World News

Tracking the EV battery factory construction boom across North America on August 16, 2023 at 12:00 pm

The onshoring of battery manufacturing for EVs started as a trickle during the COVID-19 pandemic. Now it’s a tsunami.

In 2019, just two battery factories were operating in the United States with another two under construction. Today, there are about 30 battery factories either planned, under construction or operational in the country.

U.S. President Joe Biden’s Inflation Reduction Act, signed into law August 16, 2022, might not have been the initial catalyst behind the onshoring battery factory trend. But it did help open the spigot and accelerate the pace of factory projects — not to mention sparking a climate tech arms race with the EU. One year later, we’re here to make sense of it.

China long controlled the supply and manufacture of lithium-ion batteries. The country’s grip on that supply chain began to loosen after automakers, hesitant to repeat the chip shortage crisis that hampered manufacturing during the pandemic, began promising to build EVs and batteries closer to home in 2021.

What has followed is a wave of automakers and battery makers — foreign and domestic — pledging to produce North American-made batteries before 2030.

IRA carrots and sticks

That’s because the IRA is rife with incentives for automakers and consumers to produce domestically – a concerted effort to end the U.S.’s reliance on China for batteries, while simultaneously meeting Biden’s goal to make 50% of all new vehicle sales in the U.S. electric or hybrid by 2030. Vehicles can qualify for the full $7,500 EV tax credit if they meet certain battery sourcing and production guidelines.

The IRA requires that 60% of the value of battery components be produced or assembled in North America in 2024 to qualify for half of the tax credit, $3,750. That percentage will increase to 100% starting in 2029. To get the remaining half, 50% of the value of critical materials must be sourced from the U.S. or a free trade agreement country in 2024 and 80% from 2027 to 2032.

The IRA also includes advanced manufacturing credits that give the producer a payout from the Treasury. Under Section 45X, the production of battery cells qualify for a credit of $35 per kilowatt-hour of capacity, and the production of battery modules qualify for $10 per kilowatt-hour. Companies can also be reimbursed 10% of the costs incurred due to the production of electrode active materials, like the cathode and anode.

Automakers and battery manufacturers have collectively invested and promised to invest close to $100 billion in building domestic cell and module manufacturing. Together, these companies promise to deliver an annual capacity of over 1,200 gigawatt-hours before 2030, if each factory reaches maximum capacity. That’s roughly enough batteries for 18 million EVs, based on previous Tesla predictions that say about 100 GWh capacity can power around 1.5 million EVs.

The investment into producing batteries in the U.S. and Canada changes weekly, so we’ve started tracking these promises.

Automakers investing in domestic battery production

TechCrunch created a handy map showing the location of each battery factory plus some basic information, including planned capacity. For those looking for more details and context, scroll down to read about each manufacturer’s planned or operational battery factories. Or click on a location on the map for a pop up to appear. Click more information for a shortcut to that section.

Map credit: Miranda Halpern

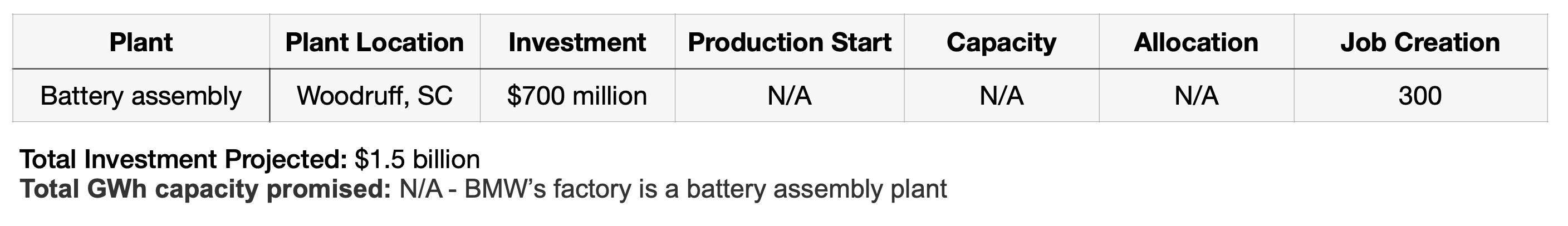

BMW

In October 2022, BMW announced a $1.7 billion investment in the U.S. that would see its Spartanburg, South Carolina plant readied for the production of EVs and the buildout of a battery assembly facility in nearby Woodruff. The automaker has not announced the production start date for the plant yet, nor which EVs will be produced there. BMW’s Spartanburg factory is currently where its sports utility and crossovers are built, including the X3, X4, X5, X6, X7 and XM.

