Entertainment

Now That You Won at the Film Festival: What’s Next?

Winning at a film festival is a monumental achievement, marking a significant milestone in a filmmaker’s career. However, the journey doesn’t end there—it’s just the beginning of a new chapter filled with opportunities and challenges. Here’s a comprehensive guide on what to focus on next, including real-world examples and insights from festivals like the Houston Comedy Film Festival.

1. Build and Strengthen Relationships

Winning a festival gives you credibility, but maintaining and expanding your network is essential for long-term success.

- Engage with Industry Professionals: Use your win as leverage to connect with producers, distributors, and collaborators. Attend mixers, panels, and Q&A sessions to meet key players in the industry. For instance, the Houston Comedy Film Festival offers panel discussions featuring leading figures from various disciplines within the film industry, including distributors and media representatives.

- Follow Up Strategically: After meeting contacts at the festival, send personalized follow-up emails or messages thanking them for their time and expressing interest in collaboration. Highlight your win as proof of your talent and dedication.

- Collaborate with Fellow Filmmakers: Building friendships with peers often leads to collaborations and opens doors to new opportunities. For example, attending workshops or peer-focused events at festivals like the Houston Comedy Film Festival can help you find future collaborators.

2. Maximize Distribution Opportunities

A festival win signals quality and marketability, making it easier to secure distribution deals.

- Prepare Your Materials: Ensure you have one-sheets, screening links, press kits, and a clear monetization strategy ready to present to potential buyers or partners. The Houston Comedy Film Festival, for instance, is open to submissions from around the world and offers a platform for filmmakers to showcase their work to industry professionals[4].

- Negotiate Collaboratively: Be open to adjustments during negotiations with distributors or production companies while protecting your creative vision. Focus on creating win-win scenarios that benefit all parties involved.

- Target Streaming Platforms: Streaming services are increasingly looking for award-winning films to add credibility to their catalogs. Use your win as leverage when pitching your film for distribution deals.

3. Enhance Visibility Through Strategic Promotion

Your award is a powerful marketing tool—use it effectively to boost your profile and attract new opportunities.

- Update Your Online Presence: Showcase your win prominently on your website, social media profiles, and press kit. Use festival hashtags and share behind-the-scenes content to engage audiences and industry professionals alike.

- Engage with Media Outlets: Reach out to local and industry press outlets with press releases or interviews about your win and future plans. Media coverage can amplify your visibility significantly.

- Submit to Other Festivals: A win at one festival often opens doors to others. Use this momentum to expand your reach by submitting your film to additional festivals that align with its themes and audience focus.

4. Plan Strategically for Future Projects

Winning a festival is just the beginning—use this moment as a stepping stone for what comes next in your filmmaking journey.

- Develop New Ideas: Start brainstorming concepts for your next project while the spotlight is still on you. Use the credibility of your win to attract investors or collaborators who want to be part of your success story. For example, winners at the Houston Comedy Film Festival have gone on to develop new projects, leveraging their win to secure funding or partnerships.

- Seek Funding Opportunities: Many festivals offer grants or funding programs for winners—explore these options as potential sources of financing for future projects.

- Join Advisory Programs: Some festivals provide mentorship opportunities or access to industry leaders who can guide you through the next stages of your career development.

5. Stay Flexible and Collaborative

While it’s important to stay true to your creative vision, filmmaking is inherently collaborative—adaptability is key when working with others in the industry.

- Be Open to Feedback: Constructive feedback from distributors, mentors, or collaborators can help refine your work for broader appeal without compromising its essence.

- Balance Vision with Practicality: Be willing to adjust certain aspects of your projects when necessary while ensuring that they align with market demands and audience expectations.

- Foster Goodwill Among Collaborators: Ensure that all parties involved—your team, partners, and collaborators—feel valued throughout the process.

Conclusion

Winning a film festival is an incredible achievement, but it’s also a launchpad for greater opportunities if approached strategically. By focusing on building meaningful relationships, leveraging distribution opportunities, enhancing visibility through promotion, planning ahead for future projects, and staying adaptable in collaborations, filmmakers can turn their festival success into sustained career growth. Festivals like the Houston Comedy Film Festival offer a platform for filmmakers to connect with industry professionals and showcase their work, making them an integral part of this journey. Remember that every step forward requires persistence, adaptability, and clear communication—not just with others but also within yourself about what you want from this journey. Your win is not the end—it’s the beginning of something much bigger!

