News

Elon Musk Threatens to Ban Apple

The tech world is abuzz with Apple’s latest power move – integrating the advanced language model ChatGPT into its ecosystem of devices and operating systems. But this bold embrace of generative AI has drawn sharp criticism from none other than Elon Musk, the outspoken CEO of Tesla and SpaceX.

At its Worldwide Developers Conference (WWDC) 2024, Apple unveiled “Apple Intelligence” – a suite of AI-powered features aimed at enhancing user experiences across iPhone, iPad, and Mac devices. Central to this initiative is a partnership with OpenAI to incorporate ChatGPT technology into iOS 18, iPadOS, and macOS.

The goal? To leverage ChatGPT’s language capabilities for streamlining tasks, providing intelligent assistance, and offering a more seamless and intuitive experience to Apple’s massive user base. From writing emails to analyzing data, Apple envisions ChatGPT as a powerful co-pilot for its customers.

However, Elon Musk, whose xAI company recently raised $6 billion to take on OpenAI, has been vocal in expressing concerns about Apple’s ChatGPT integration plans. While some view his reaction as overblown, given his vested interests, Musk’s response highlights the ongoing debates around the ethical implications of deploying such powerful AI models at a consumer scale.

Musk has long warned about the potential risks of advanced AI systems, from existential threats to human society to more immediate issues like bias, privacy violations, and the perpetuation of misinformation. His stance underscores the need for responsible development and deployment of these technologies.

As generative AI continues its rapid advancement, the battle lines are being drawn between tech titans like Apple and Musk’s xAI. Their contrasting approaches – Apple’s embrace of ChatGPT versus Musk’s cautionary stance – reflect the polarizing perspectives on AI’s future.

One thing is certain: the discussions around the ethical and societal impacts of AI will only intensify as these technologies become more integrated into our daily lives. With industry leaders like Apple and Musk shaping the narrative, the future of AI remains a hotly contested frontier.

News

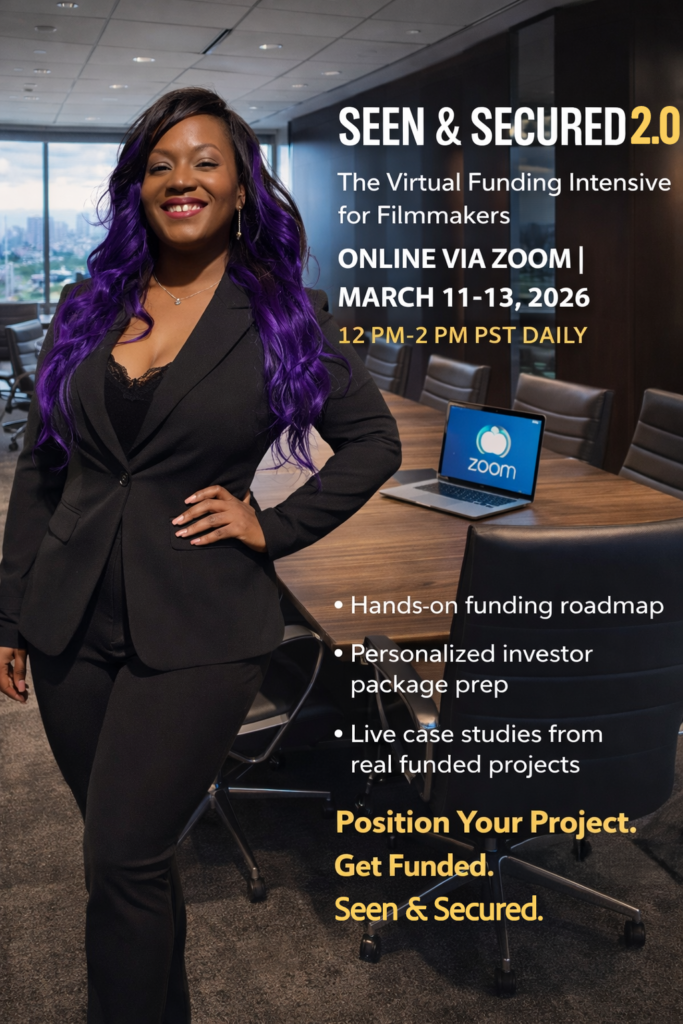

From Seen to Secured: How Filmmakers Are Owning Their Value

At Love My Productions, seen and secured are more than buzzwords — they are a creative and financial standard for how filmmakers deserve to move through the industry. Being seen speaks to visibility, voice, and representation on screen; being secured speaks to sustainability, strategy, and the ability to build a career that can weather industry shifts.

Together, they form the heartbeat of a mission led by Emmy-winning filmmaker and CEO Asha Chai-Chang, whose work centers filmmakers who have historically been underestimated or overlooked.

Love My Productions was born from Asha’s commitment to create the content and the conditions she didn’t see enough of: stories with strong, multidimensional characters and sets that are accessible, affirming, and inclusive by design.

As a first-generation Afro-Latina and Caribbean-Asian creative with disabilities and a background in finance, she bridges worlds that rarely meet — the emotional power of storytelling and the practical rigor of financial strategy.

That unique blend shapes everything the company does, from producing award-winning films to mentoring filmmakers on how to build their own “creative economies” instead of waiting for permission.

Being seen at Love My Productions means more than getting a film into a festival; it means stories that reflect the fullness of communities — across disability, culture, language, and identity — and casting and crews that mirror that depth. Asha’s projects, like Cruise Control, Spoiler Alert, A.V.G, and Marque Dos, have reached Oscar-qualifying and NAACP-recognized platforms, but their impact is measured as much by who they center as by where they screen.

Each project quietly reinforces a core belief: when filmmakers see their own value, they are more likely to claim space, negotiate fairly, and create work that doesn’t shrink to fit outdated expectations.

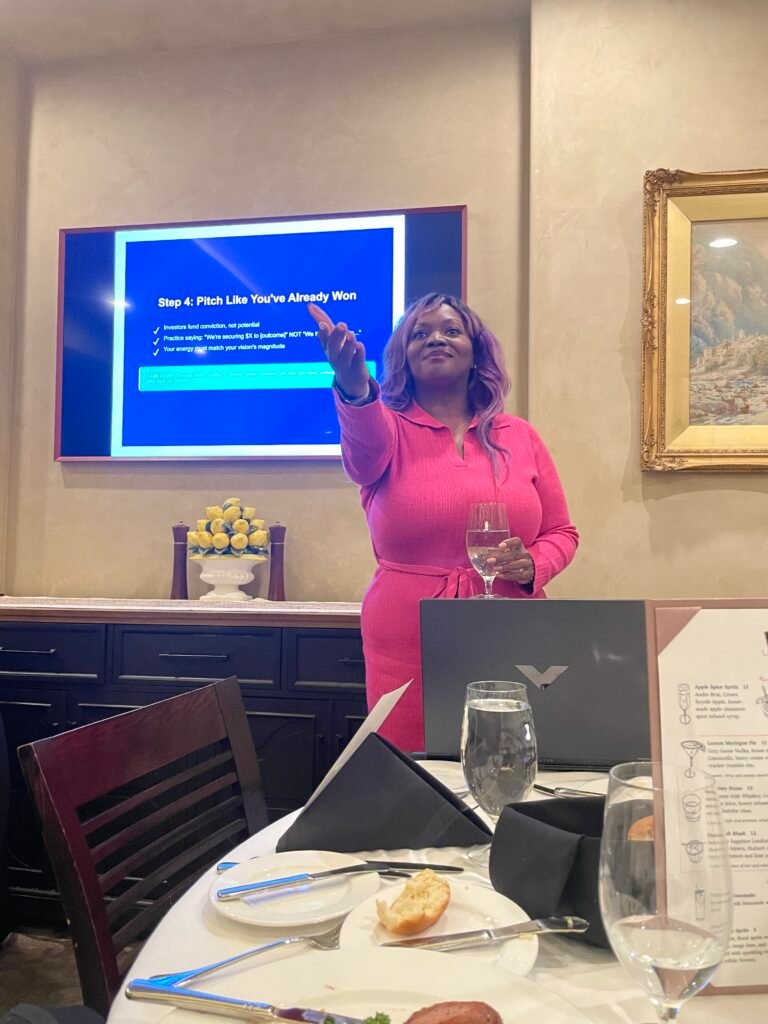

Being secured means that same filmmaker has the tools, language, and strategy to sustain that vision over time. Drawing on years as a finance professional and risk manager, Asha helps creatives understand that funding, partnerships, and deal structures are not separate from their artistry — they are extensions of it. Through education, intensives, and one-on-one guidance, Love My Productions supports filmmakers in learning how to talk to investors, design realistic budgets, and build long-term plans that align with both their values and their audiences.

Ultimately, From Seen to Secured is the story of what happens when filmmakers stop treating their worth as negotiable and start treating their careers as ecosystems they can thoughtfully design. Love My Productions exists as both proof and pathway: proof that a disabled, Afro-Latina, Caribbean-Asian filmmaker can lead an Emmy-winning, Netflix-supported career on her own terms, and a pathway for others to do the same.