BMW also partnered up with battery-maker AESC (formerly Envision AESC) to invest additional funds in a battery cell plant in Florence, SC (more on that in the AESC section). The AESC plant will produce BMW’s new sixth-generation round lithium-ion battery cells for Plant Spartanburg EVs. Groundbreaking on both the Woodruff and Florence facilities occurred in June.

Ford

In September 2021, Ford created a joint venture with South Korean battery maker SK On. The goal of the JV, called BlueOval SK, is to build three battery plants in the United States. Two are located in Kentucky; the third factory in Tennessee will be co-located with a Ford assembly plant, which will produce the automaker’s second-generation electric truck, code named Project T3.

Ford and SK On recently secured a $9.2 billion loan from the U.S. Department of Energy to help finance the construction of the three battery factories in Kentucky and Tennessee.

Ford is also building a lithium iron phosphate plant in Michigan. Chinese battery maker CATL is licensing its technology to Ford as a service provider on a contractual basis. That might change in the future, though, as Ford has now attracted the ire of House Republicans who are probing the automaker’s relationship with the Chinese battery company.

Meanwhile in Canada, Ford said in April that it would turn its 70-year-old Oakville facility in Canada into an assembly plant for its next-gen EVs. The $1.34 billion (CAD $1.8 billion) upgrade will include a 407,000-square-foot battery assembly plant that will use cells and arrays from Ford’s Kentucky plant and turn them into packs. Those packs will then be installed into the EVs produced at the Oakville plant.

General Motors

General Motors aims to have three total battery plants in the U.S. through its joint venture with LG Chem, named Ultium Cells. That joint venture secured in December 2022 a $2.5 billion loan from the government to help fund its battery factory projects.

General Motors also announced a JV with Samsung SDI in April to build a new battery plant in the United States.

GM isn’t just focused on volume production. The automaker has also partnered with startup SolidEnergy Systems in 2021 to build a prototyping facility in Woburn, Massachusetts. The goal was to build a high-capacity, pre-production lithium-ion battery this year.

“We continue to make progress on lithium-metal, both through our own labs and with outside collaborators. In fact, our R&D team, working with SES, has already demonstrated a 1,000 Wh/L lithium-metal battery with durability greater than 250,000 simulated test miles.”

Outside of the U.S., GM is working on taking control of battery materials supply chain, as well. The company partnered in March 2022 with South Korea’s Posco Chemical to build a $400 million battery materials facility in Canada. The plant will produce cathode active materials.

Honda

In August 2022, Honda announced its joint venture with South Korea’s LG Energy Solutions to supply the North American market with a “pouch type” battery cells. The facility in Ohio will produce both cells and modules.

The automaker has also made strides to secure battery resource recycling channels and has agreements with businesses including Ascend Elements, Cirba Solutions and Posco Holdings.

Honda’s engine plant in Anna, Ohio is also in the process of being retooled to add production of casing for battery modules that will power Honda and Acura EVs made in Ohio.

Hyundai

In April 2023, Hyundai and SK On approved plans to set up a joint venture to build a $5 billion battery plant in Bartow County, Georgia. The following month, Hyundai and LG Energy Solution formed another JV to build a battery cell factory near Savannah, Georgia.

Mercedes-Benz

Mercedes-Benz opened a battery plant at its existing manufacturing facility in Alabama in 2022. That summer, the plant also became the production site for the automaker’s fully electric EQS SUV. The Alabama facility is also assembling the EQE SUV, with the Maybach EQS SUV to follow this year, according to a spokesperson from the company.

Mercedes is also working with Sila, a next-gen battery materials company, to incorporate Sila’s battery chemistry into batteries as an option for buyers of the upcoming G-Class. Sila replaces the graphite in a battery cell with silicon, and is in the process of scaling up at its new Washington state facility. The companies are targeting mid-decade for a range-extended version of the G-class.

Rivian

Rivian hasn’t outright committed to building its own batteries in North America. The company is hoping to build a massive EV production facility in Georgia, which might include a cell manufacturing facility, but also might not. Rivian hasn’t confirmed.

A spokesperson told TechCrunch the company expects a formal groundbreaking on the Georgia EV facility later this year or early next, with start of production slated for 2026.

