US added 216,000 jobs in December, blowing past expectations

Business

Surprise jobs data gives boost to Biden on January 5, 2024 at 5:40 pm Business News | The Hill

A surprisingly strong December jobs gain is good news for President Biden as the prospect of the long-sought-after “soft landing” comes into greater focus at the start of an election year.

Payrolls came in hot in December with 216,000 new jobs added to the economy and the unemployment rate remaining low at 3.7 percent, according to the Labor Department.

The December jobs report was another upside surprise for a labor market that defied economists’ expectations throughout 2023. But the promising state of the economy is hardly a lock in voters’ minds for the president.

Despite ample salesmanship, Biden’s economic approval ratings are low. Just 32 percent of Americans gave Biden a thumbs up on the economy in a November Gallup poll.

His overall approval ratings are also weak, with 39 percent of Americans giving him a passing grade in December polling. That’s still a slight improvement from his November rating of 37 percent.

And Biden currently trails former President Trump, his likely Republican opponent, by 2 percent in The Hill/Decision Desk HQ poll tracker.

The state of the economy is likely to be top-of-mind for voters, so 2024 promises to be a year of intense economic rhetoric and argumentation. Here’s how the first jobs report of the year sets the stage.

The airport is ‘on the horizon’ for the soft landing

The December jobs report is boosting confidence among policymakers that the U.S. economy is in a “soft landing,” or the rebalancing of the economy toward slow and steady growth from high inflation without a recession.

After the federal government pumped trillions of dollars in stimulus into the economy and inflation took off in 2021, the Fed started raising interest rates in 2022 to slow things down, leading many economists to believe a recession was inevitable.

But despite many wrong predictions, a recession failed to materialize in 2023. The strong jobs numbers from December — along with wage growth of 4.1 percent over the past year — are yet more evidence for the soft landing scenario.

“What we’re seeing now I think we can describe as a soft landing, and my hope is that it will continue,” Treasury Secretary Janet Yellen said Friday in an interview on CNN.

“The American people did it,” she added. “The American people go to work every day, participate in the labor market, form new businesses. But President Biden has tried to create incentives that give Americans the tools they need to help this economy grow.”

Yellen’s former Fed colleagues have also noted as much.

“The airport is on the horizon,” Tom Barkin, president of the Federal Reserve Bank of Richmond, said in a speech Wednesday. “Everyone is talking about the potential for a soft landing, where inflation completes its journey back to normal levels while the economy stays healthy. And you can see the case for that.”

Optimism among investors is also percolating.

“Two consecutive positive jobs reports and solid consumer spending amid easing inflation are welcome news both for consumers and investors,” Stephen J. Rich, head of investment firm Mutual of America Capital Management, wrote in a statement sent to The Hill. “A soft landing for the economy appears much more likely.”

Parties battle for control of narrative

Democrats were eager to cheer the Friday jobs report as evidence that their policies are working as the party and Biden attempt to flip voter sentiment on the economy.

“Another strong report to round out a year of sustainable job growth, and growing the economy from the bottom-up and middle-out is the new pro-worker, pro-growth strategy,” Rep. Richard Neal (D-Mass.), ranking member of the House Ways and Means Committee, said Friday.

“By every measure, it’s working.”

Republicans, however, are keeping the focus on cost increases endured by Americans over the past two years thanks to four-decade-high inflation and the Fed’s rapid rate hikes.

“The average monthly mortgage payment has increased by $1,089 and is 96 percent higher than when President Biden took office in January 2021,” Ways and Means Republicans said in a statement.

“Consumer credit debt has reached an all-time high of just over $1 trillion and the number of Americans struggling to pay credit card bills has increased sharply.”

“As the calendar turns to 2024, working families see an administration pushing the same failed policies of ‘Bidenomics’ that have caused such financial and economic struggle, frustration, and anxiety,” Ways and Means Chair Jason Smith (R-Mo.) said.

Inflation is falling and gas prices are easing

While Americans are still dealing with elevated inflation, Democrats are hopeful that slowing price growth will bolster their pitch to voters.

Inflation has dropped from a 9-percent annual increase in June 2022 to a 3.1-percent increase this past November, according to the Labor Department’s consumer price index (CPI).

The dip in inflation comes as wage increases have broadly kept pace, with a 4.1-percent annual increase in average hourly earnings reported Friday by the Labor Department.

