Film Industry

Disney Brings Beloved Characters to ChatGPT After $1 Billion OpenAI Deal

Disney is deepening its push into artificial intelligence with a $1 billion investment in OpenAI, the company behind ChatGPT, in a far-reaching deal that will also license Disney’s iconic characters for use within OpenAI’s new conversational AI platform, Sora.

The agreement positions Disney at the forefront of the entertainment industry’s growing intersection with generative AI, blending the company’s extensive character library with OpenAI’s advanced technology. Under the terms of the partnership, OpenAI will deploy select Disney intellectual property — spanning its animation classics, Pixar, Marvel, and Lucasfilm — across AI-driven storytelling and interactive experiences within ChatGPT Sora.

Sources familiar with the rollout say users will be able to engage directly with Disney characters through immersive dialogues powered by Sora, with potential extensions into digital parks, virtual assistants, and cross-platform storytelling initiatives.

A limited launch is expected to debut in 2026 as Disney explores new ways to integrate AI into consumer experiences.

“This collaboration continues Disney’s legacy of innovation, combining our storytelling heritage with cutting-edge technology to reach audiences in remarkable new ways,” said Disney CEO Bob Iger in a statement.

For OpenAI, Disney’s backing represents both a financial boost and a creative endorsement from one of the world’s most influential content companies. The partnership could accelerate mainstream adoption of AI entertainment tools while positioning ChatGPT Sora as a leader in branded and interactive media spaces.

The investment also signals an industry-wide shift as studios seek to capture value in AI-driven content creation, distribution, and personalization. With Disney’s move, legacy media joins a growing list of entertainment heavyweights aligning with AI firms to future-proof storytelling — marking what could be a pivotal step in Hollywood’s technological reinvention.

Film Industry

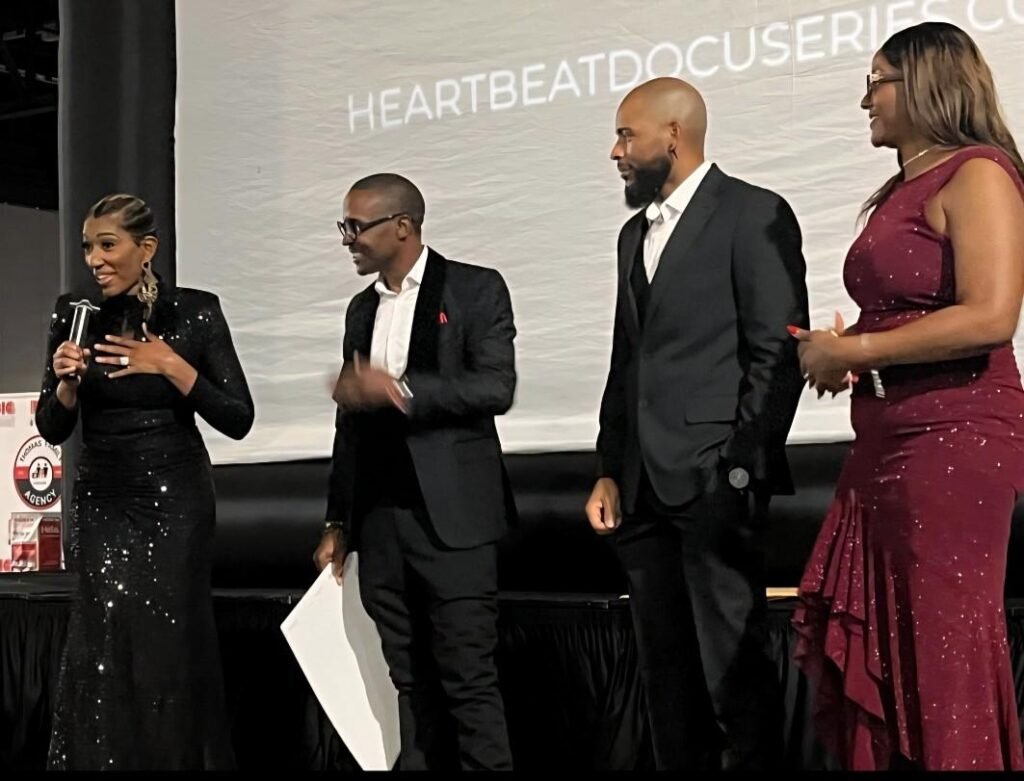

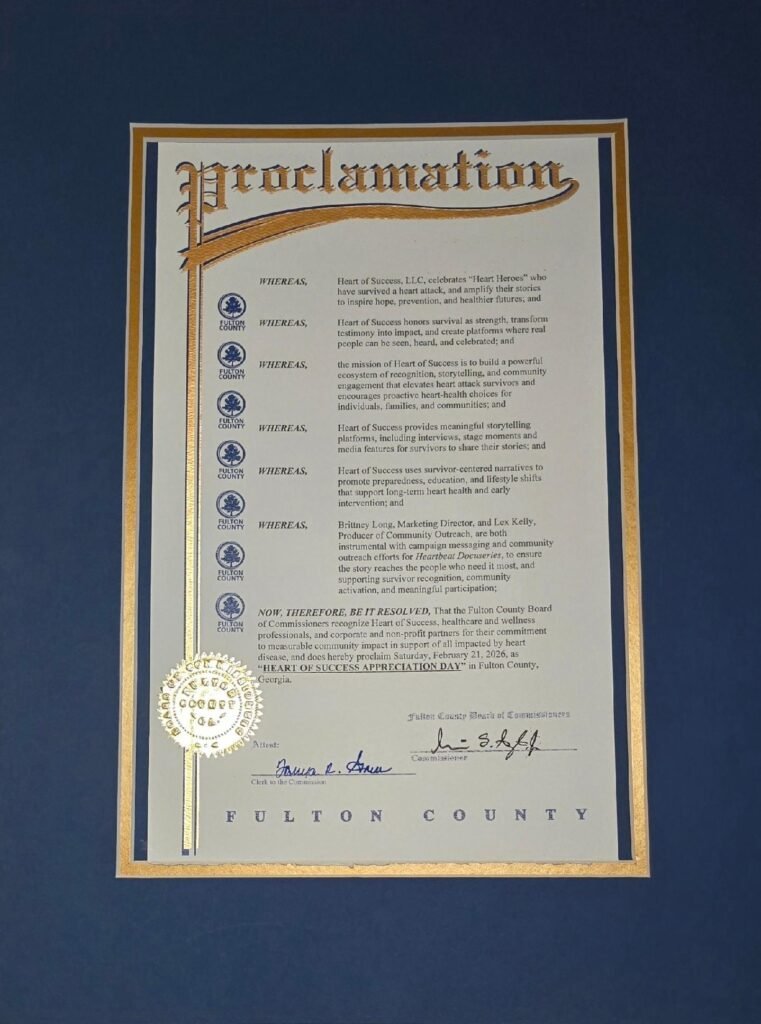

Dr. Ric Mathis Turns a Film Screening Into a Lifesaving Movement With Heartbeat

One person dies every 34 seconds from cardiovascular disease in the United States. That statistic opened the evening—and by the time the lights came back on, it had changed the way an entire room thought about their own.

Dr. Ric Mathis, the internationally recognized filmmaker known as the “Documentary King,” brought his latest docuseries Heartbeat to a packed screening event that was equal parts cinema, community gathering, and public health intervention. What unfolded was more than a premiere—it was a moment that could genuinely save lives.

A Silent Killer Meets a Powerful Storyteller

Heart disease is the leading cause of death in the United States, killing more Americans than all forms of cancer and accidental deaths combined. In 2022 alone, cardiovascular disease claimed about 941,652 lives nationwide. Yet for all its devastation, heart disease often arrives without warning: in the U.S., someone has a heart attack every 40 seconds, and about 1 in 5 of those heart attacks is “silent” — the damage is done, but the person doesn’t even know it.

That invisible danger is exactly what Heartbeat confronts head-on. From the opening seconds of the trailer—“I didn’t even see this thing coming. It was silent. It was sudden. And for many of us… it’s deadly.”—the audience is pulled into the harrowing, first-person accounts of survivors who came within moments of losing everything. One survivor describes their actual heart being placed on ice while their fate hung in the balance. The silence in the room says it all: this is no longer a statistic on a screen; it is a mirror.

The Numbers That Shook the Room

Dr. Mathis doesn’t just tell a story—he arms his audience with facts that demand action:

- In the United States, someone has a heart attack every 40 seconds.newsroom.heart+1

- Roughly 805,000 heart attacks occur in the U.S. each year; 605,000 of them are first-time events.

- More than 350,000 people experience cardiac arrest outside a hospital annually, and only about 10% survive, even with paramedic treatment.

- Cardiovascular disease costs the U.S. an estimated hundreds of billions of dollars in direct and indirect costs every year.

These numbers land differently when paired with the faces and voices in the documentary. Attendees described seeing their parents, their partners, and even themselves in the stories on screen.

A Wake-Up Call for Black Communities

The screening carries particular weight for the Black community, where the stakes are even higher.

Black Americans are about 30% more likely to die from heart disease than white Americans.

Black men face a significantly higher risk of developing heart failure compared with white men. African Americans also have some of the highest rates of uncontrolled hypertension in the world, dramatically increasing their risk of heart disease and stroke.

A major Tulane University study found that Black Americans are 54% more likely to die from cardiovascular disease, and that this disparity is driven largely by social determinants of health such as unemployment, low income, food insecurity, and lack of access to care. When researchers adjusted for these social factors, the racial gap in cardiovascular deaths completely disappeared.

This is the injustice Heartbeat refuses to let audiences ignore. Dr. Mathis uses the post-screening conversation to connect the dots between systemic inequality and the heart attacks happening in neighborhoods across the country—turning grief into understanding, and understanding into action.

From Screening Room to Doctor’s Office

What sets this event apart is how Dr. Mathis blends powerful storytelling with real-world solutions. Following the film, he leads a candid panel discussion with medical professionals and heart attack survivors, covering symptoms, prevention strategies, and often-overlooked warning signs—especially in communities where trust in healthcare has been historically broken.

The results are immediate and tangible:

- Guests sign up for health screenings on the spot.

- Attendees pledge to schedule overdue medical appointments.

- Clips and quotes from the film flood social media, turning one screening into a living awareness campaign.

- Multiple guests say the film “might have just saved my life.”

- Others commit to sharing Heartbeat with their families, churches, and community organizations.

As many cardiologists note, too many patients—particularly Black patients—see a heart specialist only after they’ve had a cardiac event. Heartbeat is designed to reverse that pattern by making prevention feel urgent and personal.

More Than a Film—A Movement

Dr. Ric Mathis has spent more than two decades using the screen as a tool for empowerment—from his acclaimed Black Friday documentary series to the biographical film Bo Legs and his financial literacy work through Rich Kid Society. With Heartbeat, he has extended that mission into the most intimate territory yet: keeping people alive.

The success of this screening is not measured in ticket sales alone. It is measured in the quiet decisions people make afterward—to get checked, to change a habit, to have a difficult conversation about health, to stop ignoring warning signs. In a country where heart disease is responsible for roughly 1 in every 3 deaths, and where the first symptom can sometimes be the last, awareness is not optional—it is survival.

If even one life is saved because someone sat in that theater and decided to take action, then Heartbeat has done exactly what it was created to do.

Entertainment

When “Professional” Means Silent

Michael B. Jordan and Delroy Lindo did not walk onto the BAFTA stage expecting to become a case study in how the industry mishandles racism in real time. They were there to present, hit their marks, and do what award shows have always asked of Black talent: bring charisma, sell the moment, keep the night moving.

Instead, while they stood under the lights, a man in the audience shouted the N‑word. The word carried across the theater and through the broadcast. The cameras kept rolling. The teleprompter kept scrolling. And the two men at the center of it did what they’ve been trained their entire careers to do: they kept going.

The incident was shocking, but the pattern around it was familiar.

The Apologies That Came After the Credits

In the days that followed, BAFTA released a public apology. The organization said it took responsibility for putting its guests “in a very difficult situation,” acknowledged that the word used carries deep trauma, and apologized to Michael B. Jordan and Delroy Lindo. It also praised them for their “dignity and professionalism” in continuing to present.

The man who shouted the slur, a Tourette syndrome campaigner, explained that his outbursts are involuntary and expressed remorse for the pain his tic caused. That context about disability matters. Any honest conversation has to hold space for the reality that not every harmful word is spoken with intent.

But context doesn’t erase impact. For people watching at home—and especially for the men on that stage—the sequence was still the same: a slur detonated in the room, the show continued as if nothing happened, and the institutional response arrived later, in carefully crafted language.

Delroy Lindo summed up the experience by saying he and Jordan “did what we had to do,” and added that he wished someone from the organization had spoken with them directly afterward. That gap between polished statements and real‑time care is exactly where trust breaks down.

Who Is “Professionalism” Really Protecting?

Strip away the PR and a hard truth emerges: almost all of the pressure fell on the people who were harmed, not the people in charge.

On stage, “professionalism” meant Jordan and Lindo were expected to stay composed so the room wouldn’t be uncomfortable. Off stage, “professionalism” meant the institution focused on managing optics after the fact instead of disrupting the show in the moment.

That raises a question the industry rarely wants to confront:

When we call for professionalism, whose comfort are we protecting?

For Black artists, professionalism has too often meant:

- Take the hit and keep your face neutral.

- Don’t make it awkward for the audience or the brand.

- Don’t risk being labeled “difficult,” no matter how blatant the disrespect.

It’s easy to admire that composure. It’s harder to admit that the system routinely demands it from the very people absorbing the harm.

If It Can Happen There, It Can Happen Anywhere

This didn’t happen in a chaotic open mic or an unsupervised live stream. It happened at one of the most carefully produced film ceremonies in the world—an event with run‑of‑show documents, stage managers, and communication channels in everyone’s ears.

If an incident like this can unfold there without a pause, it can unfold anywhere:

- At a regional festival Q&A when an audience member crosses a line.

- At a comedy show when someone heckles with a “joke” that’s really just a slur.

- At a film panel where the only Black creator on stage gets a loaded question and is expected to smile through it.

The honest question for anyone who runs events isn’t “How could BAFTA let this happen?” It’s “What would we actually do if it happened in our room?”

Would your moderator know they have explicit permission to stop everything?

Would your team know who goes to the stage, who speaks to the audience, and who stays with the person targeted?

Or would you also be scrambling to get the language right in a statement tomorrow?

Redefining Professionalism in 2026

If this moment is going to mean anything, the definition of professionalism has to change.

Professionalism cannot just be “don’t lose your cool on stage.” It has to include the courage and structure to protect the people on that stage when something goes wrong.

A better standard looks like this:

- Pause the show when serious harm happens. A clean program is not more important than a person’s dignity.

- Acknowledge it in the room. Name what happened in clear terms instead of pretending it didn’t occur and quietly editing it later.

- Center the person targeted. Check on them, give them options, and let their comfort—not the schedule—drive the next move.

- Plan the response before you need it. Build safety and harassment protocols into your festival, awards show, or live event so no one is improvising under pressure.

Sometimes the most professional thing you can do is allow a little discomfort in the room. It signals that human beings matter more than the illusion of seamlessness.

The Standard Going Forward

Michael B. Jordan and Delroy Lindo did what they have always been rewarded for doing: they protected the show. They shouldn’t have had to.

True respect for their craft and humanity would have looked like a room that moved to protect them instead—stopping the script, resetting the energy, and making it clear that the problem wasn’t their reaction, but the harm they’d just absorbed.

No performer should be asked to choose between their dignity and their career. So if you work anywhere in this industry—onstage or behind the scenes—this incident quietly handed you a new baseline:

Call it out.

Pause the show.

Back the person who was harmed.

That’s what professionalism should mean in 2026.

Film Industry

Why Burnt-Out Filmmakers Need to Unplug Right Now

If you’re reading this at 2 AM, scrolling through industry news instead of writing your script, you already know something’s wrong.

You’re not lazy. You’re not untalented. You’re burnt out—and you’re far from alone.

The Numbers Don’t Lie

87% of film and TV workers are facing mental health challenges right now. 62% of creators report burnout, with 65% constantly obsessing over content performance. Even more alarming: 1 in 10 creators experience suicidal thoughts—nearly twice the rate of the general population.

But here’s what the statistics don’t capture: the paralysis. The endless scrolling. The “should I make a feature or pivot to vertical shorts?” loop that keeps you stuck for months. The guilt of watching tutorials instead of shooting. The way political chaos and industry upheaval make creating feel pointless.

The Trap You’re In

You’re waiting. Waiting for the algorithm to make sense. Waiting for the industry to be “fair” again. Waiting for the perfect format, the right budget, the ideal moment when your head is finally clear enough to make something worthy.

That moment isn’t coming.

The filmmakers you admire didn’t wait for perfect conditions. They made their breakthrough films during recessions, pandemics, personal crises, and industry chaos. The only difference between them and you right now? They gave themselves permission to create imperfectly.

Why Now Is Actually the Perfect Time

The industry’s chaos is real, but it’s also created an opening. Streaming platforms are hungry for authentic stories. Independent films are driving growth in the global film market. In 2026, filmmakers with deep trust in a niche have more power than studios chasing mass appeal.

But none of that matters if you’re too exhausted to pick up a camera.

The 3-Day Reset

Here’s what actually helps when you’re stuck:

Day 1: News blackout during creative hours. Not forever. Just when you’re supposed to be creating. The world will still be chaotic tomorrow—but you’ll have protected the only hours that matter for your art.

Day 2: Pick one format. Just one. Feature, shorts, or vertical content—it doesn’t matter which. What matters is ending the analysis paralysis. Your first project won’t be your breakthrough anyway. It’ll be your fifth. So start.

Day 3: Make something imperfect this week. Not good. Not portfolio-worthy. Just made. A 60-second test. A rough scene. Anything that reminds you why you started doing this in the first place.

The Real Problem Isn’t Your Idea

You don’t have a creativity problem. You have an input-overload problem. Your brain is processing election cycles, algorithm changes, industry layoffs, and the constant pressure to “choose the right path” before you’re “allowed” to create.

But creativity doesn’t work on permission slips.

72% of film and TV professionals say the industry is not a mentally healthy place to work. 59% struggle to maintain any work-life balance. 50% face relentless, unrealistic timelines. The system is designed to burn you out.

Your response can’t be to wait for the system to fix itself. It has to be to protect your creative energy like it’s the most valuable resource you have—because it is.

What Happens If You Don’t Reset

The filmmakers who “wait for the right time” never make their films. They become the people who talk about the script they’re “working on” for five years. They’re the ones who know every piece of gear, every distribution strategy, every festival deadline—but have nothing to submit.

Don’t let information replace creation. Don’t let the news cycle steal your narrative.

Start Monday

Not when things calm down. Not when you figure out the perfect format. Not when the industry is “fair” again.

Monday. Imperfectly. With whatever you have.

Your story—messy, unpolished, and made anyway—is what the world needs right now. Not your perfectly researched plan. Not your anxiety about choosing wrong.

Your work.

The filmmakers who win in 2026 won’t be the ones who waited for permission. They’ll be the ones who created despite the noise, shipped despite the doubt, and remembered that done beats perfect every single time.

So take the weekend. Unplug from the chaos. Rest without guilt.

Then Monday morning, make something imperfect.

The industry doesn’t need you to wait until you’re ready. It needs you to start before you feel ready—and figure it out as you go.

That’s not reckless. That’s how every film you’ve ever loved actually got made.

If this hit home, you’re not alone. Thousands of independent filmmakers are choosing to create despite the overwhelm. Start your 3-day reset Monday. Your future self will thank you.

Advice2 weeks ago

Advice2 weeks agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Business3 weeks ago

Business3 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Entertainment4 weeks ago

Entertainment4 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Film Industry2 weeks ago

Film Industry2 weeks agoWhy Burnt-Out Filmmakers Need to Unplug Right Now

Business3 weeks ago

Business3 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Entertainment3 weeks ago

Entertainment3 weeks agoYou wanted to make movies, not decode Epstein. Too late.

Business & Money4 weeks ago

Business & Money4 weeks agoGhislaine Maxwell Just Told Congress She’ll Talk — If Trump Frees Her

News2 weeks ago

News2 weeks agoHarlem’s Hottest Ticket: Ladawn Mechelle Taylor Live