Stellantis

Stellantis and Samsung SDI commenced construction on their joint venture EV battery facility in Indiana in March 2023. The plan for the factory is to produce both lithium-ion cells and modules.

Stellantis announced in July 2023 it would build a second battery factory with Samsung, which will open in early 2027. The automaker didn’t provide any further details, like location, GWh capacity or how many jobs the new plant will create, so watch this space.

Stellantis, which includes brands Alfa Romeo, Chrysler, Jeep and Ram, had announced a joint venture with LG in 2021 to build a North America factory with an annual capacity of 40 GWh. In March 2022, the two companies announced a binding agreement to invest (CAD $5 billion) $3.7 billion to produce cells and modules at a manufacturing plant in Windsor, Ontario, Canada.

Tesla

Since beginning production at Gigafactory Nevada in 2017, Tesla says it has produced 7.3 billion battery cells and 1.5 million battery packs, which provide about 39 GWh capacity annually, according to Panasonic.

Tesla in January announced plans to invest billions more into the Nevada factory to include a new 4680 cell factory with capacity to produce enough batteries for 1.5 million light duty vehicles annually. 4680 cells, which were designed by Tesla and revealed at Battery Day 2020, are meant to reduce battery cost by over 50%. Tesla has been trying to get the cells to volume production over the last few years, but has run into roadblocks.

At the start of 2023, Tesla also laid out plans to expand its existing Gigafactory Austin to include battery cell testing and the manufacture of cathode and drive units.

There have also been reports of an extension to Tesla’s Fremont, California manufacturing facility to support the production of the 4860 cell technology. The automaker has shared few details on that extension.

Globally, Tesla also planned to produce batteries at its Giga Berlin factory. While it appears that the facility is currently in operation, it’s at a lower level than was initially expected. The factory is currently producing individual battery components, but not cells and modules. That work has been sent to Giga Austin instead, likely as a result of the IRA incentives.

Toyota

Toyota’s planned battery plant in North Carolina, initially announced in 2021, will produce both cells and modules, according to the company. When it comes online, it’ll have six production lines, four of which will support battery production for hybrid EVs. The remaining two will support battery EVs.

The Japanese automaker is also building a battery lab at its North American research and development headquarters in Michigan, where it can develop and evaluate the quality of its EV batteries. The $48 million lab is expected to begin operations in 2025, and it will support the company’s manufacturing at factories in North Carolina and Kentucky.

Volkswagen

In July 2022, Volkswagen set up a separate battery company, PowerCo SE, to build batteries for its upcoming EVs. Since its launch, the company has decided on the location of three cell factories: Two in Europe (Salzgitter, Germany and Valencia, Spain) and one in North America (St. Thomas, Canada). PowerCo expects to generate an annual revenue of over 20 billion euros by 2030.

While VW’s battery factory is in Canada and not technically in the U.S., it should still be eligible to receive Inflation Reduction Act incentives.

Volvo

Volvo has a battery assembly factory in Charleston, South Carolina, but the automaker does not manufacture batteries or battery components there. Volvo would not confirm any other plans it has for battery production in North America.

Battery manufactures building in North America

AESC

AESC (formerly Envision AESC) is a Japanese battery technology company that will have three U.S. facilities before the end of the decade. The company’s Tennessee plant has been in operation for some time. AESC broke ground at its Kentucky and South Carolina plants in August 2022 and June 2023, respectively.

Gotion

Gotion Inc. first announced its intent to build a battery factory in Michigan in October 2022. The factory, which secured $175 million in state funds in April 2023, will build both cathode and anodes that could be used for both EVs and solar generators, according to a spokesperson from the company.

Gotion is headquartered in Silicon Valley, but it’s owned by Gotion High-Tech, which is a Chinese company.

LG Energy Solution

South Korea’s LG Energy Solution supplies EV batteries to automakers like Tesla, Lucid Motors and Proterra. The battery maker has joint ventures to build battery factories with General Motors, Honda and Hyundai, as well as one with Stellantis in Canada that’s currently on hold.

In March 2023, LG said it would quintuple the capacity of its existing lithium-ion cell plant in Michigan, which was built in 2010. LG’s Holland factory makes large polymer battery cells, or pouch type cells, and packs for EVs. The expanded plant will produce new long cell design batteries, which LG says should add more range, better storage, and a more simplified pack structure.

