News

5 Challenges Filmmakers Face When Adapting to New Tech

Filmmakers face various challenges when adapting to new technology in the film industry. Some of the key challenges include:

1. Rapid Technological Change: The fast pace of technological advancements can make it challenging for filmmakers to keep up with the latest developments, especially in areas like virtual and augmented reality. This rapid change requires studios to invest in new technologies to remain competitive.

2. Costs of Technology: The high costs associated with adopting new technology can be a significant barrier for many studios, particularly smaller or independent ones. The expense of equipment and software can limit the ability of these studios to experiment with new technologies or compete effectively in the industry.

3. Legal Issues and Copyright: Filmmakers need to ensure that they comply with copyright laws and navigate legal issues related to technology, such as intellectual property rights and licensing agreements. Working with legal specialists becomes essential to guarantee compliance with legal requirements.

4. Funding Challenges: Securing funding for film projects remains a major obstacle for filmmakers, particularly in 2023 where budgetary constraints have intensified due to factors like the cost of living crisis. Traditional investors are becoming more cautious, leading filmmakers to explore alternative funding options like crowdfunding.

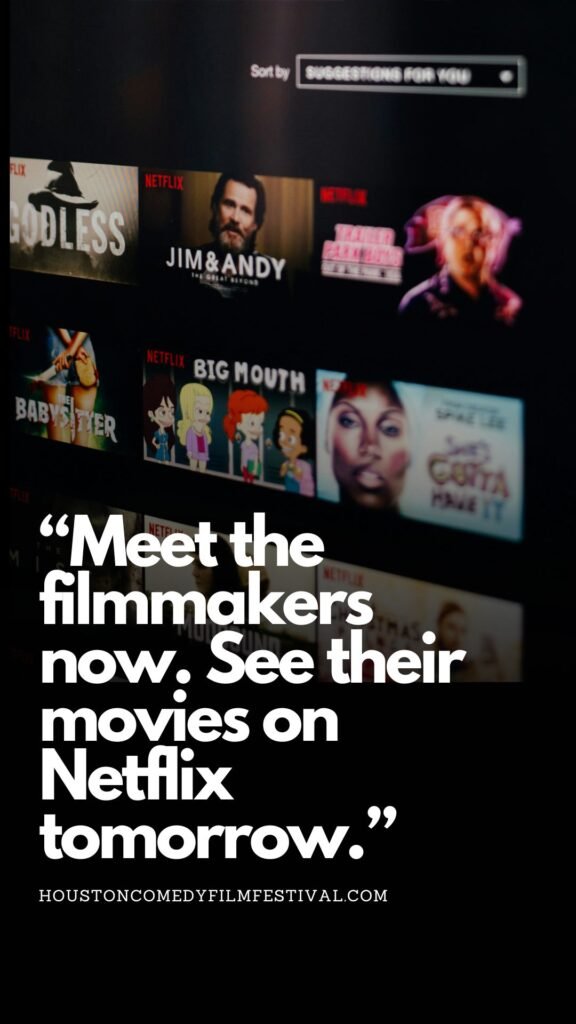

5. Distribution Complexity: Achieving distribution for films has become increasingly challenging, with the landscape becoming more crowded by the day. Filmmakers need to offer unique and compelling content to stand out in a competitive market. Focused distribution efforts and building a loyal audience are emphasized as effective strategies in navigating the distribution landscape.

In conclusion, filmmakers must navigate these challenges by staying abreast of technological advancements, managing costs effectively, addressing legal considerations, securing funding creatively, and strategically approaching film distribution in an increasingly competitive environment.

In the dynamic landscape of film production, Bolanle Media stands ready to be your guiding light from inception to distribution. With our comprehensive suite of consultation services covering ideation, tax credits, production, post-production, and distribution, we ensure your vision is not only realized but thrives in the competitive market. Let us navigate the intricacies of the industry together, empowering your project to reach its fullest potential. Reach out to us today and embark on a journey towards cinematic excellence with Bolanle Media by your side as a partner.

News

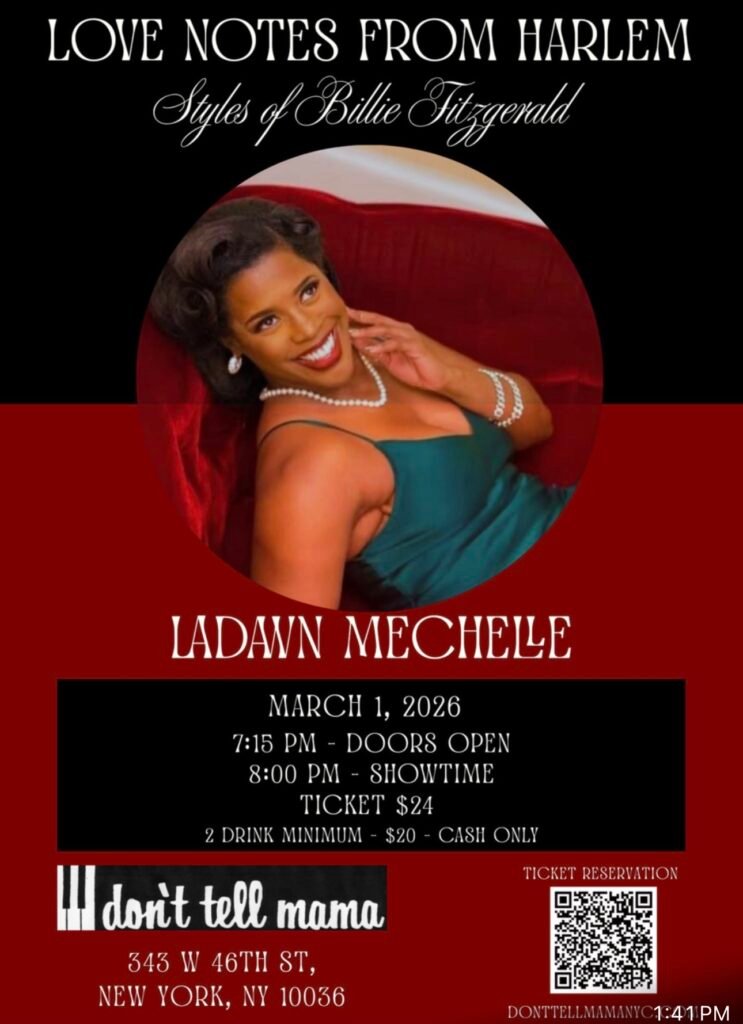

March 1 in NYC: Love Notes From Harlem at Don’t Tell Mama

Harlem doesn’t always announce its biggest nights in advance—but when it does, you can feel it in the air. Love Notes From Harlem: Styles of Billie Fitzgerald was born in Harlem, tested by a snowstorm, and now arrives for one special night at legendary cabaret club Don’t Tell Mama in Hell’s Kitchen on March 1, 2026. After weather forced the original Room 623 dates to be postponed, LaDawn Mechelle Taylor refused to treat it as a setback. She calls the storm a plot twist—one that shut the show down in Harlem and pushed her to bring the project back stronger, on a new stage, with the same heartbeat: a love letter from Harlem to the world.

Event details: March 1, 2026 – Don’t Tell Mama NYC

– Show: LaDawn Mechelle – Love Notes From Harlem (Styles of Billie Fitzgerald)

– Date: Sunday, March 1, 2026

– Venue: Don’t Tell Mama NYC, 343 W 46th St, New York, NY 10036

– Seating from: 7:15 p.m.

– Showtime: 8:00 p.m. – approximately 9:30 p.m.

– Cover charge: 24.00 USD

– Minimum: 20 USD per person (must include 2 drinks)

– Payment: Cash only

– Food menu available during the show

This is a classic New York cabaret night: intimate tables, full bar, and a powerhouse vocalist close enough for you to feel every note.

A love note that keeps moving

LaDawn has earned the nickname “Queen of Switch Up” from people who know her best. When snow hit and the original Harlem dates had to be cancelled, she did not fold. She pivoted. What began at Room 623—created for and inspired by Harlem—is now stepping into a Midtown room without losing its roots.

Love Notes From Harlem is built as a storytelling concert: LaDawn, backed by live musicians, honoring Ella Fitzgerald, Ertha Kit, Bessie Smith, Ma Rainey, Nat King Cole and others while weaving her own journey through songs and stories. It is Harlem’s soul transported to Restaurant Row for one night only.

What people close to LaDawn are saying..

From her mother, Rosalind Turner:

“My diva daughter LaDawn has totally lived her unforgettable dreams and she will never stop what she believes in. I am one great big fan of hers. She is the one who will ride through any rain, sleet, or snowstorm. I am a witness, and I know she has weathered a big storm by not giving up. She was forced to cancel a recent show and picked right back up the very next one. The girl is a realist.”

From Angela Strauman, NYC‑based actor and award‑winning writer in theater, television, and film, who joins the show:

Angela Strauman is “so grateful to be part of such a talented crew led by the marvelous LaDawn Mechelle.”

When LaDawn asked her to join the show to help represent the relationship between Marilyn Monroe and Ella Fitzgerald, she was beyond excited. She notes that multi‑racial friendships are rarely represented or portrayed in media, and that showing such a positive, supportive relationship between two friends…

…“in a time when there was such a divide, not unlike today, is such a great reminder that love and support will always win.”

These perspectives make it clear: this is not just another gig. It is community, legacy, and risk‑taking onstage.

From Disney princess to Harlem storyteller…

LaDawn’s path to this moment covers a lot of ground. She has immersed herself in performance at every level—from playing Disney’s first Black American princess, Tiana, to leading Whitney Houston tribute shows and singing from the heart at New York venues. She has proven she can carry iconic material and still sound unmistakably like herself.

In Love Notes From Harlem, she turns that experience inward: honoring the artists who shaped her, lifting up Harlem’s sound, and telling the story of a Black woman who refuses to stop moving forward, no matter the weather.

Why you should be in the room

If you love Harlem’s musical history, Black women headlining their own stories, intimate New York rooms where the singers really sing, and shows that feel like you are being transported to another era, then March 1 at Don’t Tell Mama is not the night to skip.

Love Notes From Harlem: Styles of Billie Fitzgerald is the kind of show friends talk about long after the last note—and the kind of performance you will be glad you caught before it moves on to even bigger rooms.

Learn more about Ladawn by watching her interview below:

News

Idris Elba’s Multimillion-Dollar Film Studio Is Coming to Ghana

British actor and producer Idris Elba is moving ahead with plans to establish a state-of-the-art film studio and creative hub in Accra, Ghana, in a move industry observers say could significantly boost the country’s screen sector and the wider African film ecosystem.

The multimillion-dollar complex is planned for a 22-acre site near Osu Castle in Accra and is expected to combine full production facilities with a strong talent development component.

The project has been described as both a studio and a training ground, aimed at equipping Ghanaian and African creatives with world-class skills across directing, production, cinematography, post-production, and related disciplines.

Elba, whose work spans blockbuster franchises and prestige television, has been vocal about his commitment to building sustainable film infrastructure on the continent rather than limiting engagement to short-term shoots. The Ghana studio forms part of a broader vision to position Africa as a competitive production destination, with facilities capable of servicing both local storytellers and international productions.

Industry analysts note that many African filmmakers continue to face structural challenges, including limited access to purpose-built sound stages, modern post-production services, and consistent training pathways. By situating a major creative hub in Accra, the initiative is expected to address some of these gaps, create employment opportunities, and attract higher-budget projects to Ghana.

The planned studio is also being framed as a catalyst for economic growth, with potential knock-on benefits for tourism, hospitality, and ancillary services that support film and television production. Local stakeholders have welcomed the development as a sign of growing confidence in Ghana’s creative economy and its ability to compete on a global stage.

Early reaction across social and traditional media has highlighted enthusiasm among filmmakers, actors, and young creatives who see the project as a landmark investment in African talent. As plans progress, further details on the construction timeline, partners, and specific training programs are expected to be announced.

There are videos circulating online showing Idris Elba discussing and outlining his vision for the Ghana studio project, including interview segments and news features that provide additional context and visual coverage of the announcement.

News

THE MACHINE VS. THE ARTIST

What SAG-AFTRA’s AI Rules Mean For Actors & Filmmakers in 2026

AI isn’t coming for the film industry—it’s already inside your contracts. SAG-AFTRA has been building an AI rulebook across multiple agreements, from TV/streaming to video games and commercials, and those choices will shape how your face, body, and voice can be used.

1. SAG-AFTRA’s AI “guardrails” in one page

SAG-AFTRA says its AI framework is built on three core promises: clear consent, fair compensation, and control over performances.

In practice, that means:

- Your name, image, and voice are treated as rights that must be licensed, not free raw material.

- Any AI recreation of you is supposed to require informed consent, not buried boilerplate.

- Unions are pushing to make it cheaper to hire a human than to rely on synthetic replicas.

Across contracts, SAG-AFTRA has been adding AI protections in the TV/Theatrical deal that ended the 2023 strike, in animation and commercials agreements, and in the newer Interactive Media (video game) agreement ratified in 2025.

2. What “digital replicas” actually are

Newer agreements break AI uses into categories so producers can’t hide everything under vague language.

Key terms:

- Vocal digital replica: An AI-generated version of your voice, trained from your recorded work and used to create new lines you didn’t physically say.

- Visual digital replica: A digital version of your likeness used to generate new shots or performances.

- Independently created digital replica (ICDR): A replica made from non‑union material or by prompting a generative model with your name (for example, a game company asking a tool to “make a voice like X”).

Under the 2025 Interactive Media Agreement, for example:

- These different replica types all require consent and disclosure.