Bolanle Media covers a wide range of topics, including film, technology, and culture. Our team creates easy-to-understand articles and news pieces that keep readers informed about the latest trends and events. If you’re looking for press coverage or want to share your story with a wider audience, we’d love to hear from you! Contact us today to discuss how we can help bring your news to life

Entertainment

When “Professional” Means Silent

Michael B. Jordan and Delroy Lindo did not walk onto the BAFTA stage expecting to become a case study in how the industry mishandles racism in real time. They were there to present, hit their marks, and do what award shows have always asked of Black talent: bring charisma, sell the moment, keep the night moving.

Instead, while they stood under the lights, a man in the audience shouted the N‑word. The word carried across the theater and through the broadcast. The cameras kept rolling. The teleprompter kept scrolling. And the two men at the center of it did what they’ve been trained their entire careers to do: they kept going.

The incident was shocking, but the pattern around it was familiar.

The Apologies That Came After the Credits

In the days that followed, BAFTA released a public apology. The organization said it took responsibility for putting its guests “in a very difficult situation,” acknowledged that the word used carries deep trauma, and apologized to Michael B. Jordan and Delroy Lindo. It also praised them for their “dignity and professionalism” in continuing to present.

The man who shouted the slur, a Tourette syndrome campaigner, explained that his outbursts are involuntary and expressed remorse for the pain his tic caused. That context about disability matters. Any honest conversation has to hold space for the reality that not every harmful word is spoken with intent.

But context doesn’t erase impact. For people watching at home—and especially for the men on that stage—the sequence was still the same: a slur detonated in the room, the show continued as if nothing happened, and the institutional response arrived later, in carefully crafted language.

Delroy Lindo summed up the experience by saying he and Jordan “did what we had to do,” and added that he wished someone from the organization had spoken with them directly afterward. That gap between polished statements and real‑time care is exactly where trust breaks down.

Who Is “Professionalism” Really Protecting?

Strip away the PR and a hard truth emerges: almost all of the pressure fell on the people who were harmed, not the people in charge.

On stage, “professionalism” meant Jordan and Lindo were expected to stay composed so the room wouldn’t be uncomfortable. Off stage, “professionalism” meant the institution focused on managing optics after the fact instead of disrupting the show in the moment.

That raises a question the industry rarely wants to confront:

When we call for professionalism, whose comfort are we protecting?

For Black artists, professionalism has too often meant:

- Take the hit and keep your face neutral.

- Don’t make it awkward for the audience or the brand.

- Don’t risk being labeled “difficult,” no matter how blatant the disrespect.

It’s easy to admire that composure. It’s harder to admit that the system routinely demands it from the very people absorbing the harm.

If It Can Happen There, It Can Happen Anywhere

This didn’t happen in a chaotic open mic or an unsupervised live stream. It happened at one of the most carefully produced film ceremonies in the world—an event with run‑of‑show documents, stage managers, and communication channels in everyone’s ears.

If an incident like this can unfold there without a pause, it can unfold anywhere:

- At a regional festival Q&A when an audience member crosses a line.

- At a comedy show when someone heckles with a “joke” that’s really just a slur.

- At a film panel where the only Black creator on stage gets a loaded question and is expected to smile through it.

The honest question for anyone who runs events isn’t “How could BAFTA let this happen?” It’s “What would we actually do if it happened in our room?”

Would your moderator know they have explicit permission to stop everything?

Would your team know who goes to the stage, who speaks to the audience, and who stays with the person targeted?

Or would you also be scrambling to get the language right in a statement tomorrow?

Redefining Professionalism in 2026

If this moment is going to mean anything, the definition of professionalism has to change.

Professionalism cannot just be “don’t lose your cool on stage.” It has to include the courage and structure to protect the people on that stage when something goes wrong.

A better standard looks like this:

- Pause the show when serious harm happens. A clean program is not more important than a person’s dignity.

- Acknowledge it in the room. Name what happened in clear terms instead of pretending it didn’t occur and quietly editing it later.

- Center the person targeted. Check on them, give them options, and let their comfort—not the schedule—drive the next move.

- Plan the response before you need it. Build safety and harassment protocols into your festival, awards show, or live event so no one is improvising under pressure.

Sometimes the most professional thing you can do is allow a little discomfort in the room. It signals that human beings matter more than the illusion of seamlessness.

The Standard Going Forward

Michael B. Jordan and Delroy Lindo did what they have always been rewarded for doing: they protected the show. They shouldn’t have had to.

True respect for their craft and humanity would have looked like a room that moved to protect them instead—stopping the script, resetting the energy, and making it clear that the problem wasn’t their reaction, but the harm they’d just absorbed.

No performer should be asked to choose between their dignity and their career. So if you work anywhere in this industry—onstage or behind the scenes—this incident quietly handed you a new baseline:

Call it out.

Pause the show.

Back the person who was harmed.

That’s what professionalism should mean in 2026.

Entertainment

These Movies Aren’t “True Crime for Fun”

When scandals and cover‑ups dominate the timeline, it’s tempting to process them the same way we process everything else online: as content.

A headline becomes a meme, a victim becomes a character, and a years‑long story of abuse or corruption gets flattened into a 30‑second clip. In that kind of environment, it matters what we choose to watch—and how we watch it.

Some films lean into shock and spectacle. Others slow us down, asking us to sit with the systems that make these stories possible in the first place.

This article is about that second group.

Below are three films that are difficult, necessary, and deeply relevant when we’re surrounded by conversations about power, silence, and who actually gets held accountable. They’re not “true crime for fun.” They are stories about people who push back: journalists digging through archives, lawyers refusing to look away, and insiders who decide that telling the truth matters more than staying comfortable.

Why movies about accountability matter right now

There’s a difference between consuming tragedy and engaging with it.

Scroll culture trains us to treat everything as a quick hit: outrage, reaction, move on. But systemic abuse and corruption don’t work on a 24‑hour cycle. They live in sealed files, non‑disclosure agreements, money, and relationships that make it easier to protect those in power than the people they harm. Films that focus on accountability rather than spectacle can do three important things:

- Slow our attention down long enough to see how cover‑ups are built—through policies, reputations, and quiet decisions, not just villains and heroes.

- Give us a closer look at the people trying to break those systems open: reporters, lawyers, whistleblowers, survivors, and community members.

- Help us recognize the patterns so that when a new scandal breaks, we have more than vibes and rumors to work with—we see mechanisms, not just headlines.

With that frame in mind, here are three films that are worth revisiting or discovering for the first time.

Spotlight: following the paper trail

Spotlight follows a small investigative team at a Boston newspaper as they uncover decades of child abuse inside the Catholic Church and the institutional effort to conceal it. It’s not flashy. There are no chase scenes, no “big twist.” The tension comes from phone calls that aren’t returned, doors that stay closed, and documents that may or may not exist. That’s the point.

The power of Spotlight is in its realism. The journalists don’t “win” through a single heroic act; they win through months of stubborn, often boring work—checking names, cross‑referencing records, going back to survivors who have every reason not to trust them. The film shows how systems protect themselves: not only through powerful leaders, but through a culture of looking away, minimizing harm, or deciding that “now isn’t the right time” to publish the truth.

Watching it in the context of any modern scandal is a reminder that revelations don’t come out of nowhere. Someone has to decide that the story is worth their career, their sleep, their peace. Someone has to keep calling.

Dark Waters: the cost of not looking away

In Dark Waters, a corporate defense lawyer discovers that a chemical company has been poisoning a community for years. The more he learns, the less plausible it becomes to stay on the side he’s paid to protect. What starts as a single client and a stack of records becomes a decades‑long fight against a corporation with far more money, influence, and time than he has.

The film is heavy—not because of graphic imagery, but because of the slow realization that this could happen anywhere. It shows how corporate harm doesn’t usually look like one dramatic event; it looks like small decisions, tolerated over time, because changing course would be expensive or embarrassing. Internal memos, risk calculations, and legal strategies become characters in their own right.

What makes Dark Waters important in this moment is the way it illustrates complicity. Very few people in the film set out to be “villains.” Many are simply doing their jobs, protecting their company, or choosing the convenient version of the truth. The story forces us to ask uncomfortable questions about where we draw our own lines—and what it costs to cross them.