The battery-maker also said it would quadruple its planned investment in a new factory in Arizona to $5.5 billion, a large portion of which will be dedicated to EV battery production. The complex will have two manufacturing facilities – one dedicated to cylindrical batteries for EVs and another for lithium iron phosphate pouch-type batteries for energy storage systems.

Most recently LG announced a building spree in North America, with plans to spend up to $17 billion through 2025 on constructing a total of eight factories (two of which are already operational) with more than 300 GWh capacity. While the remaining six plants are at various stages on the way to production, LG has not shared specific details.

Our Next Energy

Battery startup Our Next Energy (ONE) announced plans in October 2022 to build a gigafactory in Michigan devoted to lithium-iron-phosphate cells, AKA LFP batteries. The facility will include raw material refinement, cathode materials production, and cell and battery manufacturing.

To that end, the company recently raised a $300 million Series B to help get it to production.

Panasonic

Panasonic said in July 2022 that it plans to build the world’s largest EV battery plant, a $4 billion factory in Kansas that will manufacture and supply lithium-ion batteries to EV makers. The facility in De Soto, Kansas will be Panasonic’s second EV battery plant in the U.S. after the Panasonic Energy of North America (PENA) facility in Sparks, Nevada, which operates inside Tesla’s Nevada gigafactory and supplies the EV-maker with batteries.

Panasonic said in June that it plans to expand production at PENA by 10% within three years. In May, the Japanese company said it would build at least two new factories for the production of Tesla 4680 battery cells in North America by 2030. Panasonic aims to choose its next production site during the third quarter of 2024.

SK Battery America

South Korean battery manufacturer SK On has created joint ventures to develop batteries with Ford and Hyundai. The company’s U.S. subsidiary, SK Battery America, has its own plans.

SK Battery America has invested $2.6 billion into two manufacturing plants in Jackson County, Georgia and reached mass production in early 2022.

Redwood Materials

Battery recycling startup Redwood Materials says its upcoming battery materials campus in South Carolina will recycle, refine and remanufacture cathode and anode materials such as nickel, cobalt, lithium and copper. The company won’t be producing cells or modules, but it will provide a domestic supply source to battery makers that are.

Redwood said its SC plant has the capacity to expand to 400 GWh, but that would require several billion dollars more of investment. The company hasn’t yet broken ground on the site, according to a spokesperson.

Redwood also has a northern Nevada plant that produces anode copper foil.

Earlier this year, the startup received a $2 billion loan from the DOE to help it boost its recycling goals.

The onshoring of battery manufacturing for EVs started as a trickle during the COVID-19 pandemic. Now it’s a tsunami. In 2019, just two battery factories were operating in the United States with another two under construction. Today, there are about 30 battery factories either planned, under construction or operational in the country. U.S. President Joe

News

US May Completely Cut Income Tax Due to Tariff Revenue

President Donald Trump says the United States might one day get rid of federal income tax because of money the government collects from tariffs on imported goods. Tariffs are extra taxes the U.S. puts on products that come from other countries.

What Trump Is Saying

Trump has said that tariff money could become so large that it might allow the government to cut income taxes “almost completely.” He has also talked about possibly phasing out income tax over the next few years if tariff money keeps going up.

How Taxes Work Now

Right now, the federal government gets much more money from income taxes than from tariffs. Income taxes bring in trillions of dollars each year, while tariffs bring in only a small part of that total. Because of this gap, experts say tariffs would need to grow by many times to replace income tax money.

Questions From Experts

Many economists and tax experts doubt that tariffs alone could pay for the whole federal budget. They warn that very high tariffs could make many imported goods more expensive for shoppers in the United States. This could hit lower- and middle‑income families hardest, because they spend a big share of their money on everyday items.

What Congress Must Do

The president can change some tariffs, but only Congress can change or end the federal income tax. That means any real plan to remove income tax would need new laws passed by both the House of Representatives and the Senate. So far, there is no detailed law or full budget plan on this idea.

What It Means Right Now

For now, Trump’s comments are a proposal, not a change in the law. People and businesses still have to pay federal income tax under the current rules. The debate over using tariffs instead of income taxes is likely to continue among lawmakers, experts, and voters.

News

Epstein Files to Be Declassified After Trump Order

Former President Donald Trump has signed an executive order directing federal agencies to declassify all government files related to Jeffrey Epstein, the disgraced financier whose death in 2019 continues to fuel controversy and speculation.