- Producers must track when they use replicas and pay based on output (like per line of AI dialogue).

- Consent has to be “clear and conspicuous,” often in a separate rider that describes what the replica will do and whether it will handle sensitive material.

3. Seedance 2.0: why everyone’s talking about it

In February 2026, SAG-AFTRA publicly condemned Seedance 2.0, a new AI video model, saying it enables blatant infringement of performers’ voices and likenesses and undermines their ability to earn a living.

The union’s position:

- Seedance 2.0 disregards law, ethics, industry norms and consent by allowing unauthorized cloning and mash‑ups.

- It’s being criticized at the exact same time SAG-AFTRA is back at the table negotiating a new TV/Theatrical/Streaming contract, where AI protections are a top priority.

For you, Seedance 2.0 is a case study in what not to do: using AI tools that ingest copyrighted work or people’s likenesses without explicit, documented permission.

4. If you’re an actor: your AI checklist

Before you sign any contract, look for language about “digital replicas,” “AI,” “synthetic performance,” or “simulation.” Then ask three questions:

- Can they create a digital replica of me?

Is the contract asking for the right to use your voice or image to generate new material that looks/sounds like you? - What do I get paid if they use it?

Is there separate compensation for AI-generated lines, scenes, or future uses, or is the contract trying to roll everything into a one‑time fee? - Can I say no later?

Does the agreement give you any ability to suspend or revoke consent, especially if the content changes (becomes more sensitive, political, or explicit) or if there’s a labor dispute?

Practical moves:

- Keep a copy of every AI rider you sign and what you were told the replica would be used for.

- If something feels too broad (“any use, in any medium, forever”), ask for narrower language or talk to your rep/union before signing.

- Use SAG-AFTRA’s AI resource pages and explainers to understand your rights and current policy fights.

5. If you’re a filmmaker or producer: how not to get burned

Using AI on your project doesn’t have to mean fighting your cast later—but only if you handle it correctly.

Non‑negotiables if you’re working with union talent:

- Get explicit, written consent before creating any replica, with a rider that describes the use in plain language.

- Budget for AI‑related pay. Many agreements treat AI output as additional work, not a free bonus.

- Avoid gray‑area tools. If a model has been publicly condemned by the performers’ union for unauthorized cloning, using it with performers’ likenesses is both an ethical and legal risk.

- Align your paperwork with union rules. Update your deal memos so AI sections don’t quietly overreach beyond what the union agreements allow.

If you’re non‑union, following these standards still protects you:

- You reduce your exposure to future lawsuits or takedowns.

- You build trust with actors who may join your projects precisely because you’re not cutting corners on AI.

6. Where to learn more

If you want to go deeper than this article, start with:

- Union AI hubs and FAQs explaining their core principles.

- AI bargaining timelines that show what’s already been won and what’s still being fought over.

- Interactive media and digital replica explainers that spell out definitions, consent rules, and pay structures.

- Public statements about tools like Seedance 2.0, which show where the red lines are.

7. The bottom line

AI is not a side issue anymore—it is part of how performance is captured, stored, and reused. The only real question is whether that happens with you or to you.

If you’re an actor, your power starts with reading every AI line in your contracts and refusing to trade your likeness for a one‑time fee. If you’re a filmmaker, your reputation will be built on whether people trust you with their face, their voice, and their future earning potential.

The machine is here. The artists who last will be the ones who learn the rules, push for better ones, and refuse to treat human performance as disposable training data.

Save this, share this with your cast and crew, and make sure the story you’re telling about AI is one you’d be proud to see on screen.

Advice1 week ago

Advice1 week agoHow to Make Your Indie Film Pay Off Without Losing Half to Distributors

Entertainment4 weeks ago

Entertainment4 weeks agoWhat the Epstein Files Actually Say About Jay-Z

Entertainment3 weeks ago

Entertainment3 weeks agoWhat Epstein’s Guest Lists Mean for Working Filmmakers: Who Do You Stand Next To?

Business2 weeks ago

Business2 weeks agoHow Epstein’s Cash Shaped Artists, Agencies, and Algorithms

Film Industry1 week ago

Film Industry1 week agoWhy Burnt-Out Filmmakers Need to Unplug Right Now

News4 weeks ago

News4 weeks agoCatherine O’Hara: The Comedy Genius Who Taught Us That Character Is Everything

Business3 weeks ago

Business3 weeks agoNew DOJ Files Reveal Naomi Campbell’s Deep Ties to Jeffrey Epstein

Entertainment2 weeks ago

Entertainment2 weeks agoYou wanted to make movies, not decode Epstein. Too late.