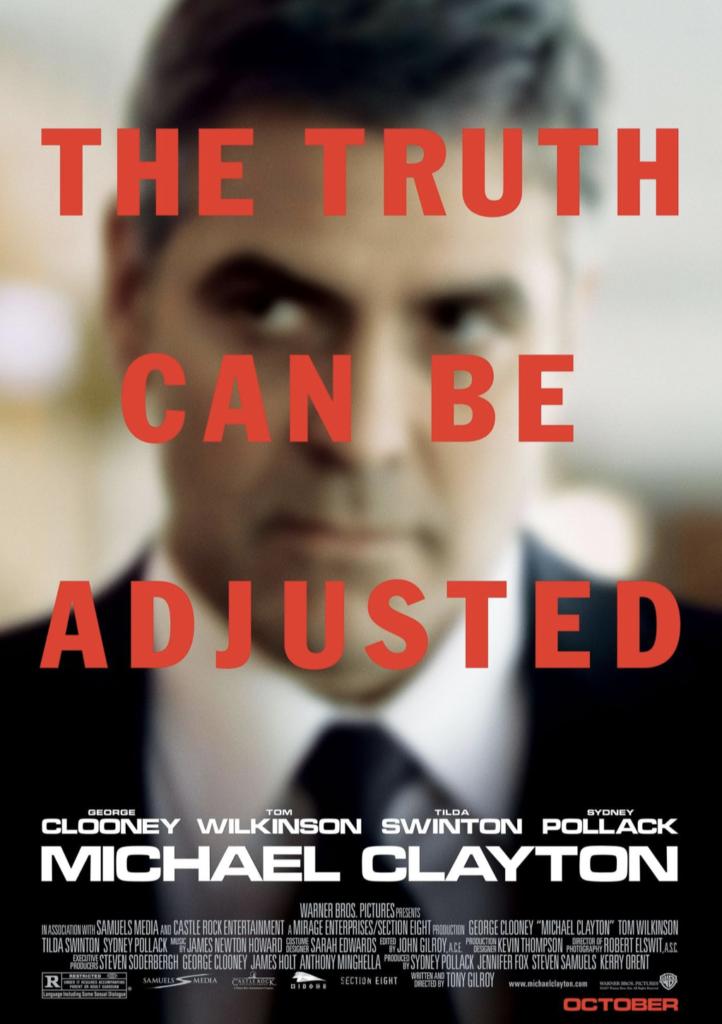

Michael Clayton: inside the clean‑up machine

If Spotlight looks at journalism and Dark Waters at corporate litigation, Michael Clayton focuses on the people whose job is to make problems disappear. The title character is a “fixer” at a prestigious law firm: he isn’t in court, and his name isn’t on the building, but he is the person they call when a client’s mess threatens to become public.

The film peels back the layers of how reputations are maintained. We see how language is used to soften reality—harm becomes “exposure,” victims become “plaintiffs,” and the goal is not necessarily to find the truth but to manage it. When Clayton begins to understand the scale of what his client has done, he faces a question at the core of a lot of modern scandals: what happens when someone inside the machine decides not to play their part anymore?

Michael Clayton is especially resonant when conversations online focus on “who knew” and “who helped.” It reminds us that entire careers and infrastructures exist to protect power and to make sure certain stories never catch fire in the first place.

How to watch these films with care

Because these movies deal with abuse, corruption, and betrayal, they can be emotionally heavy—especially for people who have personal experience with similar harms. A few ways to approach them thoughtfully:

- Check in with yourself before you press play. It’s okay to wait until you’re in a better headspace.

- Watch with someone you trust, or plan a debrief after. These aren’t background‑noise films; they merit conversation.

- Remember that survivors’ experiences are not plot devices. If a conversation about the movie starts turning into speculation or jokes about real people, you have permission to pull it back or step away.

The goal isn’t to turn real‑world pain into “content you can feel good about watching.” It’s to understand the systems around that pain more clearly and to keep our empathy intact.

Why sharing this kind of list matters

Sharing watchlists online can feel trivial, but small choices add up. When we recommend movies that take harm seriously, we’re nudging the culture in a different direction than the endless churn of sensational docuseries and clips built around shock value.

A thoughtful share says:

- I’m paying attention to the structures behind the headlines, not just the gossip.

- I’m interested in stories that center accountability, not just spectacle.

- I want our conversations to honor victims and the people fighting for the truth.

If you decide to post about these films, you don’t have to mention any specific scandal or case at all. You can simply say: “If you’re thinking a lot about power, silence, and cover‑ups right now, these are worth your time.” That alone can open up more grounded, respectful conversations than another round of speculation and rumor.

In a feed full of noise, choosing to highlight stories of persistence, investigation, and courage is its own quiet statement.

Business

How Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Jeffrey Epstein’s money did more than buy private jets and legal leverage. It flowed into the same ecosystem that decides which artists get pushed to the front, which research gets labeled “cutting edge,” and which stories about race and power are treated as respectable debate instead of hate speech. That doesn’t mean he sat in a control room programming playlists. It means his worldview seeped into institutions that already shape what we hear, see, and believe.

The Gatekeepers and Their Stains

The fallout around Casey Wasserman is a vivid example of how this works. Wasserman built a powerhouse talent and marketing agency that controls a major slice of sports, entertainment, and the global touring business. When the Epstein files revealed friendly, flirtatious exchanges between Wasserman and Ghislaine Maxwell, and documented his ties to Epstein’s circle, artists and staff began to question whose money and relationships were quietly underwriting their careers.

That doesn’t prove Epstein “created” any particular star. But it shows that a man deeply entangled with Epstein was sitting at a choke point: deciding which artists get representation, which tours get resources, which festivals and campaigns happen. In an industry built on access and favor, proximity to someone like Epstein is not just gossip; it signals which values are tolerated at the top.

When a gatekeeper with that history sits between artists and the public, “the industry” stops being an abstract machine and starts looking like a web of human choices — choices that, for years, were made in rooms where Epstein’s name wasn’t considered a disqualifier.

Funding Brains, Not Just Brands

Epstein’s interest in culture didn’t end with celebrity selfies. He was obsessed with the science of brains, intelligence, and behavior — and that’s where his money begins to overlap with how audiences are modeled and, eventually, how algorithms are trained.

He cultivated relationships with scientists at elite universities and funded research into genomics, cognition, and brain development. In one high‑profile case, a UCLA professor specializing in music and the brain corresponded with Epstein for years and accepted funding for an institute focused on how music affects neural circuits. On its face, that looks like straightforward philanthropy. Put it next to his email trail and a different pattern appears.

Epstein’s correspondence shows him pushing eugenics and “race science” again and again — arguing that genetic differences explain test score gaps between Black and white people, promoting the idea of editing human beings under the euphemism of “genetic altruism,” and surrounding himself with thinkers who entertained those frames. One researcher in his orbit described Black children as biologically better suited to running and hunting than to abstract thinking.

So you have a financier who is:

- Funding brain and behavior research.

- Deeply invested in ranking human groups by intelligence.

- Embedded in networks that shape both scientific agendas and cultural production.

None of that proves a specific piece of music research turned into a specific Spotify recommendation. But it does show how his ideology was given time, money, and legitimacy in the very spaces that define what counts as serious knowledge about human minds.

How Ideas Leak Into Algorithms

There is another layer that is easier to see: what enters the knowledge base that machines learn from.

Fringe researchers recently misused a large U.S. study of children’s genetics and brain development to publish papers claiming racial hierarchies in IQ and tying Black people’s economic outcomes to supposed genetic deficits. Those papers then showed up as sources in answers from large AI systems when users asked about race and intelligence. Even after mainstream scientists criticized the work, it had already entered both the academic record and the training data of systems that help generate and rank content.

Epstein did not write those specific papers, but he funded the kind of people and projects that keep race‑IQ discourse alive inside elite spaces. Once that thinking is in the mix, recommendation engines and search systems don’t have to be explicitly racist to reproduce it. They simply mirror what’s in their training data and what has been treated as “serious” research.

Zoomed out, the pipeline looks less like a neat conspiracy and more like an ecosystem:

- Wealthy men fund “edgy” work on genes, brains, and behavior.

- Some of that work revives old racist ideas with new data and jargon.

- Those studies get scraped, indexed, and sometimes amplified by AI systems.

- The same platforms host and boost music, video, and news — making decisions shaped by engagement patterns built on biased narratives.

The algorithm deciding what you see next is standing downstream from all of this.

The Celebrity as Smoke Screen

Epstein’s contact lists are full of directors, actors, musicians, authors, and public intellectuals. Many now insist they had no idea what he was doing. Some probably didn’t; others clearly chose not to ask. From Epstein’s perspective, the value of those relationships is obvious.

Being seen in orbit around beloved artists and cultural figures created a reputational firewall. If the public repeatedly saw him photographed with geniuses, Oscar winners, and hit‑makers, their brains filed him under “eccentric patron” rather than “dangerous predator.”

That softens the landing for his ideas, too. Race science sounds less toxic when it’s discussed over dinner at a university‑backed salon or exchanged in emails with a famous thinker.

The more oxygen is spent on the celebrity angle — who flew on which plane, who sat at which dinner — the less attention is left for what may matter more in the long run: the way his money and ideology were welcomed by institutions that shape culture and knowledge.

What to Love, Who to Fear

The point is not to claim that Jeffrey Epstein was secretly programming your TikTok feed or hand‑picking your favorite rapper. The deeper question is what happens when a man with his worldview is allowed to invest in the people and institutions that decide:

- Which artists are “marketable.”

- Which scientific questions are “important.”

- Which studies are “serious” enough to train our machines on.

- Which faces and stories are framed as aspirational — and which as dangerous.

If your media diet feels saturated with certain kinds of Black representation — hyper‑visible in music and sports, under‑represented in positions of uncontested authority — while “objective” science quietly debates Black intelligence, that’s not random drift. It’s the outcome of centuries of narrative work that men like Epstein bought into and helped sustain.

No one can draw a straight, provable line from his bank account to a specific song or recommendation. But the lines he did draw — to elite agencies, to brain and music research, to race‑obsessed science networks — are enough to show this: his money was not only paying for crimes in private. It was also buying him a seat at the tables where culture and knowledge are made, where the stories about who to love and who to fear get quietly agreed upon.

A Challenge to Filmmakers and Creatives

For anyone making culture inside this system, that’s the uncomfortable part: this isn’t just a story about “them.” It’s also a story about you.

Filmmakers, showrunners, musicians, actors, and writers all sit at points where money, narrative, and visibility intersect. You rarely control where the capital ultimately comes from, but you do control what you validate, what you reproduce, and what you challenge.

Questions worth carrying into every room:

- Whose gaze are you serving when you pitch, cast, and cut?

- Which Black characters are being centered — and are they full humans or familiar stereotypes made safe for gatekeepers?

- When someone says a project is “too political,” “too niche,” or “bad for the algorithm,” whose comfort is really being protected?

- Are you treating “the industry” as a neutral force, or as a set of human choices you can push against?

If wealth like Epstein’s can quietly seep into agencies, labs, and institutions that decide what gets made and amplified, then the stories you choose to tell — and refuse to tell — become one of the few levers of resistance inside that machine. You may not control every funding source, but you can decide whether your work reinforces a world where Black people are data points and aesthetics, or one where they are subjects, authors, and owners.

The industry will always have its “gatekeepers.” The open question is whether creatives accept that role as fixed, or start behaving like counter‑programmers: naming the patterns, refusing easy archetypes, and building alternative pathways, platforms, and partnerships wherever possible. In a landscape where money has long been used to decide what to love and who to fear, your choices about whose stories get light are not just artistic decisions. They are acts of power.

Advice2 weeks ago

Advice2 weeks agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Business3 weeks ago

Business3 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Entertainment4 weeks ago

Entertainment4 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Film Industry2 weeks ago

Film Industry2 weeks agoWhy Burnt-Out Filmmakers Need to Unplug Right Now

Business3 weeks ago

Business3 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Entertainment3 weeks ago

Entertainment3 weeks agoYou wanted to make movies, not decode Epstein. Too late.

News2 weeks ago

News2 weeks agoHarlem’s Hottest Ticket: Ladawn Mechelle Taylor Live

Business & Money4 weeks ago

Business & Money4 weeks agoGhislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her