Under Asha Chai-Chang’s leadership, the company invites filmmakers not just to be visible in the frame, but to be structurally supported behind it — owning their value, their voice, and their future.

News

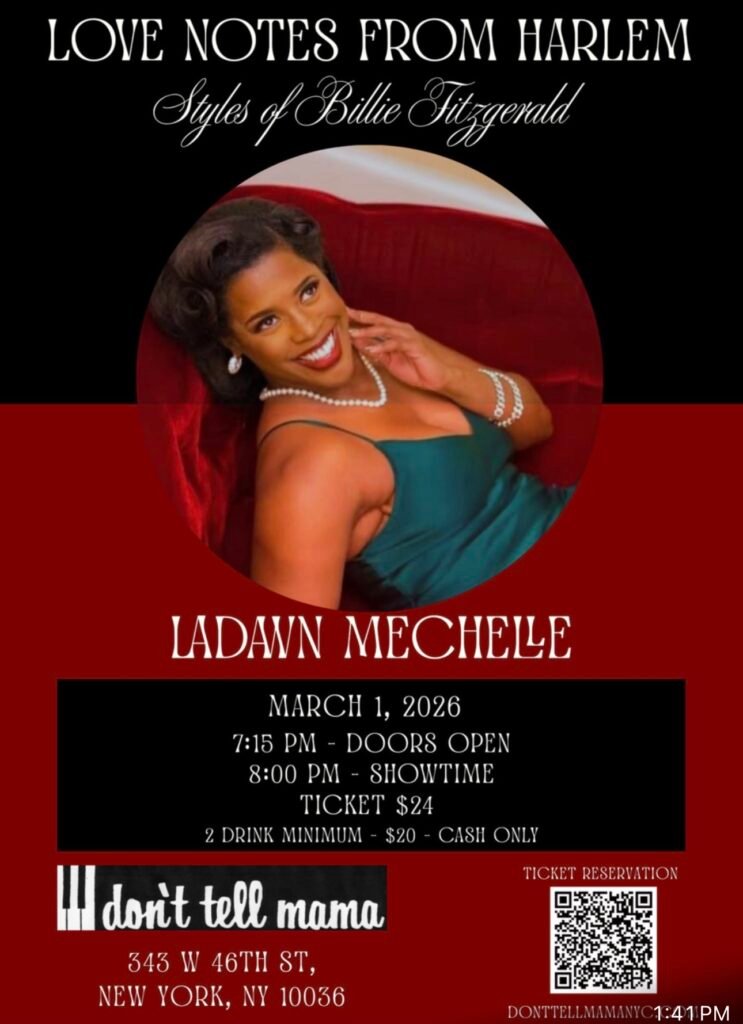

March 1 in NYC: Love Notes From Harlem at Don’t Tell Mama

Harlem doesn’t always announce its biggest nights in advance—but when it does, you can feel it in the air. Love Notes From Harlem: Styles of Billie Fitzgerald was born in Harlem, tested by a snowstorm, and now arrives for one special night at legendary cabaret club Don’t Tell Mama in Hell’s Kitchen on March 1, 2026. After weather forced the original Room 623 dates to be postponed, LaDawn Mechelle Taylor refused to treat it as a setback. She calls the storm a plot twist—one that shut the show down in Harlem and pushed her to bring the project back stronger, on a new stage, with the same heartbeat: a love letter from Harlem to the world.

Event details: March 1, 2026 – Don’t Tell Mama NYC

– Show: LaDawn Mechelle – Love Notes From Harlem (Styles of Billie Fitzgerald)

– Date: Sunday, March 1, 2026

– Venue: Don’t Tell Mama NYC, 343 W 46th St, New York, NY 10036

– Seating from: 7:15 p.m.

– Showtime: 8:00 p.m. – approximately 9:30 p.m.

– Cover charge: 24.00 USD

– Minimum: 20 USD per person (must include 2 drinks)

– Payment: Cash only

– Food menu available during the show

This is a classic New York cabaret night: intimate tables, full bar, and a powerhouse vocalist close enough for you to feel every note.

A love note that keeps moving

LaDawn has earned the nickname “Queen of Switch Up” from people who know her best. When snow hit and the original Harlem dates had to be cancelled, she did not fold. She pivoted. What began at Room 623—created for and inspired by Harlem—is now stepping into a Midtown room without losing its roots.

Love Notes From Harlem is built as a storytelling concert: LaDawn, backed by live musicians, honoring Ella Fitzgerald, Ertha Kit, Bessie Smith, Ma Rainey, Nat King Cole and others while weaving her own journey through songs and stories. It is Harlem’s soul transported to Restaurant Row for one night only.

What people close to LaDawn are saying..

From her mother, Rosalind Turner:

“My diva daughter LaDawn has totally lived her unforgettable dreams and she will never stop what she believes in. I am one great big fan of hers. She is the one who will ride through any rain, sleet, or snowstorm. I am a witness, and I know she has weathered a big storm by not giving up. She was forced to cancel a recent show and picked right back up the very next one. The girl is a realist.”

From Angela Strauman, NYC‑based actor and award‑winning writer in theater, television, and film, who joins the show:

Angela Strauman is “so grateful to be part of such a talented crew led by the marvelous LaDawn Mechelle.”

When LaDawn asked her to join the show to help represent the relationship between Marilyn Monroe and Ella Fitzgerald, she was beyond excited. She notes that multi‑racial friendships are rarely represented or portrayed in media, and that showing such a positive, supportive relationship between two friends…

…“in a time when there was such a divide, not unlike today, is such a great reminder that love and support will always win.”

These perspectives make it clear: this is not just another gig. It is community, legacy, and risk‑taking onstage.

From Disney princess to Harlem storyteller…

LaDawn’s path to this moment covers a lot of ground. She has immersed herself in performance at every level—from playing Disney’s first Black American princess, Tiana, to leading Whitney Houston tribute shows and singing from the heart at New York venues. She has proven she can carry iconic material and still sound unmistakably like herself.

In Love Notes From Harlem, she turns that experience inward: honoring the artists who shaped her, lifting up Harlem’s sound, and telling the story of a Black woman who refuses to stop moving forward, no matter the weather.

Why you should be in the room

If you love Harlem’s musical history, Black women headlining their own stories, intimate New York rooms where the singers really sing, and shows that feel like you are being transported to another era, then March 1 at Don’t Tell Mama is not the night to skip.

Love Notes From Harlem: Styles of Billie Fitzgerald is the kind of show friends talk about long after the last note—and the kind of performance you will be glad you caught before it moves on to even bigger rooms.

Learn more about Ladawn by watching her interview below:

News

Idris Elba’s Multimillion-Dollar Film Studio Is Coming to Ghana

British actor and producer Idris Elba is moving ahead with plans to establish a state-of-the-art film studio and creative hub in Accra, Ghana, in a move industry observers say could significantly boost the country’s screen sector and the wider African film ecosystem.

The multimillion-dollar complex is planned for a 22-acre site near Osu Castle in Accra and is expected to combine full production facilities with a strong talent development component.

The project has been described as both a studio and a training ground, aimed at equipping Ghanaian and African creatives with world-class skills across directing, production, cinematography, post-production, and related disciplines.

Elba, whose work spans blockbuster franchises and prestige television, has been vocal about his commitment to building sustainable film infrastructure on the continent rather than limiting engagement to short-term shoots. The Ghana studio forms part of a broader vision to position Africa as a competitive production destination, with facilities capable of servicing both local storytellers and international productions.

Industry analysts note that many African filmmakers continue to face structural challenges, including limited access to purpose-built sound stages, modern post-production services, and consistent training pathways. By situating a major creative hub in Accra, the initiative is expected to address some of these gaps, create employment opportunities, and attract higher-budget projects to Ghana.

The planned studio is also being framed as a catalyst for economic growth, with potential knock-on benefits for tourism, hospitality, and ancillary services that support film and television production. Local stakeholders have welcomed the development as a sign of growing confidence in Ghana’s creative economy and its ability to compete on a global stage.

Early reaction across social and traditional media has highlighted enthusiasm among filmmakers, actors, and young creatives who see the project as a landmark investment in African talent. As plans progress, further details on the construction timeline, partners, and specific training programs are expected to be announced.

There are videos circulating online showing Idris Elba discussing and outlining his vision for the Ghana studio project, including interview segments and news features that provide additional context and visual coverage of the announcement.

Advice2 weeks ago

Advice2 weeks agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Business3 weeks ago

Business3 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Film Industry2 weeks ago

Film Industry2 weeks agoWhy Burnt-Out Filmmakers Need to Unplug Right Now

Business4 weeks ago

Business4 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Entertainment3 weeks ago

Entertainment3 weeks agoYou wanted to make movies, not decode Epstein. Too late.

Business & Money4 weeks ago

Business & Money4 weeks agoGhislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her

News2 weeks ago

News2 weeks agoHarlem’s Hottest Ticket: Ladawn Mechelle Taylor Live

News2 weeks ago

News2 weeks agoHow Misinformation Overload Breaks Creative Focus