For the lowest-paid workers in the economy, their wage increases have outpaced inflation for a net gain throughout the pandemic.

And gas prices, which are some of the costs that consumers feel most acutely, are also on the retreat.

The national average price for a gallon of gas was $3.09 on Friday — a far cry from the $5 peak at the height of inflation.

“Right now, the average driver in America is spending over $100 less than if gas prices had stayed at their peak,” Biden touted in a Friday post on X, formerly known as Twitter.

Rate cuts may be delayed as job market holds strong

Investors had started to price in rate cuts for some time this year in anticipation of inflation returning to the Fed’s 2-percent annual expectation.

That could lead to an additional boost for the stock market, which is already near record highs, with the S&P 500 index of major U.S. stocks up nearly 600 points since the end of October.

But the strength of the Friday jobs report will likely mean the Fed will push back rate cuts.

The chances of the Fed holding rates steady at its next meeting at the current range of 5.25 to 5.5 percent were clocked by the CME Fedwatch prediction algorithm on Friday at 95 percent.

Strengthening consumer sentiment may also be a tailwind for Biden heading into 2024, with the Michigan Survey of Consumer Sentiment soaring 14 percent in December.

Business, Economy, News, 2024 election, Biden administration, Donald Trump, inflation, Jobs Report, Joe Biden, soft landing A surprisingly strong December jobs gain is good news for President Biden as the prospect of the long-sought-after “soft landing” comes into greater focus at the start of an election year. Payrolls came in hot in December with 216,000 new jobs added to the economy and the unemployment rate remaining low at 3.7 percent, according…

Business

How Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Jeffrey Epstein’s money did more than buy private jets and legal leverage. It flowed into the same ecosystem that decides which artists get pushed to the front, which research gets labeled “cutting edge,” and which stories about race and power are treated as respectable debate instead of hate speech. That doesn’t mean he sat in a control room programming playlists. It means his worldview seeped into institutions that already shape what we hear, see, and believe.

