World News

As Better.com readies for its public debut, CEO Vishal Garg says he went through ‘a lot of leadership training’ on August 23, 2023 at 11:00 am

Online mortgage lender Better.com is making its public debut Thursday on the Nasdaq Capital Market under the ticker symbols “BETR” and “BETRW.”

After merging with SPAC Aurora Acquisition Corp., the combined entity is called Better Home & Finance Holding Company. The deal unlocks about $565 million of fresh capital for Better.com, including a $528 million convertible note from affiliates of SoftBank and additional common equity from funds affiliated with NaMa Capital (formerly Novator Capital) — an investment firm that sponsors Aurora.

The company could use the funds. Better.com posted a net loss of $89.9 million in the first quarter and slashed about 91% of its workforce over an approximately 18-month period. While the startup has narrowed its loss compared to a net loss of $327.7 million in the first quarter of 2022, it clearly still has been struggling amid high mortgage interest rates and a national housing market slowdown. The company also suffered significant damage to its reputation since December 2021, making the move from a private entity to a public one in this case is a particularly bold one. Better has made headlines for multiple botched layoffs, poor treatment of current and former employees, admitted financial missteps, high-profile executive departures and other allegations.

In a written statement, Arnaud Massenet, former CEO of Aurora and now a director of Better Home & Finance said: “I am proud of the role Aurora has played in bringing Better to the public market. When we launched Aurora in March 2021, we did so to find a high-quality, tech-focused, business disrupting the status quo in its sector. Through our business combination with Better, we have now successfully fulfilled that aim and, over the past two years, Aurora has worked to deliver over $1.3 billion to Better’s balance sheet. We believe this transaction will deliver long-term value for our shareholders and we look forward to being part of the next stage of this journey.”

Better touts that its Tinman platform, which the company describes as a unique “supervised learning model” in the mortgage business, allows it to service its customers “faster and cheaper due to less personnel overhead costs.” Specifically, Better claims that it offers home loans that are 45 bps (basis points) cheaper than other lenders on average, “saving customers 10s of thousands of dollars on a 30-year mortgage” and that it is the first fintech lender to do $100 billion in loans.

I recently sat down with Better.com CEO and co-founder Vishal Garg and Nick Calamari, former general counsel and chief administrative officer, to discuss the company’s foray into the public market and plans for the future.

This interview has been edited for brevity and clarity.

You’ve had plans to go public for two years. Did you ever reconsider going forward with a SPAC and not going public at all?

VG: I think honestly, there were a lot of times where we thought maybe we should try to do something private instead and/or stay private. But ultimately, we thought that with going public, the important thing is that we would get an additional $550 million of capital from SoftBank. And that capital would allow us to grow the business, to get rates cheaper to our customers, to prove our technology that makes our loan processing times even faster. And ultimately, we decided that being public and having access to that capital was a much better outcome than being a private company…I would be lying if I told you I didn’t have any jitters..

How is the company’s cash flow?

The company is still losing money. Interest rates went up a lot more than we expected. The mortgage market has shrunk a lot faster than we expected. And housing supply has been a lot more limited than we expected. So we went from creating this awesome company that was able to refinance mortgages and do 100 billion of them within a space of six or seven years to having to pivot really hard to doing purchase mortgages, and to try to get good at it within the space of 18 months. Ninety percent of our mortgages are now purchase mortgages.We really hard pivoted to do a different product, and we’ve had to focus on things that matter to the purchase mortgage customer like speed and certainty and ease of use, not just the thing that we were known for, which was lower rates. But we’ve taken $1 billion out of recurring costs. (Note: The company also says it has has decreased quarterly losses by 73% YoY).

What percentage of business was refinancing vs new purchase previously?

Previously, 90% of our business was refinances and 10% purchases. That has now flipped.

What are your revenue sources?

The places where we’re generating revenue today is our mortgage revenue – which is revenue from selling our mortgages to the institutional investor community, and through title insurance, homeowners insurance, realtor match, and then also through our UK platform. During the pandemic, we bought a mortgage lender and a bank in the United Kingdom. So we have an international revenue source as well.

What is your plan for the capital from SoftBank?

