systems that protect predators.

- The confusion when people they admired turn out to be complicit.

- The dread that this is all so big, so entrenched, that nothing they do matters.

If your work dodges that, it doesn’t just feel “light.” It feels dishonest.

That doesn’t mean every film has to be a trafficking exposé. It means even your “small” stories are now taking place in a world where institutions have failed in ways we can’t unsee. If you pretend otherwise, the audience can feel the lie in the walls.

Numbness Is the Real Villain You’re Up Against

You asked for something that could inspire movement and change. To do that, you have to understand the enemy that’s closest to home:

It’s not only the billionaire on the jet. It’s numbness.

Numbness is what happens when your nervous system has been hit with too much horror and too little justice. It looks like apathy, but it’s not. It’s self‑defense. It says:

- “If I let myself feel this, I’ll break.”

- “If I care again and nothing changes, I’ll lose my mind.”

- “If everyone at the top is corrupt, why should I bother being good?”

When you entertain without acknowledging this, you help people stay comfortably numb. When you only horrify without hope, you push them deeper into it.

Your job is more dangerous and more sacred than that. Your job is to take numbness seriously—and then pierce it.

How?

- By creating characters who feel exactly what your audience feels: overwhelmed, angry, hopeless.

- By letting those characters try anyway—in flawed, realistic, human ways.

- By refusing to end every story with “the system wins, nothing matters,” even if you can’t promise a clean victory.

Movement doesn’t start because everyone suddenly believes they can win. It starts because enough people decide they’d rather lose fighting than win asleep.

Show that decision.

Don’t Just Expose Monsters. Expose Mechanisms.

If you make work that brushes against Epstein‑type themes, avoid the easiest trap: turning it into a “one bad guy” tale.

The real horror isn’t one predator. It’s how many people, institutions, and incentives it takes to keep a predator powerful.

If you want your work to fuel real change:

- Show the assistants and staffers who notice something is off and choose silence—or risk.

- Show the PR teams whose entire job is to wash blood off brands.

- Show the industry rituals—the invite‑only parties, the “you’re one of us now” moments—where complicity becomes a form of currency.

- Show the fans, watching allegations pile up against someone who shaped their childhood, and the war inside them between denial and conscience.

When you map the mechanism, you give people a way to see where they fit in that machine. You also help them imagine where it can be broken.

Your Camera Is a Weapon. Choose a Target.

In a moment like this, neutrality is a story choice—and the audience knows it.

Ask yourself, project by project:

- Who gets humanized? If you give more depth to the abuser than the abused, that says something.

- Who gets the last word? Is it the lawyer’s statement, the spin doctor, the jaded bystander—or the person who was actually harmed?

- What gets framed as inevitable? Corruption? Cowardice? Or courage?

You don’t have to sermonize. But you do have to choose. If your work shrugs and says, “That’s just how it is,” don’t be surprised when it lands like anesthetic instead of ignition.

Ignition doesn’t require a happy ending. It just requires a crack—a moment where someone unexpected refuses to play along. A survivor who won’t recant. A worker who refuses the payout. A friend who believes the kid the first time.

Those tiny acts are how movements start in real life. Put them on screen like they matter, because they do.

Stop Waiting for Permission

A lot of people in your position are still quietly waiting—for a greenlight, for a grant, for a “better time,” for the industry to decide it’s ready for harsher truths.

Here’s the harshest truth of all: the system you’re waiting on is the same one your audience doesn’t trust.

So maybe the movement doesn’t start with the perfectly packaged, studio‑approved, four‑quadrant expose. Maybe it starts with:

- A microbudget feature that refuses to flatter power.

- A doc shot on borrowed gear that traces one tiny piece of the web with obsessive honesty.

- A series of shorts that make it emotionally impossible to look at “open secrets” as jokes anymore.

- A narrative film that never names Epstein once, but makes the logic that created him impossible to unsee.

If you do your job right, people will leave your work not just “informed,” but uncomfortable with their own passivity—and with a clearer sense of where their own leverage actually lives.

The Movement You Can Actually Spark

You are not going to single‑handedly dismantle trafficking, corruption, or elite impunity with one film. That’s not your job.

Your job is to help people:

- Feel again where they’ve gone numb.

- Name clearly what they’ve only sensed in fragments.

- See themselves not as background extras in someone else’s empire, but as moral agents with choices that matter.

If your film makes one survivor feel seen instead of crazy, that’s movement.

If it makes one young viewer question why they still worship a predator, that’s movement.

If it makes one industry person think twice before staying silent, that’s movement.

And movements, despite what the history montages pretend, are not made of big moments. They’re made of a million small, private decisions to stop lying—to others, and to ourselves.

You wanted to make movies, not decode Epstein.

Too late.

You’re here. The curtain’s already been pulled back. Use your camera to decide what we look at now: more distraction from what we know, or a clearer view of it.

One of those choices helps people forget.

The other might just help them remember who they are—and what they refuse to tolerate—long enough to do something about it.

Advice7 days ago

Advice7 days agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Entertainment4 weeks ago

Entertainment4 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry4 weeks ago

Film Industry4 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Entertainment3 weeks ago

Entertainment3 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Business2 weeks ago

Business2 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

News4 weeks ago

News4 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Business2 weeks ago

Business2 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Film Industry7 days ago

Film Industry7 days agoWhy Burnt-Out Filmmakers Need to Unplug Right Now