The Gatekeepers and Their Stains

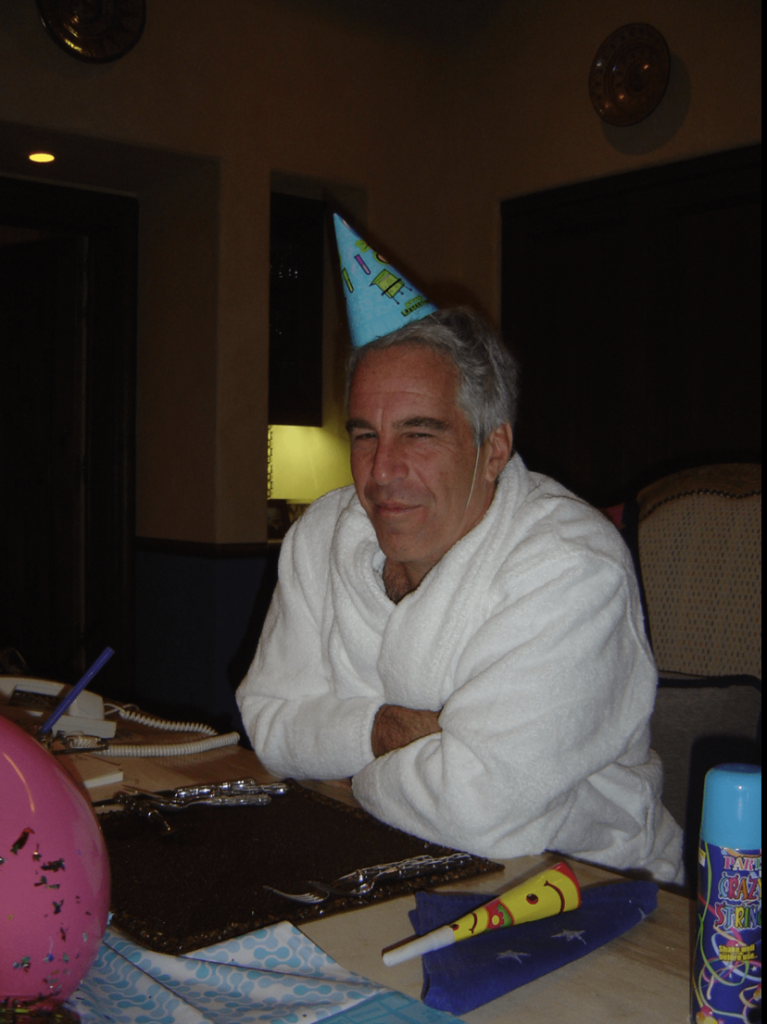

The fallout around Casey Wasserman is a vivid example of how this works. Wasserman built a powerhouse talent and marketing agency that controls a major slice of sports, entertainment, and the global touring business. When the Epstein files revealed friendly, flirtatious exchanges between Wasserman and Ghislaine Maxwell, and documented his ties to Epstein’s circle, artists and staff began to question whose money and relationships were quietly underwriting their careers.

That doesn’t prove Epstein “created” any particular star. But it shows that a man deeply entangled with Epstein was sitting at a choke point: deciding which artists get representation, which tours get resources, which festivals and campaigns happen. In an industry built on access and favor, proximity to someone like Epstein is not just gossip; it signals which values are tolerated at the top.

When a gatekeeper with that history sits between artists and the public, “the industry” stops being an abstract machine and starts looking like a web of human choices — choices that, for years, were made in rooms where Epstein’s name wasn’t considered a disqualifier.

Funding Brains, Not Just Brands

Epstein’s interest in culture didn’t end with celebrity selfies. He was obsessed with the science of brains, intelligence, and behavior — and that’s where his money begins to overlap with how audiences are modeled and, eventually, how algorithms are trained.

He cultivated relationships with scientists at elite universities and funded research into genomics, cognition, and brain development. In one high‑profile case, a UCLA professor specializing in music and the brain corresponded with Epstein for years and accepted funding for an institute focused on how music affects neural circuits. On its face, that looks like straightforward philanthropy. Put it next to his email trail and a different pattern appears.

Epstein’s correspondence shows him pushing eugenics and “race science” again and again — arguing that genetic differences explain test score gaps between Black and white people, promoting the idea of editing human beings under the euphemism of “genetic altruism,” and surrounding himself with thinkers who entertained those frames. One researcher in his orbit described Black children as biologically better suited to running and hunting than to abstract thinking.

So you have a financier who is:

- Funding brain and behavior research.

- Deeply invested in ranking human groups by intelligence.

- Embedded in networks that shape both scientific agendas and cultural production.

None of that proves a specific piece of music research turned into a specific Spotify recommendation. But it does show how his ideology was given time, money, and legitimacy in the very spaces that define what counts as serious knowledge about human minds.

How Ideas Leak Into Algorithms

There is another layer that is easier to see: what enters the knowledge base that machines learn from.

Fringe researchers recently misused a large U.S. study of children’s genetics and brain development to publish papers claiming racial hierarchies in IQ and tying Black people’s economic outcomes to supposed genetic deficits. Those papers then showed up as sources in answers from large AI systems when users asked about race and intelligence. Even after mainstream scientists criticized the work, it had already entered both the academic record and the training data of systems that help generate and rank content.

Epstein did not write those specific papers, but he funded the kind of people and projects that keep race‑IQ discourse alive inside elite spaces. Once that thinking is in the mix, recommendation engines and search systems don’t have to be explicitly racist to reproduce it. They simply mirror what’s in their training data and what has been treated as “serious” research.

Zoomed out, the pipeline looks less like a neat conspiracy and more like an ecosystem:

- Wealthy men fund “edgy” work on genes, brains, and behavior.

- Some of that work revives old racist ideas with new data and jargon.

- Those studies get scraped, indexed, and sometimes amplified by AI systems.

- The same platforms host and boost music, video, and news — making decisions shaped by engagement patterns built on biased narratives.

The algorithm deciding what you see next is standing downstream from all of this.

The Celebrity as Smoke Screen

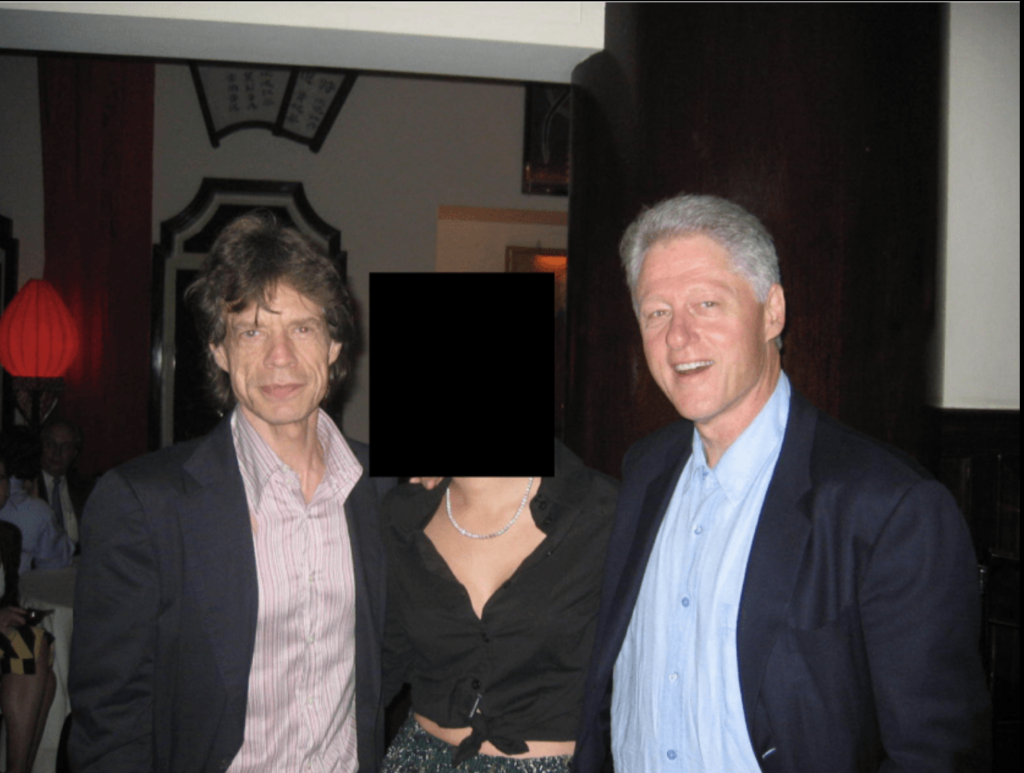

Epstein’s contact lists are full of directors, actors, musicians, authors, and public intellectuals. Many now insist they had no idea what he was doing. Some probably didn’t; others clearly chose not to ask. From Epstein’s perspective, the value of those relationships is obvious.

Being seen in orbit around beloved artists and cultural figures created a reputational firewall. If the public repeatedly saw him photographed with geniuses, Oscar winners, and hit‑makers, their brains filed him under “eccentric patron” rather than “dangerous predator.”

That softens the landing for his ideas, too. Race science sounds less toxic when it’s discussed over dinner at a university‑backed salon or exchanged in emails with a famous thinker.

The more oxygen is spent on the celebrity angle — who flew on which plane, who sat at which dinner — the less attention is left for what may matter more in the long run: the way his money and ideology were welcomed by institutions that shape culture and knowledge.

What to Love, Who to Fear

The point is not to claim that Jeffrey Epstein was secretly programming your TikTok feed or hand‑picking your favorite rapper. The deeper question is what happens when a man with his worldview is allowed to invest in the people and institutions that decide:

- Which artists are “marketable.”

- Which scientific questions are “important.”

- Which studies are “serious” enough to train our machines on.

- Which faces and stories are framed as aspirational — and which as dangerous.

If your media diet feels saturated with certain kinds of Black representation — hyper‑visible in music and sports, under‑represented in positions of uncontested authority — while “objective” science quietly debates Black intelligence, that’s not random drift. It’s the outcome of centuries of narrative work that men like Epstein bought into and helped sustain.

No one can draw a straight, provable line from his bank account to a specific song or recommendation. But the lines he did draw — to elite agencies, to brain and music research, to race‑obsessed science networks — are enough to show this: his money was not only paying for crimes in private. It was also buying him a seat at the tables where culture and knowledge are made, where the stories about who to love and who to fear get quietly agreed upon.

A Challenge to Filmmakers and Creatives

For anyone making culture inside this system, that’s the uncomfortable part: this isn’t just a story about “them.” It’s also a story about you.

Filmmakers, showrunners, musicians, actors, and writers all sit at points where money, narrative, and visibility intersect. You rarely control where the capital ultimately comes from, but you do control what you validate, what you reproduce, and what you challenge.

Questions worth carrying into every room:

- Whose gaze are you serving when you pitch, cast, and cut?

- Which Black characters are being centered — and are they full humans or familiar stereotypes made safe for gatekeepers?

- When someone says a project is “too political,” “too niche,” or “bad for the algorithm,” whose comfort is really being protected?

- Are you treating “the industry” as a neutral force, or as a set of human choices you can push against?

If wealth like Epstein’s can quietly seep into agencies, labs, and institutions that decide what gets made and amplified, then the stories you choose to tell — and refuse to tell — become one of the few levers of resistance inside that machine. You may not control every funding source, but you can decide whether your work reinforces a world where Black people are data points and aesthetics, or one where they are subjects, authors, and owners.

The industry will always have its “gatekeepers.” The open question is whether creatives accept that role as fixed, or start behaving like counter‑programmers: naming the patterns, refusing easy archetypes, and building alternative pathways, platforms, and partnerships wherever possible. In a landscape where money has long been used to decide what to love and who to fear, your choices about whose stories get light are not just artistic decisions. They are acts of power.

Business

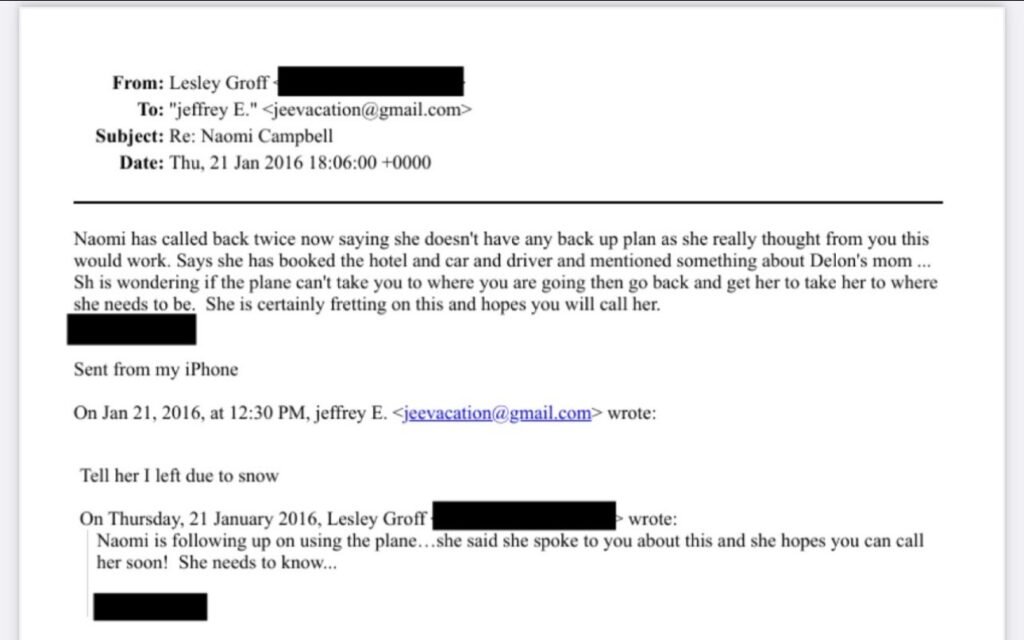

New DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

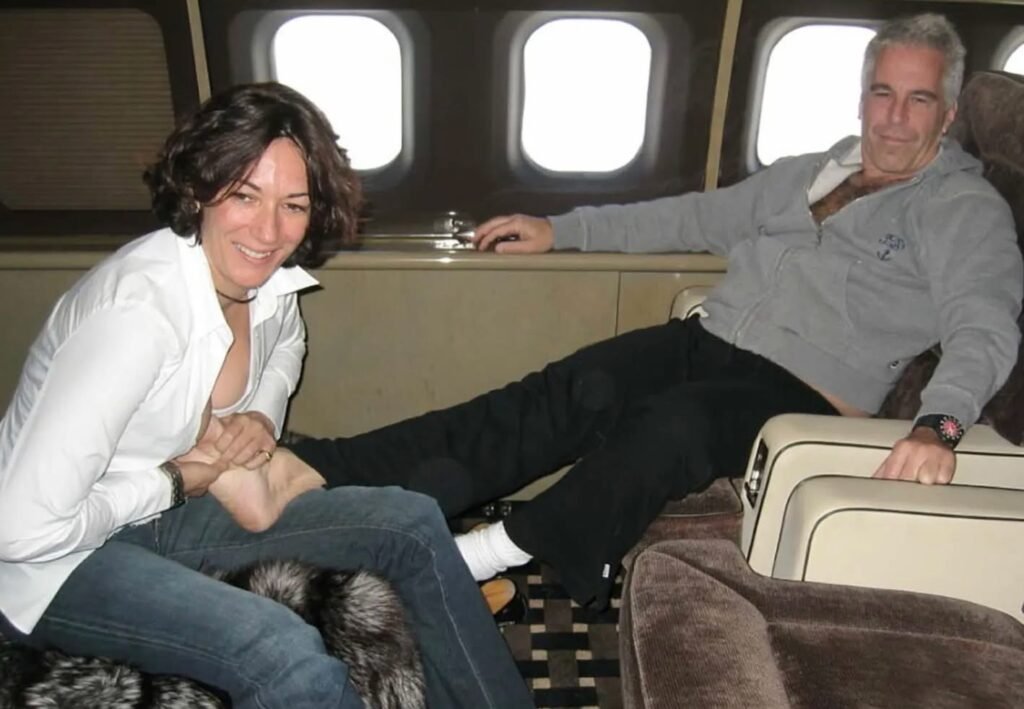

In early 2026, the global conversation surrounding the “Epstein files” has reached a fever pitch as the Department of Justice continues to un-redact millions of pages of internal records. Among the most explosive revelations are detailed email exchanges between Ghislaine Maxwell and Jeffrey Epstein that directly name supermodel Naomi Campbell. While Campbell has long maintained she was a peripheral figure in Epstein’s world, the latest documents—including an explicit message where Maxwell allegedly offered “two playmates” for the model—have forced a national re-evaluation of her proximity to the criminal enterprise.

The Logistics of a High-Fashion Connection

The declassified files provide a rare look into the operational relationship between the supermodel and the financier. Flight logs and internal staff emails from as late as 2016 show that Campbell’s travel was frequently subsidized by Epstein’s private fleet. In one exchange, Epstein’s assistants discussed the urgency of her travel requests, noting she had “no backup plan” and was reliant on his jet to reach international events.

This level of logistical coordination suggests a relationship built on significant mutual favors, contrasting with Campbell’s previous descriptions of him as just another face in the crowd.

In Her Own Words: The “Sickened” Response

Campbell has not remained silent as these files have surfaced, though her defense has been consistent for years. In a widely cited 2019 video response that has been recirculated amid the 2026 leaks, she stated, “What he’s done is indefensible. I’m as sickened as everyone else is by it.” When confronted with photos of herself at parties alongside Epstein and Maxwell, she has argued against the concept of “guilt by association,” telling the press:

She has further emphasized her stance by aligning herself with those Epstein harmed, stating,

“I stand with the victims. I’m not a person who wants to see anyone abused, and I never have been.””

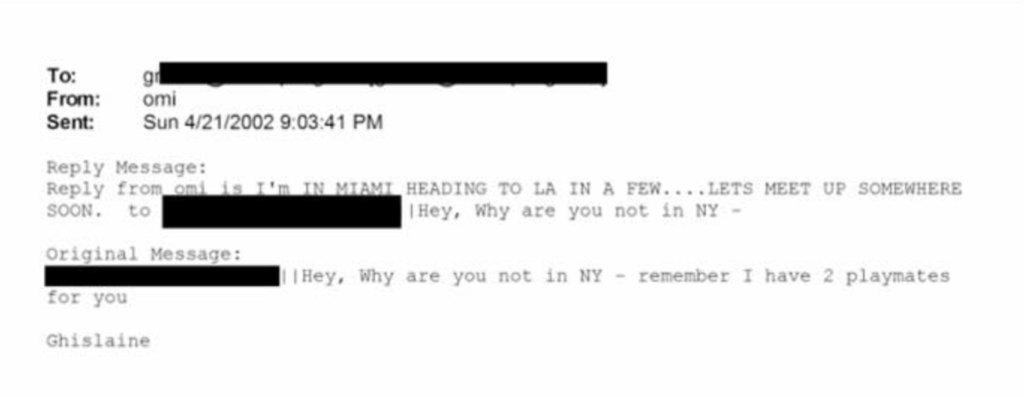

The Mystery of the “Two Playmates”

The most damaging piece of evidence in the recent 2026 release is an email where Maxwell reportedly tells Epstein she has “two playmates” ready for Campbell.

While the context of this “offer” remains a subject of intense debate—with some investigators suggesting it refers to the procurement of young women for social or sexual purposes—Campbell’s legal team has historically dismissed such claims as speculative. However, for a public already wary of elite power brokers, the specific wording used in these private DOJ records has created a “stop-the-scroll” moment that is proving difficult for the fashion icon to move past.

A Reputation at a Crossroads

As a trailblazer in the fashion industry, Campbell is now navigating a period where her professional achievements are being weighed against her presence in some of history’s most notorious social circles. The 2026 files don’t just name her; they place her within a broader system where modeling agents and scouts allegedly groomed young women under the guise of high-fashion opportunities. Whether these records prove a deeper complicity or simply illustrate the unavoidable overlap of the 1% remains the central question of the ongoing DOJ investigation.

Business

Google Accused Of Favoring White, Asian Staff As It Reaches $28 Million Deal That Excludes Black Workers

Google has tentatively agreed to a $28 million settlement in a California class‑action lawsuit alleging that white and Asian employees were routinely paid more and placed on faster career tracks than colleagues from other racial and ethnic backgrounds.

- A Santa Clara County Superior Court judge has granted preliminary approval, calling the deal “fair” and noting that it could cover more than 6,600 current and former Google workers employed in the state between 2018 and 2024.

How The Discrimination Claims Emerged

The lawsuit was brought by former Google employee Ana Cantu, who identifies as Mexican and racially Indigenous and worked in people operations and cloud departments for about seven years. Cantu alleges that despite strong performance, she remained stuck at the same level while white and Asian colleagues doing similar work received higher pay, higher “levels,” and more frequent promotions.

Cantu’s complaint claims that Latino, Indigenous, Native American, Native Hawaiian, Pacific Islander, and Alaska Native employees were systematically underpaid compared with white and Asian coworkers performing substantially similar roles. The suit also says employees who raised concerns about pay and leveling saw raises and promotions withheld, reinforcing what plaintiffs describe as a two‑tiered system inside the company.

Why Black Employees Were Left Out

Cantu’s legal team ultimately agreed to narrow the class to employees whose race and ethnicity were “most closely aligned” with hers, a condition that cleared the path to the current settlement.

The judge noted that Black employees were explicitly excluded from the settlement class after negotiations, meaning they will not share in the $28 million payout even though they were named in earlier versions of the case. Separate litigation on behalf of Black Google employees alleging racial bias in pay and promotions remains pending, leaving their claims to be resolved in a different forum.

What The Settlement Provides

Of the $28 million total, about $20.4 million is expected to be distributed to eligible class members after legal fees and penalties are deducted. Eligible workers include those in California who self‑identified as Hispanic, Latinx, Indigenous, Native American, American Indian, Native Hawaiian, Pacific Islander, and/or Alaska Native during the covered period.

Beyond cash payments, Google has also agreed to take steps aimed at addressing the alleged disparities, including reviewing pay and leveling practices for racial and ethnic gaps. The settlement still needs final court approval at a hearing scheduled for later this year, and affected employees will have a chance to opt out or object before any money is distributed.

H2: Google’s Response And The Broader Stakes

A Google spokesperson has said the company disputes the allegations but chose to settle in order to move forward, while reiterating its public commitment to fair pay, hiring, and advancement for all employees. The company has emphasized ongoing internal audits and equity initiatives, though plaintiffs argue those efforts did not prevent or correct the disparities outlined in the lawsuit.

For many observers, the exclusion of Black workers from the settlement highlights the legal and strategic complexities of class‑action discrimination cases, especially in large, diverse workplaces. The outcome of the remaining lawsuit brought on behalf of Black employees, alongside this $28 million deal, will help define how one of the world’s most powerful tech companies is held accountable for alleged racial inequities in pay and promotion.

Advice7 days ago

Advice7 days agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Entertainment4 weeks ago

Entertainment4 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry4 weeks ago

Film Industry4 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Entertainment3 weeks ago

Entertainment3 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Business2 weeks ago

Business2 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

News4 weeks ago

News4 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Business2 weeks ago

Business2 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Film Industry7 days ago

Film Industry7 days agoWhy Burnt-Out Filmmakers Need to Unplug Right Now