The goal is to effectively reinvigorate ourselves. Our goal is to be prudent and weather the storm still out there. Goldman Sachs economists forecast that rates will be coming back down in June of 2024. We’ll keep investing in technology that makes the process faster for our customers. Ultimately it’s still a pretty broken process, it takes 51 days for a consumer to get a mortgage. We’ve launched something called One-Day mortgage that would take the consumer from click to a commitment in one day. But then there’s still friction associated with getting titled, getting an appraisal, getting closed. We have a long way to go before we can make the process of being able to finance or refinance a home in one day. And that’s what we’re gunning for.

How many employees does Better.com currently have?

Just under 1,000.

How have you worked to rebuild trust within, and outside, the company?

A lot of leadership training. I think I was very mission-centric, customer centric, and really really focused on what it took to drive growth, And I think I’ve learned now that in order for our customers to be delighted, our teammates also have to feel delight. So I’ve worked really, really hard to change the way that I show up to the team every day, and to be more empathetic and to treat them with the same level of kindness that I showed our customers.

And then the second thing is we’ve continued to innovate on our mission, which is to make homeownership more affordable and more accessible, and ultimately the 1,000 people that are at Better.com today are driven not just by me but really by our mission which is to make homeownership more affordable and more accessible.

Do you anticipate having to conduct any more layoffs?

I can’t honestly tell you whether or not we have any layoffs in the future. I think a lot of that depends on the mortgage market. But we think that we’re appropriately staffed and actually we’re adding headcount in a variety of areas to drive growth.

How do you feel about the SEC’s determination from 10 days ago?

I was very positively relieved because we had always felt we did nothing wrong. It’s really great to see that outcome. I feel blessed to have this second chance to build this amazing company.

Are there still issues with laid-off employees not receiving unemployment?

NC: We did do some significant restructuring over the past 18 months and none of that always goes smoothly or perfectly. But I do think that we’ve done our best to try and treat all of our current and former employees with not just respect, but with care. And so yes, were there times where we needed to address certain problems like unemployment? Yes, but those were addressed and resolved and we’re going to continue to do that for everyone going forward, just like we have in the past.

Want more fintech news in your inbox? Sign up for The Interchange here.

Online mortgage lender Better.com is making its public debut Thursday on the Nasdaq Capital Market under the ticker symbols “BETR” and “BETRW.” After merging with SPAC Aurora Acquisition Corp., the combined entity is called Better Home & Finance Holding Company. The deal unlocks about $565 million of fresh capital for Better.com, including a $528 million

News

US May Completely Cut Income Tax Due to Tariff Revenue

President Donald Trump says the United States might one day get rid of federal income tax because of money the government collects from tariffs on imported goods. Tariffs are extra taxes the U.S. puts on products that come from other countries.

What Trump Is Saying

Trump has said that tariff money could become so large that it might allow the government to cut income taxes “almost completely.” He has also talked about possibly phasing out income tax over the next few years if tariff money keeps going up.

How Taxes Work Now

Right now, the federal government gets much more money from income taxes than from tariffs. Income taxes bring in trillions of dollars each year, while tariffs bring in only a small part of that total. Because of this gap, experts say tariffs would need to grow by many times to replace income tax money.

Questions From Experts

Many economists and tax experts doubt that tariffs alone could pay for the whole federal budget. They warn that very high tariffs could make many imported goods more expensive for shoppers in the United States. This could hit lower- and middle‑income families hardest, because they spend a big share of their money on everyday items.

What Congress Must Do

The president can change some tariffs, but only Congress can change or end the federal income tax. That means any real plan to remove income tax would need new laws passed by both the House of Representatives and the Senate. So far, there is no detailed law or full budget plan on this idea.

What It Means Right Now

For now, Trump’s comments are a proposal, not a change in the law. People and businesses still have to pay federal income tax under the current rules. The debate over using tariffs instead of income taxes is likely to continue among lawmakers, experts, and voters.

News

Epstein Files to Be Declassified After Trump Order

Former President Donald Trump has signed an executive order directing federal agencies to declassify all government files related to Jeffrey Epstein, the disgraced financier whose death in 2019 continues to fuel controversy and speculation.

The order, signed Wednesday at Trump’s Mar-a-Lago estate, instructs the FBI, Department of Justice, and intelligence agencies to release documents detailing Epstein’s network, finances, and alleged connections to high-profile figures. Trump described the move as “a step toward transparency and public trust,” promising that no names would be shielded from scrutiny.

“This information belongs to the American people,” Trump said in a televised statement. “For too long, powerful interests have tried to bury the truth. That ends now.”