The order, signed Wednesday at Trump’s Mar-a-Lago estate, instructs the FBI, Department of Justice, and intelligence agencies to release documents detailing Epstein’s network, finances, and alleged connections to high-profile figures. Trump described the move as “a step toward transparency and public trust,” promising that no names would be shielded from scrutiny.

“This information belongs to the American people,” Trump said in a televised statement. “For too long, powerful interests have tried to bury the truth. That ends now.”

U.S. intelligence officials confirmed that preparations for the release are already underway. According to sources familiar with the process, the first batch of documents is expected to be made public within the next 30 days, with additional releases scheduled over several months.

Reactions poured in across the political spectrum. Supporters praised the decision as a bold act of accountability, while critics alleged it was politically motivated, timed to draw attention during a volatile election season. Civil rights advocates, meanwhile, emphasized caution, warning that some records could expose private victims or ongoing legal matters.

The Epstein case, which implicated figures in politics, business, and entertainment, remains one of the most talked-about scandals of the past decade. Epstein’s connections to influential individuals—including politicians, royals, and executives—have long sparked speculation about the extent of his operations and who may have been involved.

Former federal prosecutor Lauren Fields said the release could mark a turning point in public discourse surrounding government transparency. “Regardless of political stance, this declassification has the potential to reshape how Americans view power and accountability,” Fields noted.

Officials say redactions may still occur to protect sensitive intelligence or personal information, but the intent is a near-complete disclosure. For years, critics of the government’s handling of Epstein’s case have accused agencies of concealing evidence or shielding elites from exposure. Trump’s order promises to change that narrative.

As anticipation builds, journalists, legal analysts, and online commentators are preparing for what could be one of the most consequential information releases in recent history.

Politics

Netanyahu’s UN Speech Triggers Diplomatic Walkouts and Mass Protests

What Happened at the United Nations

On Friday, Israeli Prime Minister Benjamin Netanyahu addressed the United Nations General Assembly in New York City, defending Israel’s ongoing military operations in Gaza. As he spoke, more than 100 delegates from over 50 countries stood up and left the chamber—a rare and significant diplomatic walkout. Outside the UN, thousands of protesters gathered to voice opposition to Netanyahu’s policies and call for accountability, including some who labeled him a war criminal. The protest included activists from Palestinian and Jewish groups, along with international allies.

Why Did Delegates and Protesters Walk Out?

The walkouts and protests were a response to Israel’s continued offensive in Gaza, which has resulted in widespread destruction and a significant humanitarian crisis. Many countries and individuals have accused Israel of excessive use of force, and some international prosecutors have suggested Netanyahu should face investigation by the International Criminal Court for war crimes, including claims that starvation was used as a weapon against civilians. At the same time, a record number of nations—over 150—recently recognized the State of Palestine, leaving the United States as the only permanent UN Security Council member not to join them.

International Reaction and Significance

The diplomatic walkouts and street protests demonstrate increasing global concern over the situation in Gaza and growing support for Palestinian statehood. Several world leaders, including Colombia’s President Gustavo Petro, showed visible solidarity with protesters. Petro called for international intervention and, controversially, for US troops not to follow orders he viewed as supporting ongoing conflict. The US later revoked Petro’s visa over his role in the protests, which he argued was evidence of a declining respect for international law.

Why Is This News Important?

The Gaza conflict is one of the world’s most contentious and closely-watched issues. It has drawn strong feelings and differing opinions from governments, activists, and ordinary people worldwide. The United Nations, as an international organization focused on peace and human rights, is a key arena for these debates. The events surrounding Netanyahu’s speech show that many nations and voices are urging new action—from recognition of Palestinian rights to calls for sanctions against Israel—while discussion and disagreement over the best path forward continue.

This episode at the UN highlights how international diplomacy, public protests, and official policy are all intersecting in real time as the search for solutions to the Israeli-Palestinian conflict remains urgent and unresolved.

Advice1 week ago

Advice1 week agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Entertainment4 weeks ago

Entertainment4 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry4 weeks ago

Film Industry4 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Entertainment3 weeks ago

Entertainment3 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Business2 weeks ago

Business2 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Business2 weeks ago

Business2 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

News4 weeks ago

News4 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Film Industry1 week ago

Film Industry1 week agoWhy Burnt-Out Filmmakers Need to Unplug Right Now