U.S. intelligence officials confirmed that preparations for the release are already underway. According to sources familiar with the process, the first batch of documents is expected to be made public within the next 30 days, with additional releases scheduled over several months.

Reactions poured in across the political spectrum. Supporters praised the decision as a bold act of accountability, while critics alleged it was politically motivated, timed to draw attention during a volatile election season. Civil rights advocates, meanwhile, emphasized caution, warning that some records could expose private victims or ongoing legal matters.

The Epstein case, which implicated figures in politics, business, and entertainment, remains one of the most talked-about scandals of the past decade. Epstein’s connections to influential individuals—including politicians, royals, and executives—have long sparked speculation about the extent of his operations and who may have been involved.

Former federal prosecutor Lauren Fields said the release could mark a turning point in public discourse surrounding government transparency. “Regardless of political stance, this declassification has the potential to reshape how Americans view power and accountability,” Fields noted.

Officials say redactions may still occur to protect sensitive intelligence or personal information, but the intent is a near-complete disclosure. For years, critics of the government’s handling of Epstein’s case have accused agencies of concealing evidence or shielding elites from exposure. Trump’s order promises to change that narrative.

As anticipation builds, journalists, legal analysts, and online commentators are preparing for what could be one of the most consequential information releases in recent history.

Politics

Netanyahu’s UN Speech Triggers Diplomatic Walkouts and Mass Protests

What Happened at the United Nations

On Friday, Israeli Prime Minister Benjamin Netanyahu addressed the United Nations General Assembly in New York City, defending Israel’s ongoing military operations in Gaza. As he spoke, more than 100 delegates from over 50 countries stood up and left the chamber—a rare and significant diplomatic walkout. Outside the UN, thousands of protesters gathered to voice opposition to Netanyahu’s policies and call for accountability, including some who labeled him a war criminal. The protest included activists from Palestinian and Jewish groups, along with international allies.

Why Did Delegates and Protesters Walk Out?

The walkouts and protests were a response to Israel’s continued offensive in Gaza, which has resulted in widespread destruction and a significant humanitarian crisis. Many countries and individuals have accused Israel of excessive use of force, and some international prosecutors have suggested Netanyahu should face investigation by the International Criminal Court for war crimes, including claims that starvation was used as a weapon against civilians. At the same time, a record number of nations—over 150—recently recognized the State of Palestine, leaving the United States as the only permanent UN Security Council member not to join them.

International Reaction and Significance

The diplomatic walkouts and street protests demonstrate increasing global concern over the situation in Gaza and growing support for Palestinian statehood. Several world leaders, including Colombia’s President Gustavo Petro, showed visible solidarity with protesters. Petro called for international intervention and, controversially, for US troops not to follow orders he viewed as supporting ongoing conflict. The US later revoked Petro’s visa over his role in the protests, which he argued was evidence of a declining respect for international law.

Why Is This News Important?

The Gaza conflict is one of the world’s most contentious and closely-watched issues. It has drawn strong feelings and differing opinions from governments, activists, and ordinary people worldwide. The United Nations, as an international organization focused on peace and human rights, is a key arena for these debates. The events surrounding Netanyahu’s speech show that many nations and voices are urging new action—from recognition of Palestinian rights to calls for sanctions against Israel—while discussion and disagreement over the best path forward continue.

This episode at the UN highlights how international diplomacy, public protests, and official policy are all intersecting in real time as the search for solutions to the Israeli-Palestinian conflict remains urgent and unresolved.

Advice4 days ago

Advice4 days agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Entertainment3 weeks ago

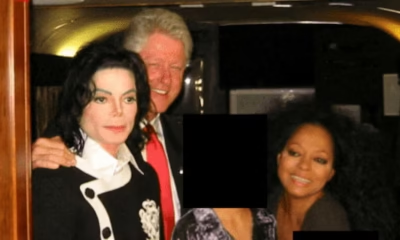

Entertainment3 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Film Industry4 weeks ago

Film Industry4 weeks agoAI Didn’t Steal Your Job. It Revealed Who Actually Does the Work.

Entertainment2 weeks ago

Entertainment2 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Film Industry4 weeks ago

Film Industry4 weeks agoHow to Write a Logline That Makes Programmers Hit Play

News3 weeks ago

News3 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Business1 week ago

Business1 week agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Business2 weeks ago

Business2 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein